Gardens By The Bay, Singapore

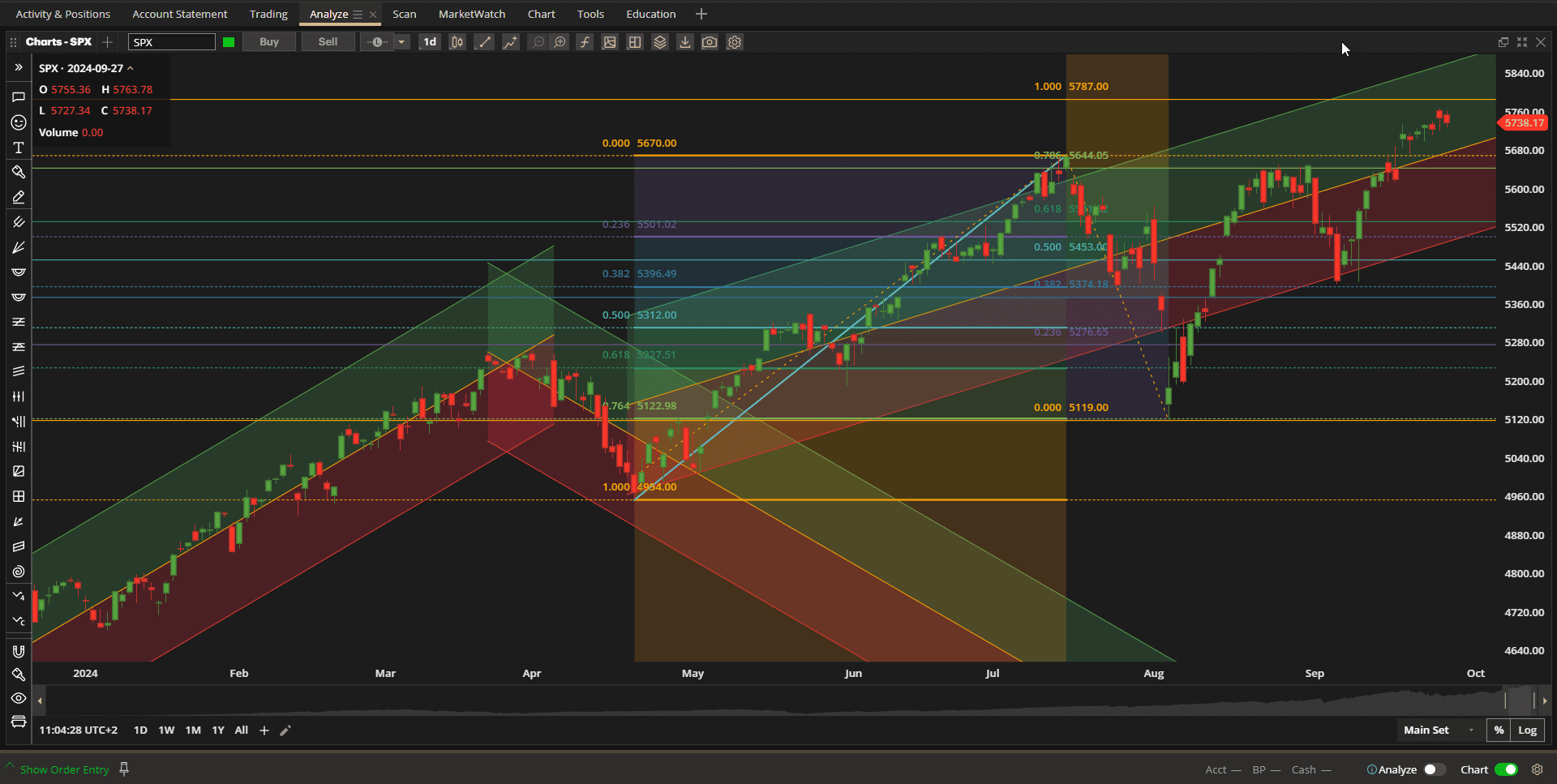

It was a relatively uneventful/quiet week in the US Equity markets with stocks showing a modest 0.5% gain on the week:

While we are still near all-time highs in the SPX (S&P 500 Index) I see possible resistance around the 5790 level before seeing another pullback/correction towards to lower portion of the current bullish trend channel.

