Fantasy Gardens, Koh Samui, Thailand

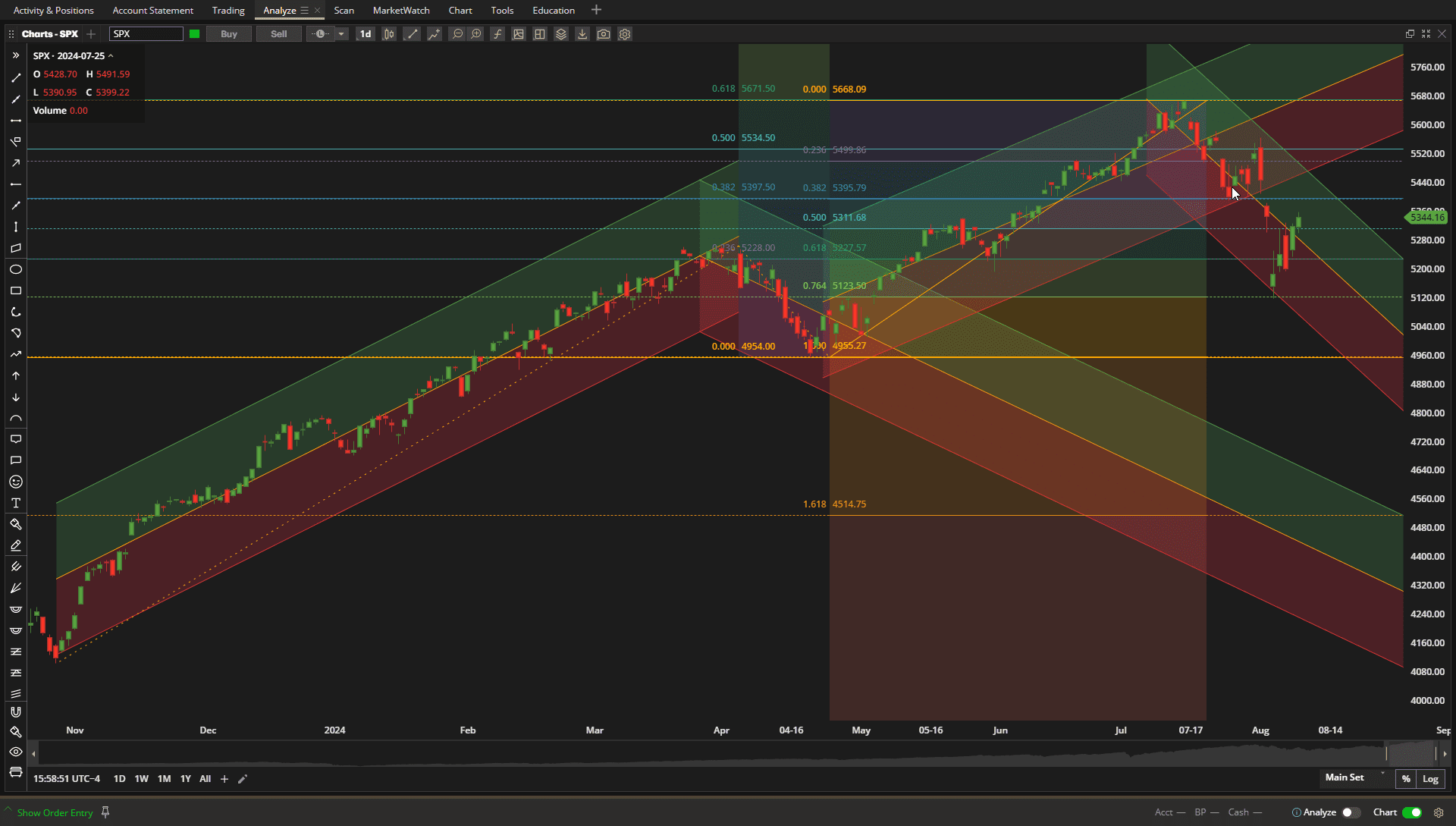

If we were just to look at prices today and the same time last week we might think that it was a quiet week in the US markets – but, it was far from that, with a dramatic pullback on Monday followed by a full recovery by the end of the week:

Monday saw a dramatic drop to the bottom of the downtrend channel suggested in last week’s review and, coincidentally, the 76.4% Fibonnaci retracement level. This level is not usually associated with strong support, although, since we blew through the strongest 61.8% level it is not too surprising that this level came into play. We are presently at the center line of the tentative bearish regression channel and we wait for next week’s action as political uncertainties affect the markets.

