Thanksgiving Table

Bohr is the Sector BPI portfolio scheduled for review this morning. Before making any decisions or moving forward with this update of the Bohr, I checked the Bullish Percent Indicators (BPI) for the eleven market sectors and found no changes. Technology is still overbought and that is the single sector currently residing outside the “neutral” zones. Readers will recall that BPI percentages 70% and above are considered to be overbought and BPI percentages 30% and below are designated as oversold sectors.

Before moving into the analysis of the Bohr, let me wish all readers of the blog a very Happy Thanksgiving. I know I am late for several readers, but I am tied to the U.S. holiday dates.

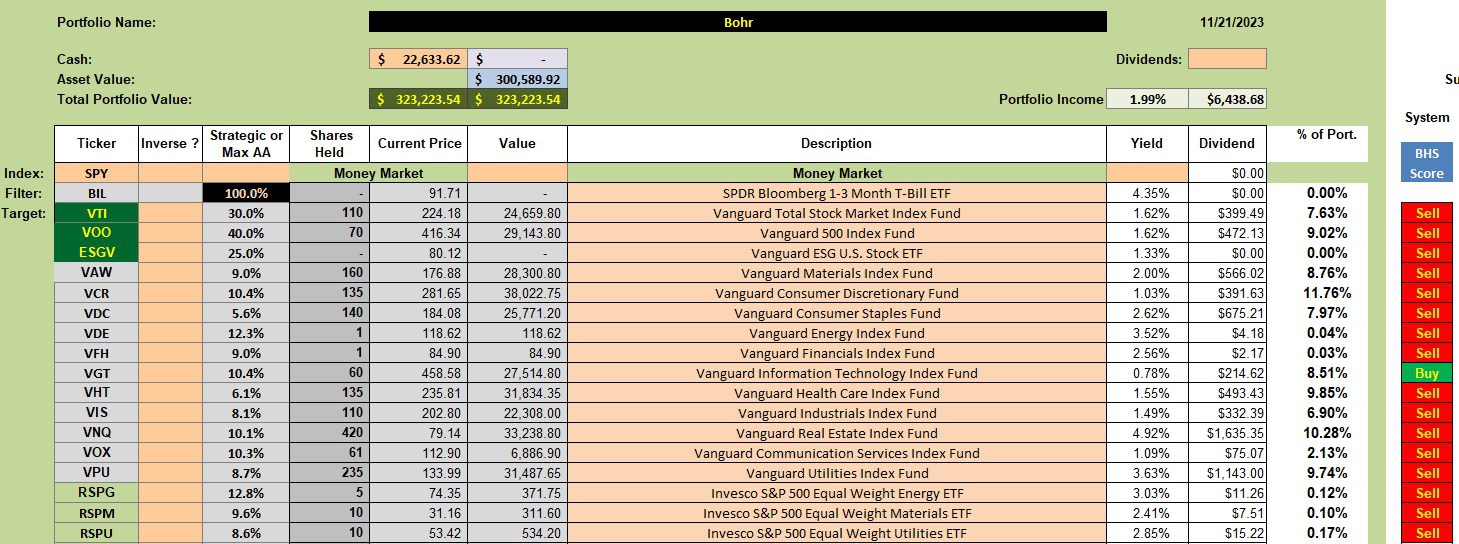

Bohr Investment Quiver and Holdings

Below is the current investment quiver and holdings for the Bohr. To test the equal-weight ETFs I set limit orders to pick up a few shares of the RSPx shares as you can see in the table below.

When a sector reaches the oversold zone I will make a performance comparison between an equal-weight ETF and a cap-weighted ETF. Shares will be purchased for the ETF with the superior performance based on a 5-year look-back period.

