Future Americas Cup Hopefulls going out on Training Session

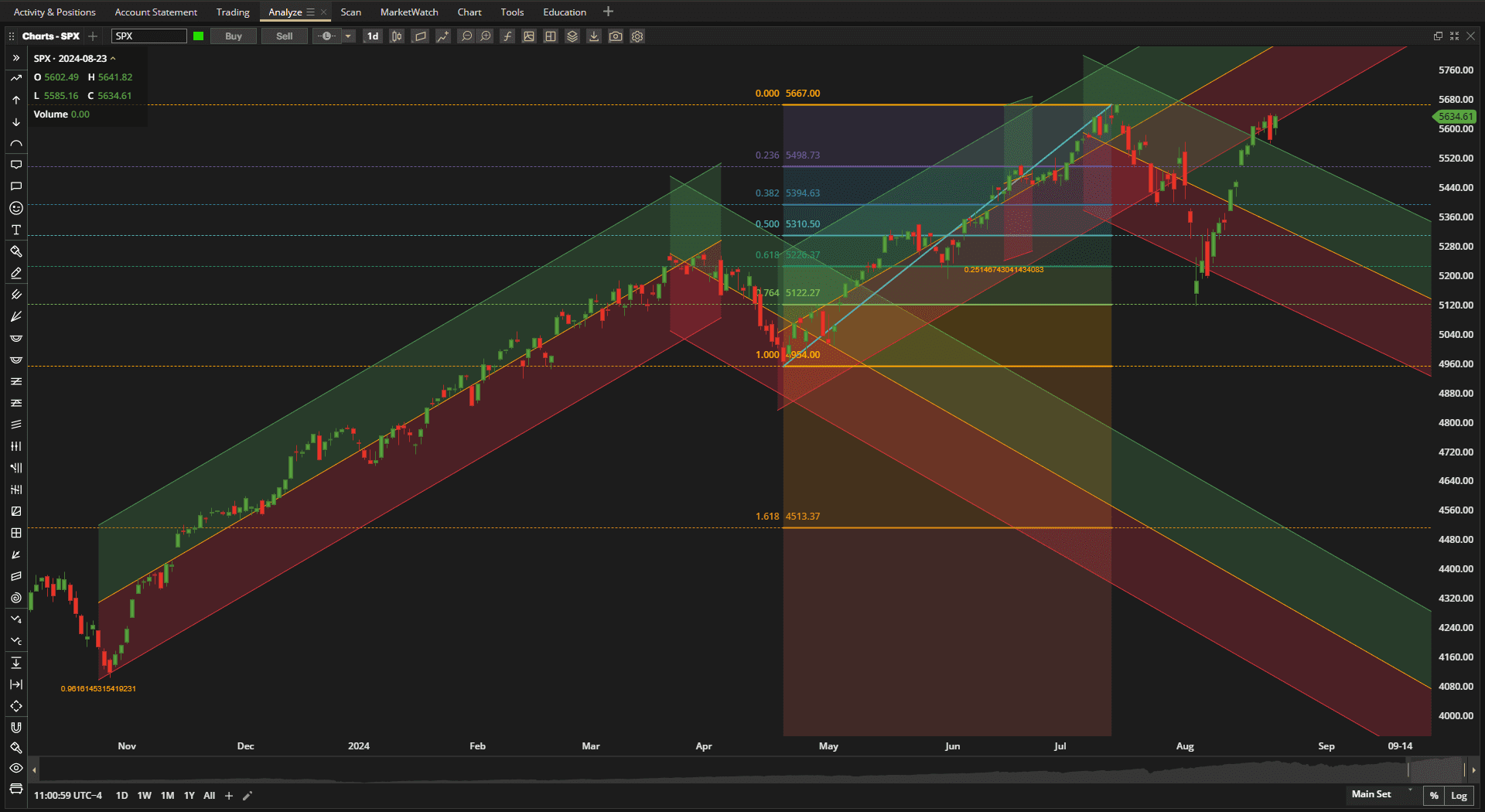

It has been a wild month in the US Equity markets with significant volatility – but we are currently back near the all-time highs that we saw in July:

The range that we have seen in in the last few weeks extends far outside the “normal” 2 Standard Deviation range (indicating significant nervousness in the markets) and we now wait to see where we go from here now that the Jackson Hole meetings are through for another year.