Monday saw a dramatic drop to the bottom of the downtrend channel suggested in last week’s review and, coincidentally, the 76.4% Fibonnaci retracement level. This level is not usually associated with strong support, although, since we blew through the strongest 61.8% level it is not too surprising that this level came into play. We are presently at the center line of the tentative bearish regression channel and we wait for next week’s action as political uncertainties affect the markets.

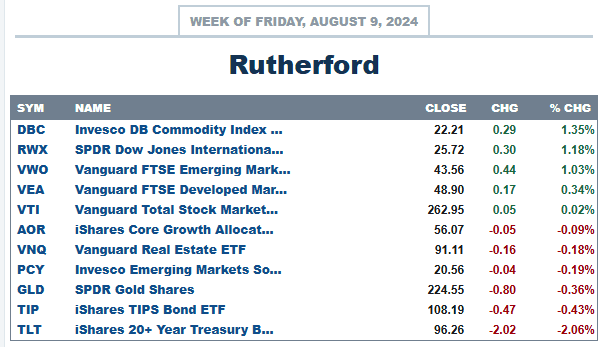

Relative to other major asset classes, US Equities again ended the week at the center of the pack:

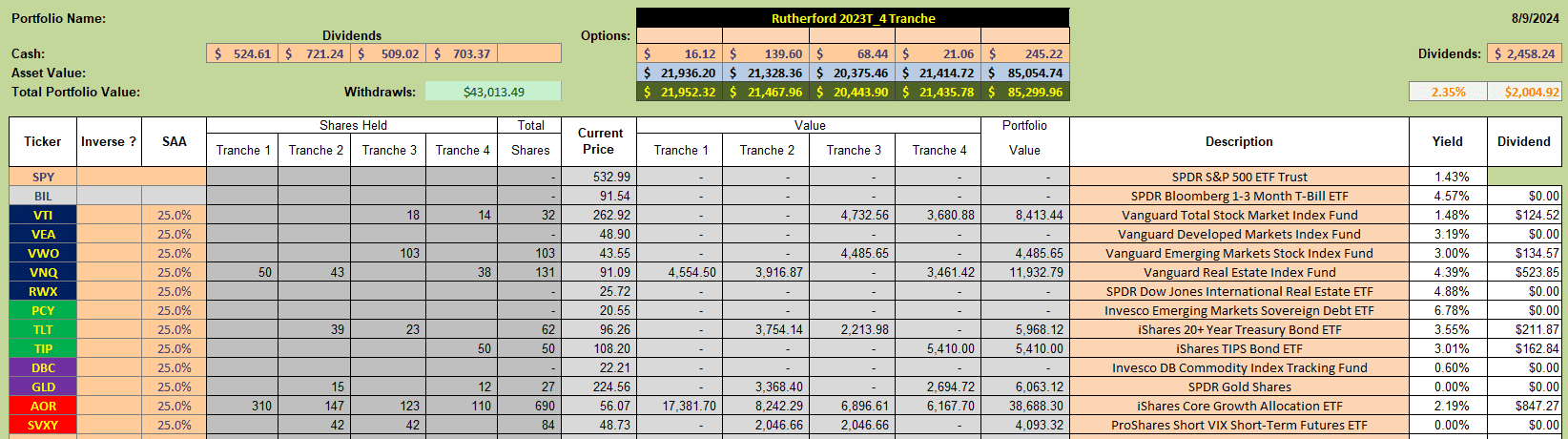

With current holdings in the portfolio looking like this:

With current holdings in the portfolio looking like this:

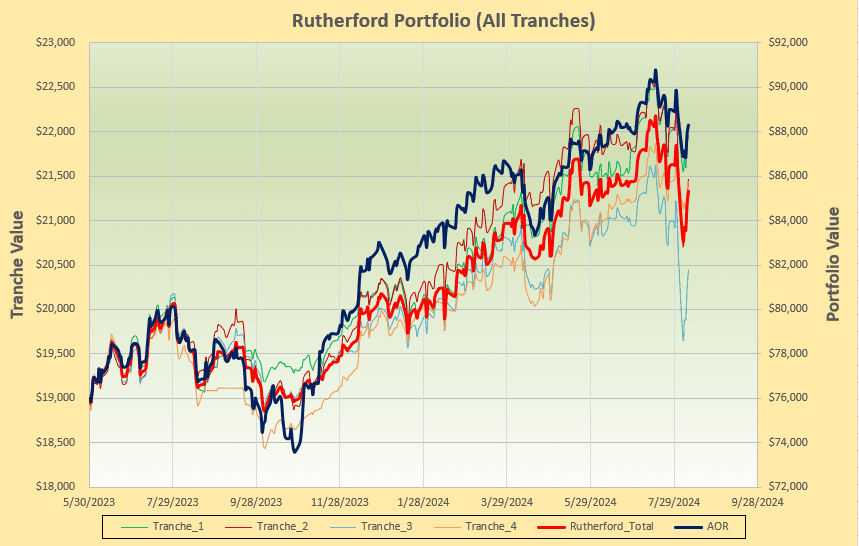

although I have been reducing exposure to equities over the past 2 weeks, the portfolio is still tilted slightly in favor of equities so performance followed the equity trend:

although I have been reducing exposure to equities over the past 2 weeks, the portfolio is still tilted slightly in favor of equities so performance followed the equity trend:

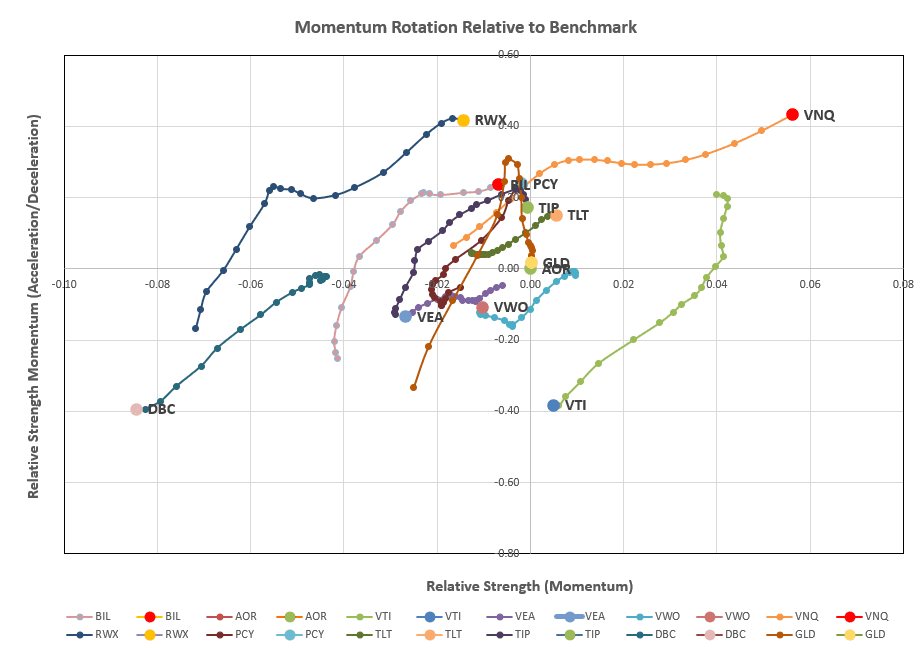

With Tranche 3 (the focus of this week’s review) holding significant allocations to equities (VTI and VWO) we check the rotation graphs:

With Tranche 3 (the focus of this week’s review) holding significant allocations to equities (VTI and VWO) we check the rotation graphs:

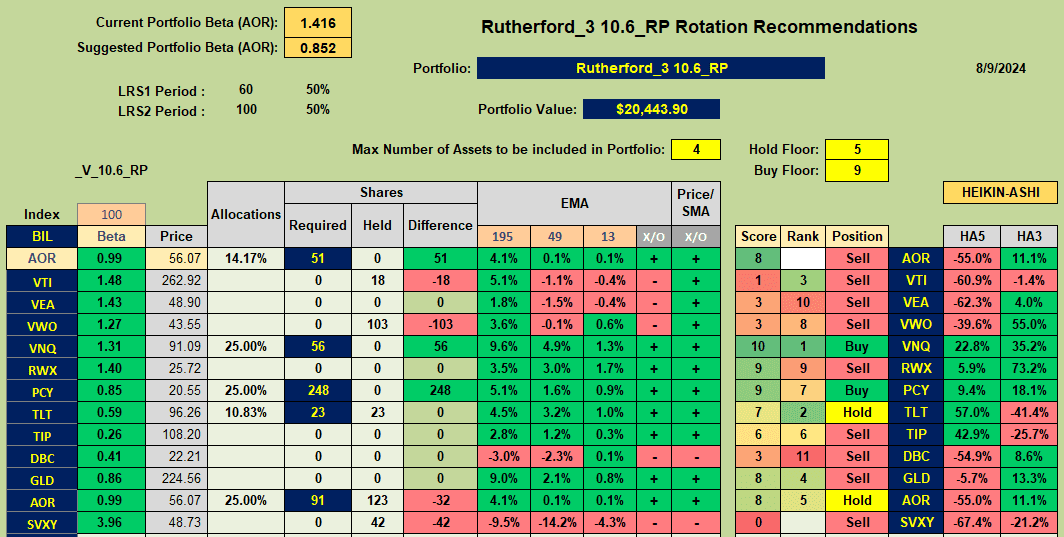

where we see the continued demise of US Equities (VTI) and relative strength in the Real Estate sector (VNQ). Defensive stocks (Bonds and Gold) show relatively strongly (although not dramatically so) and this is confirmed by the recommendations from the Rotation model algorithm used to manage this portfolio:

where we see VNQ and PCY as recommended Buys and TLT and AOR with Hold recommendations. All equity ETFs (VTI,VEA and VWO) are recommended Sells.

where we see VNQ and PCY as recommended Buys and TLT and AOR with Hold recommendations. All equity ETFs (VTI,VEA and VWO) are recommended Sells.

