Supertrees, Gardens by the Bay, Singapore

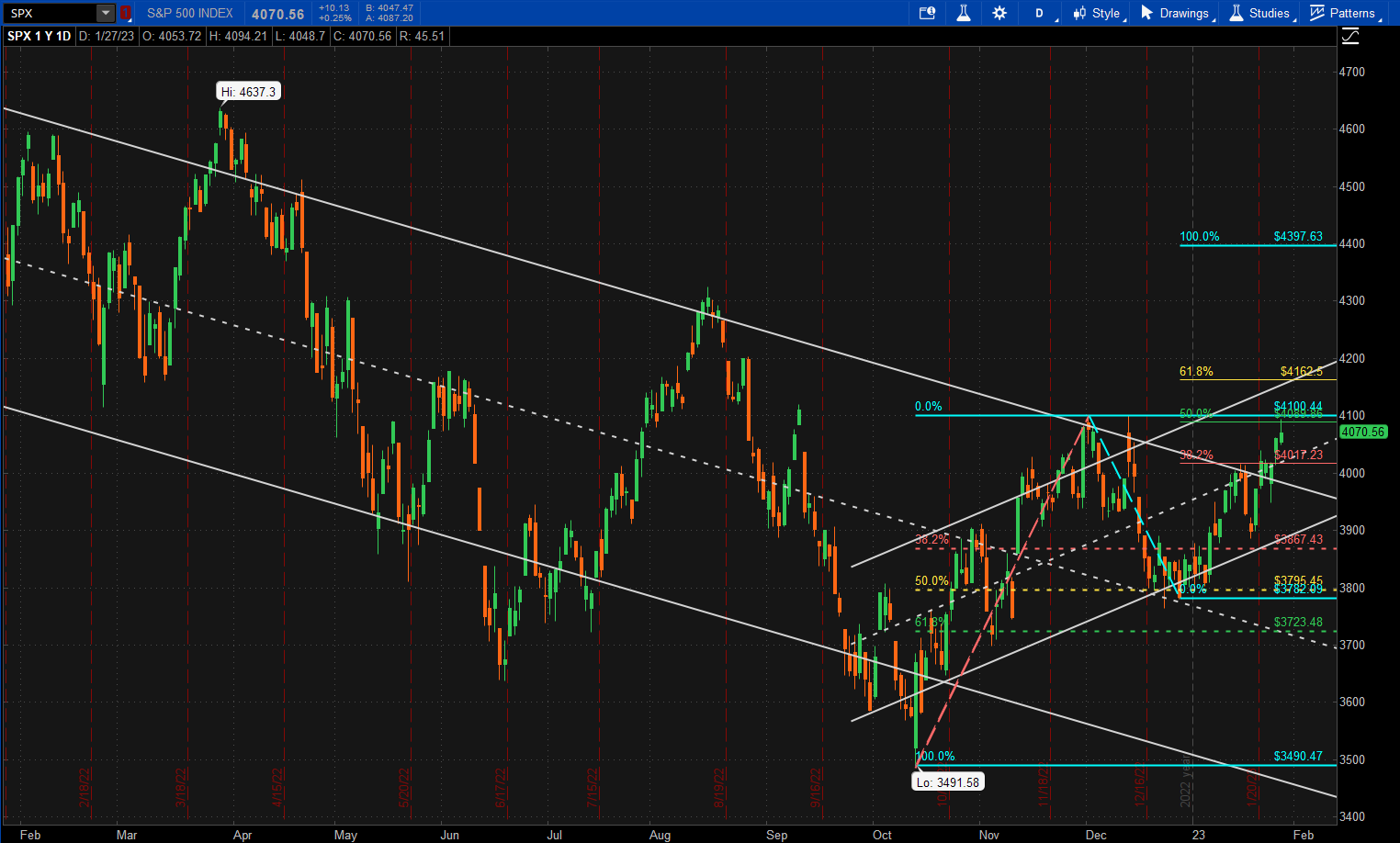

It was a bullish week for US equities with the SPX up over 2.6% on the week:

