Palace Gardens, Bali, Indonesia

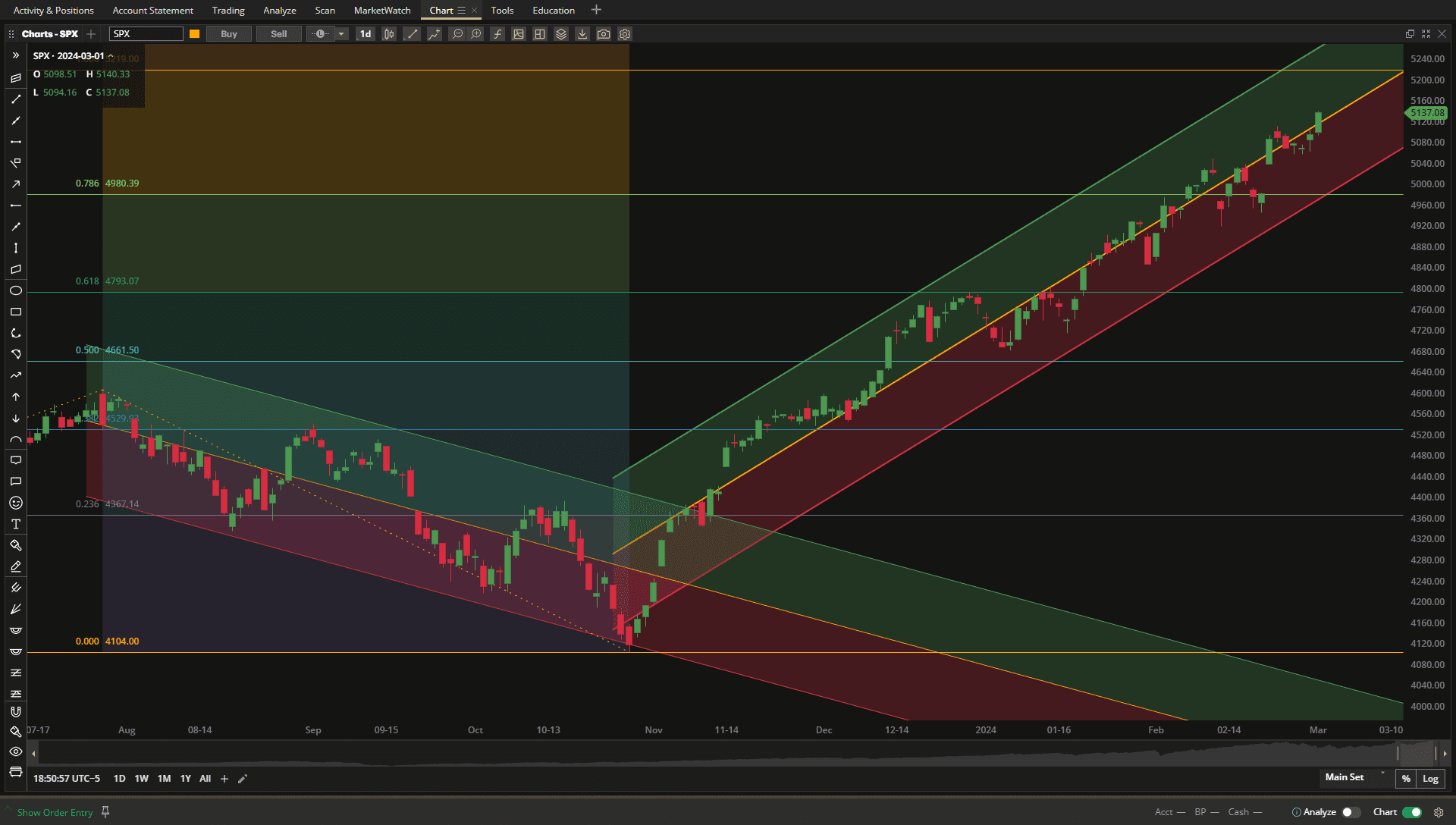

US Equities continued their bullish climb over the past week and are still heading towards the 5200 level where we might expect to see a little resistance:

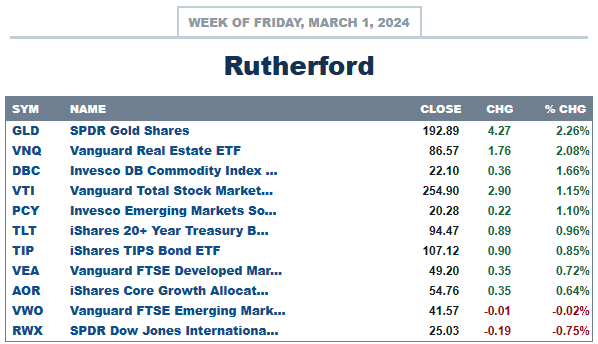

In terms of relative strength VTI (representing US Equities) came in roughly the middle of the pack being outshone by Gold (GLD) and US Real Estate (VNQ):

