Setting up outdoor pianos at Portland Art Museum

Earlier this morning I posted BPI data and that information will impact the four Sector BPI portfolios, the Carson being one. This review will lay out the process I go through when working with a Sector BPI portfolio. From the BPI data we found two sectors are recommended for purchase and they are, Energy and Utilities.

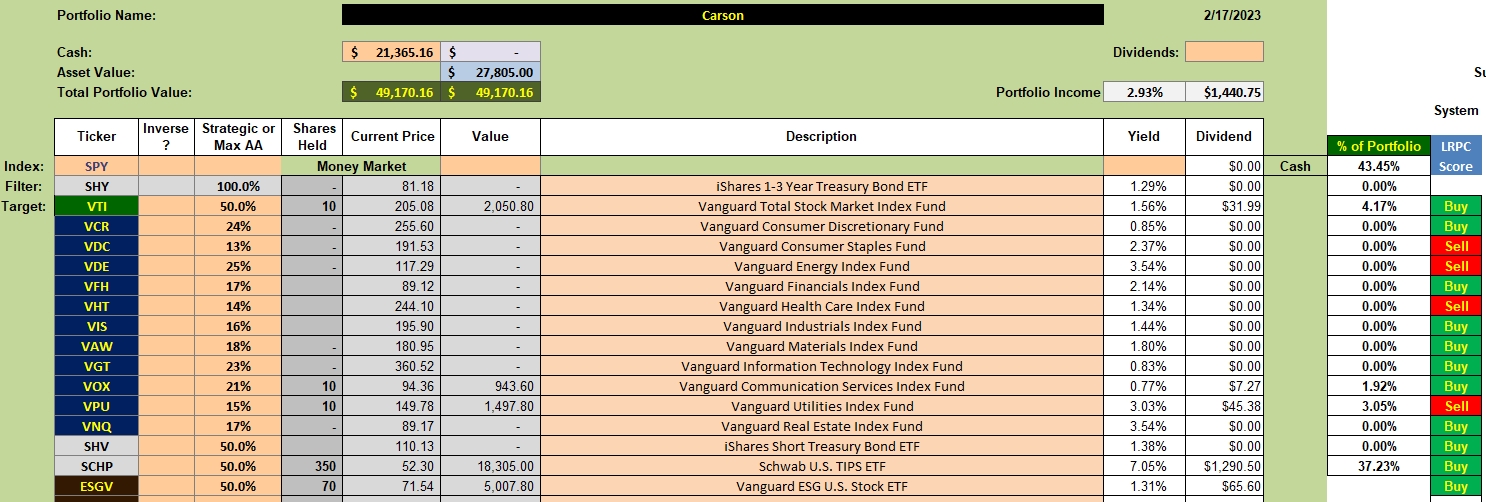

Carson Investment Quiver

Below is the current investment quiver for the Carson. When there is excess cash, I invest it in VTI, SHV, SCHP, or ESGV. As you can see, the Carson holds another $21,000 in cash and that might be sufficient to bring VDE up to 25% and VPU up to 15% of the portfolio.

The third column from the left is the Strategic or Max Asset Allocation. To come up with this percentage I take the three-year annualized volatility and multiply it by 0.70 so at least one of the sectors will show a 25% figure. VDE is currently that sector with VCR, VGT, and VOX close behind.