The range that we have seen in in the last few weeks extends far outside the “normal” 2 Standard Deviation range (indicating significant nervousness in the markets) and we now wait to see where we go from here now that the Jackson Hole meetings are through for another year.

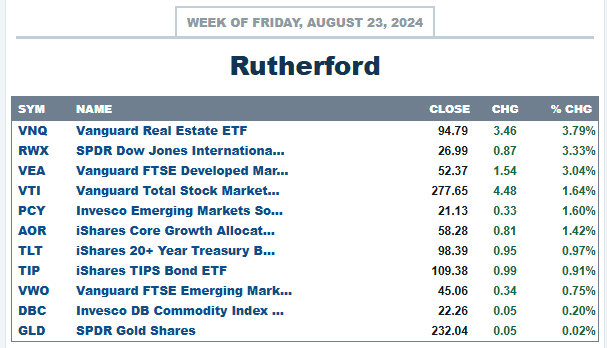

Performance of equity ETFs over the past week were relatively strong – although not as strong as the Real Estate sectors:

All major asset classes showed positive returns.

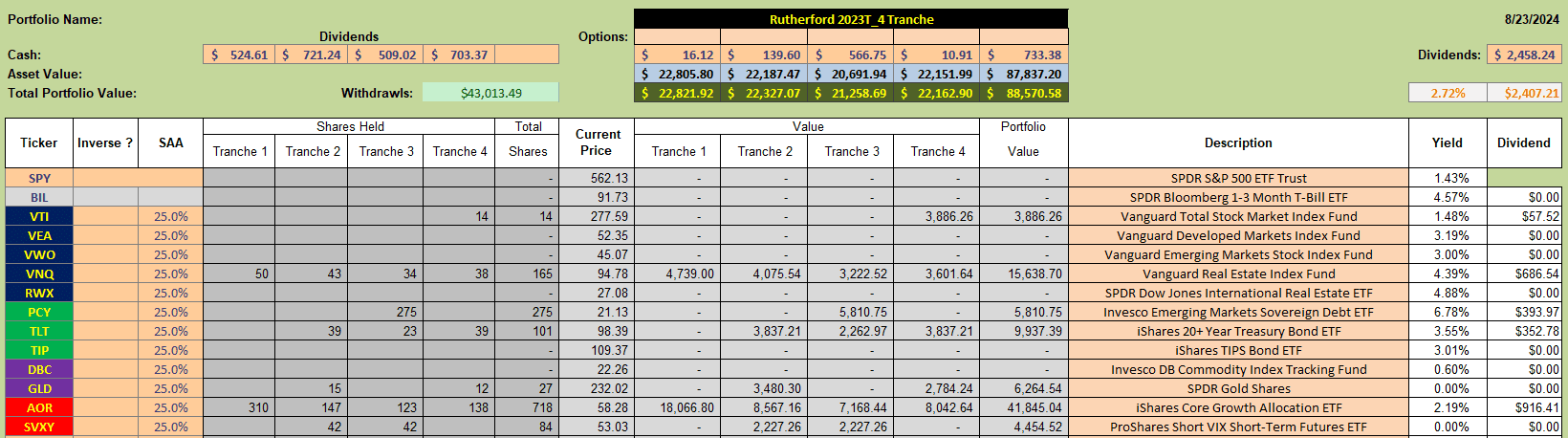

Current holdings in the Rutherford Portfolio look like this:

with Tranche 1 (the focus of this week’s review) holding “neutral” positions in US Real Estate and AOR, our benchmark equity/bond fund.

with Tranche 1 (the focus of this week’s review) holding “neutral” positions in US Real Estate and AOR, our benchmark equity/bond fund.

