Bird Of Paradise, Auckland Botanic Gardens, New Zealand

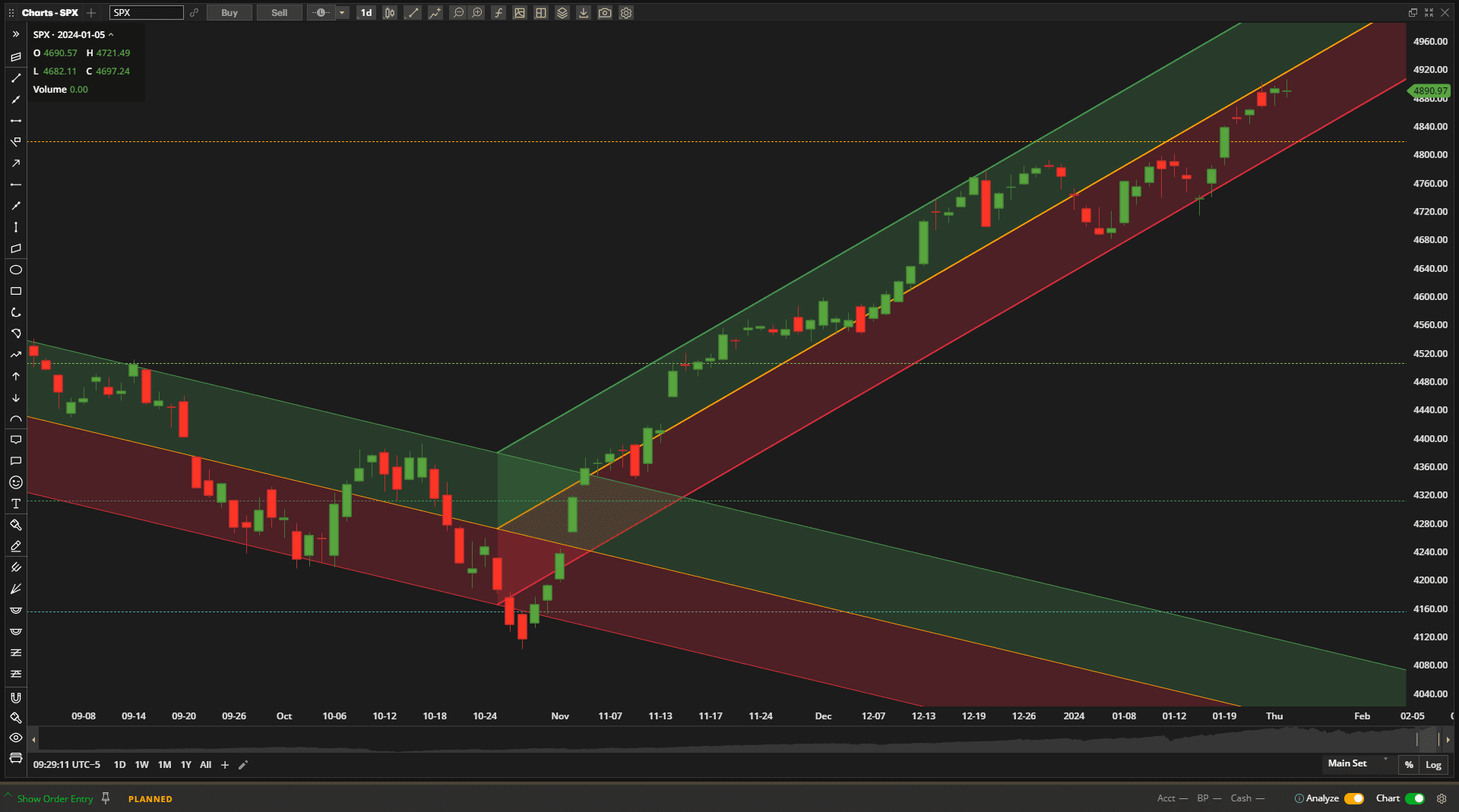

It was a relatively calm but bullish week in US equity markets as the S&P 500 Index continued it’s climb above the important 4800 resistance level (that now becomes a potential support level):

