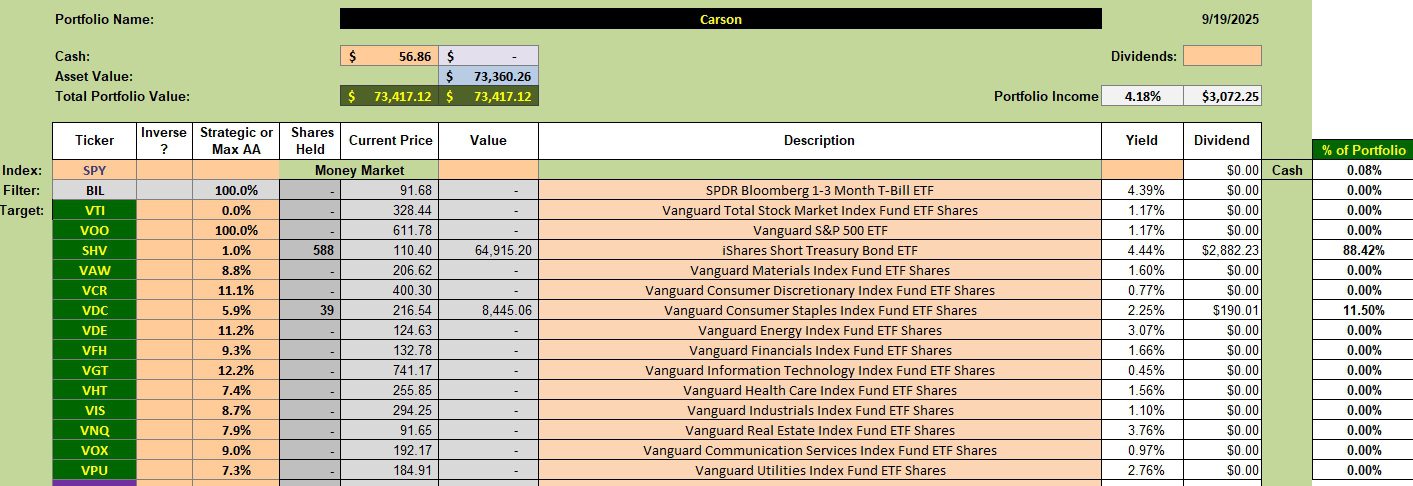

We begin Fall with an update of the Carson portfolio, the original Sector BPI portfolio. When Consumer Staples dropped into the oversold zone I added more shares of VDC not realizing the Carson already held shares representing this sector. That is why the portfolio has an abundance of this security.

This morning I invested the remaining cash back into the short-term treasury, SHV.

Carson Sector ETFs and Other Holdings

Below are the current holding within the Carson portfolio.

Carson Performance Data

Since 12/31/2021 the Carson has outperformed all potential benchmarks. As readers can see, it is very difficult to consistently outperform the S&P 500. The Carson is one of the few ITA portfolios to best the S&P 500.

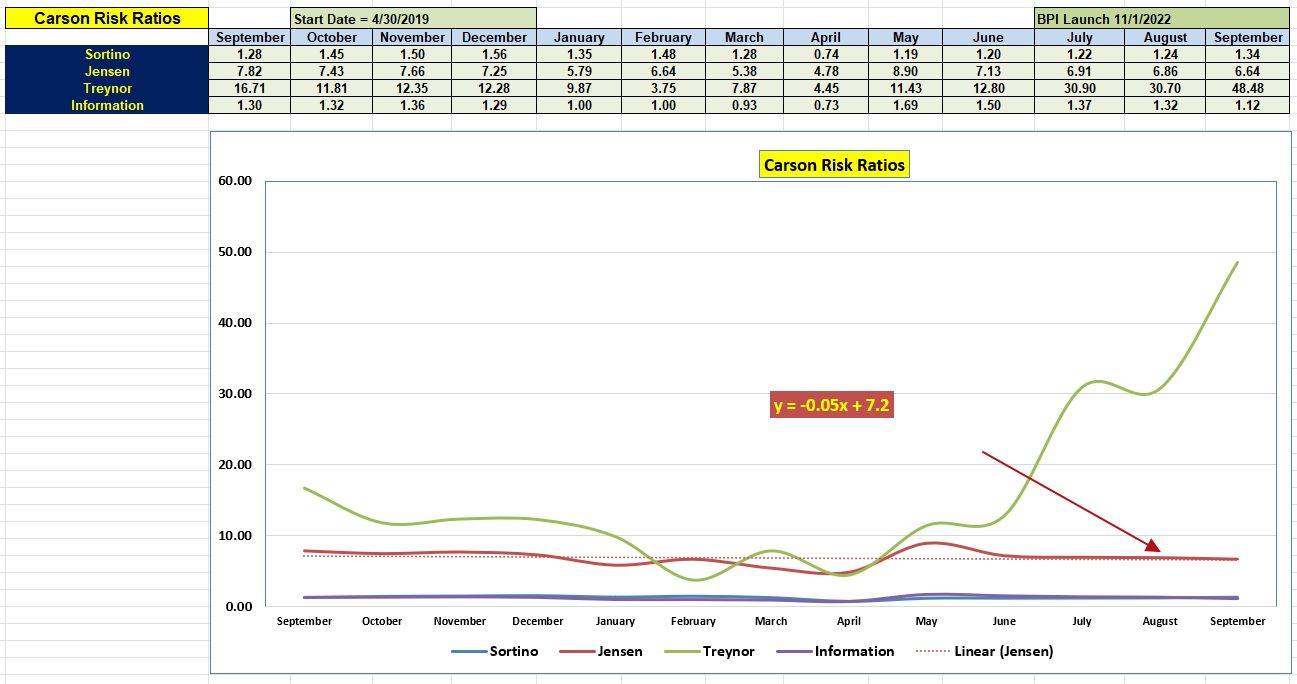

Carson Risk Ratios

Checking in on the two most important risk ratios, both the Jensen and Information are below their high points for the year. When holding such a high percentage in income (88%) I don’t expect to gain on a bullish market. At some point over the next year I predict a draw-down and when that occurs ITA will have cash available to invest in equities.

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question