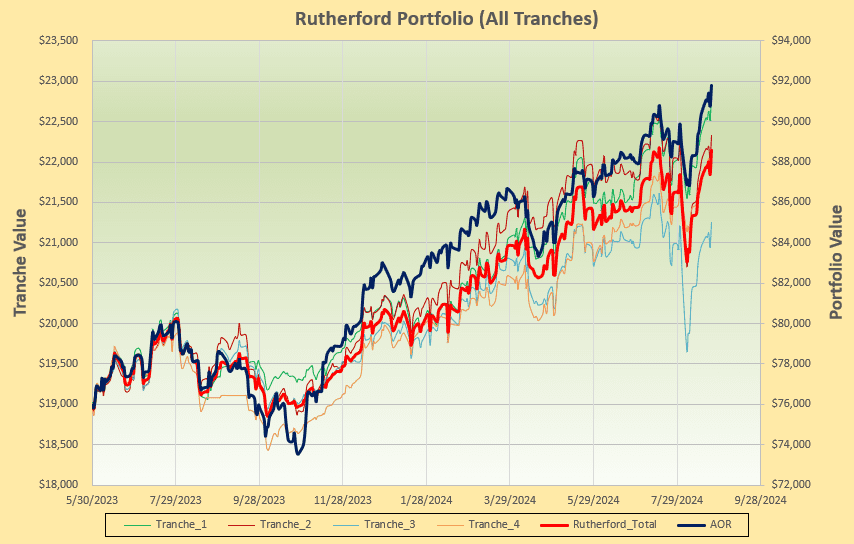

Recent performance looks like this:

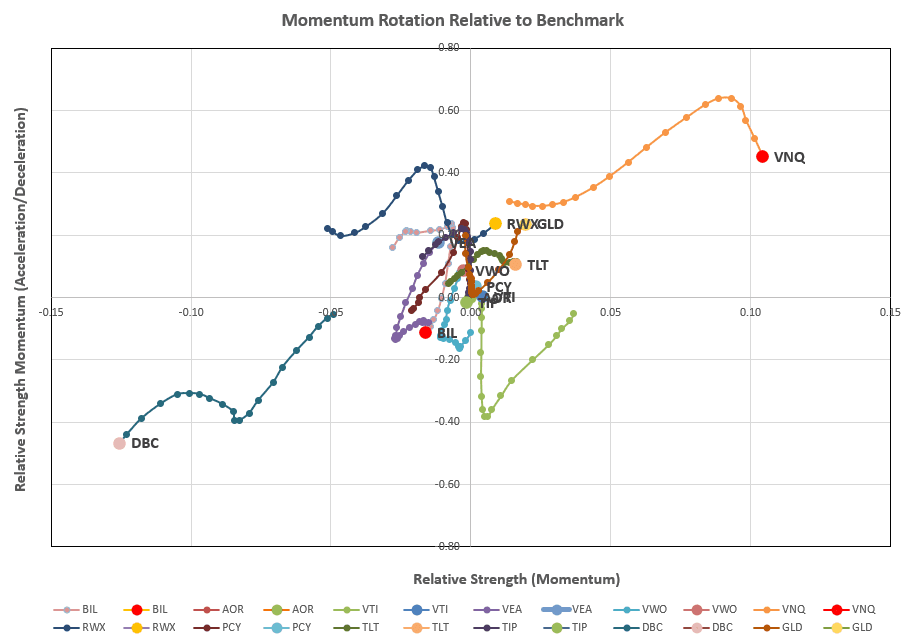

as we check the current rotation graphs:

as we check the current rotation graphs:

where we see a little relative softening of the US Real Estate market (VNQ) following the tear that it has been on over the past month.

where we see a little relative softening of the US Real Estate market (VNQ) following the tear that it has been on over the past month.

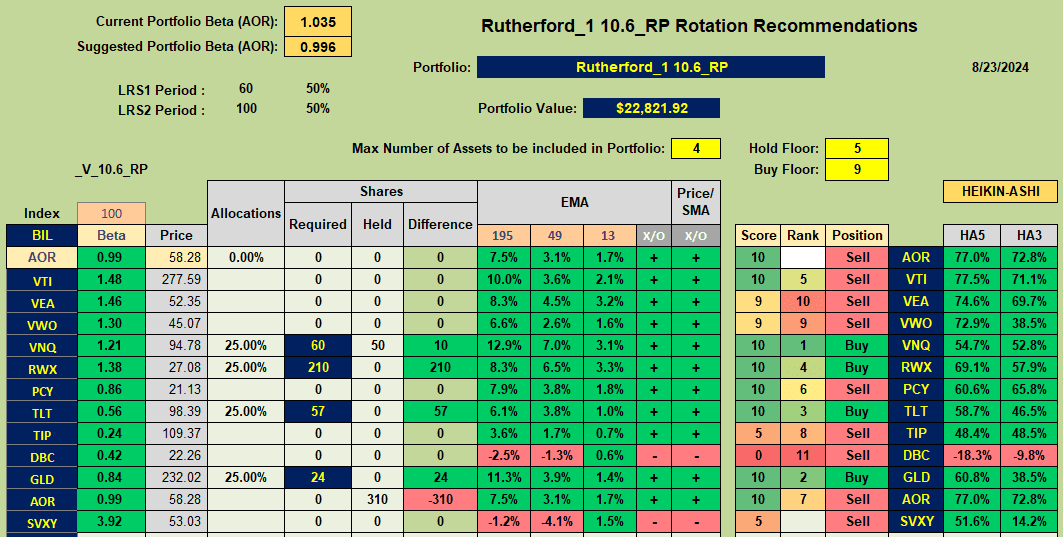

Looking at the ranking and recommendations from the rotation model:

we see a lot of green positivity with VNQ, RWX, TLT and GLD getting Buy recommendations.

we see a lot of green positivity with VNQ, RWX, TLT and GLD getting Buy recommendations.

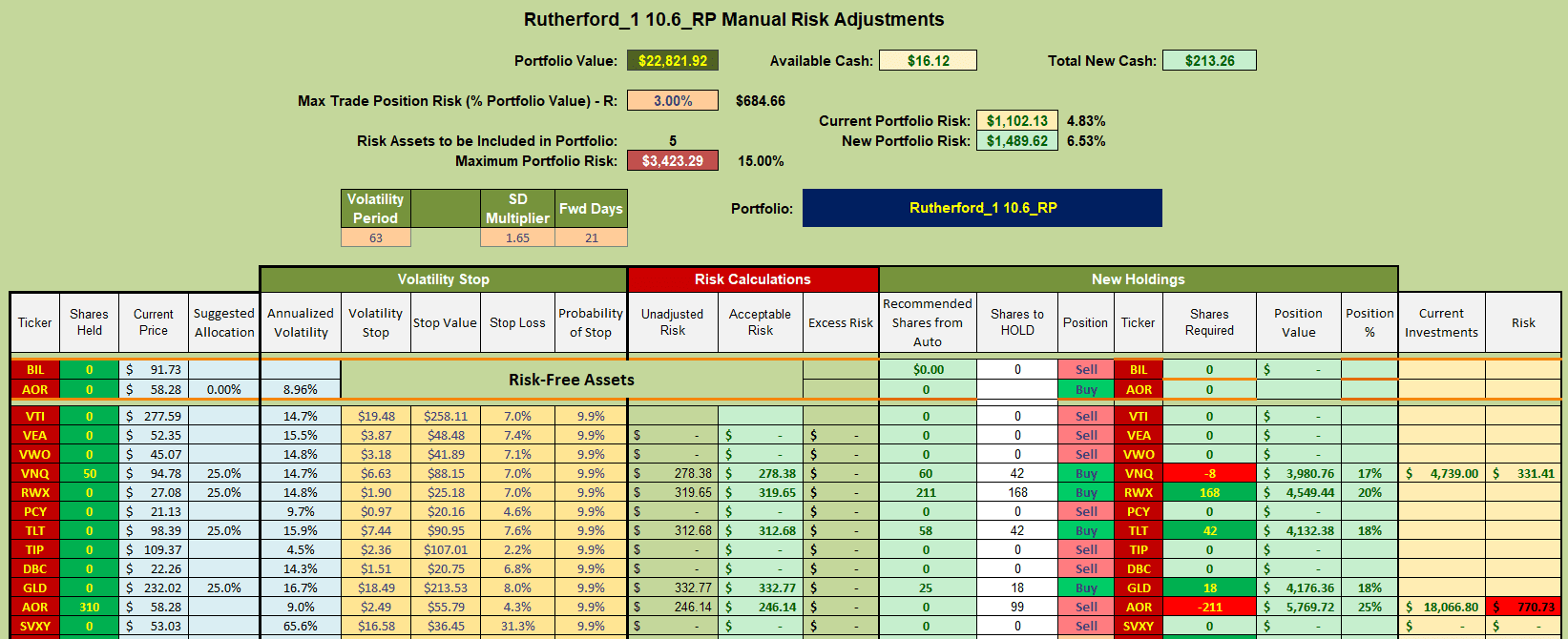

Following these recommendations the adjustments for next week will look something like this:

where I shall sell currently held shares in AOR to add positions in RWX, TLT and GLD. I will not make any minor adjustments to VNQ so as to avoid trading costs.

where I shall sell currently held shares in AOR to add positions in RWX, TLT and GLD. I will not make any minor adjustments to VNQ so as to avoid trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question