King’s College, Cambridge, England

As investors we have to ignore the polititians and focus on the impact of policy on the markets. Obviously, Trump’s victory is seen positively by the majority of investors as being good for the markets – at least for now.

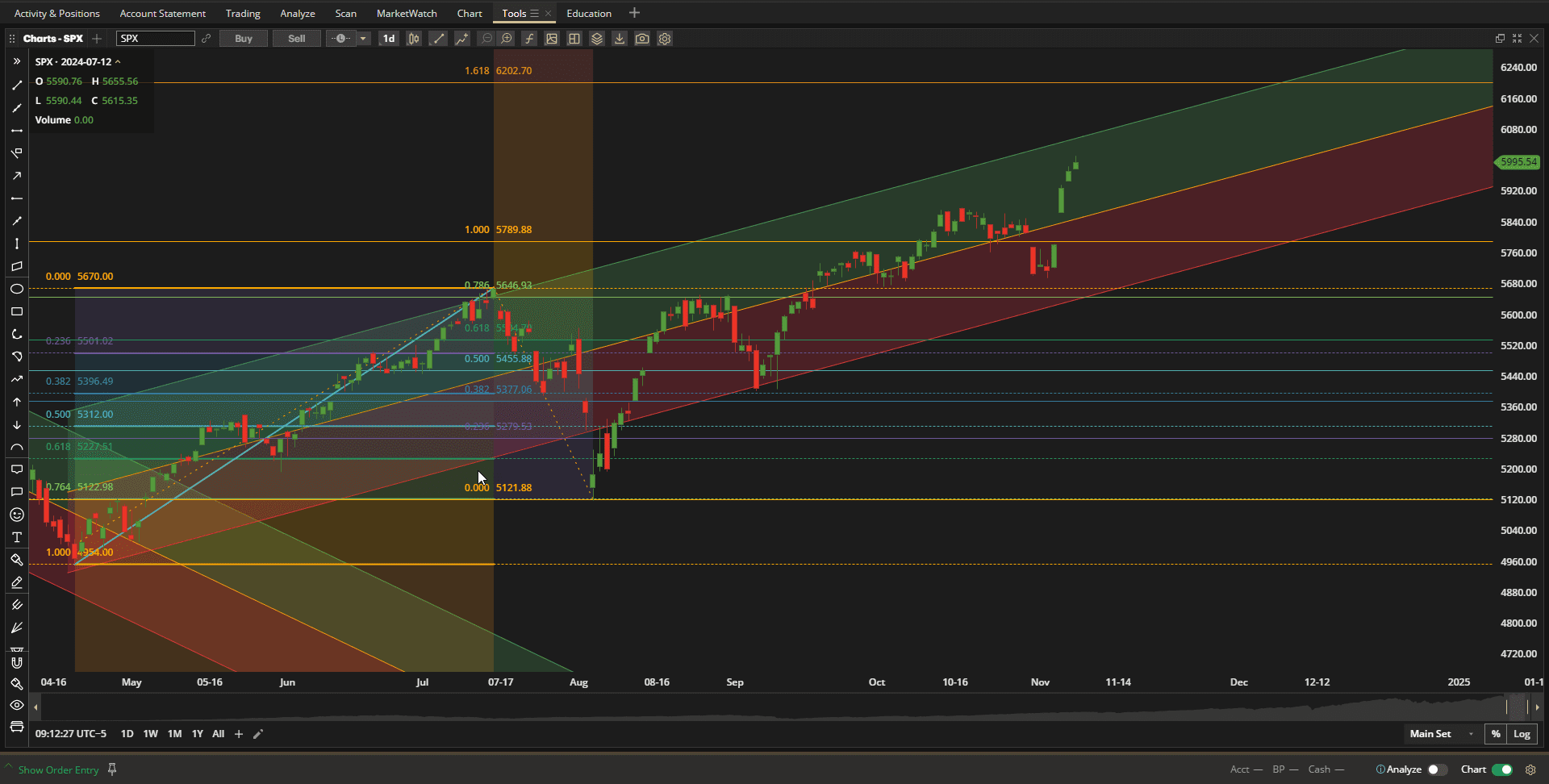

Last week I suggested that if we broke above the 5800 resistance zone in the SPX (S&P 500 Index) that we could easily see 6000 by the end of the year. I did not expect to get there by the end of the week but we hit that target on Friday:

We can probably expect a little consolidation/resistance here (at the psychologically significant “round number”), but I can see the next target being 6200 – or the 168% Fibonacci extension from the April Lows. This looks quite a reasonable target for the end of the year and a possible 30% annual return on US equities.