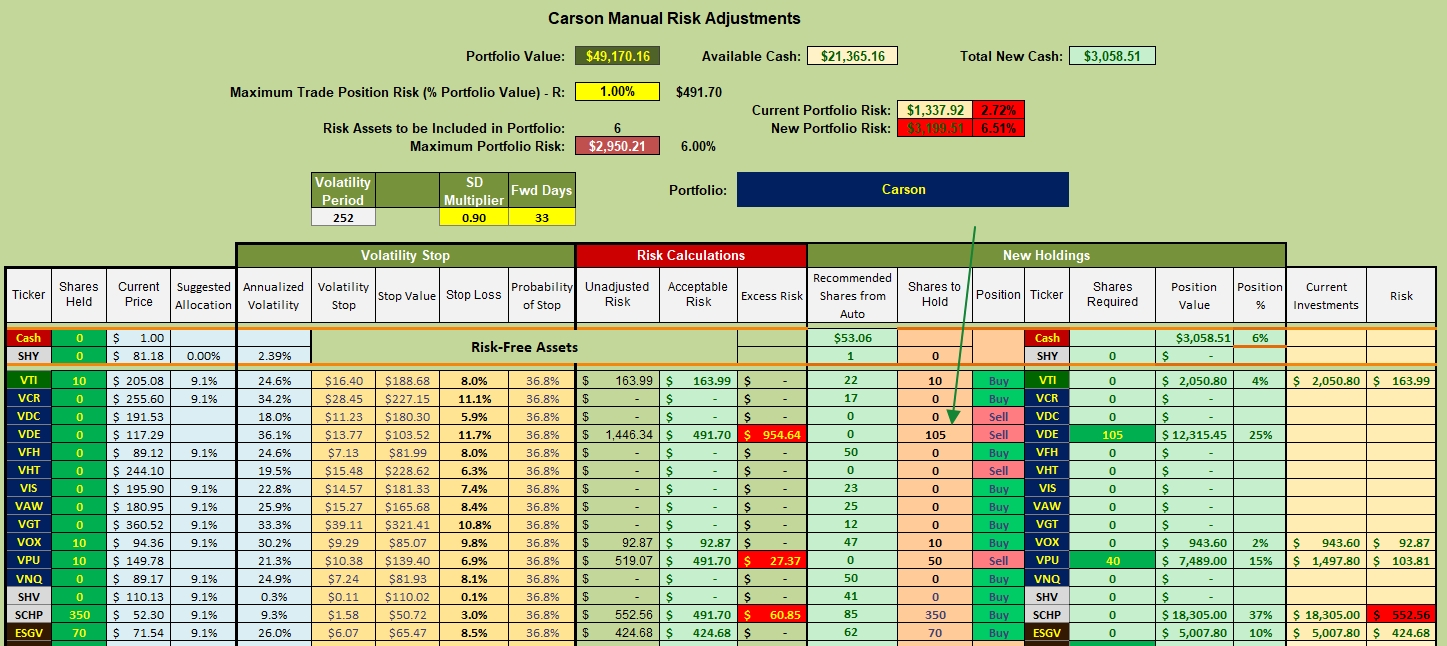

Carson Manual Adjustment Worksheet

The manual risk adjustment worksheet from the Kipling spreadsheet is used as a guideline to determine how many shares are required to fill VDE and VPU.

One hundred and five (105) shares of VDE brings the percentage up to 25%. See the third column from the right. Adding another 40 shares to VPU will bring Utilities up to 15% of the total portfolio. This still leaves $3,058 dollars to be invested or left in cash. I don’t need to sell any of the current holdings to raise cash to fill VDE and VPU.

Take note that the Buy-Hold-Sell model identifies VDE and VPU as a Sell. Both are over-sold so we expect them to show up as a Sell. The Sector BPI Model is a contrary approach. We buy when the sector is out-of-favor and sell when the sector is in-favor.

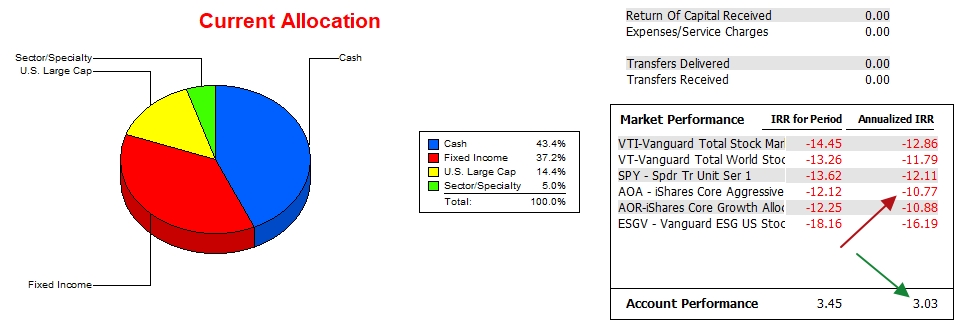

Carson Performance Data

The following data is for 13.5 months so the 13.8% difference between the Carson and the AOA benchmark is not completely due to the Sector BPI model. Until the Carson is fully operational it will be difficult to maintain a 13% to 14% lead over the AOA benchmark.

