Street Musician

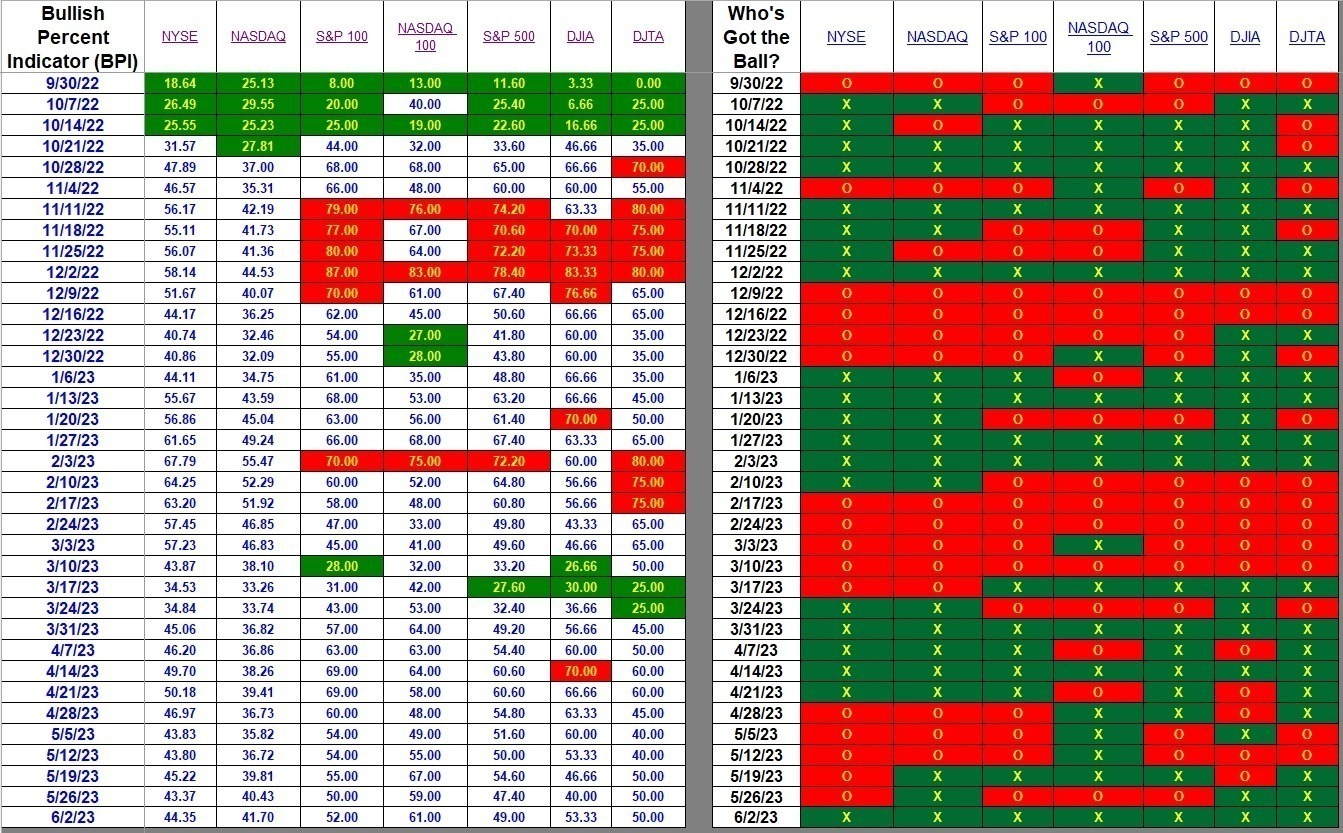

Friday’s strong market turned out to be a positive injection for the U.S. Equities market. International ETFs benefited as well. This reaction to the debt limit solution is reflected in the first screenshot below. What is somewhat surprising is that approximately 50% of the stocks in the indexes are still bearish. In other words, the current stock market is not over heated by any measurement method.

Index BPI

While every major index is bullish, check the percentages of the NYSE and NASDAQ and we see where over 50% of the stocks in these two major indexes are still bearish. This market has a long way to go before it is overvalued.

Sector BPI

Both Energy and Real Estate moved out of the Buy zone, only to be replaced by Utilities. Investors managing a Sector BPI Plus portfolio will want to invest as much as 15.8% of the portfolio in Utilities (VPU). Here is my plan for the four Sector BPI portfolios I’m tracking. After the market opens on Monday I plan to sell any CEFs not recommended as a Buy using the Kipling spreadsheet guidelines. Use that cash to build VPU up to 15.8% of the portfolio.

Look for an update of the Carson and during that review I’ll walk readers through my thinking process.

Explaining the Hypothesis of the Sector BPI Model

Carson Portfolio Update: 18 November 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Be sure to check the Forum for a recent comment on Benchmarks.

Lowell