Forgotten California

Friday, the 13th of January, brings changes to those managing a Sector BPI portfolio. Energy, Financial, and Real Estate all moved into the over-bought zone this week. All major indexes are bullish. None of the indexes penetrated the over-bought zone, but the NASDAQ is getting close. We see a big percentage jump in Technology which dominates the NASDAQ.

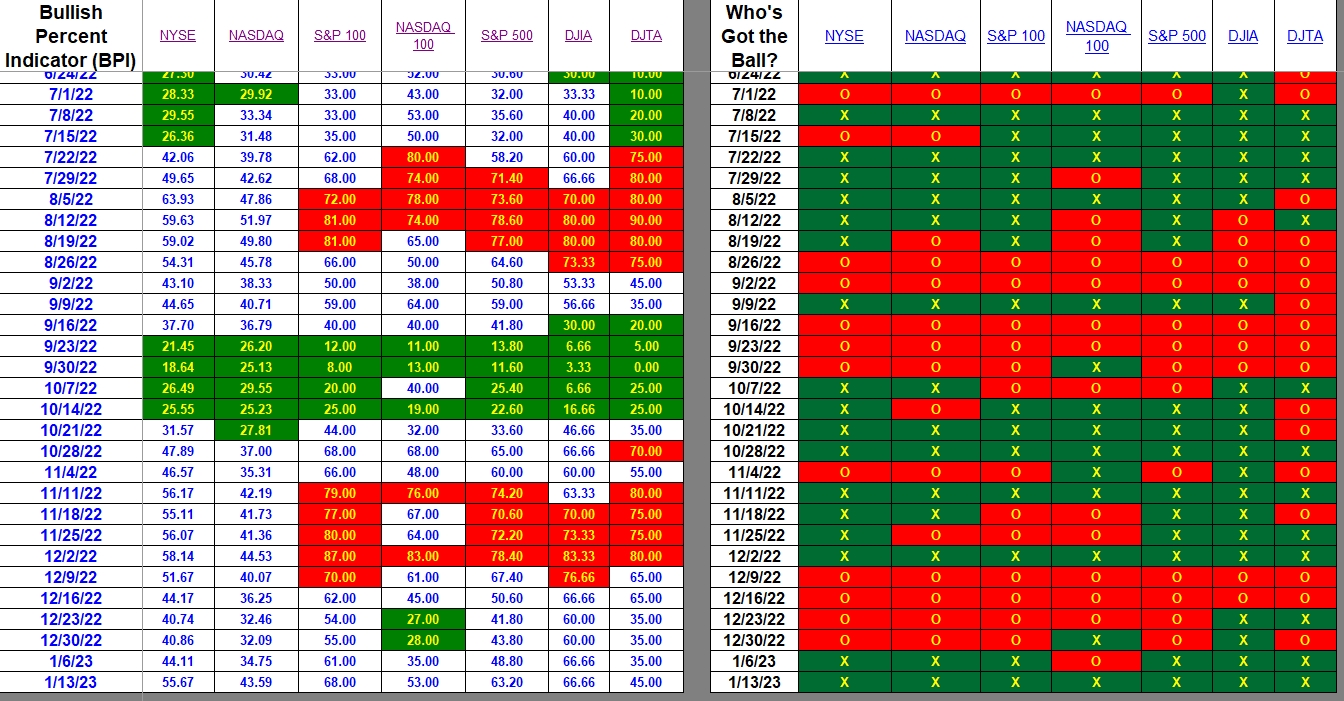

Index BPI

As you peruse the data table below, use the right side to gain a broad view of the U.S. Equities market. The single remaining holdout, NASDAQ 100, moved into the bullish phase. The right side of the table is Point and Figure (PnF) data from StockCharts.

The left side, where we see specific percentages, drills down and gives us more precise information. Just two weeks ago the NASDAQ 100 was over-sold when the percentage dipped to 27% and 28% bullish to where it is this week. The percentage of bullish stocks within the NASDAQ 100 nearly doubled within weeks.