Before looking at the adjustment sheet for next week I should just mention here that, although my intention was to sell holdings in SVXY (favoring lower volatility) last week, so as to reduce my exposure to volatility, I did NOT do so since volatility spiked on Monday so I let it ride (hopefully to lower levels). Since this is a discretionary adjustment I will not sell SVXY this week unless volatility drops more towards it’s “mean” level – at which time I will also sell holdings in Tranche 2 (last week’s intended trade).

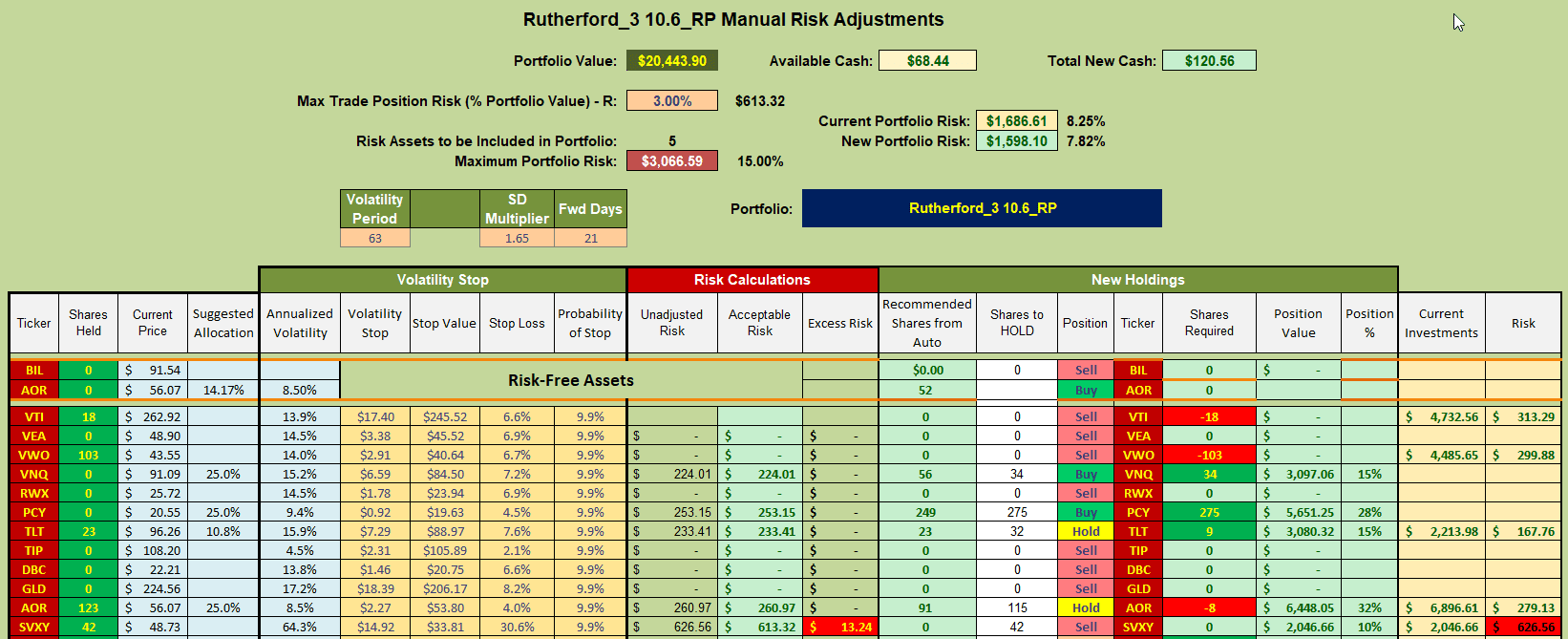

Adjustments for next week will look something like this:

where I shall sell current holdings in VTI and VWO and use the funds to buy shares in VNQ (for the 4th week in a row) and PCY (that were sold out last week). Any excess funds will be used to buy a few more shares in TLT.

where I shall sell current holdings in VTI and VWO and use the funds to buy shares in VNQ (for the 4th week in a row) and PCY (that were sold out last week). Any excess funds will be used to buy a few more shares in TLT.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.