Decoration at Wait Park in Canby, OR

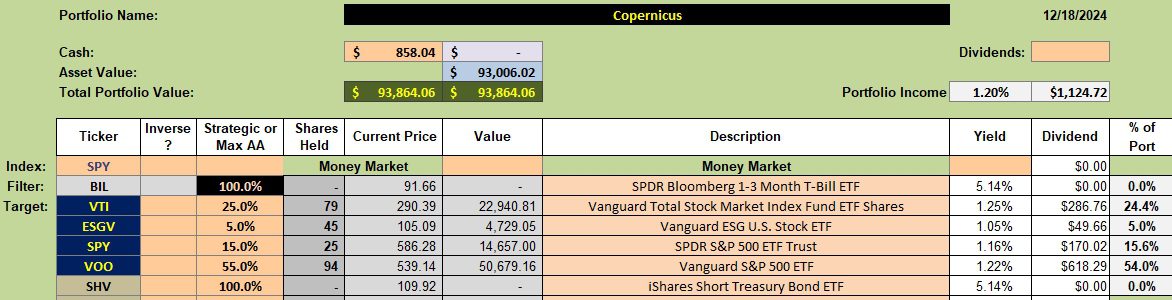

Keep it simple is the philosophy of the Copernicus portfolio. Invest only in U.S. Equities such as VOO and VTI and never sell unless there is an emergency. Keep cash levels low and expenses to a minimum. One reason for including ESGV as part of the portfolio is to purchase shares if the remaining cash is around $100 or insufficient to purchase a share of either VTI or VOO.

Copernicus Current Portfolio

Since the last review an infusion of new cash from the owner permitted additional purchases of VTI and VOO. This leaves sufficient cash to set limit orders to pick up an additional share of VOO and one more share of VTI. Both limit orders are set slightly below the current price.

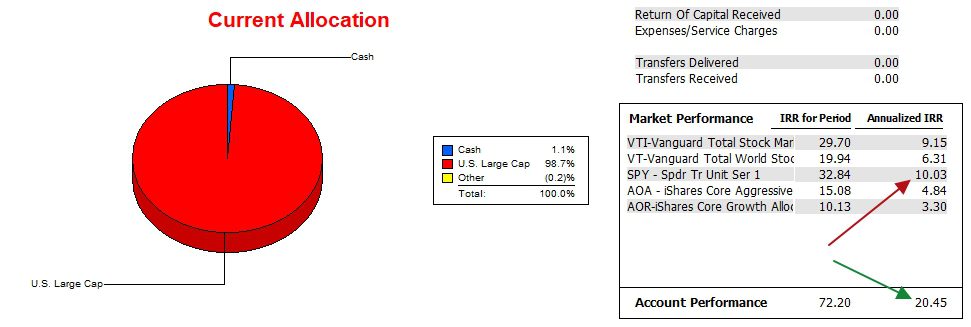

Copernicus Performance Data

Since 12/31/2021 the Copernicus has significantly outperformed the S&P 500 index or SPY, the ETF equivalent.

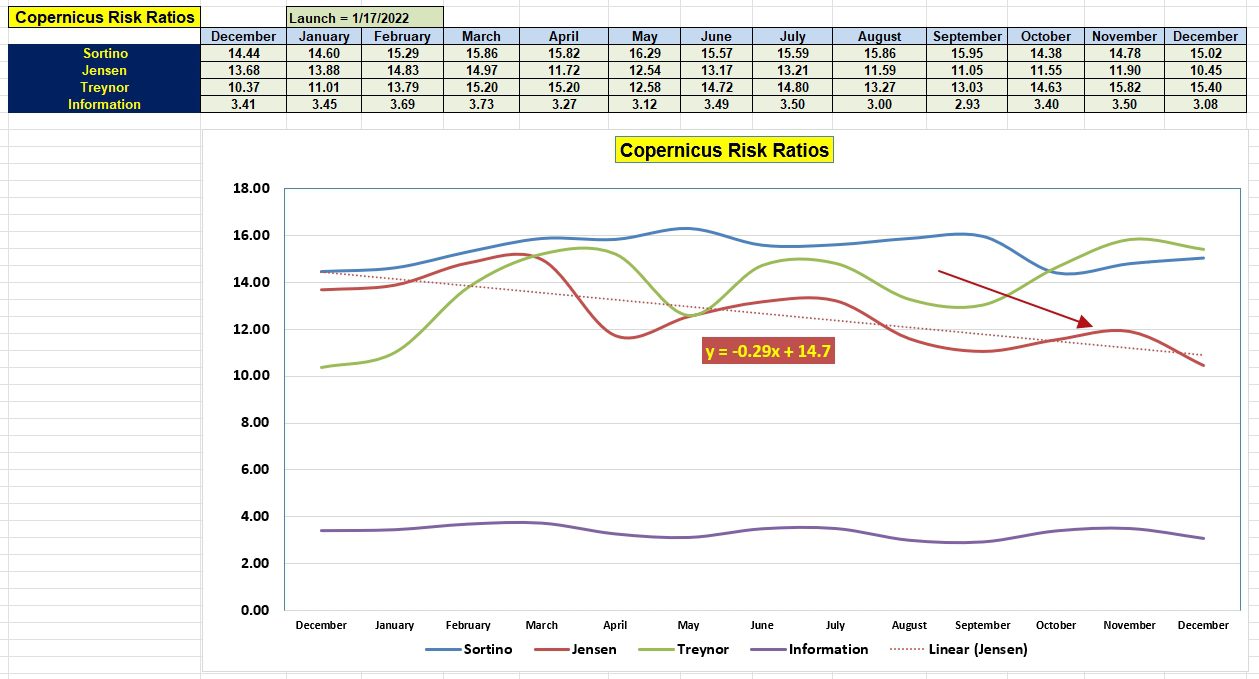

Copernicus Risk Ratios

Over the last three weeks the Sortino Ratio (superior to Sharpe Ratio) shows a slight gain since the November recording. However, the more important risk measurement, Jensen Performance Index, declined. In fact this ratio, while still extremely high, hit its low for the year. Since VOO mirrors the benchmark, what likely happened is that VTI dropped faster than the SPY benchmark.

Of the four risk ratios I pay most attention to the Jensen with the Information Ratio a close second.

Questions and Comments are always welcome. Post them in the Comment section provided with each blog post.

Pass on the https://itawealth.com link to your friends and family. Tell them to register as a Guest and wait to be elevated to the Platinum level so all blog posts are visible. This blog is free.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question