Arenson Gardens

Bohr is a portfolio of moderate size managed using a few equity oriented ETFs. As with the Kepler, Einstein and a few other portfolios, this account is following a similar conservative approach due to all the uncertainties surrounding the unnecessary tariff wars.

Bohr Security Holdings

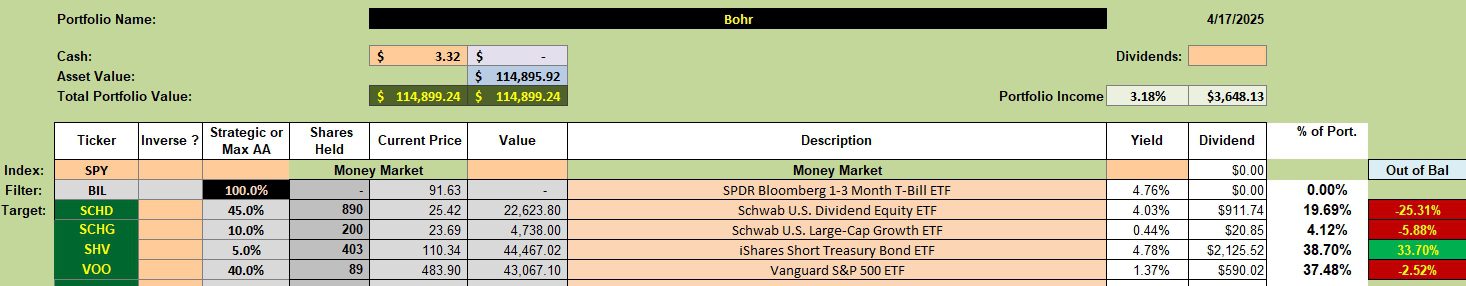

The Bohr currently holds the following ETFs listed below. Trailing Stop Loss Orders (TSLOs) are in place to sell all shares of SCHG and VOO while holding on to the dividend paying SCHD and the short-term treasury, SHV. New money coming from deposits and dividends are invested in SHV.

Bohr Rebalancing Recommendations

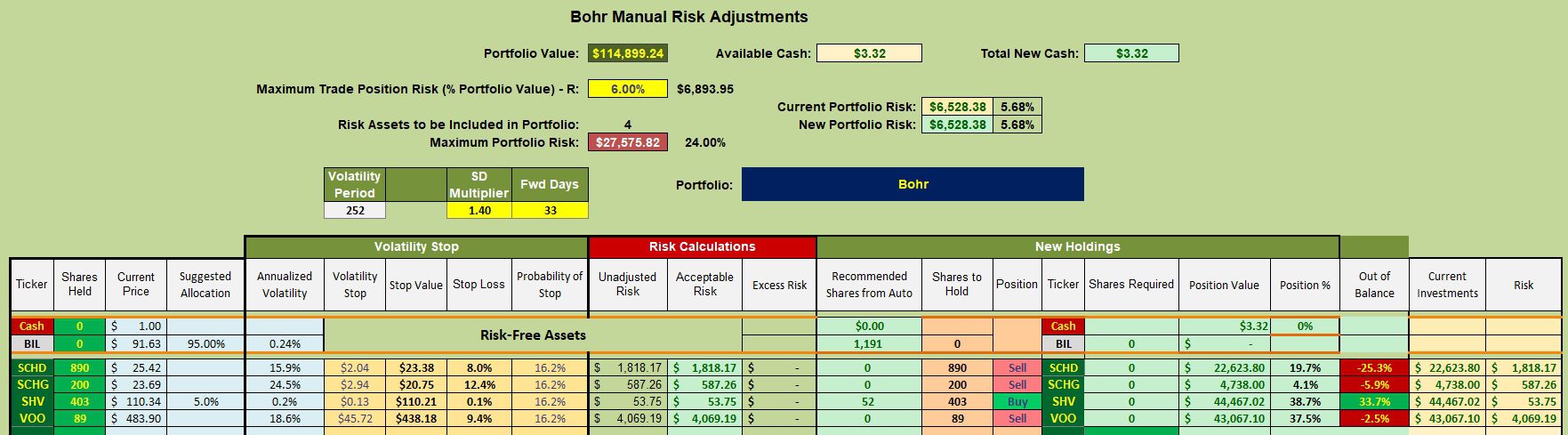

Using the Kipling spreadsheet, only SHV is recommending a Buy. I have the metrics set to react rather fast to any upswings. Should tariffs be removed or the FEDs lower interest rates, this market would take a rapid jump. The longer the extreme tariff percentages are in effect the less likely the U.S. Stock Market will react positively as the supply chains are being broken daily. At some point it is going to take a lot of time to repair the damage that is currently taking place.

Bohr Performance Data

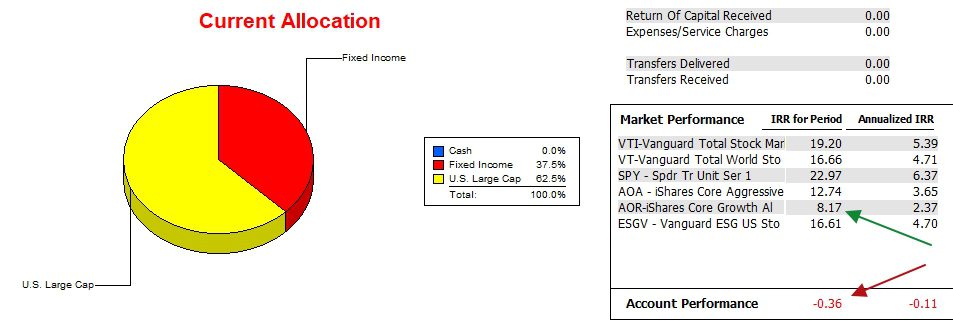

Bohr has been anything but a stellar performer. When a portfolio is this far below its benchmark I resort to looking at the movement of the Jensen Performance Index to see which way it is trending. Check the next section of this blog.

Bohr Risk Ratios

Over this past year the Bohr gained slightly on the benchmark. It is still much too early to know how this concentrated Asset Allocation investing model is working.

The goal is to keep the slope of the Jensen moving in a positive direction.

Buffett Indicator & Shiller PE Ratio

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question