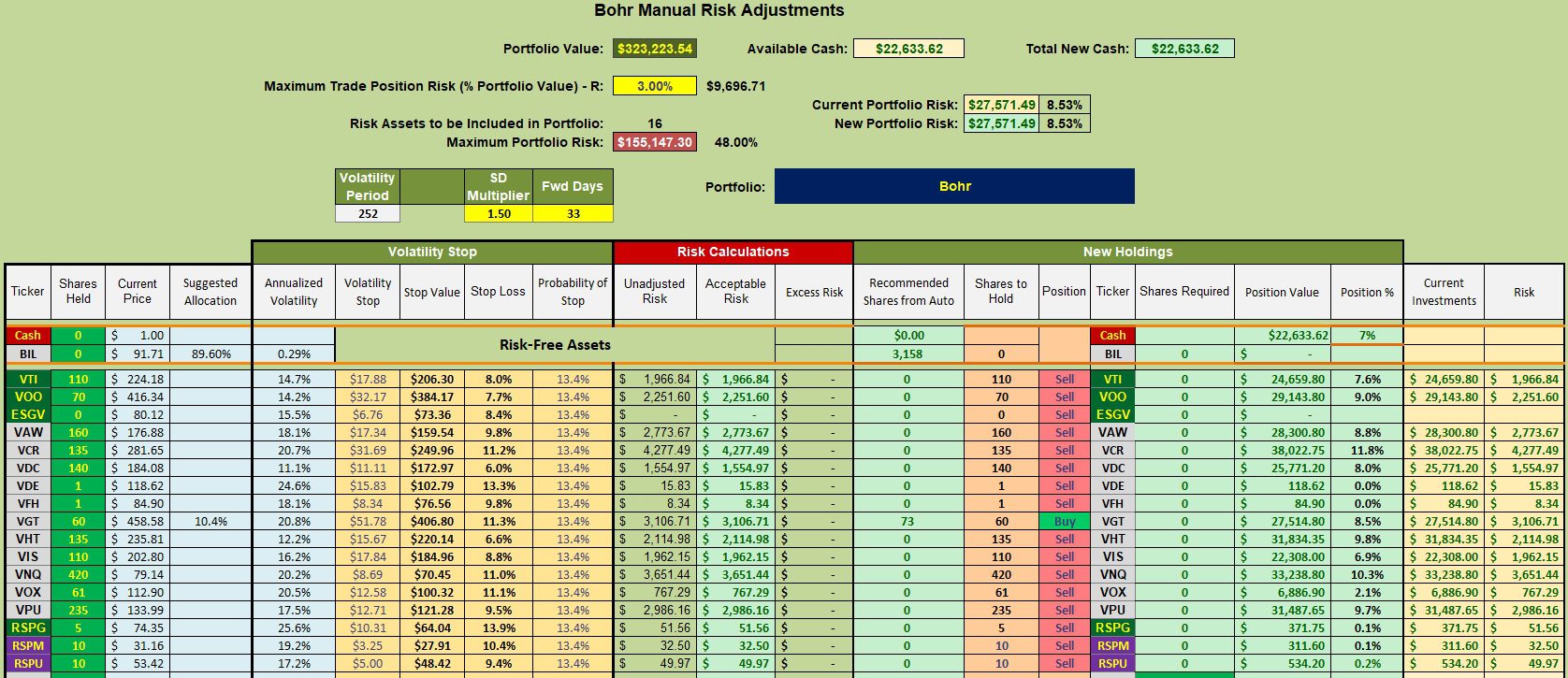

Bohr Manual Risk Adjustments

No sectors are currently oversold and the Kipling spreadsheet is not recommending we purchase any more shares of VTI, VOO, or ESGV. Therefore I plan to hold the $22,000 in the money market. Patience is the name of the game right now.

