Entrance to Edinburgh Castle, Scotland

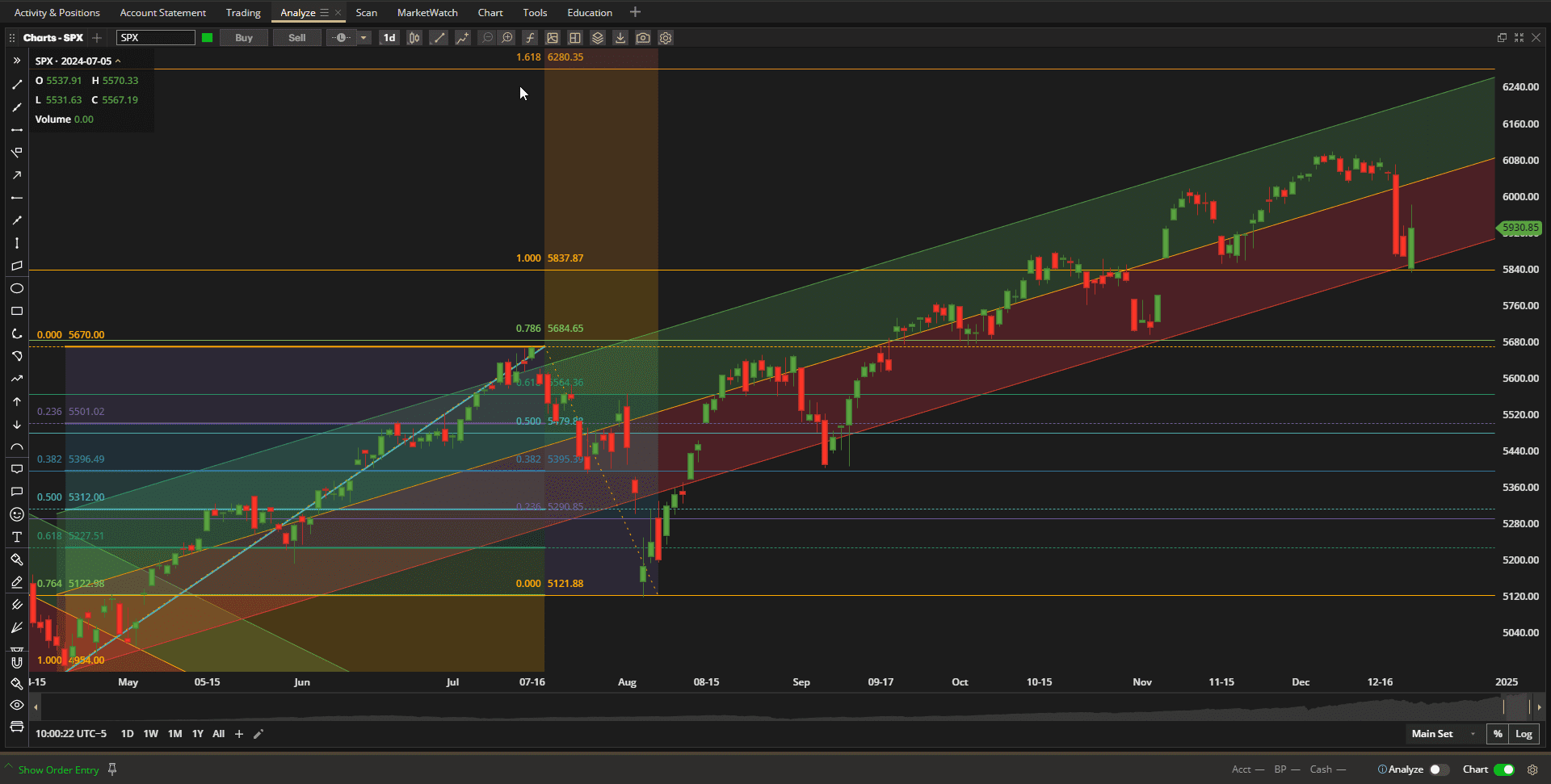

Mr Powell seems to be the Grinch who stole Christmas and blocked Santa’s rally to the 6200 level. Investors did not react well to Mr Powell’s statements that there might only be two rate cuts next year and US markets dropped close to 4% following his comments before recovering some of this on Friday:

However, we remain in the uptrend channel that started in May and may still close the year with significant gains.

However, we remain in the uptrend channel that started in May and may still close the year with significant gains.