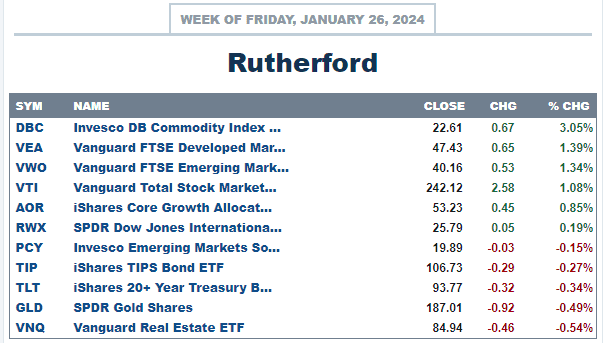

US equities rose a little over 1% over the past week – generally in line with international equity markets, but all of which were dominated by the strength in Commodities:

US equities rose a little over 1% over the past week – generally in line with international equity markets, but all of which were dominated by the strength in Commodities:

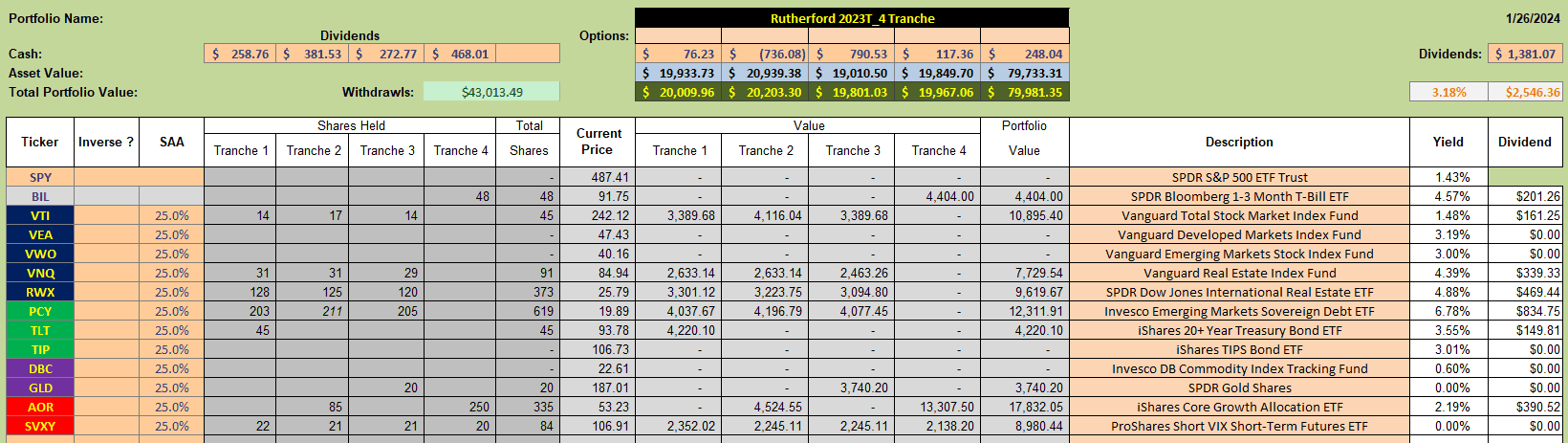

Unfortunately, I am not currently holding any shares in DBC in The Rutherford Portfolio:

Unfortunately, I am not currently holding any shares in DBC in The Rutherford Portfolio:

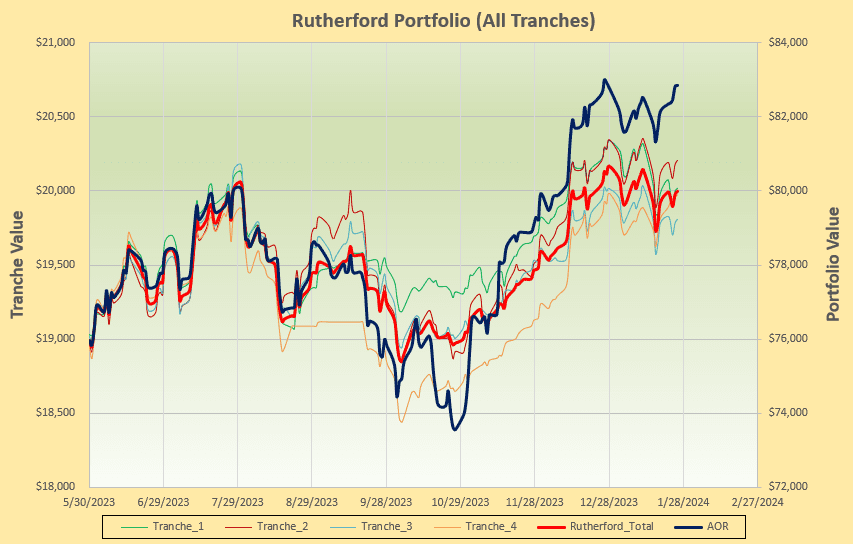

and performance lost a little ground relative to the diversified AOR benchmark fund:

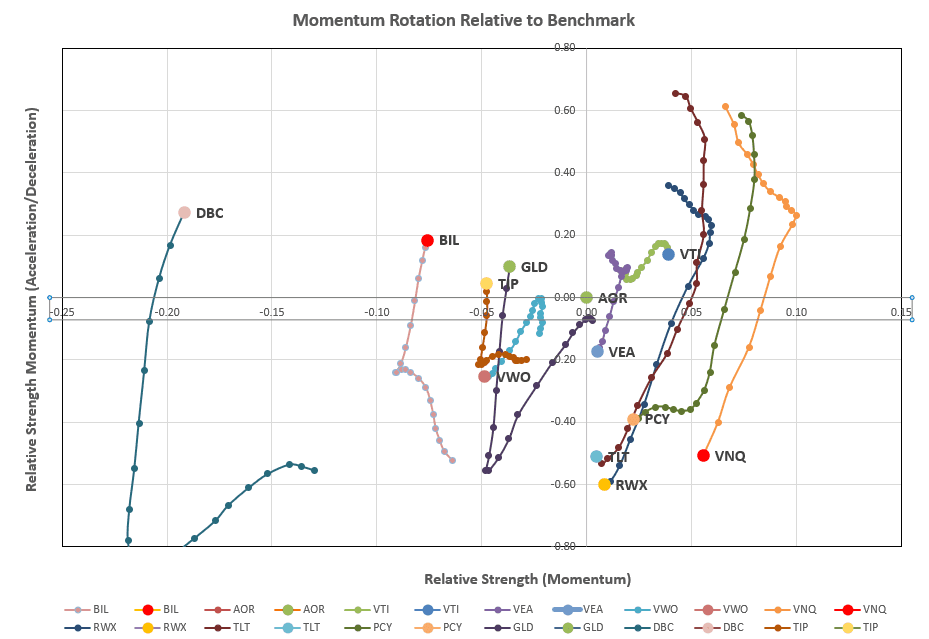

Unfortunately, I was again too busy to make any adjustments to Tranche 2 last week – so I will attempt to catch up next week. Looking at the situation in Tranche 3 (the focus of this week’s review) we see the following picture in the rotation graphs:

Unfortunately, I was again too busy to make any adjustments to Tranche 2 last week – so I will attempt to catch up next week. Looking at the situation in Tranche 3 (the focus of this week’s review) we see the following picture in the rotation graphs:

where there has been significant weakening in all asset classes with only VTI (US equities) remaining in the desirable top right quadrant. In the short term (upward vertical movement) DBC, GLD, BIL and TIP are showing relative strength but it remains to be seem whether this trend will be reflected in the longer term (by left to right movement along the horizontal axis).

where there has been significant weakening in all asset classes with only VTI (US equities) remaining in the desirable top right quadrant. In the short term (upward vertical movement) DBC, GLD, BIL and TIP are showing relative strength but it remains to be seem whether this trend will be reflected in the longer term (by left to right movement along the horizontal axis).

