Poor Chinese Farmer

Investors managing a Sector BPI model portfolio will find the data below of interest. On Monday I’ll check in on the Carson and use this data to make any changes, if recommended. Follow along for more analysis.

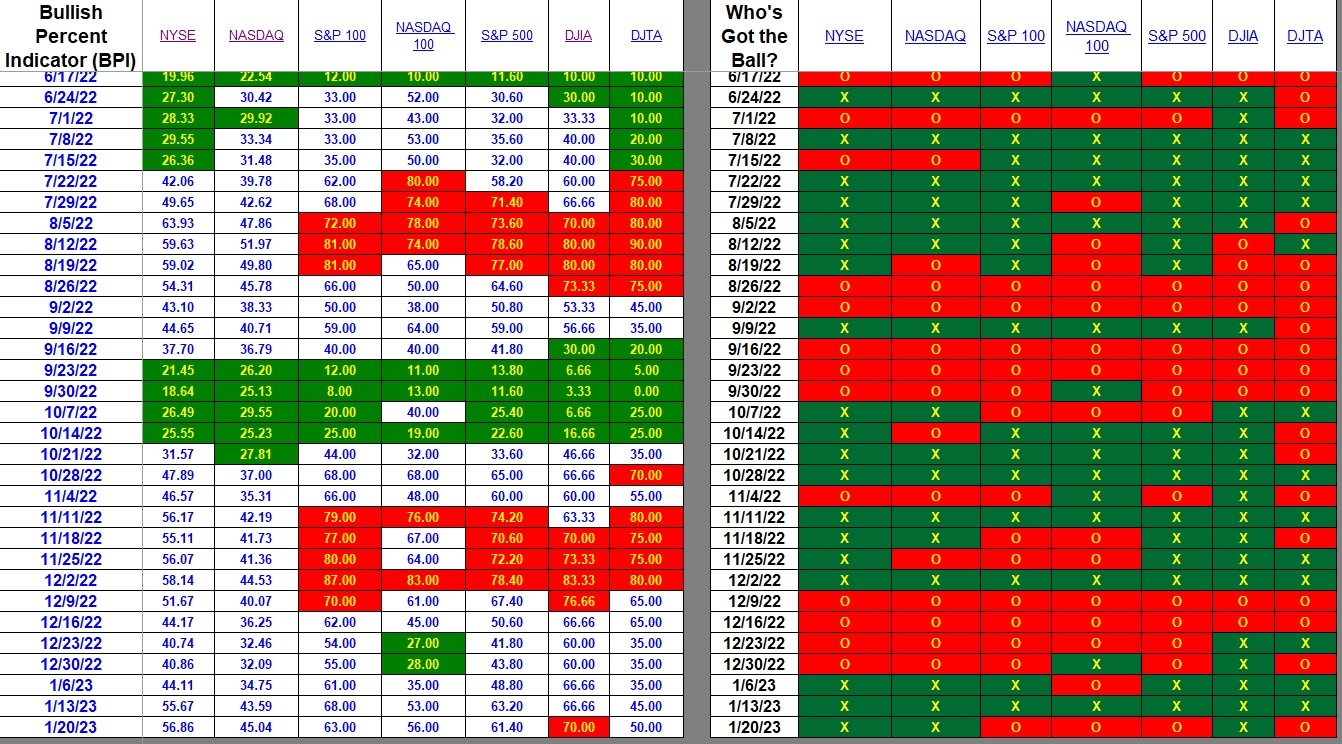

Index BPI

The only major index over-bought is the Dow Jones Industrial Average (DJIA). All others are positioned in the “neutral” zone. Pay most attention to the two broad indexes, NYSE and NASDAQ. Both are hovering around the 50% bullish zone and as such are fairly valued.

