Evening Walk

Managing Sector BPI portfolios requires patience as it is not unusual to wait months before we see a Buy or Sell signal. In the last two to three months we have had sector action as a number of sectors dipped into the oversold zone. In other words, several sectors moved below the 30% bullish line or were so close to oversold I placed limit orders. As a result the Carson is now invested in six of the eleven sectors.

At its core, the Sector BPI investing model is a reversion to the mean approach to investing. We wait for a sector to dip into an oversold condition and sell when it reaches the overbought zone.

“Reversion to the mean is a statistical concept where an extreme value in a system is likely to be followed by one that is closer to the average, or “mean”. It is a fundamental principle in finance, business, and research, explaining why exceptional performance is often followed by more average results, and why extreme traits are not fully passed on through generations. In trading, it is a strategy based on the belief that asset prices and returns will eventually gravitate back to their historical averages. ”

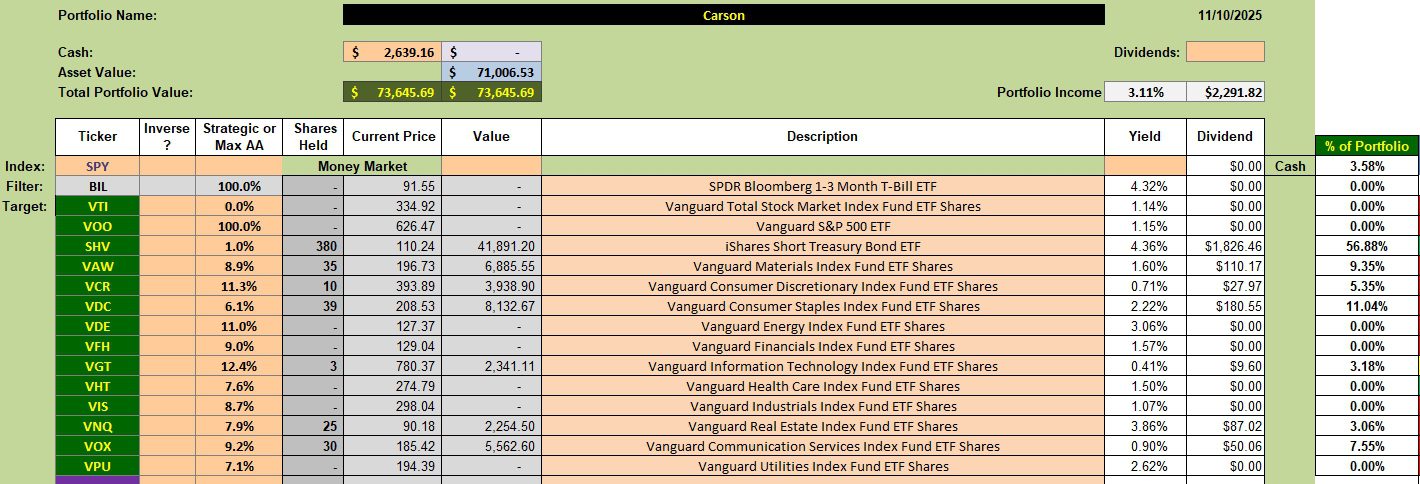

Carson Sector ETF Holdings

Below are the current holdings for the Carson portfolio. The Industrial sector is sufficiently close to the oversold zone that I have a limit order in for VIS. I also have a limit order in for VGT so as to bring it up to the target percentage.