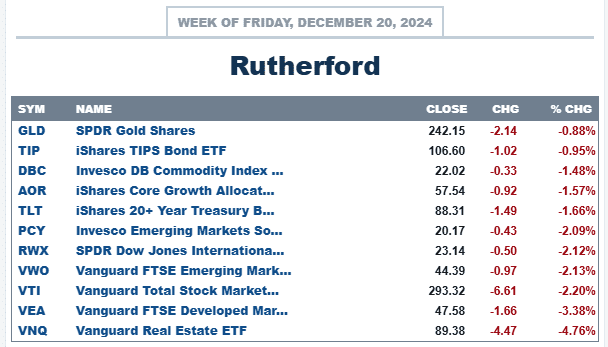

US markets were not the only losers and all major asset classes showed losses on the week. So much for the benefits of diversification 🙂

US markets were not the only losers and all major asset classes showed losses on the week. So much for the benefits of diversification 🙂

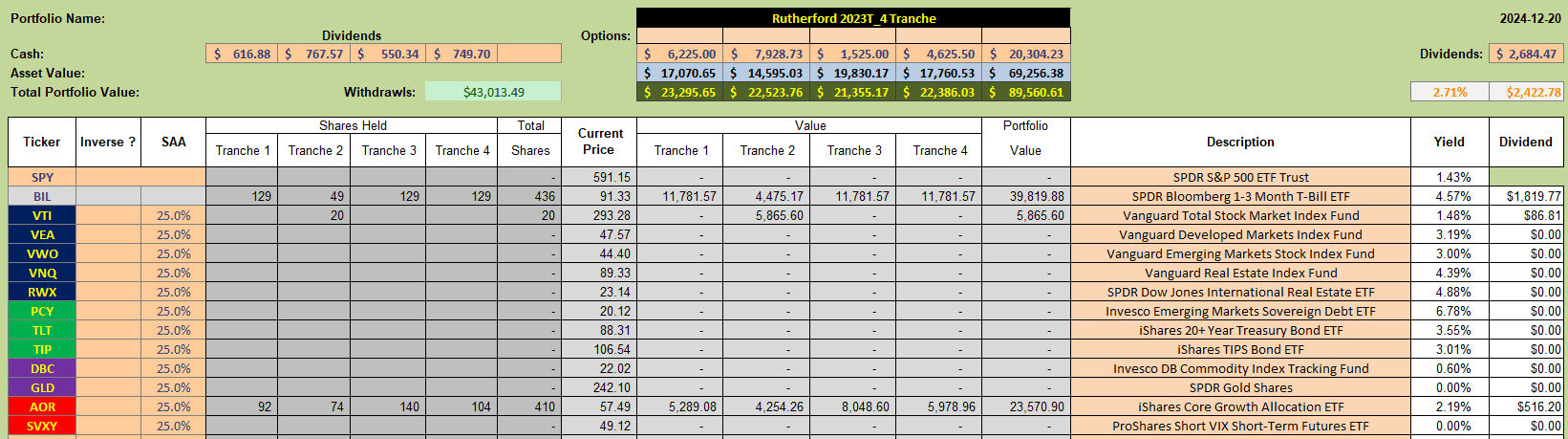

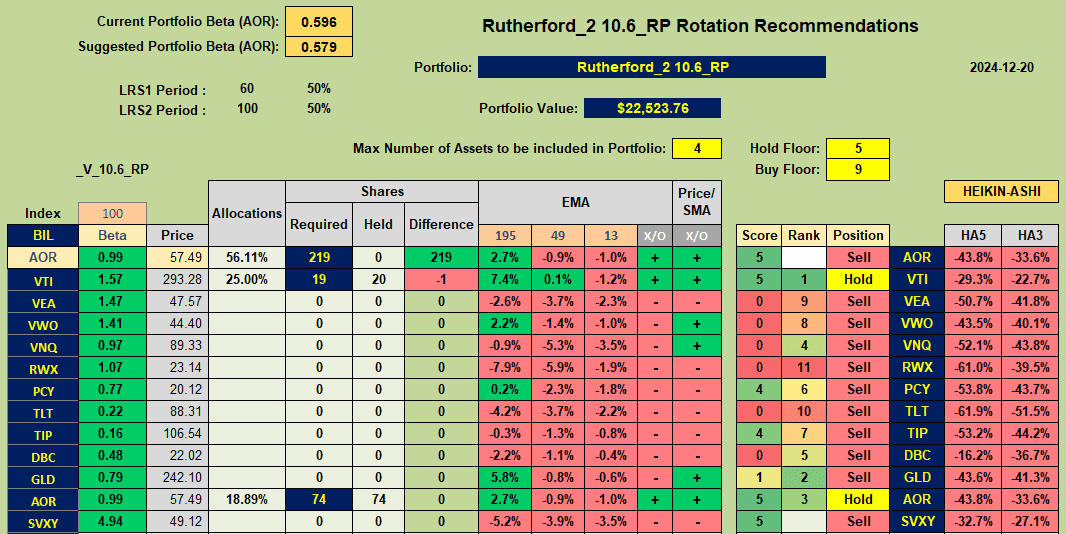

Due to the fact that I am revisiting my strategy for managing the Rutherford Portfolio it currently has few holdings:

with only the benchmark AOR Fund and a few shares in VTI being held in addition T-Bills (BIL).

with only the benchmark AOR Fund and a few shares in VTI being held in addition T-Bills (BIL).