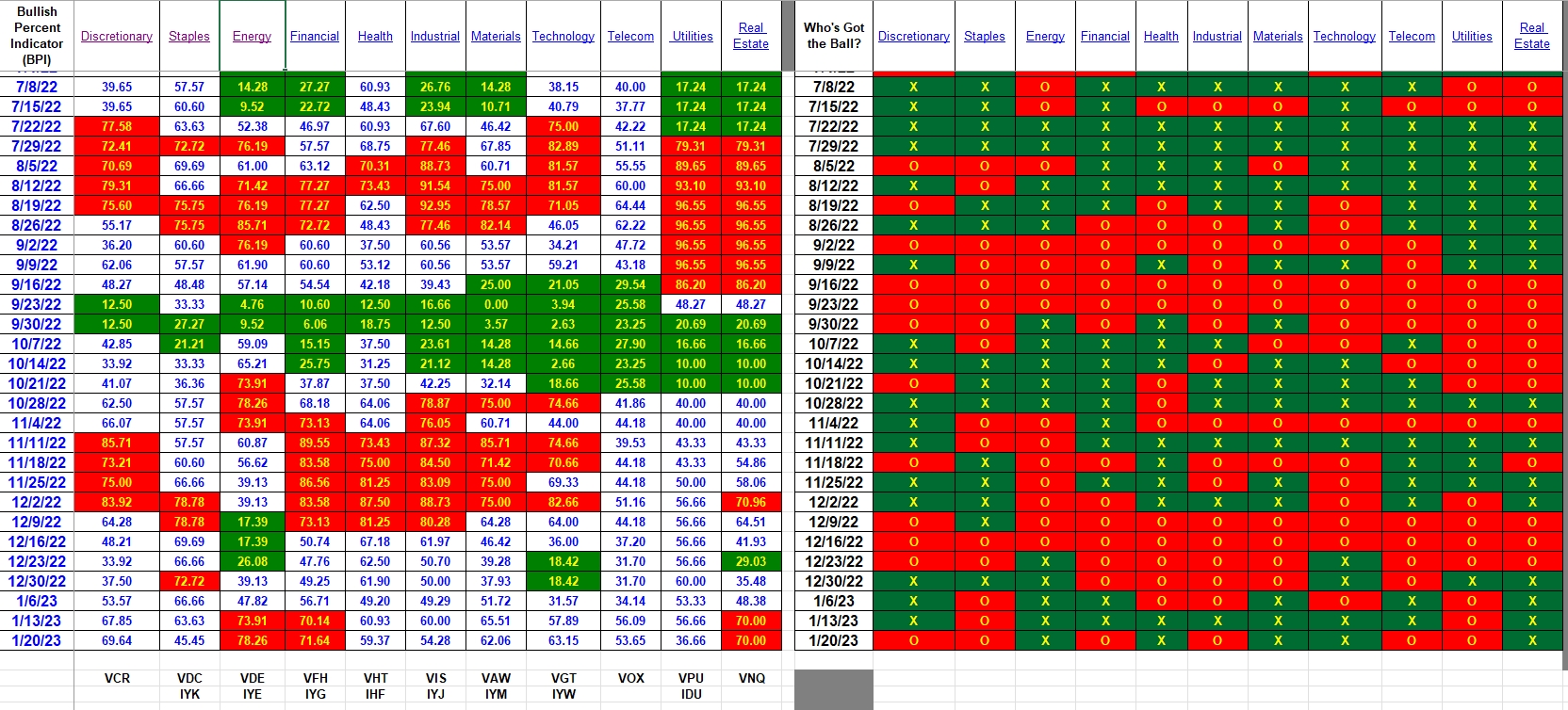

Sector BPI

If you are holding either Energy, Financial or Real Estate, place 3% TSLOs on VDE, VFH and VNQ respectively. When last reviewed the Carson held Energy (VDE). That sector may have been sold out of the portfolio since January 9th. Check in on Monday to see what is going on within the Carson portfolio as I will conduct a complete review on that Sector BPI portfolio.

Utilities is the closest any sector is to approaching the over-sold zone. Otherwise, holdings in any of the other sectors require no action.

Explaining the Hypothesis of the Sector BPI Model

Carson Portfolio Update: 18 November 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

I’ve been running BPI as part of several of my portfolios since the end of September. I’ve been buying arbitrary amounts but so far I’m up ~6% in 4 months. Still holding VPU from a buy in October and VGT from buys in December but all others have cycled through to sells. Now in the spirit of how do we make decisions within BPI, if VPU falls into oversold do I add to the VPU position?.

Bob Warasila

Bob,

Excellent question. Take the Carson as an example. Based on the last volatility rating I see where the Carson will hold 16% in Utilities as a maximum. If you have a full position based on the percentage calculation, don’t all more. However, if you don’t have a full position, as is the case with the Carson, add more shares should Utilities drop below the 30% bullish position.

How do deal with a situation should so many sectors drop into the Buy zone where the volatility calculations add up to more than 100%. I have some ideas, but as yet have not had to deal with that situation.

Lowell