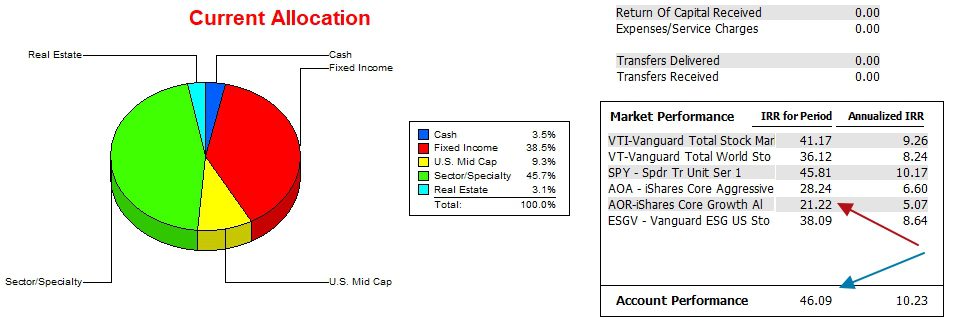

Carson Performance Data

Since 12/31/2021 the Carson has consistently outperformed the AOR benchmark and is also edging out the S&P 500. Besting the S&P 500 is testament to the validity of the Sector BPI investing model. We are beginning to move out of the hypothesis stage for Sector BPI investing as we now have a little over three years of data.

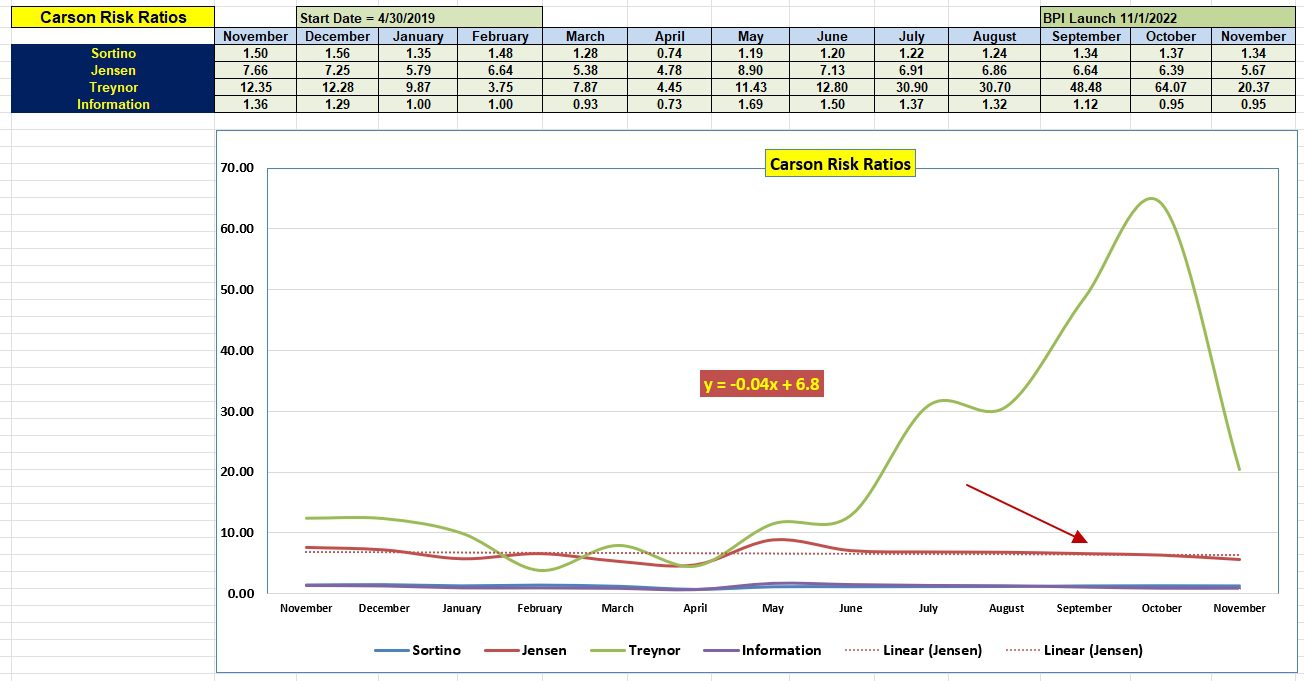

Carson Risk Ratios

The current market draw-down is impacting the Carson. However, all risk measurements are above where they were last April.

The slope of the Jensen Alpha is flat and the goal is to see it turn positive sometime in 2026.

If you find this material beneficial, pass the link on to your friends and relatives. Post your questions and comments in the space provided below.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question