While we are still near all-time highs in the SPX (S&P 500 Index) I see possible resistance around the 5790 level before seeing another pullback/correction towards to lower portion of the current bullish trend channel.

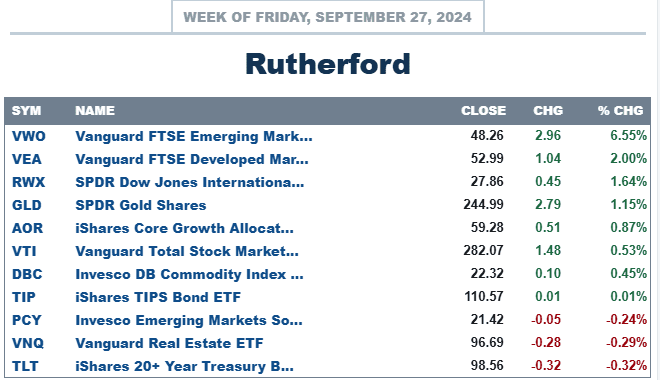

In terms of relative performance compared with other major asset classes US equities ended the week in the middle of the pack with International equities (VWO and VEA) leading the field:

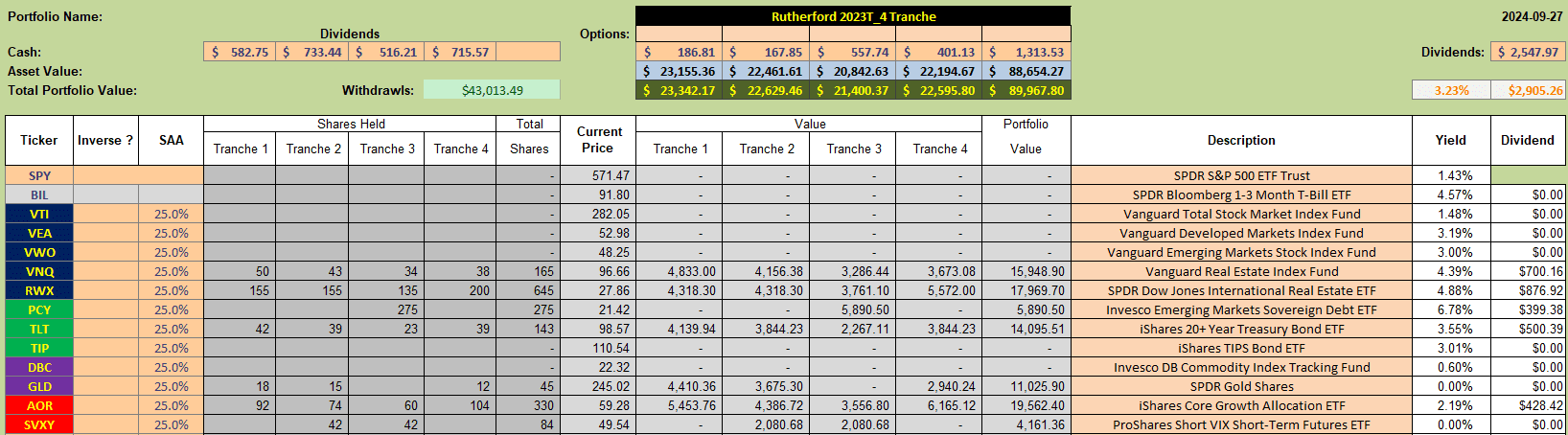

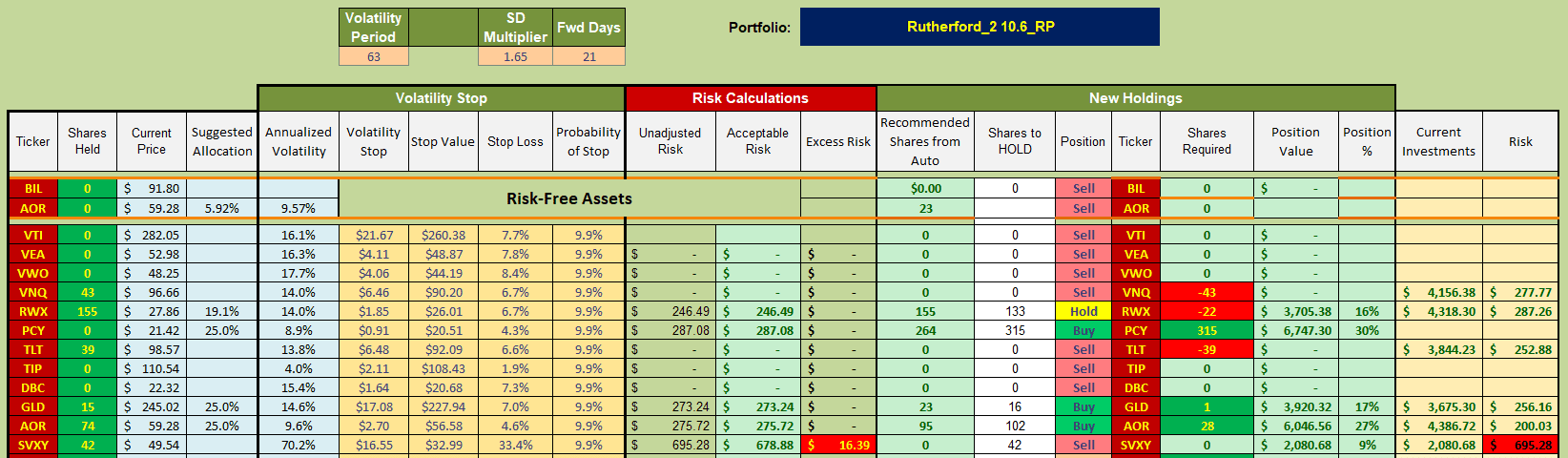

