Spring brings color.

With this portfolio review of the Copernicus comes a few adjustments. I am adding SCHD to the existing asset classes and altering the recommended percentages to invest in each. No plans are in the works to sell off any securities that are over target. Instead, new cash and dividends will be used to gradually build up SCHD which will be under target for many months.

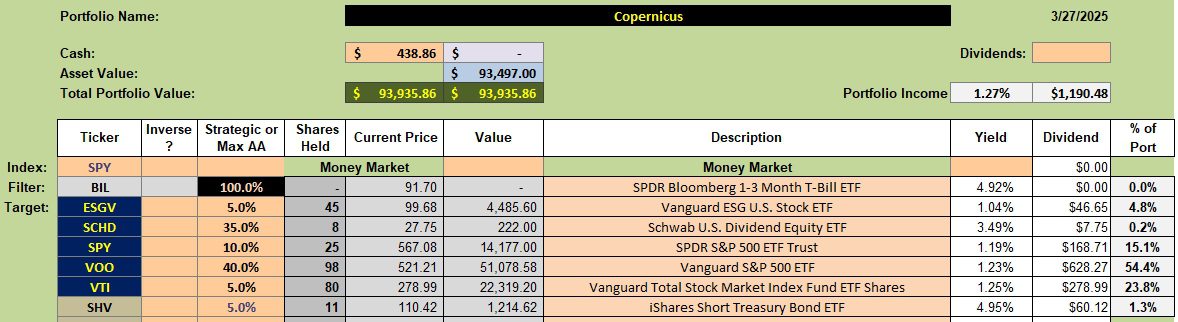

Copernicus Holdings

Below are the current holdings in the Copernicus portfolio. The recommended percentages are listed in the third column from the left while the actual percentages are found in the far right-hand column. As readers can see, SCHD is the ETF that will require additions over the next few months.

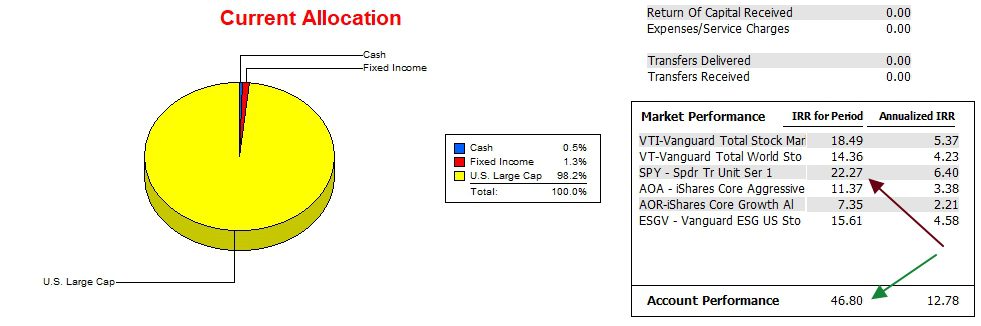

Copernicus Performance Data

Since 12/31/2021, or close to the launch of the Copernicus, this portfolio has far outperformed the S&P 500 (SPY) benchmark. Dollar cost averaging is the primary reason for the excellent performance.

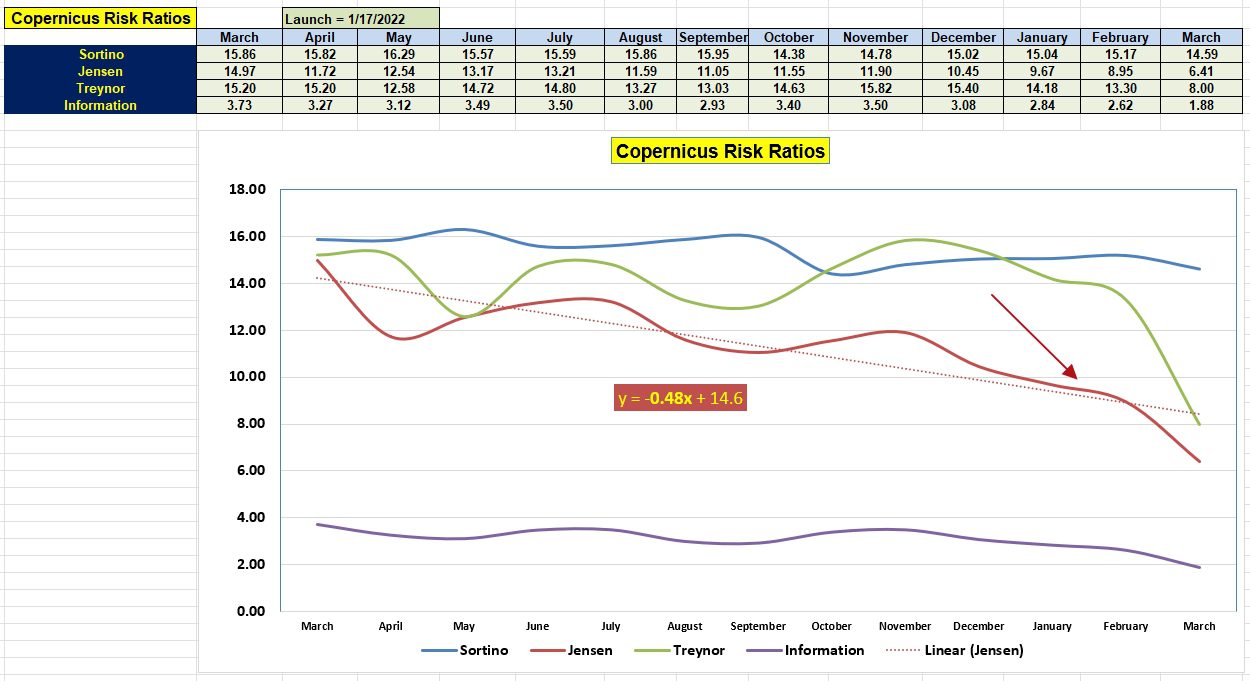

Copernicus Risk Ratios

While the Copernicus has an excellent Internal Rate of Return (IRR) in recent months the Jensen Performance Index declined. This is yet another example as to how difficult it is to keep pace with the broad U.S. Equities market.

The Copernicus is not exactly set up to weather the chaotic market anticipated over the next few years. Regardless, I will continue to stick to the original plan of only adding to the portfolio with the idea of never selling unless there is some emergence declared by the owner.

Comments are always welcome. Send the https://itawealth.com link to your friends and relatives. This blog is free to all who register as a Guest.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question