Smith Rocks – Central Oregon

The dog days of summer are at work when it comes to U.S. Equities as we observe another down week for stocks. All the major indexes declined in the number of bullish stocks and we are getting close to a buy in one sector. More on this later.

This coming week the portfolios up for review are: Carson, Kepler, Pauling, and Huygens so we have several investing models to examine.

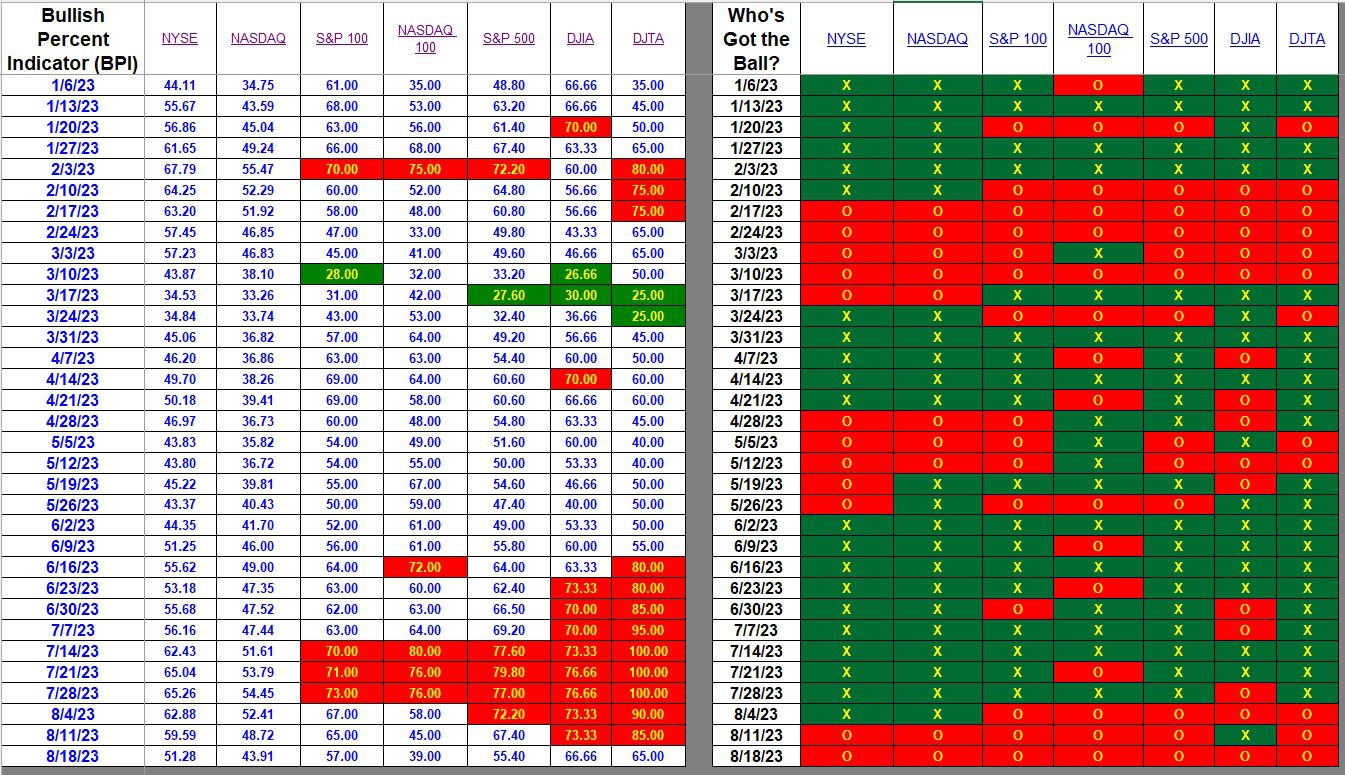

Index BPI

As mentioned above, all the major indexes declined in the number of bullish stocks. Transportation took a big hit as the percentage of bullish stocks dropped from 85% bullish down to 65% bullish. Checking in on the NYSE and NASDAQ, the two primary indexes, the market is neither over or under valued.