In terms of relative strength VTI (representing US Equities) came in roughly the middle of the pack being outshone by Gold (GLD) and US Real Estate (VNQ):

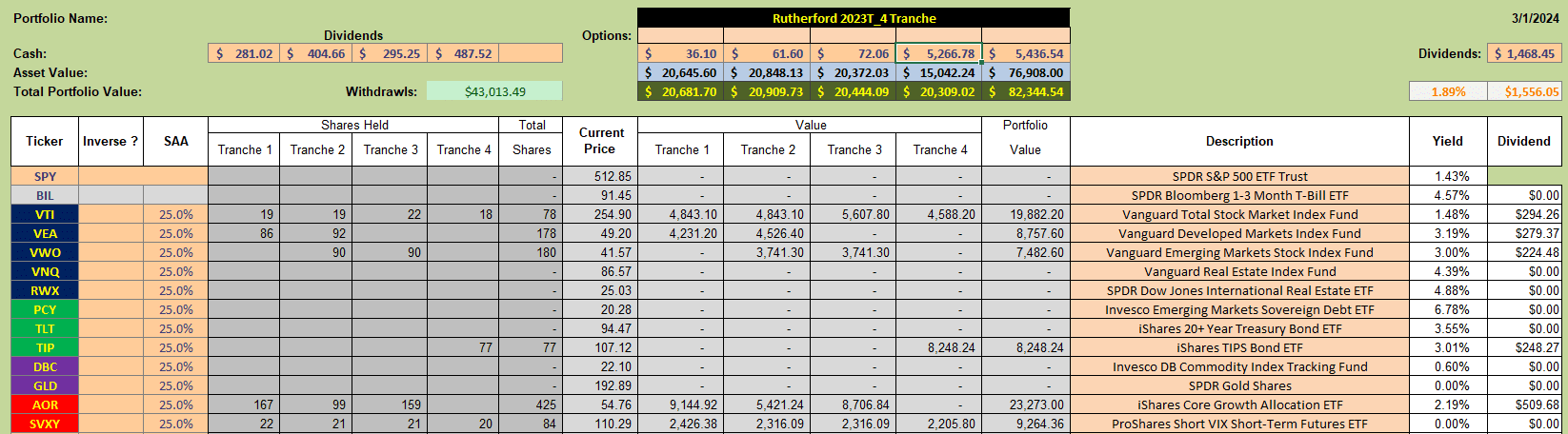

Unfortunately I made a mistake in making my adjustments based on last week’s recommendations and inadvertently sold all my holdings in GLD, including shares held in Tranche 4 (the focus of this week’s review) as well as in Tranche 3 (that was the focus of last week’s review). As a result, current holdings in the Rutherford Portfolio look like this:

Unfortunately I made a mistake in making my adjustments based on last week’s recommendations and inadvertently sold all my holdings in GLD, including shares held in Tranche 4 (the focus of this week’s review) as well as in Tranche 3 (that was the focus of last week’s review). As a result, current holdings in the Rutherford Portfolio look like this:

with excess cash in Tranche 4 as a result of selling out of my position in GLD.

with excess cash in Tranche 4 as a result of selling out of my position in GLD.

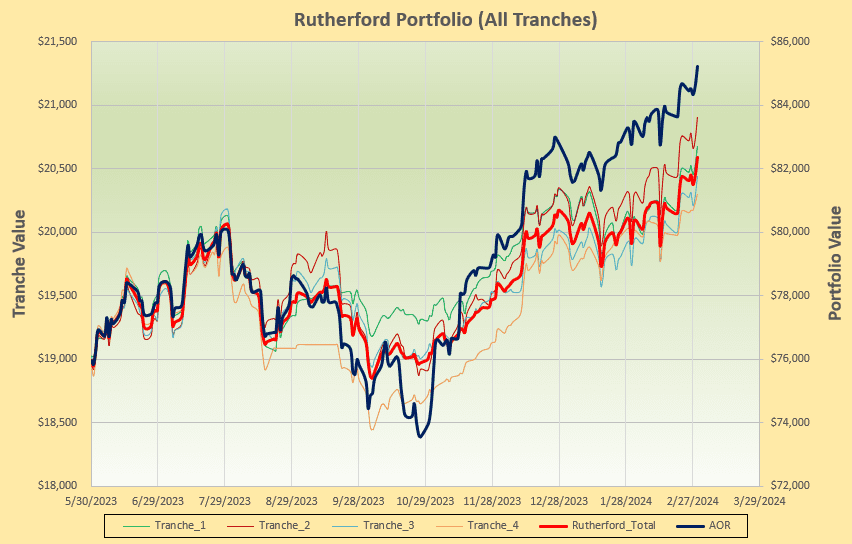

Although I lost out a little by selling the shares in GLD, performance of the total portfolio stayed in line with that of the benchmark AOR Fund:

The above screenshot shows the performance of the Rutherford Portfolio since moving to the momentum-based rotation model ~10 months ago and, although not quite keeping up with the benchmark AOR Fund, it does show lower volatility (risk) and less sensitivity to review date (timing) luck than other models – so is a more defensive portfolio with benefits in terms of minimizing downside risk.

The above screenshot shows the performance of the Rutherford Portfolio since moving to the momentum-based rotation model ~10 months ago and, although not quite keeping up with the benchmark AOR Fund, it does show lower volatility (risk) and less sensitivity to review date (timing) luck than other models – so is a more defensive portfolio with benefits in terms of minimizing downside risk.

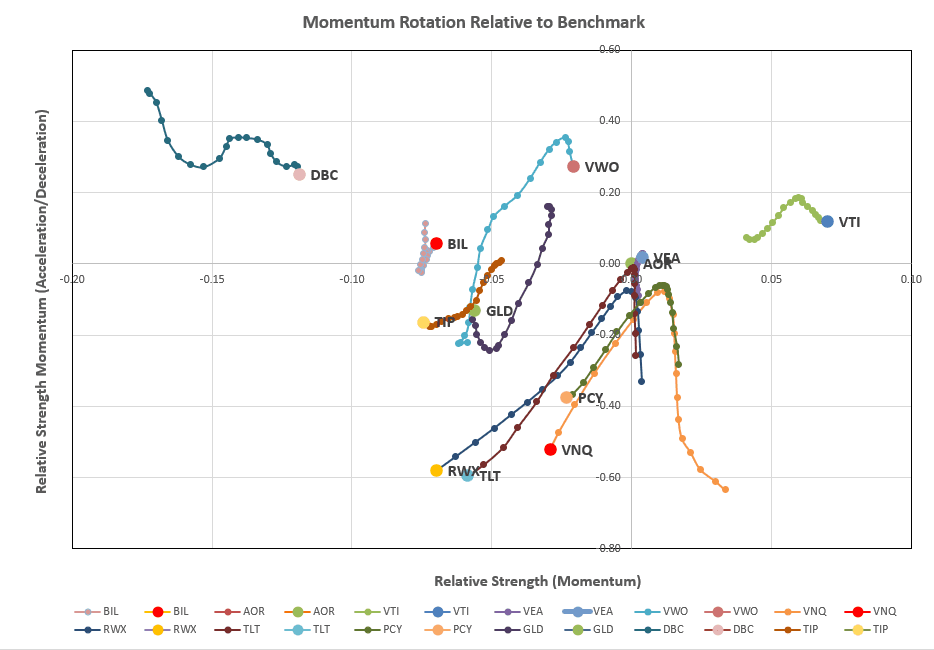

Checking the rotation graphs for this week’s recommendations:

we still see VTI in the desirable top right quadrant with a number of asset classes heading in the wrong direction towards the bottom left quadrant (weaker short and long-term momentum).

we still see VTI in the desirable top right quadrant with a number of asset classes heading in the wrong direction towards the bottom left quadrant (weaker short and long-term momentum).

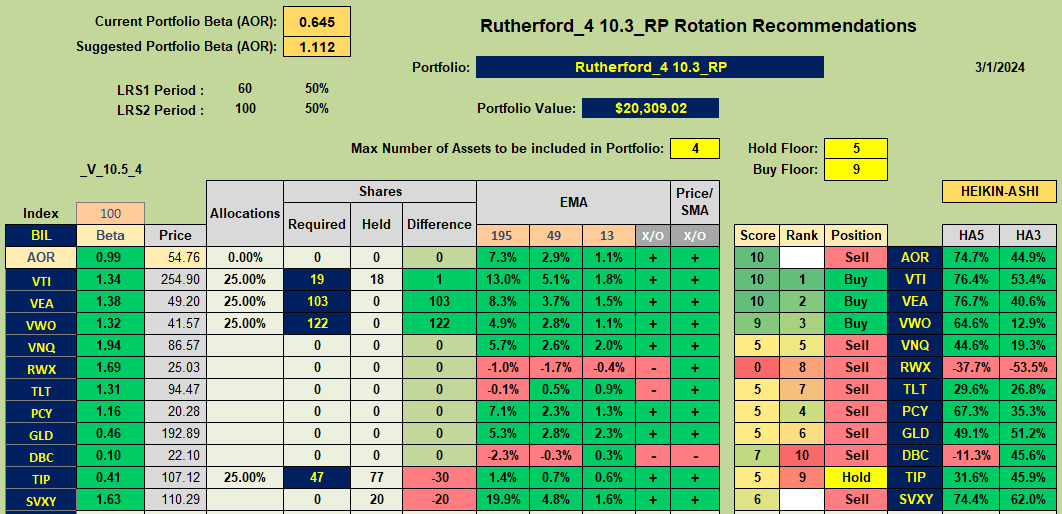

From the rotation model algorithm we see the following recommendations:

where, as in the last 2 reviews, the recommendation is to buy into global equities. Had I not sold my holdings in GLD last week I might be doing so now, although the recommendation would be to Hold (with a Score of 5).

where, as in the last 2 reviews, the recommendation is to buy into global equities. Had I not sold my holdings in GLD last week I might be doing so now, although the recommendation would be to Hold (with a Score of 5).

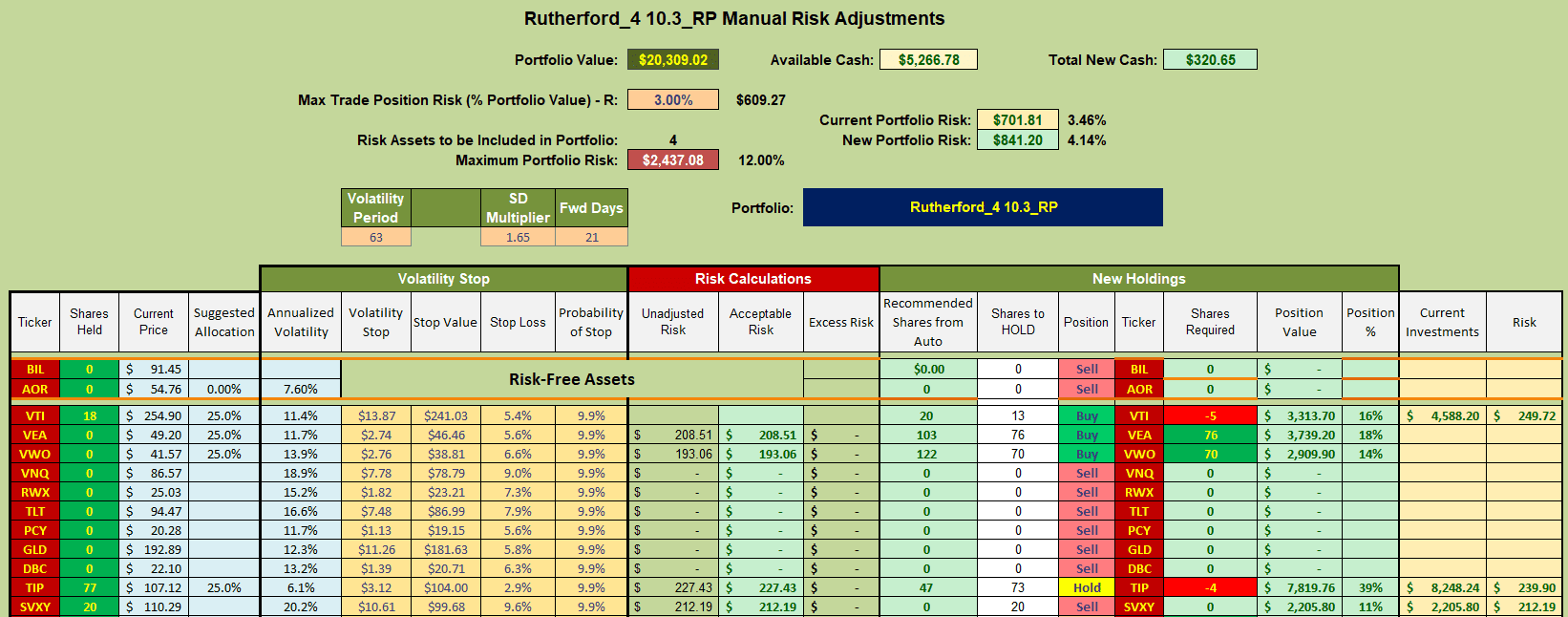

Based on the above, my adjustments for this week (if I can manage to get it right) will look something like this:

where I will use the existing cash to Buy shares in VEA and VWO. Rather than worry about the minor adjustments to VTI and TIP I will simply apportion the (Cash) funds between the International Equity ETFs.

where I will use the existing cash to Buy shares in VEA and VWO. Rather than worry about the minor adjustments to VTI and TIP I will simply apportion the (Cash) funds between the International Equity ETFs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.