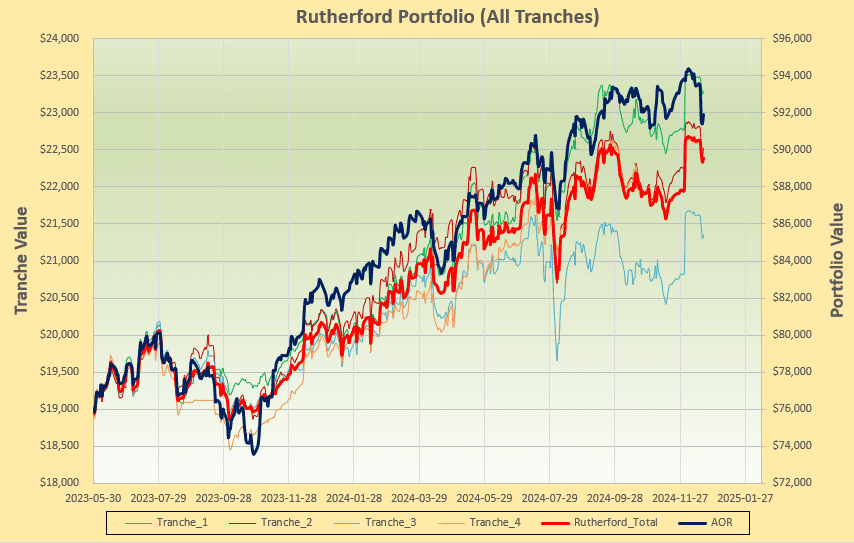

This helped a little with this week’s melt-down:

but it was just about impossible to avoid completely.

but it was just about impossible to avoid completely.

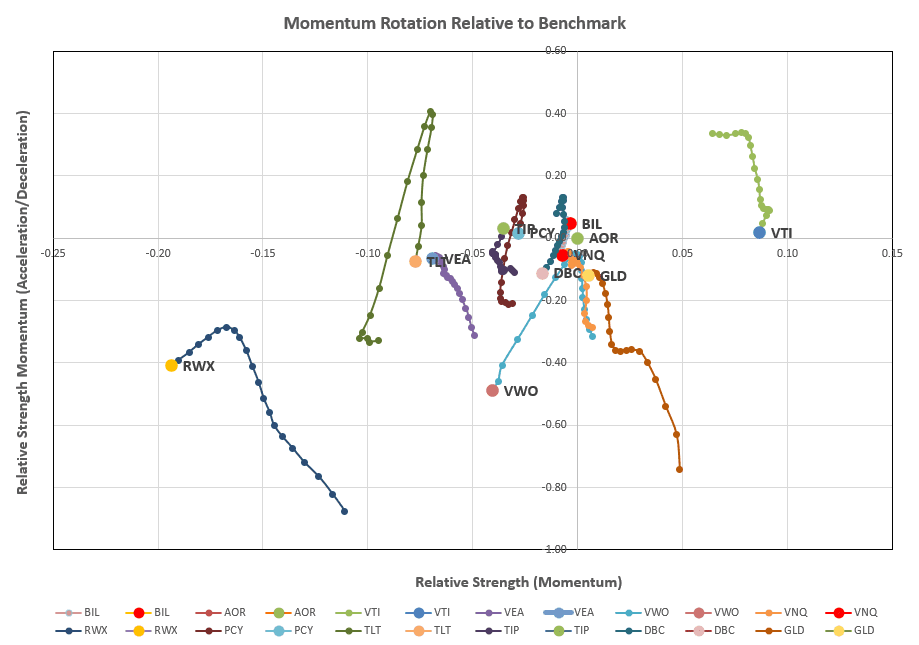

Checking the rotation graphs:

VTI is barely holding in the top right quadrant and the rankings/recommendation sheet is showing a lot of red:

VTI is barely holding in the top right quadrant and the rankings/recommendation sheet is showing a lot of red:

As I have mentioned I am closing down the use of this rotation model for the Rutherford – so I will sell my last holdings in VTI and hold AOR until the end of the year.

As I have mentioned I am closing down the use of this rotation model for the Rutherford – so I will sell my last holdings in VTI and hold AOR until the end of the year.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question