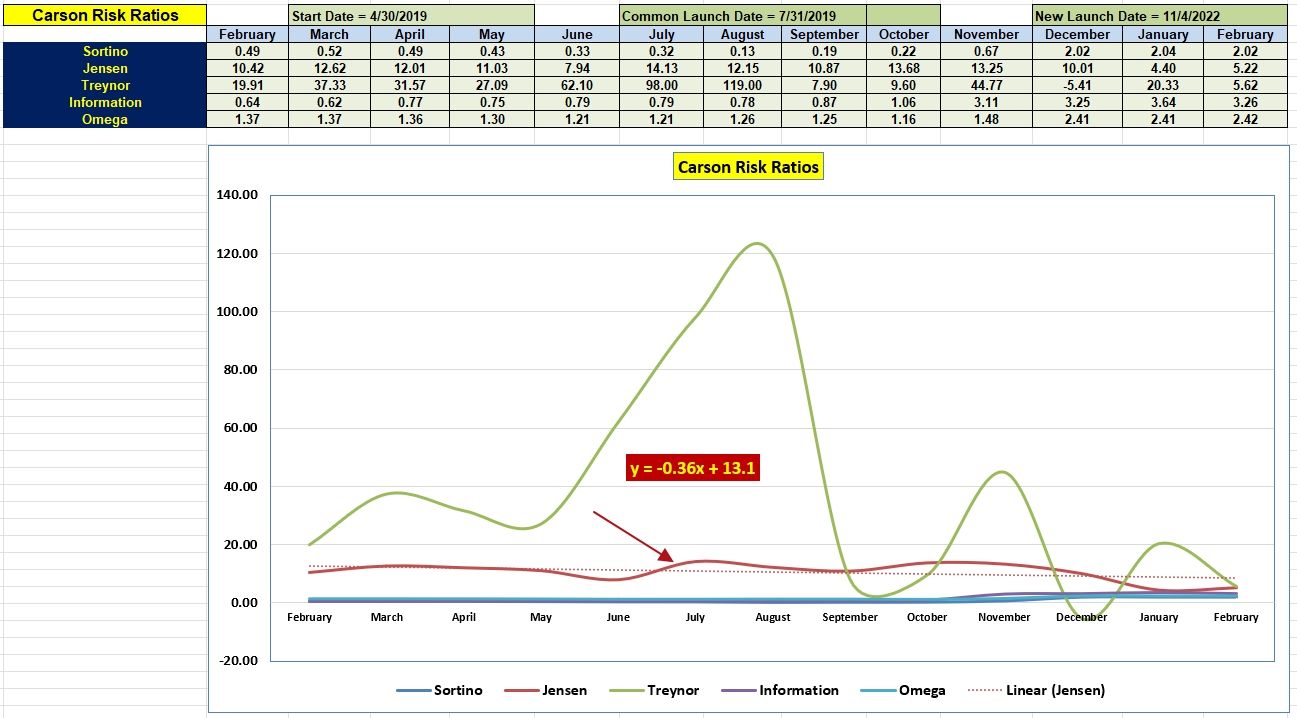

Carson Risk Ratios

All the Carson risk numbers are quite high. It will be another nine to ten months before we have useful information as to how well the Sector BPI approach is working. Thus far it is looking very good, but let’s not jump to any early conclusions.

Check out the following links for more information as to how the Sector BPI model works. In addition, stay tuned to the Carson, Franklin, Gauss, and Millikan portfolios.

Buying Guidelines For BPI Model Portfolios: 9 December 2022

New Carson Launched: 4 November 2022

Carson Portfolio: Creating A New Investing Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.