Horseshoe Falls, Niagara Falls, Canada

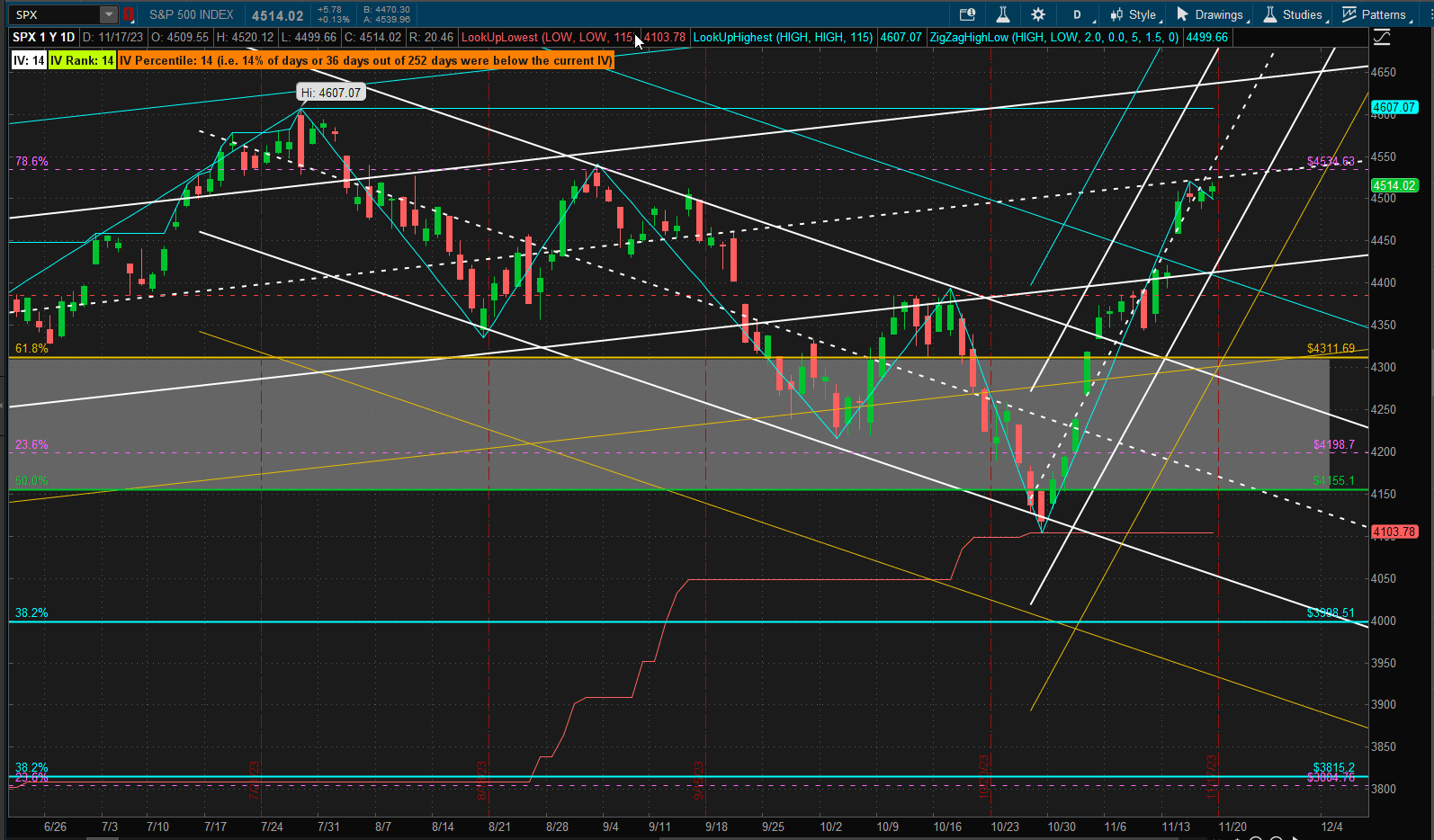

After Tuesday’s strong breakout to the upside, US Equities calmed down into consolidation mode but ended the week up ~2.5% from last week’s close:

I think we can say that we have broken out of the downtrend channel that we have experienced over the past 3 months and may be gearing up for Santa’s rally into the end of the year. However, the new channel looks a little steep right now so we might experience a pullback to re-test the support/resistance area at ~4400 before we see if we can take out the July high at ~4610 before the end of the year.

