Iris Admirer

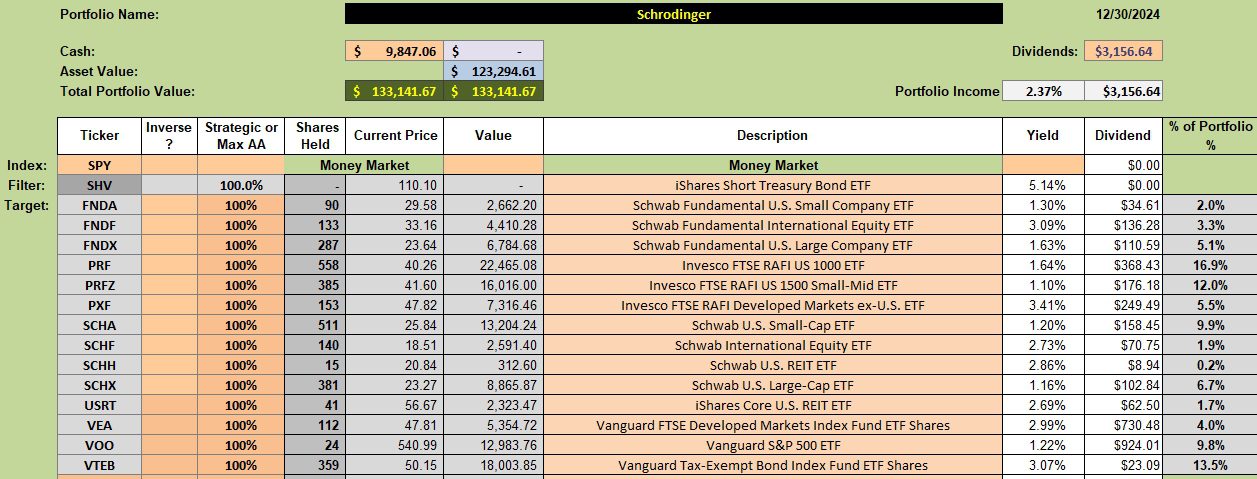

While this Schrodinger post is going up on January 2nd, the data is accurate as of 31 December 2024. The overall performance is quite strong despite the four percentage point loss in December. This post of the Schrodinger marks the three-year point of data collection. Overall, the results have been quite impressive and surpass my expectations for this Robo Advisor portfolio.

During the recent market drop the Schwab computer(s) added shares of three different ETFs. Fourth quarter dividends were sufficient to add these shares.

Schrodinger Intelligent Portfolio

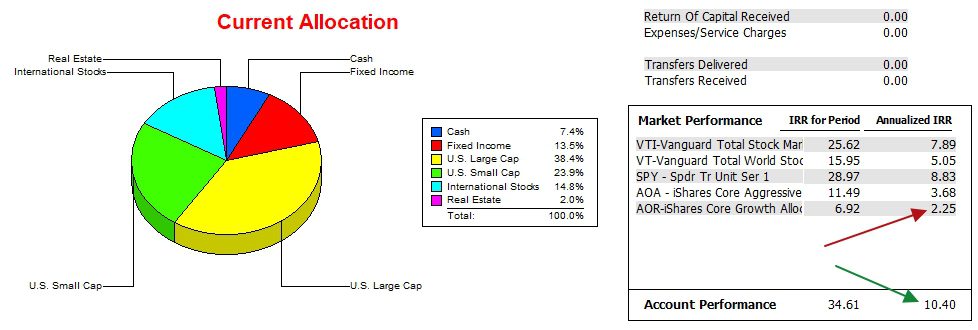

Below is the current asset allocation makeup of the Schrodinger. It is a well diversified portfolio, but a tad shy on real estate.

Schrodinger Performance Data

Over the past three years the Schrodinger consistently outperformed all the benchmarks I track. Should 2025 turn out to be a volatile year it will be interesting to watch the performance of this computer managed portfolio.

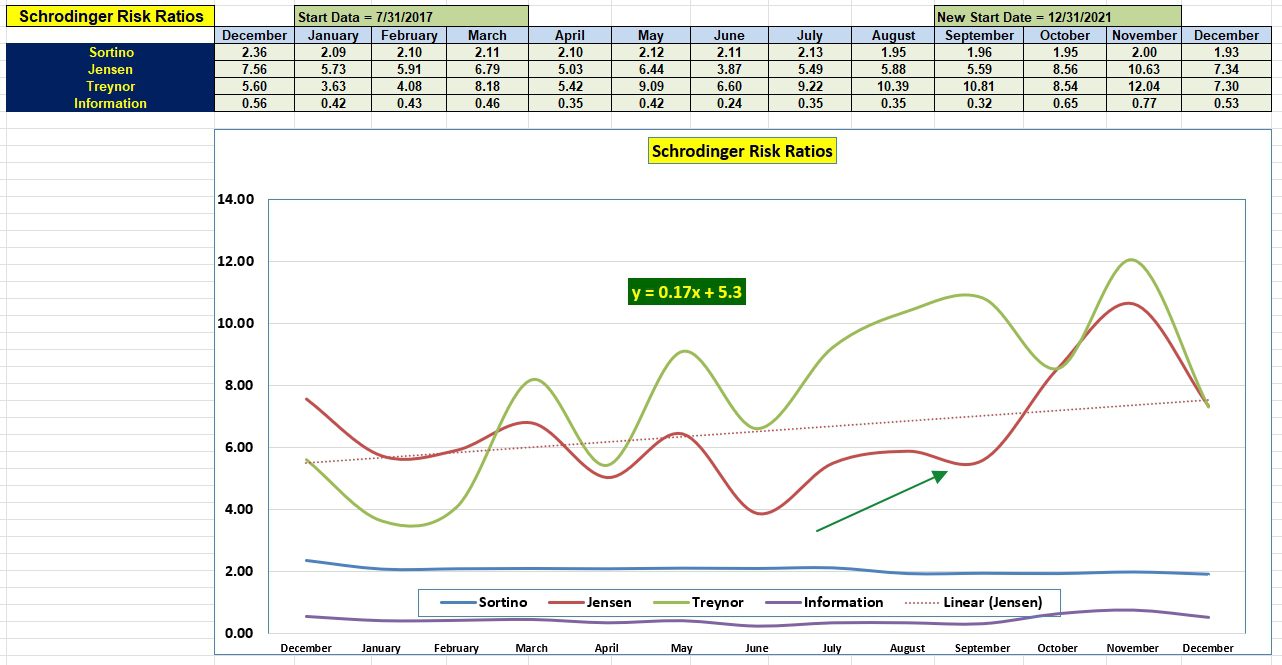

Schrodinger Risk Ratio

The December 2024 values align with the December 2023 ratios. Continue to closely monitor the Jensen and Information Ratios as they are the most important. Next in importance is the Sortino Ratio with the Treynor a distant fourth.

While I recommend every investor or family hold at least one “Schrodinger” style portfolio, here is another simple option. I asked Gemini, Google’s AI program, to create an asset allocation portfolio using only ETFs. This is the recommendation.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question