Asset Allocation is a popular investing model when it comes to constructing a portfolio. What asset classes to include and what percentage of each asset is open for debate and discussion. In the follow example, titled ITA-AA, I’ve selected ten asset classes that come from two sources, Mebane Faber and David Swensen. As readers can see this asset allocation is quite conservative in that TLT, TIP, BND, GSG, and DBC are non-equity ETFs. Personally, I prefer to take a bit more risk. One option is to add VOO to the quiver knowing it overlaps to a high degree with VTI. Regardless, that would begin to tilt the asset allocation makeup toward U.S. Equities. As currently constructed, this might be considered as an “all-weather” portfolio.

Asset Allocation Portfolio

The following asset allocation portfolio is an alternative to two of my favorites, Copernicus and Schrodinger. The least two favorite asset classes in this portfolio are gold (GSG) and commodities (DBC). If you prefer to be a tad more aggressive or prefer more exposure to equities, swap out GSG and DBC with VO and VB. Such a move will add mid- and small-cap stocks to the large-cap asset class, VTI.

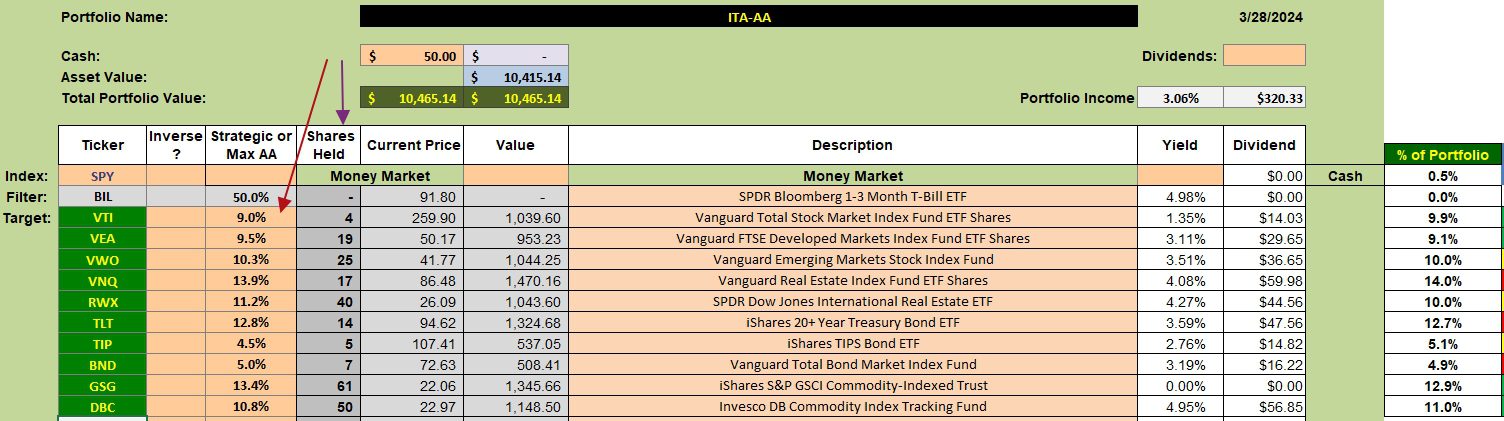

The red arrow (table below) points to the percentage guidelines for each asset. For example, we want to hold sufficient shares so 9.0% of the portfolio is investing in VTI. Four shares will bring the percentage up to 9.9% as one sees in the far right column.

How is the 9.0% calculated? What I’ve done is to take an average of the three-year volatility for each asset. I then use what I call a volatility coefficient to make sure the Max AA column adds to 100%. Omit the BIL percentage as it is not involved in the portfolio.

The same calculations will work, with few adjustments, if one prefers to expand the portfolio to fifteen (15) asset classes.

A benefit of this portfolio is the 3.0% dividend to be thrown off each year. That is a nice return in this market. The underlying portfolio management style for this portfolio is to monthly add money and to never sell.

If one compares the third column from the left with the far right column, these asset classes are under populated. They are: VEA, VWO, RWX, TLT, BND, and GSG. Each time the portfolio comes up for review, update prices and if cash is available, add a share or two to the asset class most beneath the recommended percentage found in the third column from the left. Never sell, but keep adding shares to under populated asset classes, thus building the portfolio over time.

If this style of portfolio appeals to you, let me know and I will construct another one that is a tad more aggressive by including more U.S. Equity type asset classes.

Send the ITA blog link on to your friends and family. Also, post the URL ( https://itawealth.com ) to your social media sites. Help me spread the word that here is a free investment site for all who register as a Guest.