We can probably expect a little consolidation/resistance here (at the psychologically significant “round number”), but I can see the next target being 6200 – or the 168% Fibonacci extension from the April Lows. This looks quite a reasonable target for the end of the year and a possible 30% annual return on US equities.

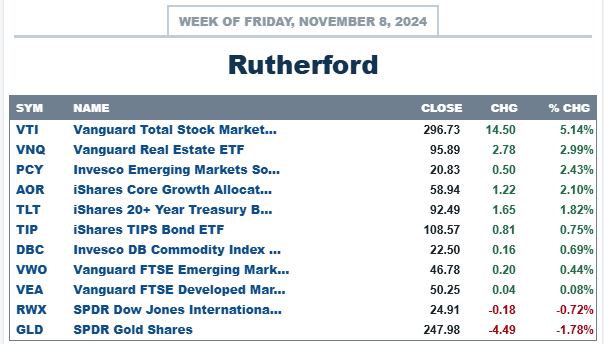

In terms of performance relative to other major asset classes:

US equities clearly topped the list with gains in excess of 5%. The US Dollar strengthened and Gold took the biggest hit.

US equities clearly topped the list with gains in excess of 5%. The US Dollar strengthened and Gold took the biggest hit.

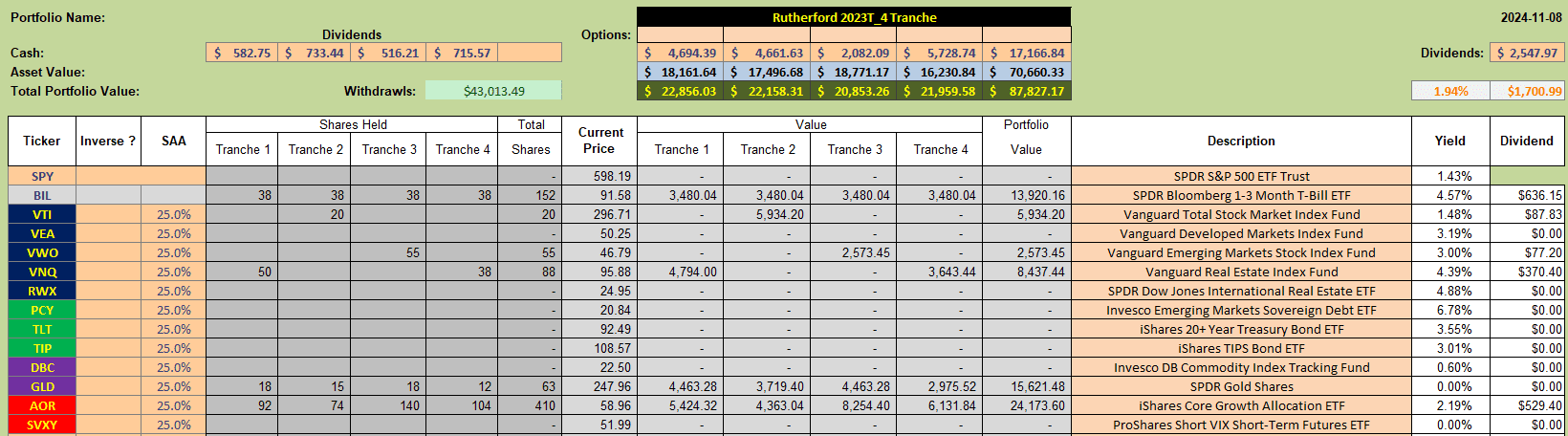

Current holdings in the Rutherford Portfolio look like this:

where I sold all holdings in DBC last week (including shares held in Tranche 2) so as to clear the portfolio before I decide on how to proceed to manage this portfolio going forward. Although the above screenshot is showing $17,167 in Cash, $17,100 has been withdrawn as a mandatory withdrawal on tax deferred pension accounts. I have placed the excess Cash in BIL to pickup the ~5% distribution being paid. This started as a $100,000 account and I have taken out ~$60,000 with ~$70,000 remaining – so $30,000 returns in ~ 7 years

where I sold all holdings in DBC last week (including shares held in Tranche 2) so as to clear the portfolio before I decide on how to proceed to manage this portfolio going forward. Although the above screenshot is showing $17,167 in Cash, $17,100 has been withdrawn as a mandatory withdrawal on tax deferred pension accounts. I have placed the excess Cash in BIL to pickup the ~5% distribution being paid. This started as a $100,000 account and I have taken out ~$60,000 with ~$70,000 remaining – so $30,000 returns in ~ 7 years

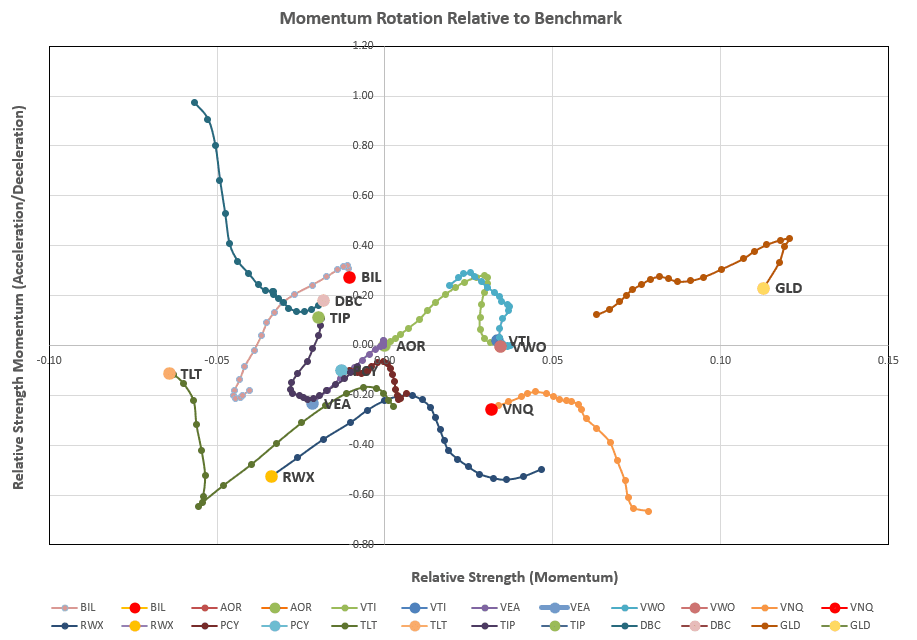

Checking on the rotation graphs for possible adjustments:

we see that Gold (GLD) is still leading in terms of longer-term strength (position along the horizontal axis) but that it has suffered significantly in the short-term, since the election (pullback along the vertical axis).

we see that Gold (GLD) is still leading in terms of longer-term strength (position along the horizontal axis) but that it has suffered significantly in the short-term, since the election (pullback along the vertical axis).