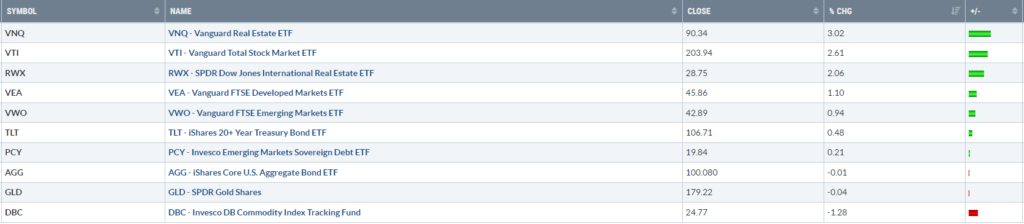

and touching (but not closing above) the 4100 level that might indicate a reversal of the 2022 downtrend. In terms of relative strength, US equities outperformed all other major asset classes except for US Real estate:

and touching (but not closing above) the 4100 level that might indicate a reversal of the 2022 downtrend. In terms of relative strength, US equities outperformed all other major asset classes except for US Real estate:

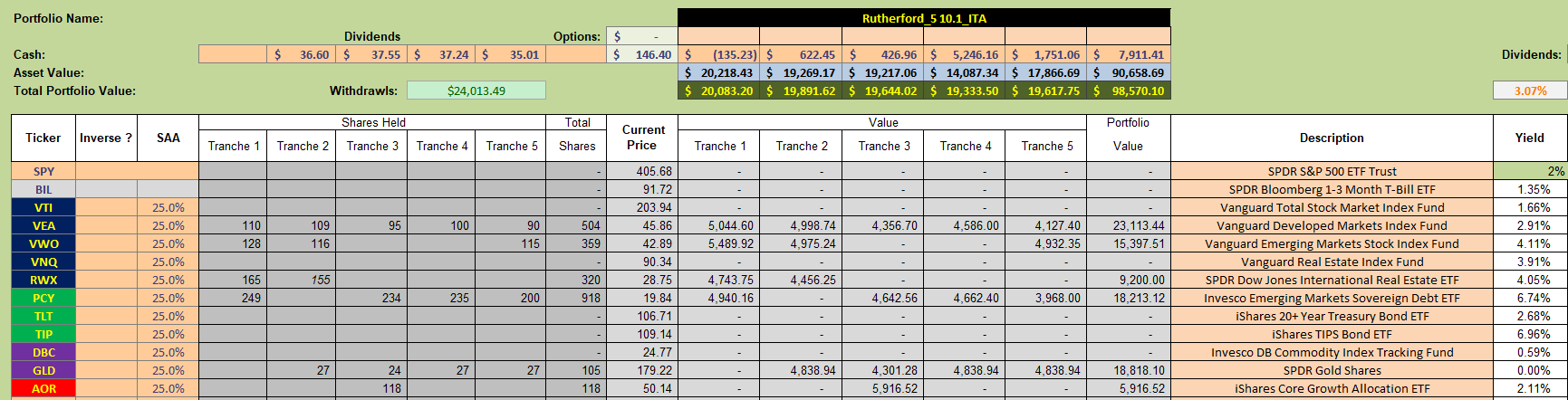

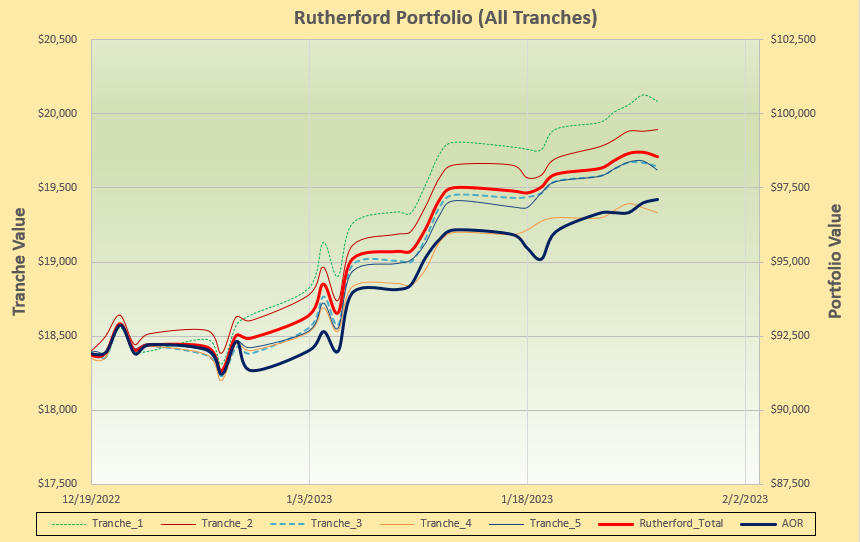

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

and performance, year-to-date, like this:

and performance, year-to-date, like this:

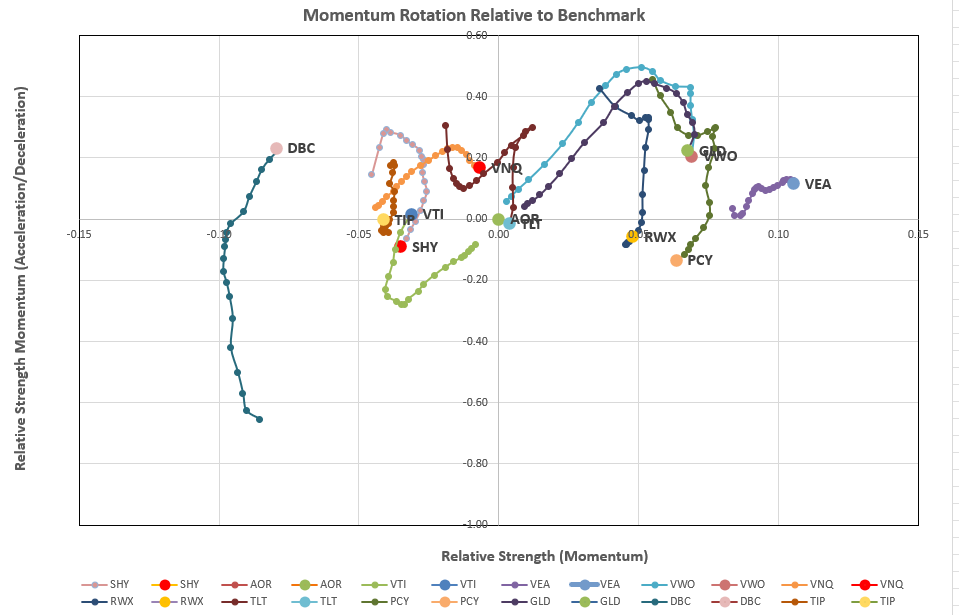

I am presently using the Rotation model to manage this portfolio and the rotation graphs are shown in the following screenshot:

I am presently using the Rotation model to manage this portfolio and the rotation graphs are shown in the following screenshot:

with Developed Market Equities still showing the highest relative strength.

with Developed Market Equities still showing the highest relative strength.

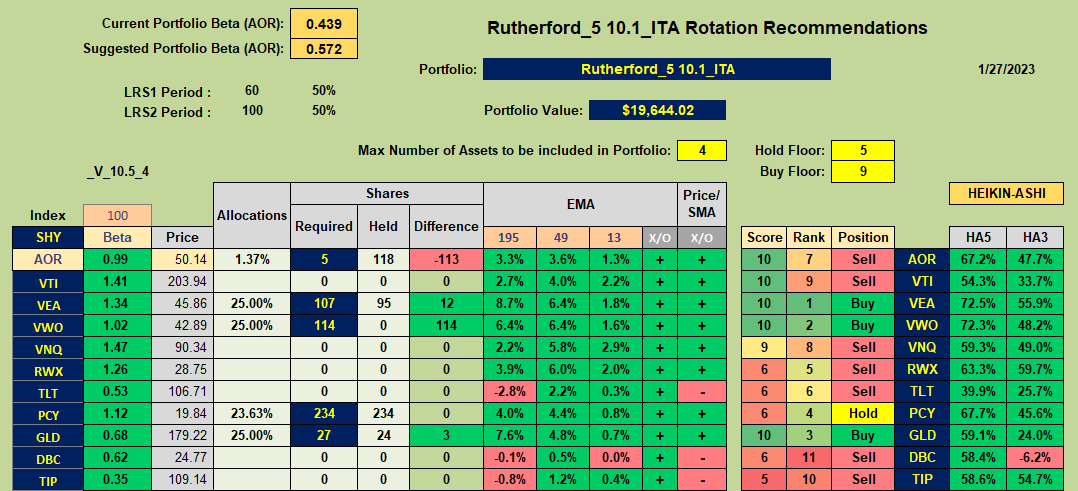

Recommendations from the model look like this:

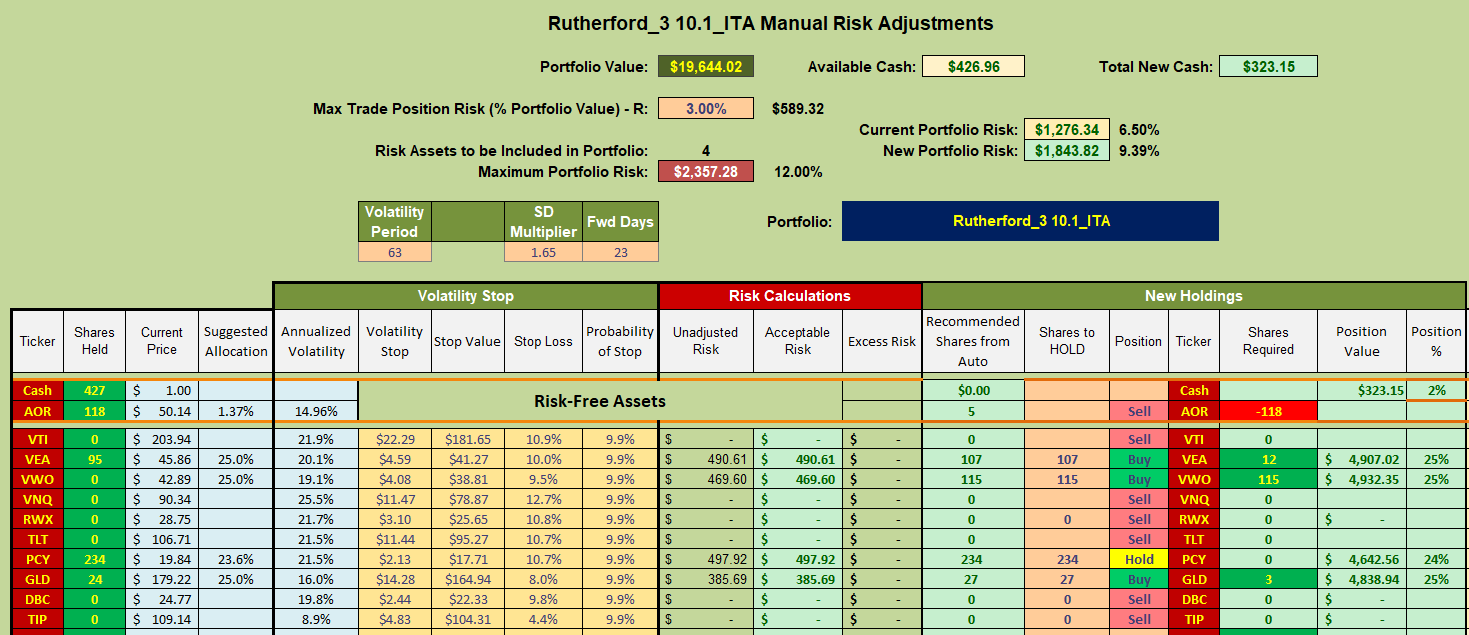

with recommendations (for Tranche 3, the focus of this week’s review) to Buy VEA, VWO and GLD, Hold current holdings in PCY and Sell holdings in AOR (the benchmark fund). Accordingly my adjustments for this week will look something like this:

with recommendations (for Tranche 3, the focus of this week’s review) to Buy VEA, VWO and GLD, Hold current holdings in PCY and Sell holdings in AOR (the benchmark fund). Accordingly my adjustments for this week will look something like this:

essentially replacing holdings in AOR with holdings in VWO (Emerging Market Equities).

essentially replacing holdings in AOR with holdings in VWO (Emerging Market Equities).

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.