If you can’t tell White from Wong this is a good place to eat in Auckland, New Zealand.

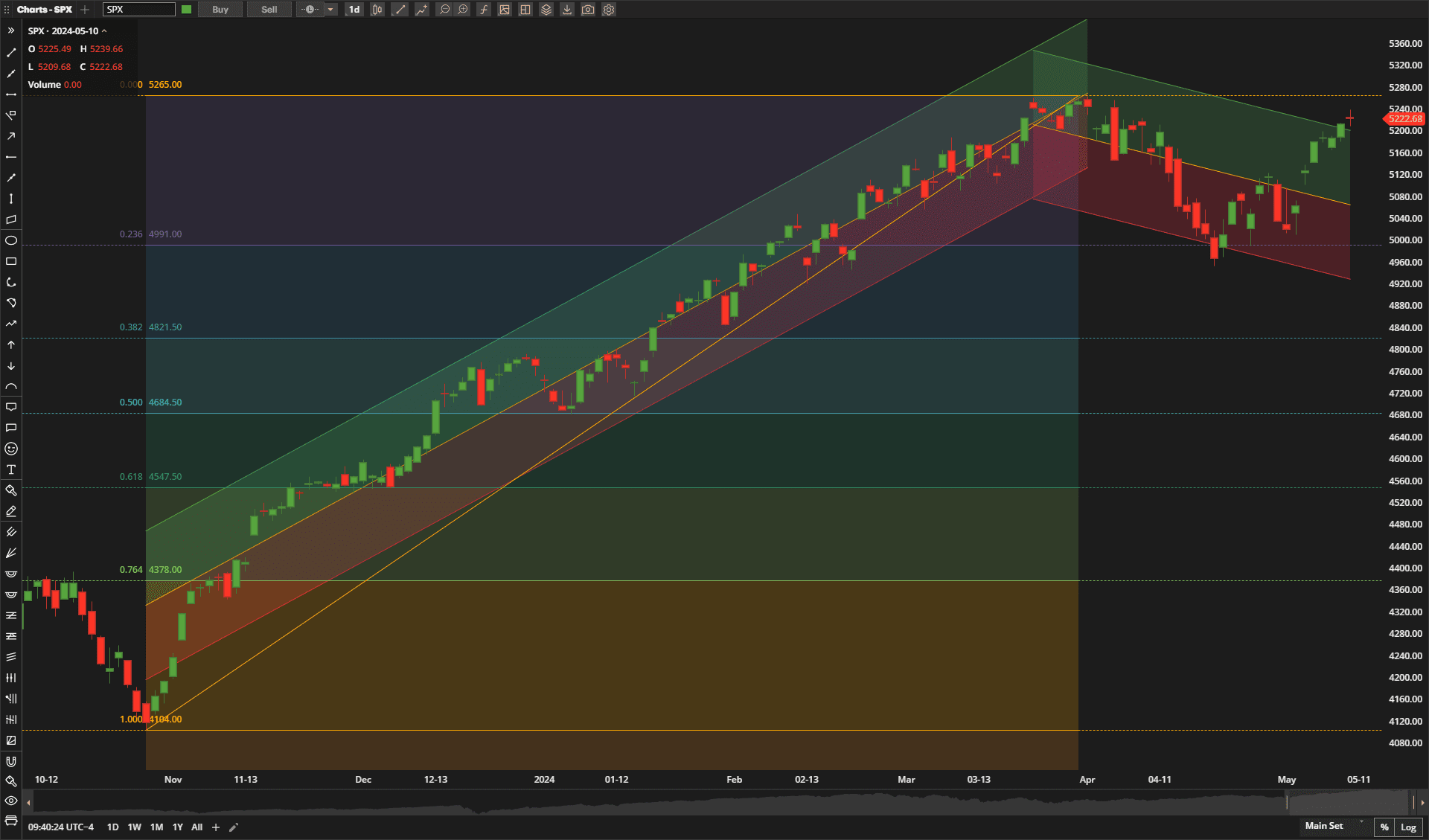

It was another bullish week in US equities with stocks ending ~1.8% higher than last week’s close:

This resulted in prices closing slightly outside the upper boundary of the tentative downtrend channel and above the psychological “round” 5200 resistence level left by the April pullback – but not quite returning to the all-time highs. It seems likely that these highs will be tested next week but we shall have to wait and see whether the bull market continues from there.