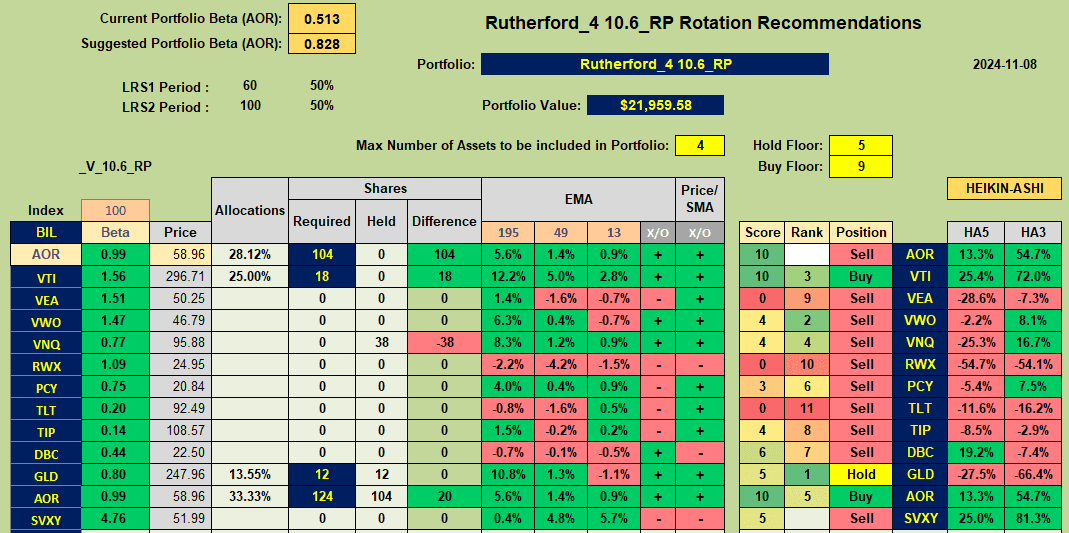

Checking the rankings/recommendation sheet for this Tranche 4:

we see Buy recommendations for AOR and VTI and a Sell for VNQ.

we see Buy recommendations for AOR and VTI and a Sell for VNQ.

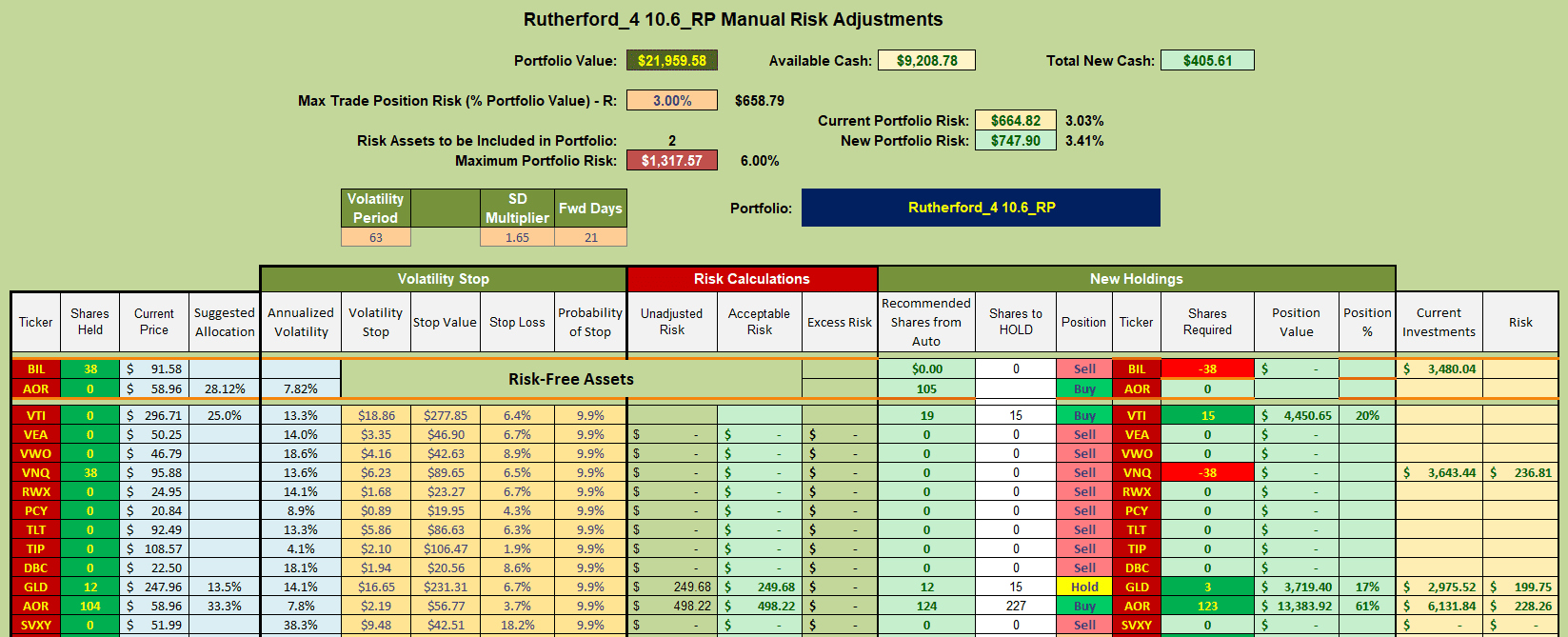

Suggested adjustments are shown below:

where the suggestion is to sell shares in VNQ and to Buy shares in AOR and VTI.

where the suggestion is to sell shares in VNQ and to Buy shares in AOR and VTI.