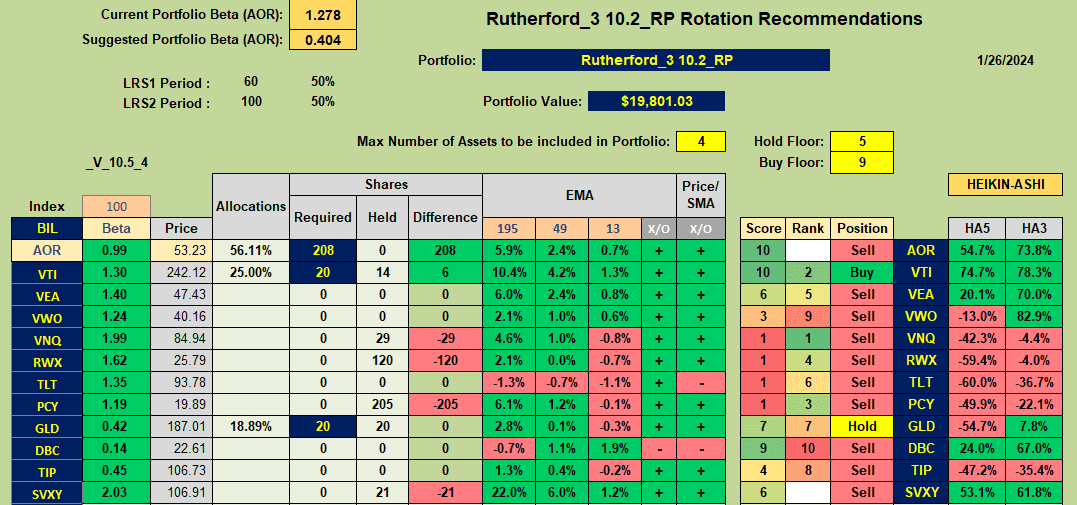

Recomendations from the rotation model look like this:

with a Buy recommendation for VTI and a Hold recommendation for GLD.

with a Buy recommendation for VTI and a Hold recommendation for GLD.

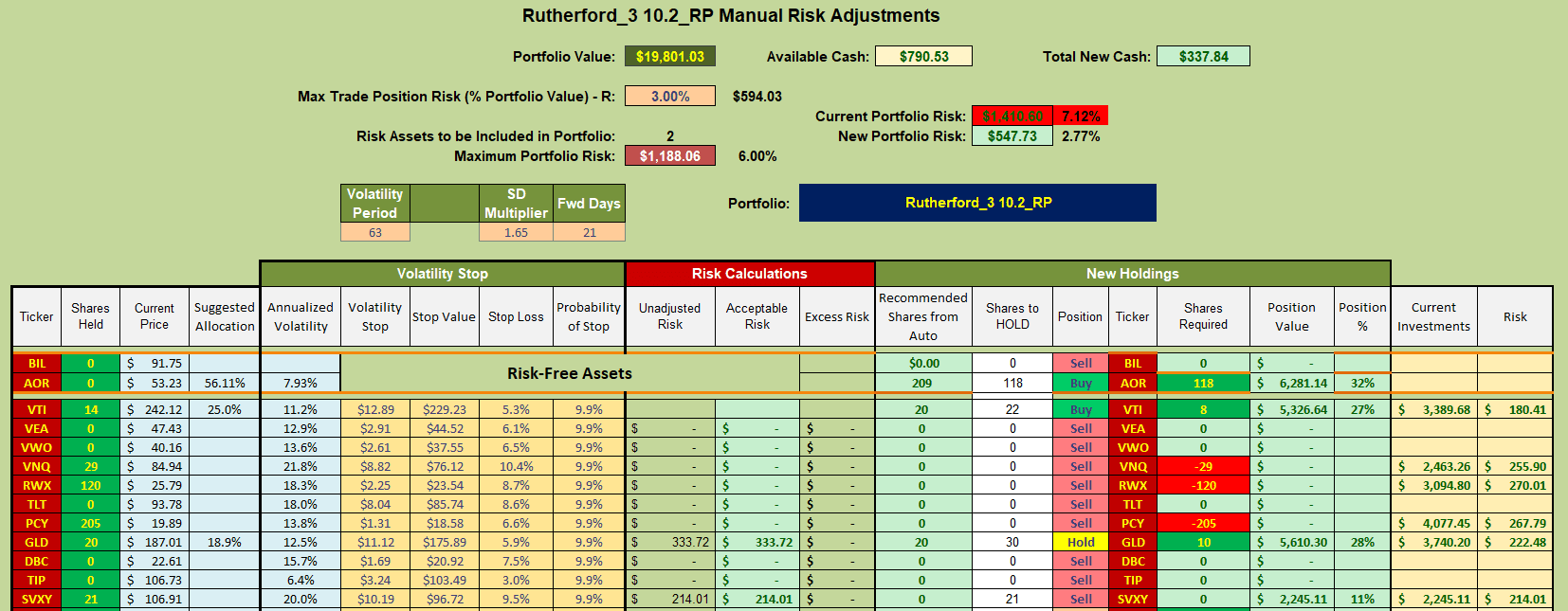

Consequently, this week’s adjustments look something like this:

which means that I shall be selling positions held in Real Estate (VNQ and RWX) and International Bonds (PCY) with most of the proceeds going into the benchmark AOR Fund (and minor additions to VTI and GLD).

which means that I shall be selling positions held in Real Estate (VNQ and RWX) and International Bonds (PCY) with most of the proceeds going into the benchmark AOR Fund (and minor additions to VTI and GLD).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.