This resulted in prices closing slightly outside the upper boundary of the tentative downtrend channel and above the psychological “round” 5200 resistence level left by the April pullback – but not quite returning to the all-time highs. It seems likely that these highs will be tested next week but we shall have to wait and see whether the bull market continues from there.

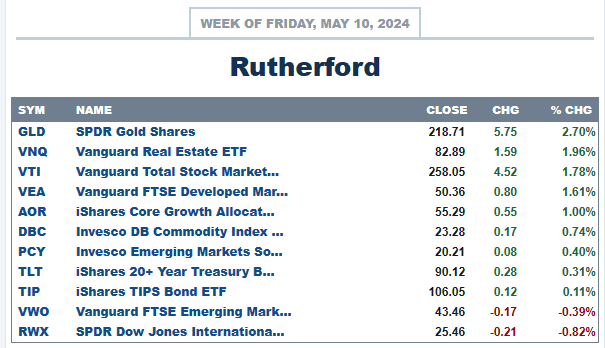

In terms of performance relative to other major asset classes US equities came in close to the top of the list:

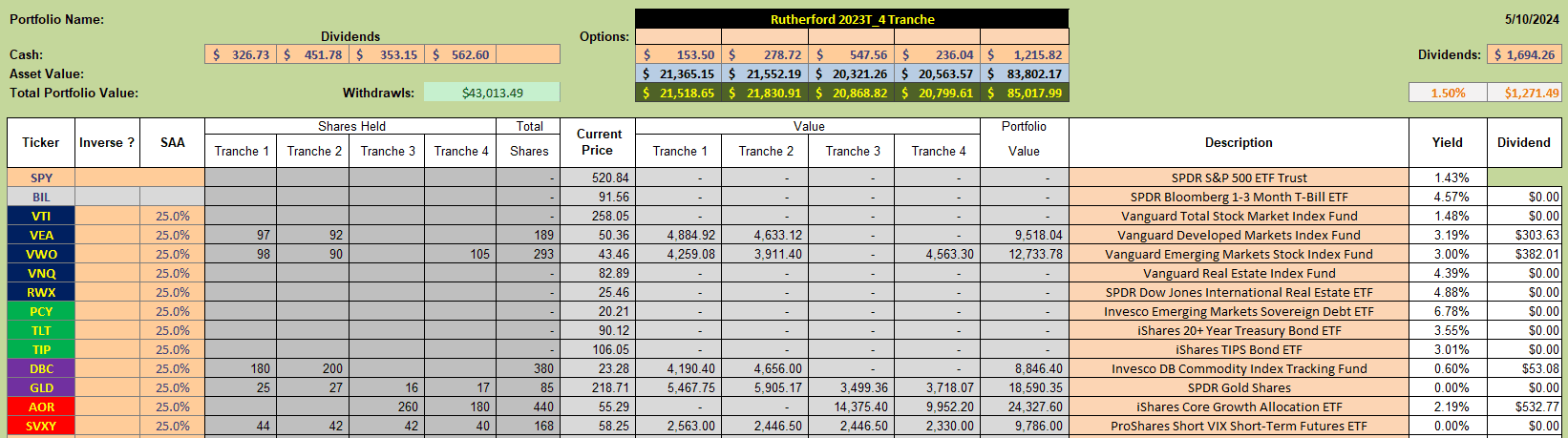

and, with holdings in the Rutherford Portfolio looking like this:

and, with holdings in the Rutherford Portfolio looking like this:

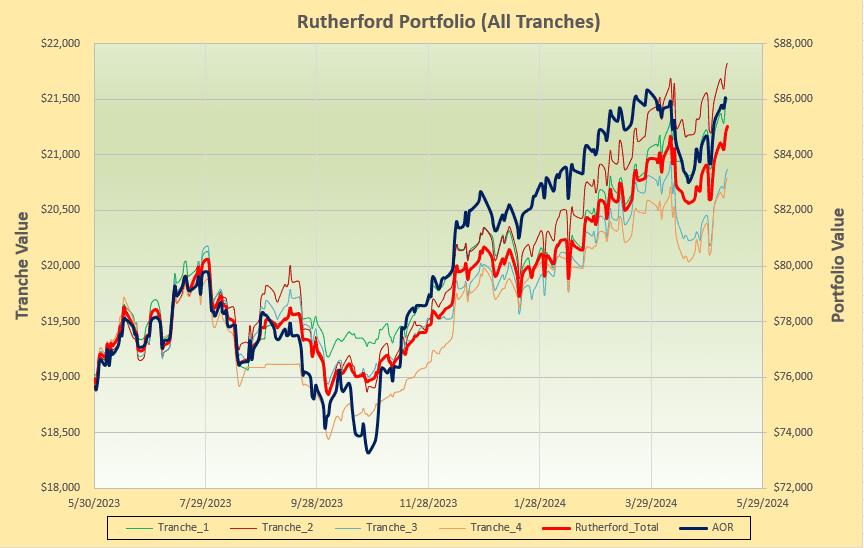

we saw performance in line with the benchmark AOR fund:

we saw performance in line with the benchmark AOR fund:

This week’r review focusses on Tranche 2 of this portfolio where we are currently holding positions in International Equities (VEA, VWO), Commodities (DBC) and Gold (GLD) as well as a long position in the inverse volatility ETF, SVXY.

This week’r review focusses on Tranche 2 of this portfolio where we are currently holding positions in International Equities (VEA, VWO), Commodities (DBC) and Gold (GLD) as well as a long position in the inverse volatility ETF, SVXY.