Since I am winding down this portfolio before deciding on how to manage it in 2025 I will Sell holdings in VNQ (also shares held in Tranche 1) and place the proceeds in AOR. I will not open a new position in VTI so as to reduce trading costs – and US Equities are at least partially covered in AOR. Although not yet a recommended Sell I am also going to sell my positions in GLD in all 4 Tranches – based on recent behaviour following the elections – and I will put these funds in BIL.

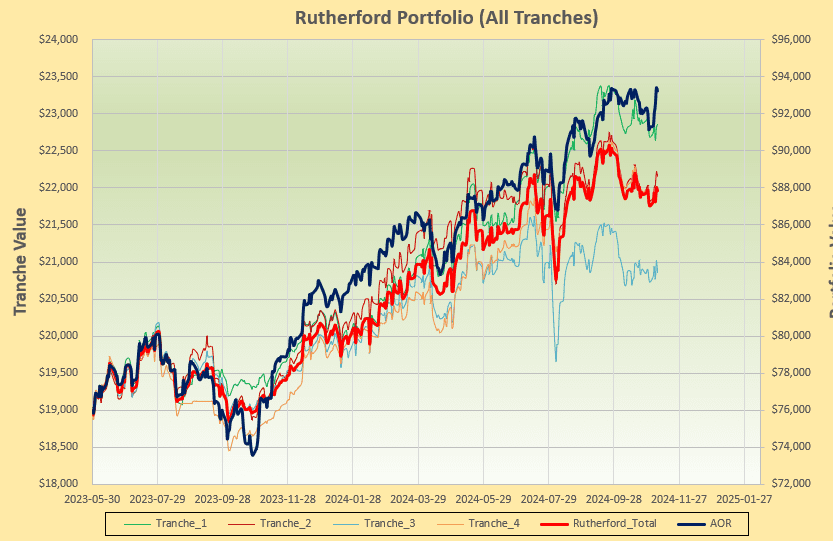

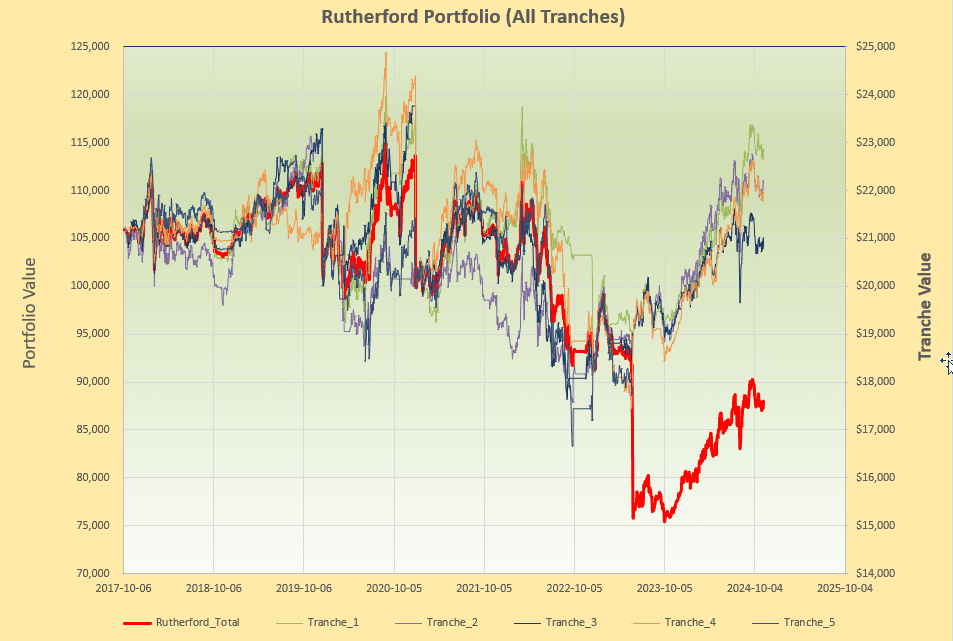

This Rutherford Portfolio was opened in October 2017 (7 years ago) – so let’s look at performance over this period, recognizing that money has been withdrawn from the portfolio over this time period. The following screenshot shows a picture of performance:

This picture is a little confusing due to the ~$43,000 withdrawals over the period. However, as we can see, the average of the Tranche returns is ~$22,ooo at the present time, whereas it was ~$21,000 at inception. In addition ~$43,000 was withdrawn from the portfolio. So, the portfolio value (heavy red line ~$88,000) represents an $88,000 + $43,000 = $131,000 – $105,000 = $26,000 return on $105,000 originally invested or ~25% over 7 years or ~3.5% (actually ~4%) annually over the 7 years. In addition, the $43,000 withdrawn has also been invested in other portfolios – with positive returns. The situation is complex, but, the bottom line is that the average tranche portfolio (~$22,000) is greater than the original tranche portfolio (~$21,000) despite having withdrawn $43,000 from the account – so we should be ahead of the game. The withdrawals in 2023 (following the 2022 downturn in the markets) were probably not at the best time (but obligatory due to regulatory requirements) but investment in other portfolios (e.g Hawking) probably more than compensated for this.

This picture is a little confusing due to the ~$43,000 withdrawals over the period. However, as we can see, the average of the Tranche returns is ~$22,ooo at the present time, whereas it was ~$21,000 at inception. In addition ~$43,000 was withdrawn from the portfolio. So, the portfolio value (heavy red line ~$88,000) represents an $88,000 + $43,000 = $131,000 – $105,000 = $26,000 return on $105,000 originally invested or ~25% over 7 years or ~3.5% (actually ~4%) annually over the 7 years. In addition, the $43,000 withdrawn has also