Floral “sculpture”, Gardens on the Bay, Singapore

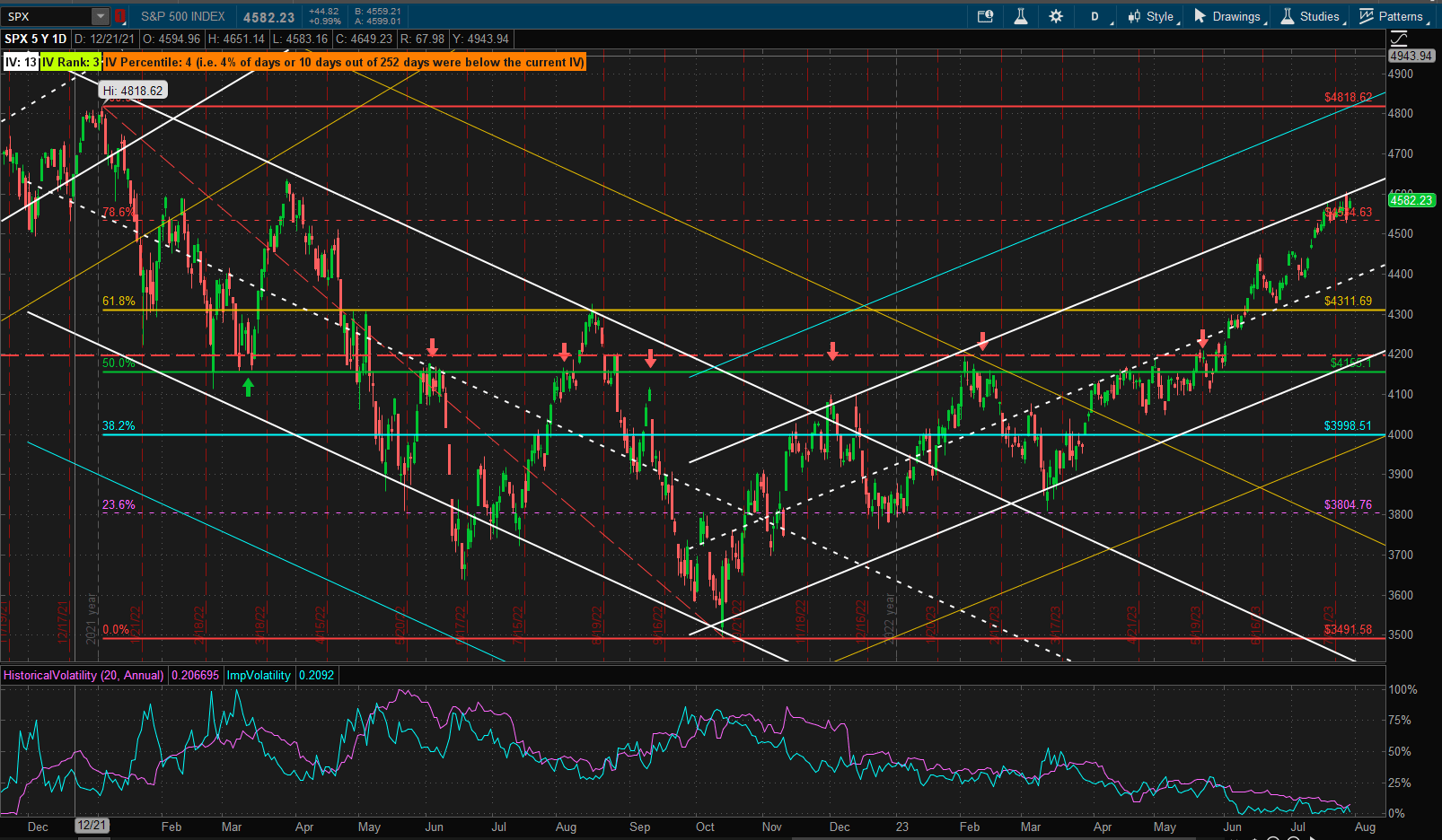

A quiet week in US equities with the only excitent comming on Thursday with the Fed announcements – but then we settled back down and finished the week very close to last weel’s close and still at the top of the 1 SD bounary of the bullish trend channel:

Note how, over the past ~2 years prices have rarely moved outside of the 1 SD trend channels – except at the change in trend in February. It will be interesting to see whether we can test the prior all-times highs at ~4820 but it does not look as though this will be challenged until maybe November or December at the earliest.