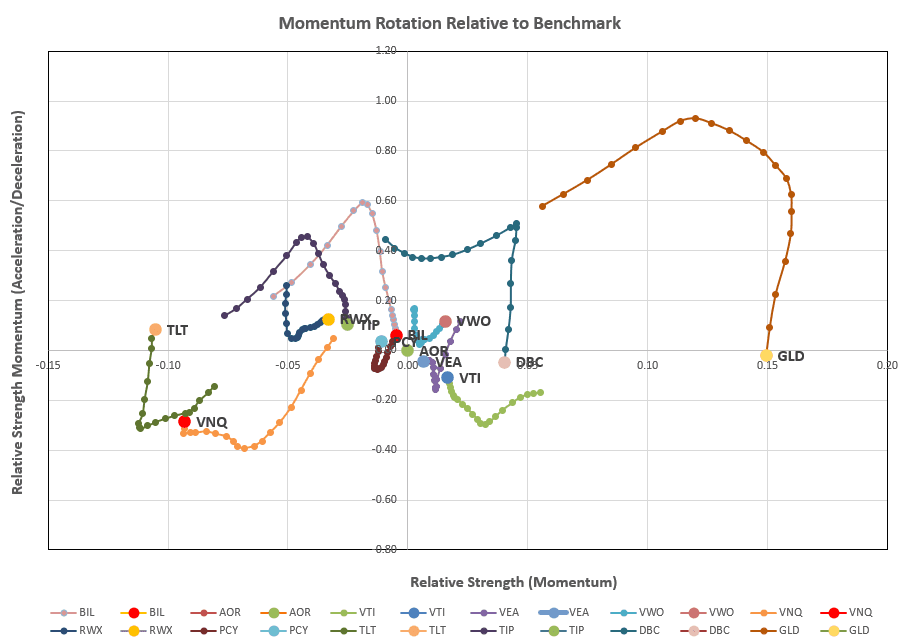

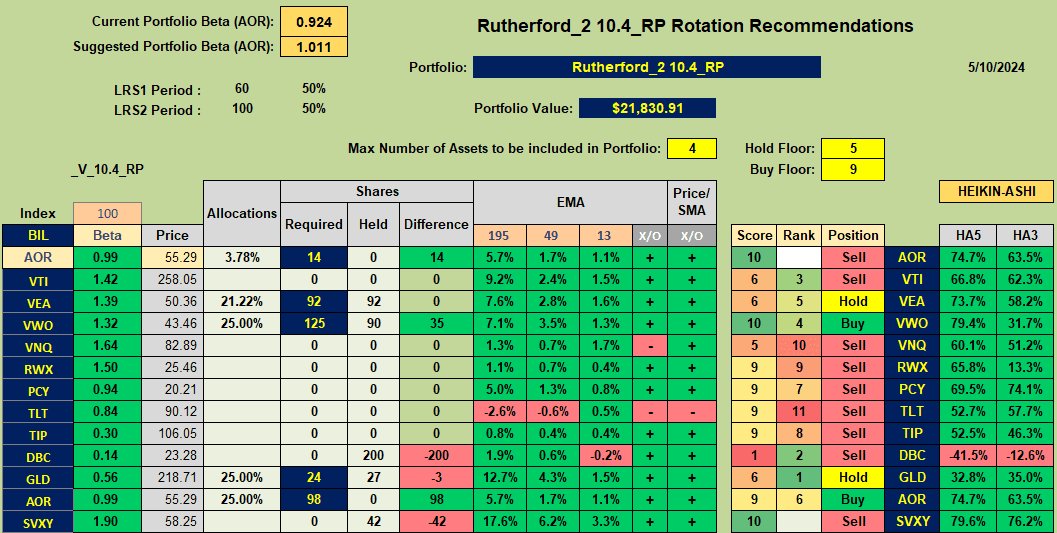

Checking current rankings and recommendations for the Rotation model we see the following picture:

with GLD and DBC in a short-term nose dive (vertical drop) – but still relatively strong longer term (further to the right). So, moving to the recommendation sheet:

with GLD and DBC in a short-term nose dive (vertical drop) – but still relatively strong longer term (further to the right). So, moving to the recommendation sheet:

we find Buy recommendations for VWO and AOR with Hold recommendations for VEA and GLD.

we find Buy recommendations for VWO and AOR with Hold recommendations for VEA and GLD.

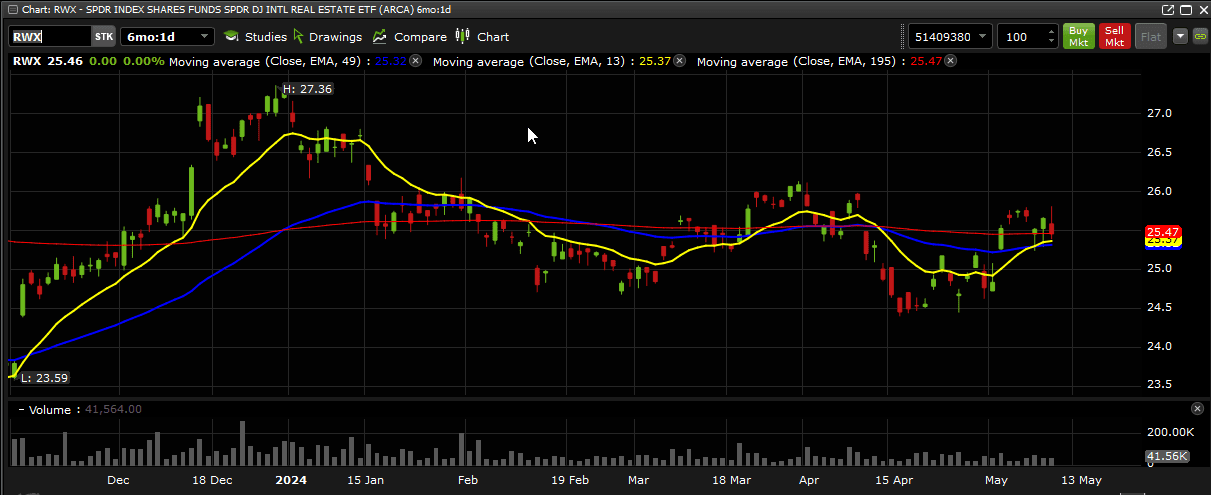

Last week a sharp ITA member asked why RWX was not a recommended Buy based on it’s high Score. This was primarily due to the fact that the 13-day EMA was then below the 49-day EMA – but that has now changed (barely):

However, RWX is still not showing as a Buy because of the maximum 4 asset limit being used to manage this portfolio. In fact, the maximum number of assets needs to be increased to 7 before RWX shows as a Buy – PCY and TIP slightly beat it out and, although we want to follow the “rules”, we don’t want to overtrade and increase our trading costs unnecessarily – so we’ll wait to see whether RWX continues it’s turn-around.