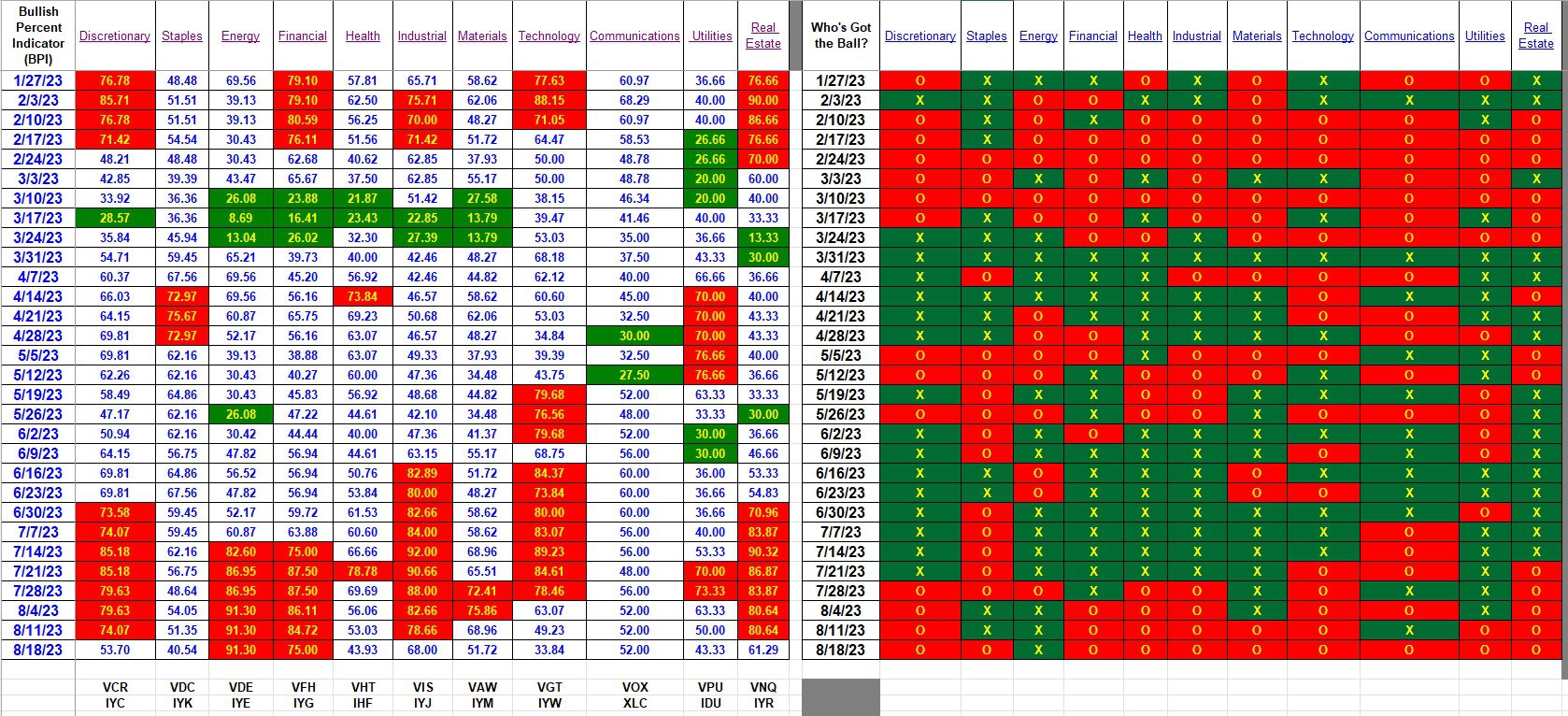

Sector BPI

Sectors are where we go for information when it comes to managing the Sector BPI Plus portfolios. The Carson is one of those portfolios and it is up for review on Monday.

Note the Technology dropped to 33.84% bullish stocks or very close to a Buy. If the percentage of bullish stocks drops to 30% or lower we will purchase the Technology ETF. The choices are either VGT or IYW. I tend to favor Vanguard as holding these shares makes one a part owner of the company.

When a sector moves as close to the oversold zone as we see Technology, I update the BPI spreadsheet daily rather than wait for the weekend data. While I don’t post a complete review of the BPI data, I will keep readers informed as to any changes so check in daily for any possible buying opportunities if you are managing a Sector BPI portfolio.

Carson Portfolio Update: 18 November 2022

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Despite the lousy day (August 24th) for equities, none of the BPI sectors dropped into the Buy or oversold zone. Staples is close, but still above the 30% purchase zone.

Lowell