Note how, over the past ~2 years prices have rarely moved outside of the 1 SD trend channels – except at the change in trend in February. It will be interesting to see whether we can test the prior all-times highs at ~4820 but it does not look as though this will be challenged until maybe November or December at the earliest.

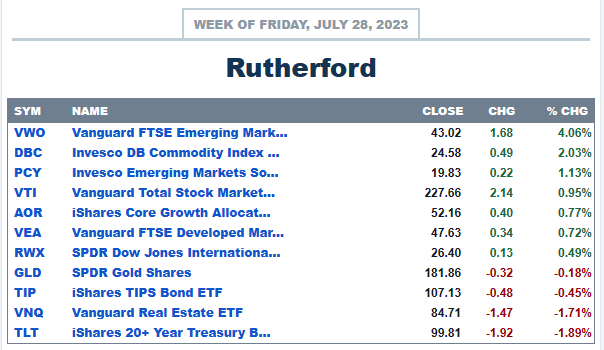

In terms of performance relative to other major asset classes:

US equities (VTI) falls in the middle of the pack with strength in Emerging Markets and Commodities. Long Term Treasuries and US Real Estate bring up the rear.

US equities (VTI) falls in the middle of the pack with strength in Emerging Markets and Commodities. Long Term Treasuries and US Real Estate bring up the rear.