I think we can say that we have broken out of the downtrend channel that we have experienced over the past 3 months and may be gearing up for Santa’s rally into the end of the year. However, the new channel looks a little steep right now so we might experience a pullback to re-test the support/resistance area at ~4400 before we see if we can take out the July high at ~4610 before the end of the year.

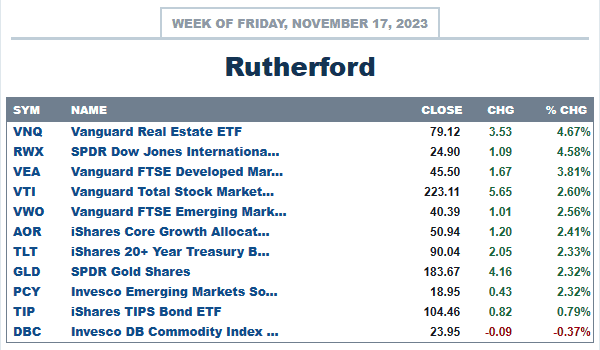

Despite the strong performance of global equity markets over the past week this was outdone by strength in the Real Estate sector:

Unfortunately, the Rutherford portfolio is not holding positions in either equities or Real Estate:

Unfortunately, the Rutherford portfolio is not holding positions in either equities or Real Estate:

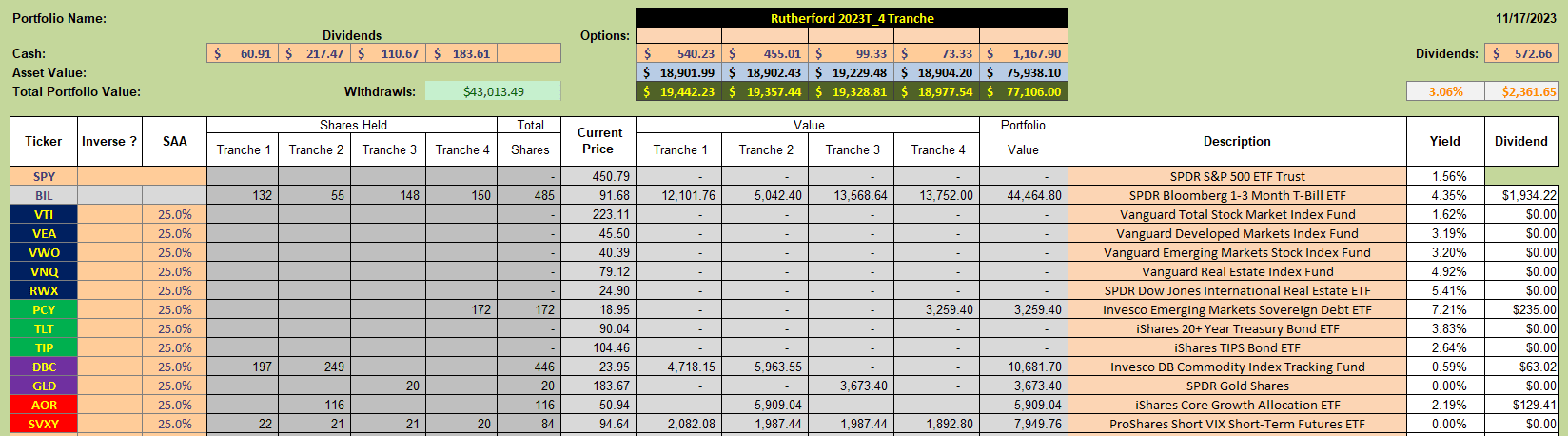

so we missed out on Tuesday’s strong burst to the upside:

so we missed out on Tuesday’s strong burst to the upside:

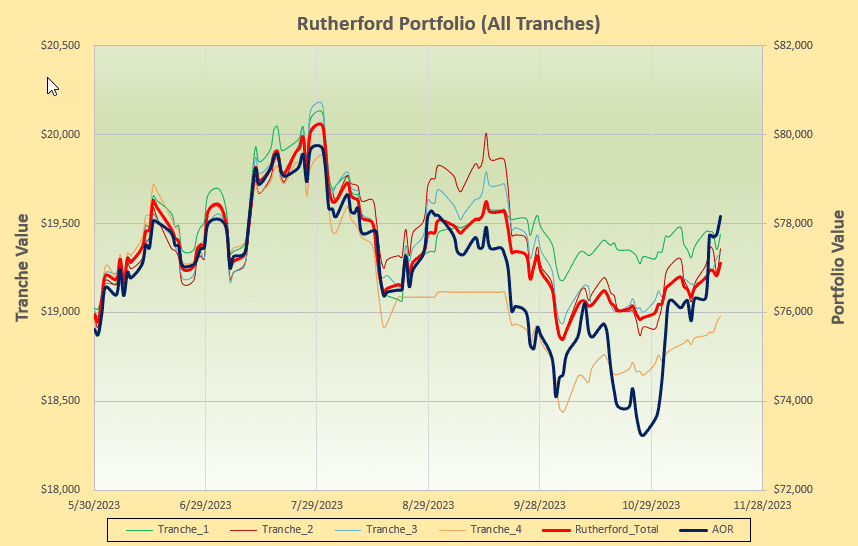

and have fallen below the performance (in terms of total returns) of the benchmark AOR Fund. However, in risk-adjusted terms, for a conservative investor, performance is acceptable since we saw less volatility (and smaller losses) during the downturn.

and have fallen below the performance (in terms of total returns) of the benchmark AOR Fund. However, in risk-adjusted terms, for a conservative investor, performance is acceptable since we saw less volatility (and smaller losses) during the downturn.

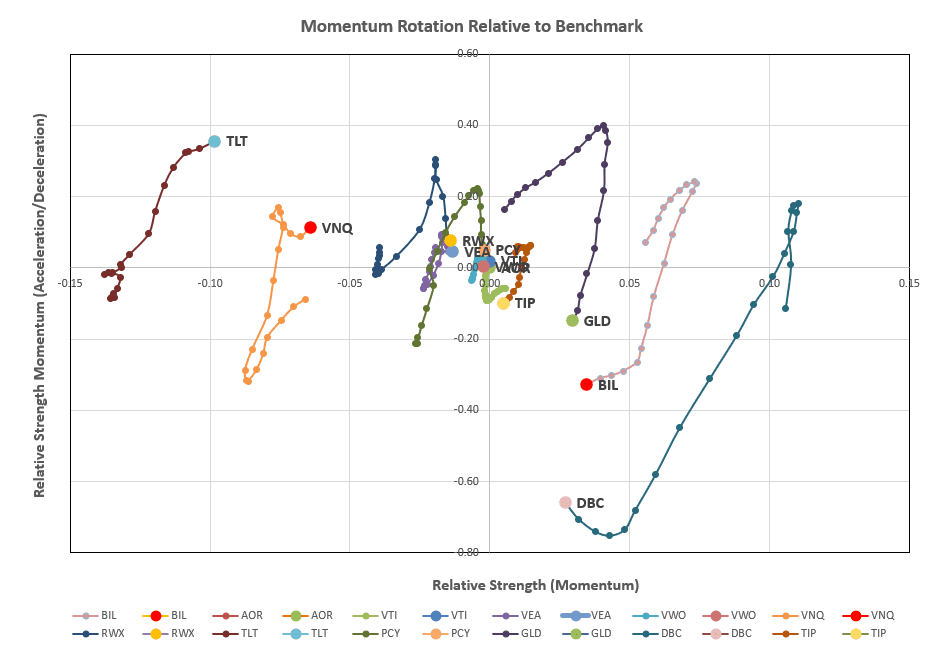

Checking the current rotation graphs:

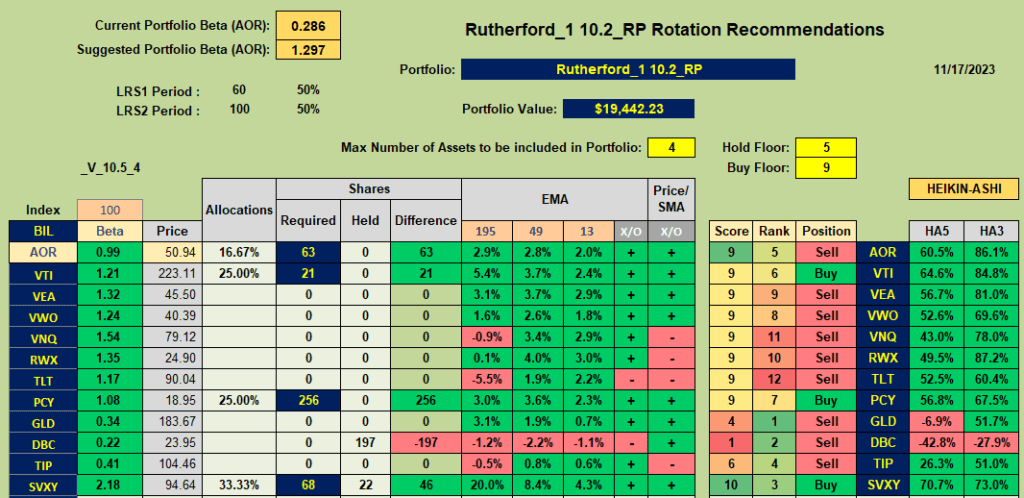

we still see little action in the desirable top right quadrant although the rotation algorithm is giving us the following recommendations:

we still see little action in the desirable top right quadrant although the rotation algorithm is giving us the following recommendations:

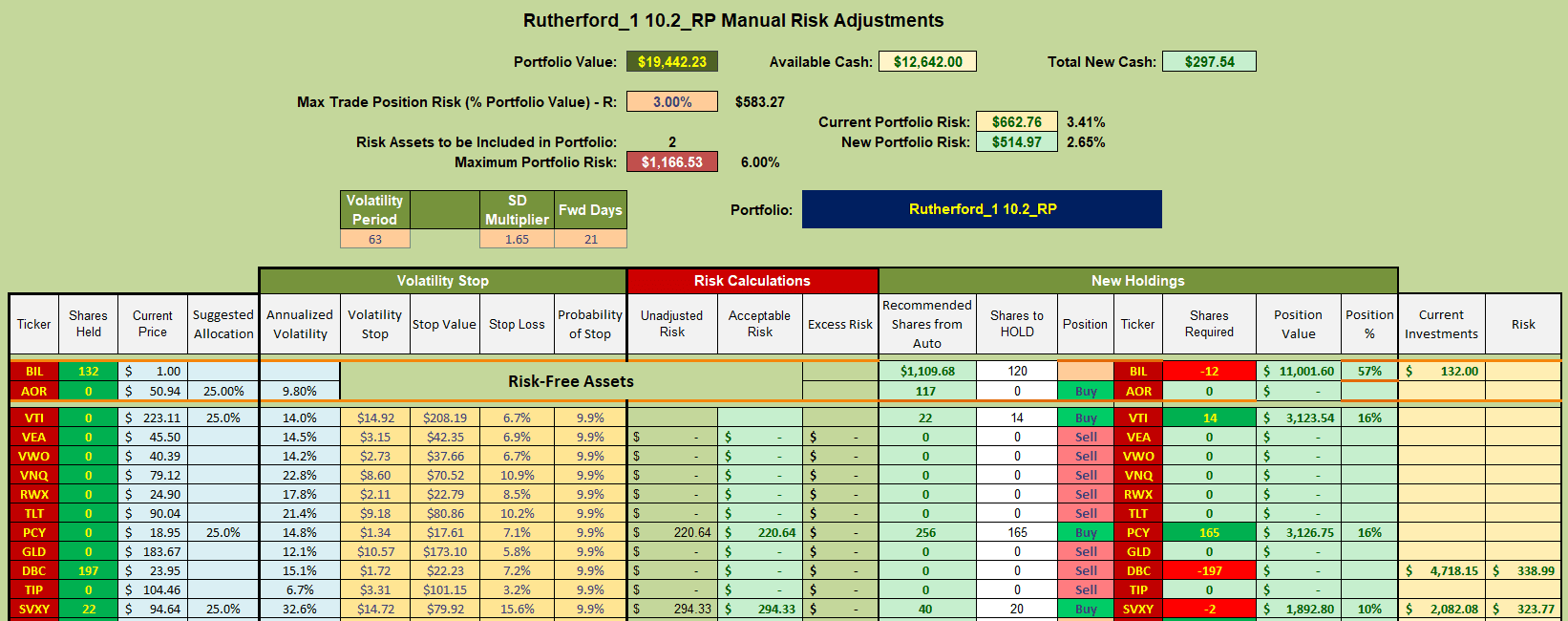

with Buy recommendations for adding shares of PCY, and VTI in addition to our volatility class diversifier SVXY and a Sell recommendation for DBC (Commodities) that is currently held in Tranche 1 (the focus of this weeks review). This leaves us with the following potential adjustments:

with Buy recommendations for adding shares of PCY, and VTI in addition to our volatility class diversifier SVXY and a Sell recommendation for DBC (Commodities) that is currently held in Tranche 1 (the focus of this weeks review). This leaves us with the following potential adjustments:

i.e. I will be selling the current position in DBC and adding shares of PCY and VTI. This will require the sale of a few shares of BIL to free up sufficient cash for the purchases but will still leave me with a relatively high percentage (57%) in short term treasury notes.

i.e. I will be selling the current position in DBC and adding shares of PCY and VTI. This will require the sale of a few shares of BIL to free up sufficient cash for the purchases but will still leave me with a relatively high percentage (57%) in short term treasury notes.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.