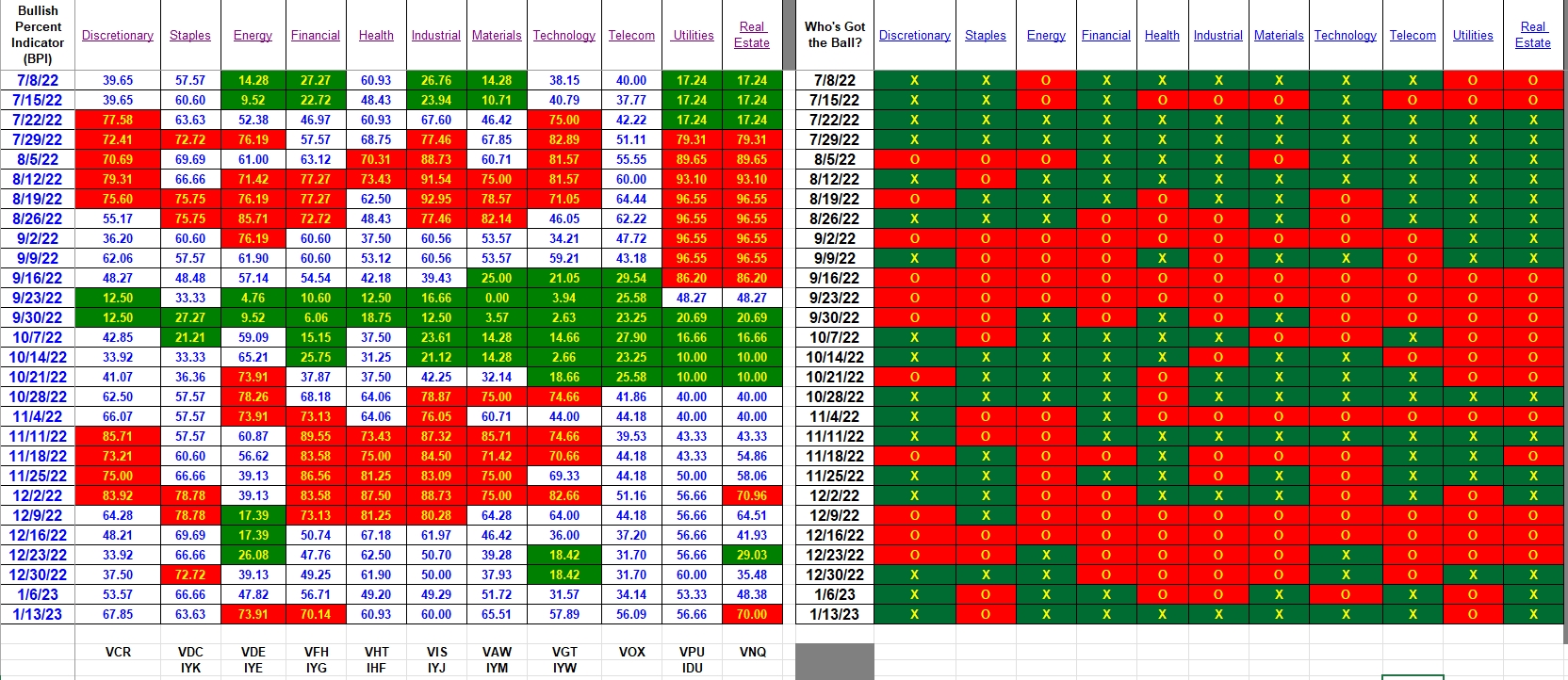

Sector BPI

Here at ITA, several Sector BPI managed portfolios hold Energy (VDE) and/or Real Estate (VNQ). In those cases, place a Trailing Stop Loss Order (TSLO) for 3% as all are still in the 70% over-bought zone. Had any of these sectors zoomed to the 80% bullish level, a 2% TSLO would have been in order.

For more information on the Sector BPI model, search this title or search for the Carson portfolio.

None of the Sector BPI portfolios hold Financial (VFH) so no TSLOs are required. Before the market opens next Tuesday I’ll check on the Carson, Franklin, Gauss, and Millikan to make sure 3% TSLOs are set for any holdings in VDE and VNQ. As ITA readers, if your Sector BPI portfolio holds VFH, set a 3% TSLO for that ETF.

Cash is held in one of three places. Use either SHV, SCHP, or the money market. If you are using a broker other than Schwab, then go with a short-term treasury or their TIP ETF. I’ve been dividing cash, held in the four Sector BPI portfolios, in all three buckets.

It is my understanding the U.S. Treasury will run out of money to pay its bills this coming Thursday. Treasury Secretary, Janet Yellen, is doing some creative bookkeeping to keep the wolf away from the door for a few more months. Regardless, there remains a major threat from the majority of House members who are interested in nothing except financial chaos. One can only hope six moderate Republicans will join the 212 Democrats to raise the debt limit so funds are available to pay for “products” already purchased. Refusal to raise the debt limit or to cherry pick what will be paid for and what will remain unpaid is a fools errand. This is where the Sector BPI model should work its magic. If there is a “House made” recession, Sector BPI portfolios will be either in cash or looking for buying opportunities at much lower prices.

Over the next few months, pay attention to how the Sector BPI portfolio perform compared to the AOA benchmark as well as the Copernicus and Schrodinger portfolios. In Friday’s Gauss Review I demonstrated how Real Estate (VNQ) is going to turn a profit. Remember that the Schrodinger is a Buy and Hold portfolio managed by a computer algorithm. The Copernicus is a Buy and Hold portfolio where investments are held only in U.S. Equities such as VTI, SHY, ESGV, and VOO.

If you have any Comments or Questions, post them in the comment section provided below. Another place to ask general questions is the Forum section of the blog.

Remember the stock market is closed Monday in celebration of Martin Luther King, Jr. Day.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.