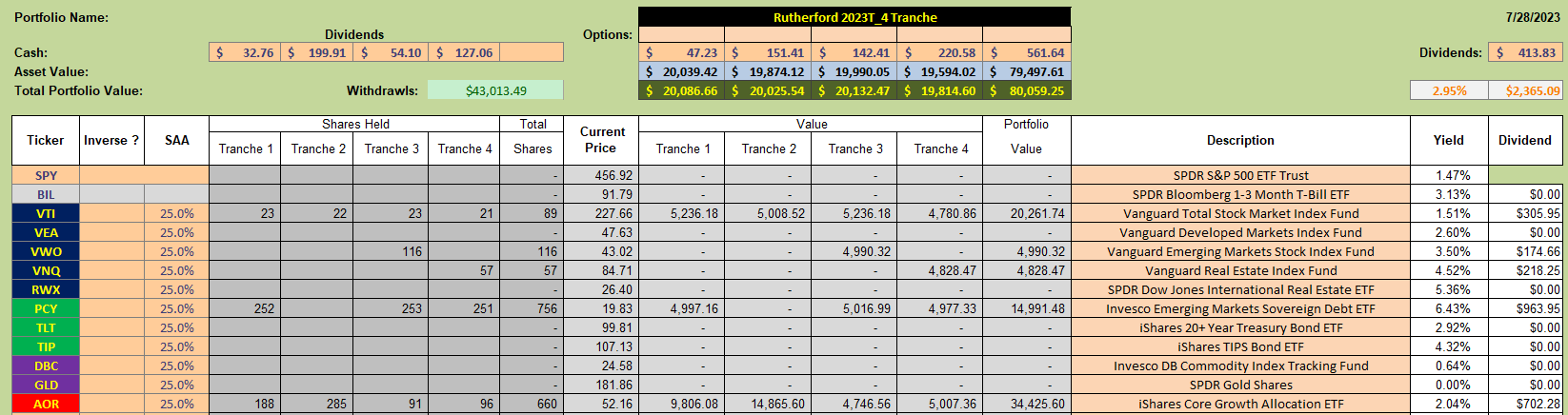

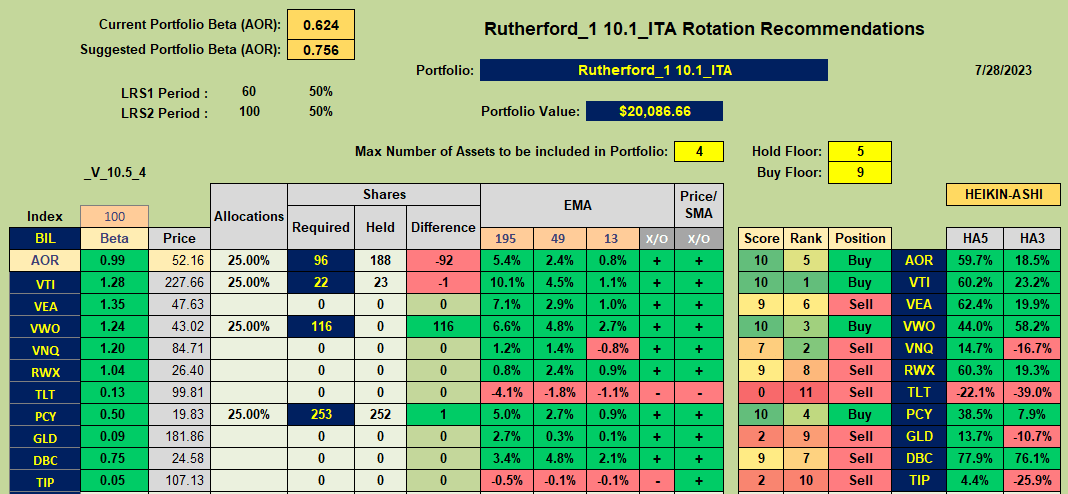

Checking our current holdings in the Rutherford Portfolio:

we see that we are reasonably well diversified and holding positions in VTI, PCY and AOR in Tranche 1 (the focus of this week’s review).

we see that we are reasonably well diversified and holding positions in VTI, PCY and AOR in Tranche 1 (the focus of this week’s review).

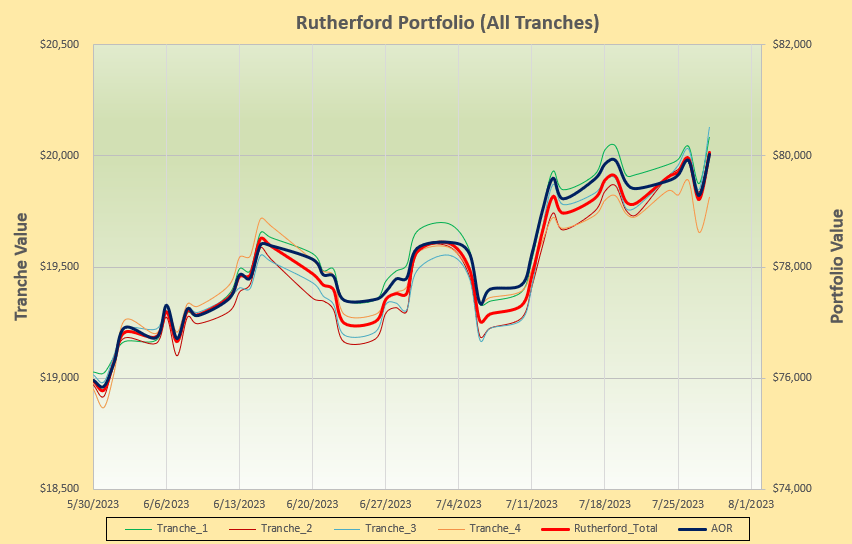

Performance to date (since moving to the rotation system) is looking like this:

and we are running pretty close to the performance of our benchmark fund (AOR).

and we are running pretty close to the performance of our benchmark fund (AOR).

