Spruce Goose located at the Evergreen Aviation and Space Museum – McMinnville, Oregon

Copernicus is the passively managed portfolio up for review this morning. This portfolio is easy to manage and update and it happens to be one of the more successful portfolios tracked here at ITA. As readers will recall, the Copernicus is populated with U.S. Equities and the philosophy is to never sell. Only save and invest so it is a portfolio designed for young investors or individuals still working.

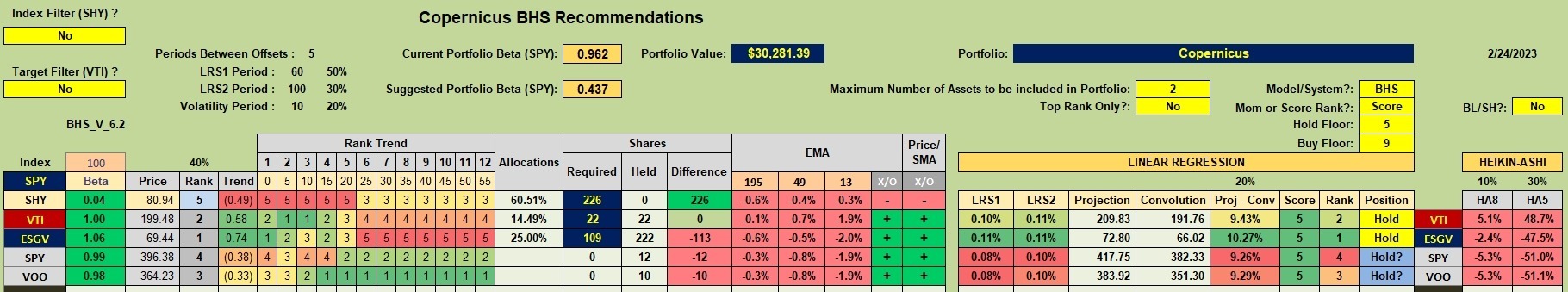

Copernicus Investment Quiver

Four equity ETFs are included in the investment quiver and I only use this worksheet as a guideline to help identify which of the four ETFs to invest in when the portfolio comes up for review. Today ESGV holds the top position, but all four equity securities are highly correlated.

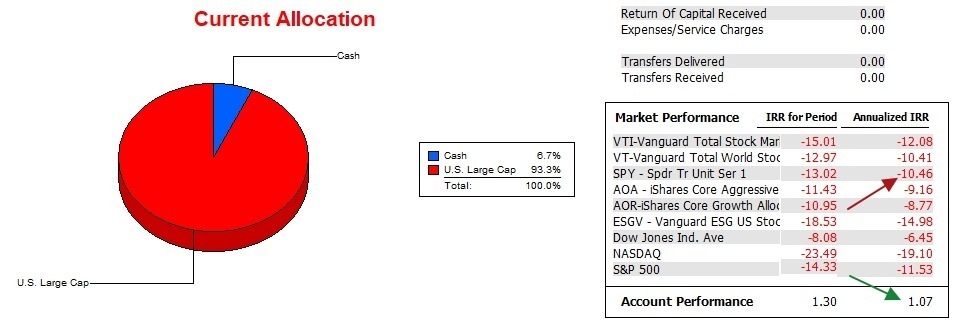

Copernicus Performance Data

The Copernicus has been operational for approximately 15 months and over that period has managed to open up a lead of over 10% annualized above the S&P 500 (SPY). This is a result of dollar cost averaging where new injections of cash and dividends were reinvested when the market was lower than it is today. Those lower cost shares boost the IRR value of the portfolio.

A cash value of 6.7% is too high as cash is a performance drag in an up market. I need to put all available cash to good use in order to maintain the lead over the benchmarks.

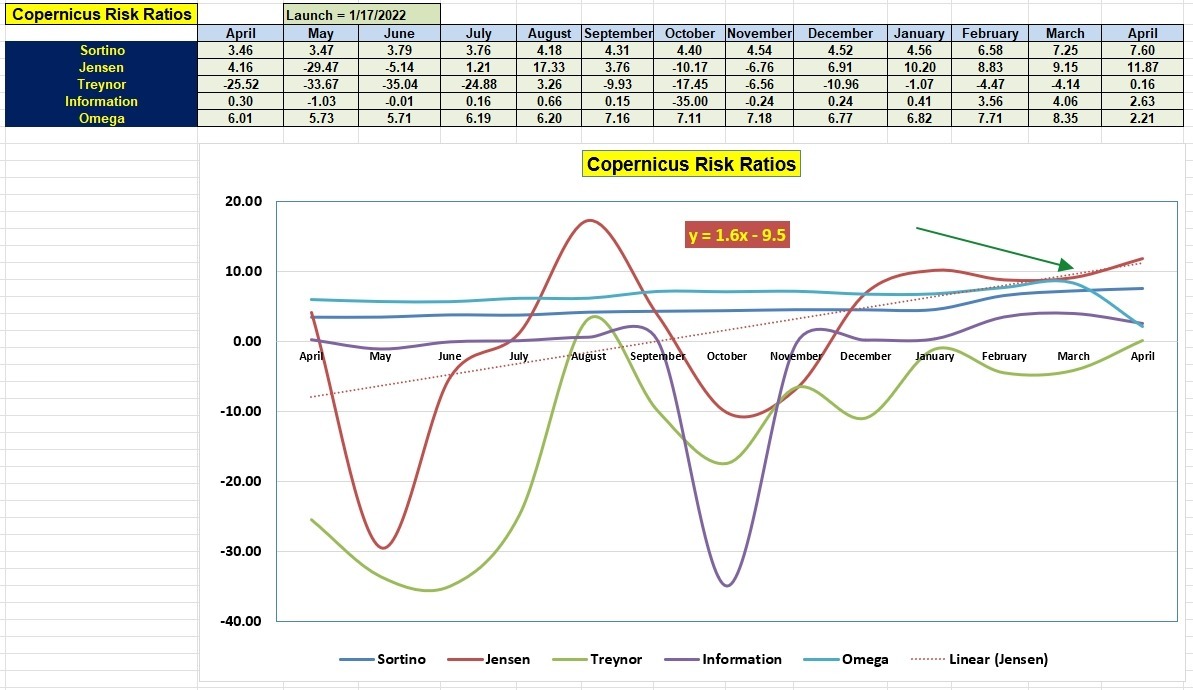

Copernicus Risk Ratios

When comparing the risk ratio values with those of April 2022, we see improvement in nearly every metric. The slope of the Jensen is very high and will jump even higher next month when we trim April 2022 from the table.

Copernicus Portfolio Review: 11 August 2022

The Elements of Investing: Part II

I highly recommend a Copernicus style portfolio be central to a family investment strategy. Save and continue to invest in a broad market ETF or no-load mutual fund.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.