However, RWX is still not showing as a Buy because of the maximum 4 asset limit being used to manage this portfolio. In fact, the maximum number of assets needs to be increased to 7 before RWX shows as a Buy – PCY and TIP slightly beat it out and, although we want to follow the “rules”, we don’t want to overtrade and increase our trading costs unnecessarily – so we’ll wait to see whether RWX continues it’s turn-around.

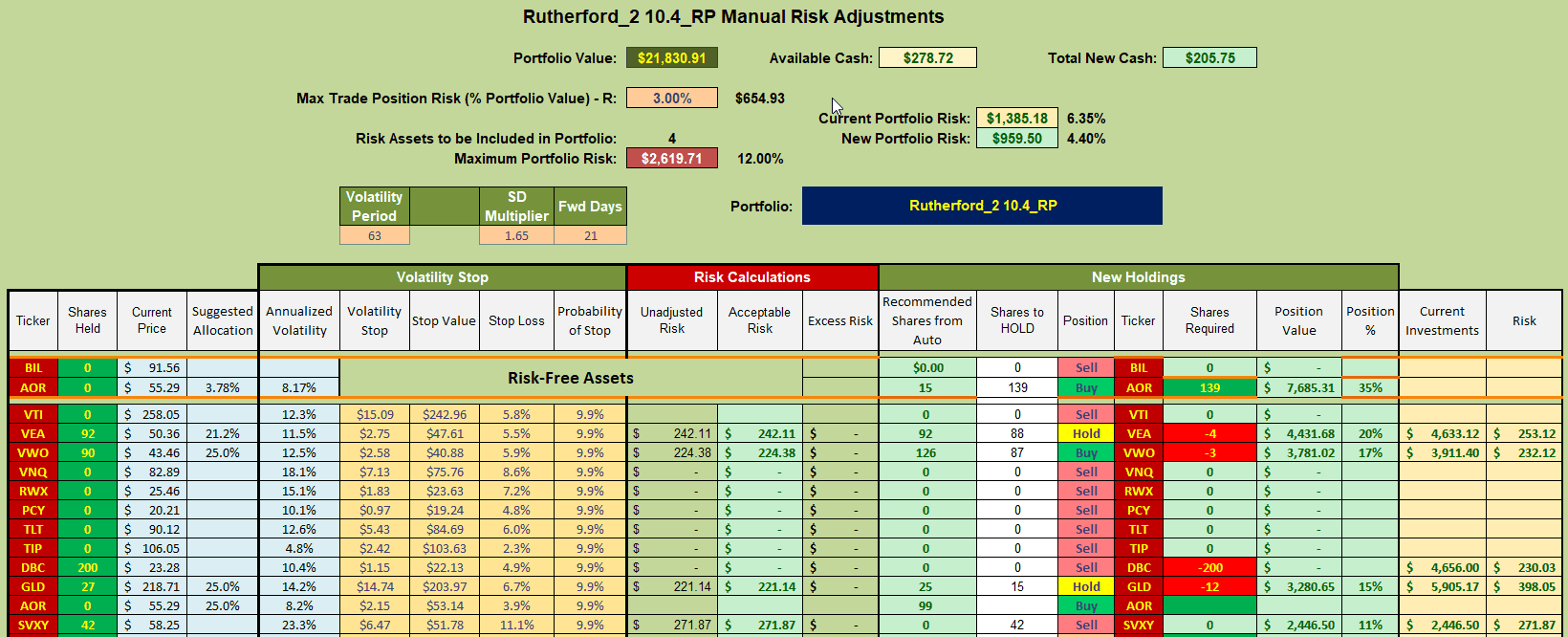

Based on the above information, adjustments for next week will look something like this:

where I shall be selling 200 shares of DBC and using the cash generated to buy shares in the benchmark AOR fund. I will not worry about the minor adjustments in VEA, VWO and GLD so as to avoid trading costs, especially with AOR being a diversified “balanced” fund.

where I shall be selling 200 shares of DBC and using the cash generated to buy shares in the benchmark AOR fund. I will not worry about the minor adjustments in VEA, VWO and GLD so as to avoid trading costs, especially with AOR being a diversified “balanced” fund.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question