been invested in other portfolios – with positive returns. The situation is complex, but, the bottom line is that the average tranche portfolio (~$22,000) is greater than the original tranche portfolio (~$21,000) despite having withdrawn $43,000 from the account – so we should be ahead of the game. The withdrawals in 2023 (following the 2022 downturn in the markets) were probably not at the best time (but obligatory due to regulatory requirements) but investment in other portfolios (e.g Hawking) probably more than compensated for this.

This is just just one portolio in a portfolio of portfolios and, as such, has managed to keep it’s head above water over the past 7 years. As I get older I would like to reduce the number of portfolios (and the time to manage these portfolios) to a minimum – so that is why I am trying to decide on how many (and which) portfolios, I will manage going forward.

.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Sorry to hear that this portfolio is soon to be “cashed out.” I’ve looked forward to your weekly summaries. It has been fun trying to replicate all of your graphs on ThinkorSwim (now Schwab).

Thanks for sharing.

~jim

Jim and David,

Did I miss a communication? Is the Rutherford to be closed down?

Lowell

Lowell, Jim,

Because I need to withdraw money from this account I will, at least, need to rebalance the tranches if I continue with this management approach. Also, I want to (calmly) consider whether to continue using the rotation system – this has always been a bit of a dilema for me since the graphs seem to contain a lot of useful information. However, I don’t feel that I’ve ever been able to come up with the right algorithm to take advantage of that information. I feel the “Tranche” approach is a good one since it reduces the impact of timing/review date luck – that I feel is the largest problem with actively managed systems when reviewed only on a monthly basis.

I like the Rutherford Portfolio for it’s diversification of assets – so, I will probably keep that quiver intact. It’s just a matter of the system that I will use to manage it.

I lost my ThinkorSwim account when TD sold out to Schwab – and Schwab doesn’t open accounts to Canadian resudents, I really miss that platform (especially for Options) as I think it’s by far the best platform out there for analytical work.

No matter which way I go I’ll try to keep up the weekly market summaries.

David