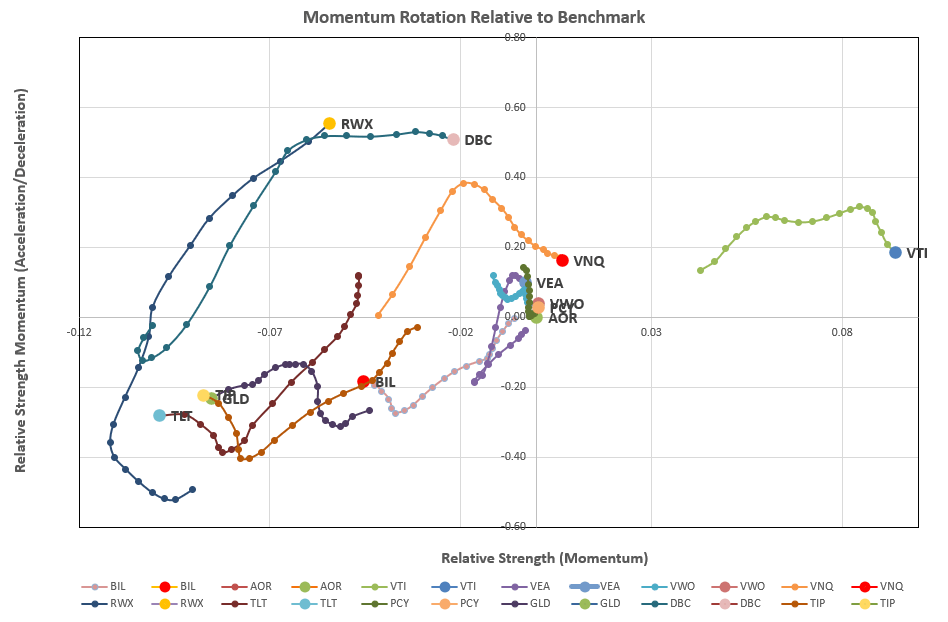

So we check on the rotation graphs:

and note that US Equities are running way ahead of other asset classes. It is therefore not surprising to find this as a Buy recommendation in the Tranche sheet:

and note that US Equities are running way ahead of other asset classes. It is therefore not surprising to find this as a Buy recommendation in the Tranche sheet:

where it is joined by VWO, PCY and AOR

where it is joined by VWO, PCY and AOR

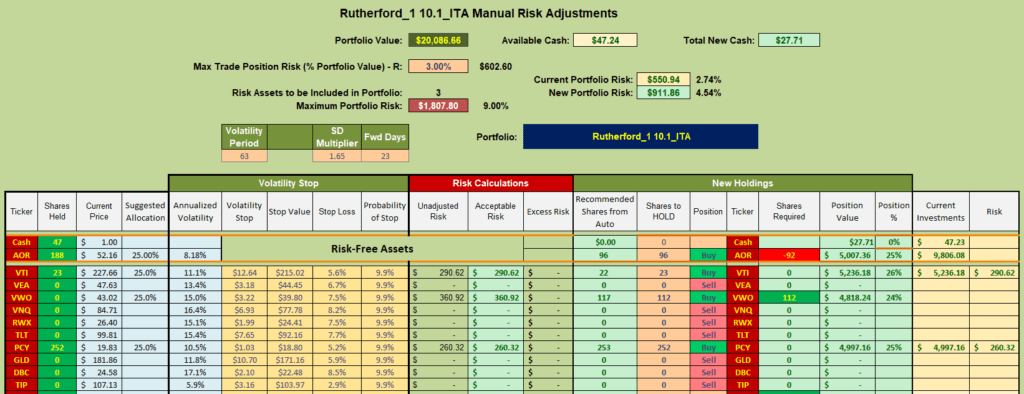

Consequently, this week’s adjustments will look like this:

i.e. I will be selling a portion of holdings in the benchmark fund to free up cash to buy shares in VWO (Emerging Market Equities). Positions in VTI and PCY are already held in this Tranche and so will stay there.

i.e. I will be selling a portion of holdings in the benchmark fund to free up cash to buy shares in VWO (Emerging Market Equities). Positions in VTI and PCY are already held in this Tranche and so will stay there.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.