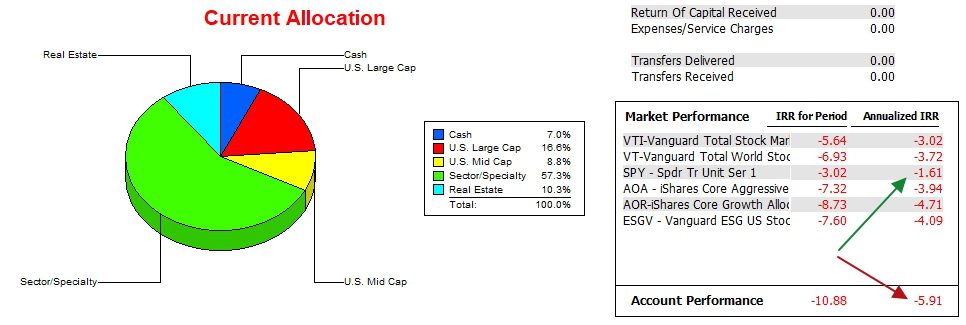

Bohr Performance Data

Over the past 23 months the Bohr is trailing the SPY benchmark by a significant percentage. The Bohr portfolio is new to the Sector BPI model so we need to watch for improvement over the coming year. The Risk Ratio table is the best source for this information.

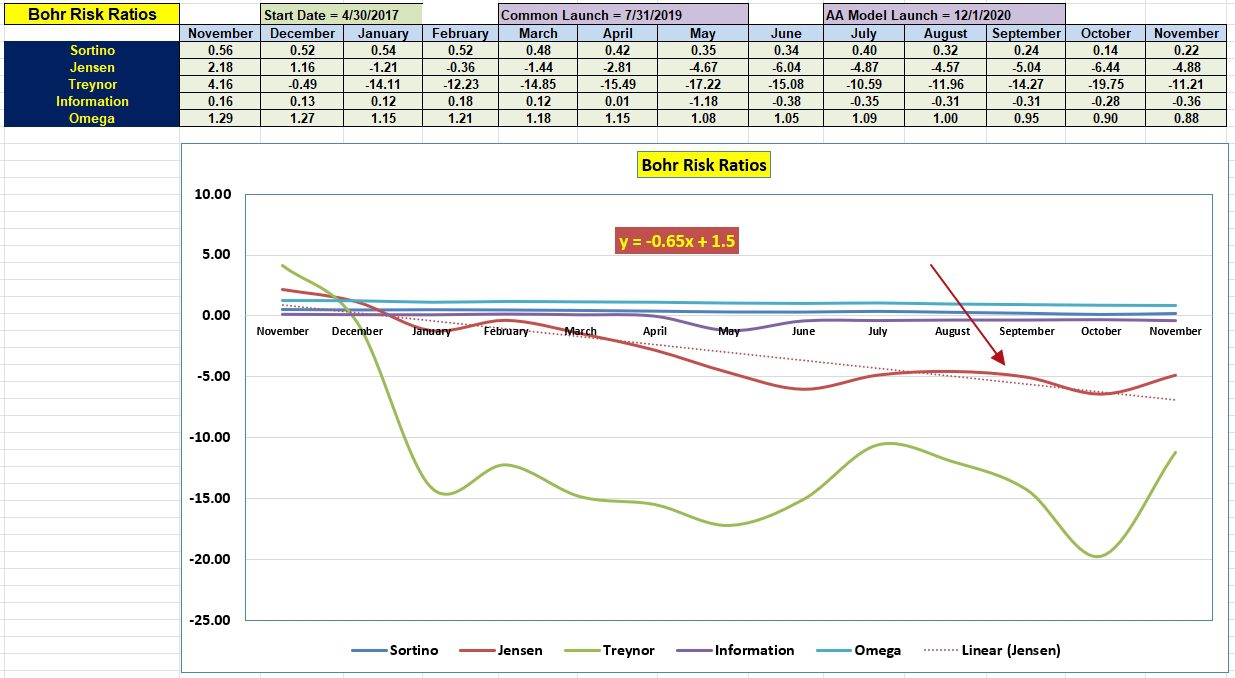

Bohr Risk Ratios

Since the last update the slope of the Jensen (currently -0.65) improved. The Sortino Ratio improved since October, but the Bohr lost ground to the benchmark as shown by the Information Ratio. The direction of the Information Ratio is of concern so I will be paying close attention over the coming months.

Continue to pay most attention to the Jensen Alpha, Information and Sortino Ratios in that order.

Questions and Comments are most welcome.

Pass on the URL of this blog to your friends and family members.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.