Comments and questions are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Great work Lowell. This portfolio has great appeal. What physicist were your name and after or, consider naming it after mental giant-Daniel Kahneman

who passed away last week. Although he was not a great investor, he taught all of us a great deal about the role of content biases when making investment decisions. Thanks for your good work. John

John,

Thanks for the kind words. I’ve not come up with a name and Kahneman is already taken by one of Hedgehunter portfolios. I’m considering a famous woman scientist. Curie is already taken as it is one of the portfolios I don’t report on regularly as the owner prefers I keep it hidden from public view.

I’m currently working on a 15 asset class portfolio that will provide for a higher percentage of equity stocks and will add diversity into the small- and mid-cap stock asset classes. Technology and International Bonds are also two other potential asset classes.

Does this sound interesting?

Lowell

I would be VERY interested in such a portfilio and how you manage it.

Since Curie is out of the running, let me continue my rudeness of suggesting what other names for your consideration. Recently passed Charlie Munger, although not a scientist has made vast contributions to mental models and cognitive biases. thx again for your tireless efforts for all of us. John.

John,

I will be launching this Asset Allocation model tomorrow. I’m going to convert the Pauling and for the time being, title it Pauling II. This way I will not need to set up an entirely new portfolio. Currently, the Pauling comes in dead last based on annualized IRR calculations so that is easy to remember. Will the Asset Allocation model work its way off the bottom rung? That is the initial test.

There is cash in the Pauling portfolio so I will be able to purchase a few shares of each of the 15 ETFs that make up the new Pauling II portfolio. I’ll break one of the “no sell” rules by lowering the number of shares of VOO so additional cash is available to spread over the other 14 ETFs in the portfolio.

This should be an interesting project. Looking forward to setting up the Pauling II and then observing results. I plan to carry the Risk Ratio data forward so it will not reflect the AA model results until April of 2025.

Lowell

John et al.,

“What physicist were your name and after…”

I may convert one of the Sector BPI portfolios over to an Asset Allocation portfolio rather than add another portfolio to the list. The Pauling is a potential candidate as it has a poor IRR performance record. Nothing like starting at the bottom and watching to see if there is positive growth as a result of a change in investment strategy.

I’ve long been a fan of Asset Allocation based on academic papers I read nearly 40 years ago. It may be time to get back to my investing roots.

Lowell

Lowell,

Pardon the pun, but is “The Ivy Portfolio” a return to your Asset Allocation roots? 🙂

– Lee

Lee,

At least a partial return to my roots. (g)

I’m likely to shift the Pauling to the Asset Allocation model as I don’t want to open up another portfolio at Schwab. It is sufficient trouble keeping after all the different ones now operating. Also, Pauling has some available cash which will make it possible to invest in some new asset classes.

Lowell

Lowell

I called your remark from mid-March

“. . . Since 12/31/2021 the Schrodinger has outperformed the S&P 500 (SPY) by a huge margin. Frankly, I did not anticipate a computer managed portfolio based on a Asset Allocation model would perform to this level. . . .”

Your observation about the performance of the Schrodinger (a) caused me to understand your comment about setting up an Asset Allocation model and (b) to order a copy of “The Ivy Portfolio,” so I can more closely follow your analysis.

All the best and Happy Easter!

– Lee

.

Lee,

Happy Easter to you and all ITA readers. Hope you enjoy Faber’s “Ivy” book. The Pauling will include a few different ETFs, but the basic model is similar.

I plan to review this new Pauling II the first Monday of each month. I think there will be an ETF or two that pay monthly dividends. Not sure about that. Eventually, I want the portfolio to be of sufficient size so I can make new purchases in blocks of 5. Again, that is not a primary rule, but a general one. Once the portfolio is fully operational this portfolio will operate like the Copernicus in that it is a “no sell” portfolio so as to reduce taxable events.

Lowell

Lowell,

I realize that you want a “buy and hold” portfolio, at least with the chosen securities. But, have you thought about rebalancing periodically. I suspect that is one reason the Schrodinger has done so well. I just looked at my Schrodinger account at Schwab and the rebalances have been going to VMBS (mortgage backed securities etf) and SCHI (5-10 year corporate bond etf).

I started my Schrodinger-like account in April of 2016 and over the last five years it has had an 8.35% annualized return. It is a moderately aggressive portfolio with limited international exposure (targeted at 15%).

~jim

Jim,

I plan to rebalance in the sense of keeping the 15 ETFs close to the recommended percentages. I don’t see the portfolio changing the basic 15 asset classes. That could change, but I don’t see that happening at this time.

The Schrodinger portfolio I track adds or subtracts ETFs (asset classes) from time to time. This new Pauling II will differ in that sense.

Lowell