I was finally able to catch up a little on my adjustments – at least to the point of adding positions in RWX (International Real Estate). Current holdings in the portfolio now look like this;

with the following performance in the equity graphs:

with the following performance in the equity graphs:

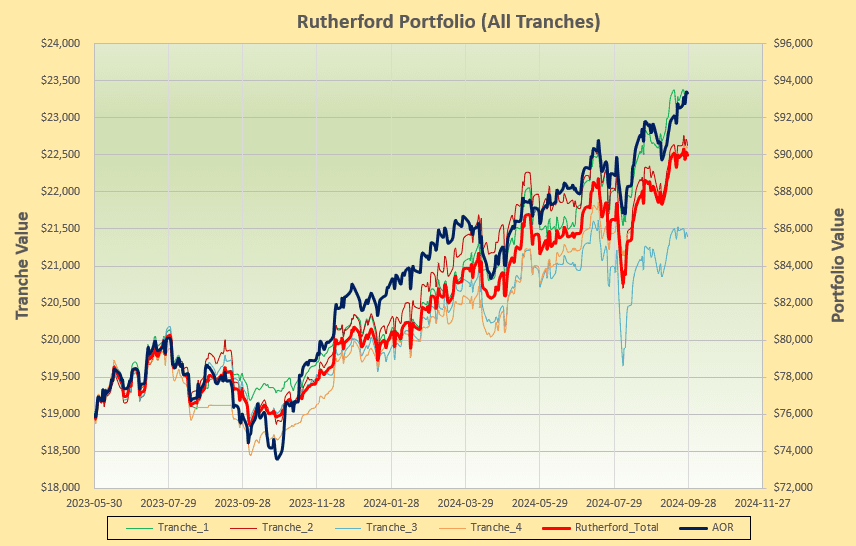

We are still lagging the performance of the benchmark AOR Fund, primarily as a result of timing/review date luck in one of the tranches (Tranche 3).

We are still lagging the performance of the benchmark AOR Fund, primarily as a result of timing/review date luck in one of the tranches (Tranche 3).

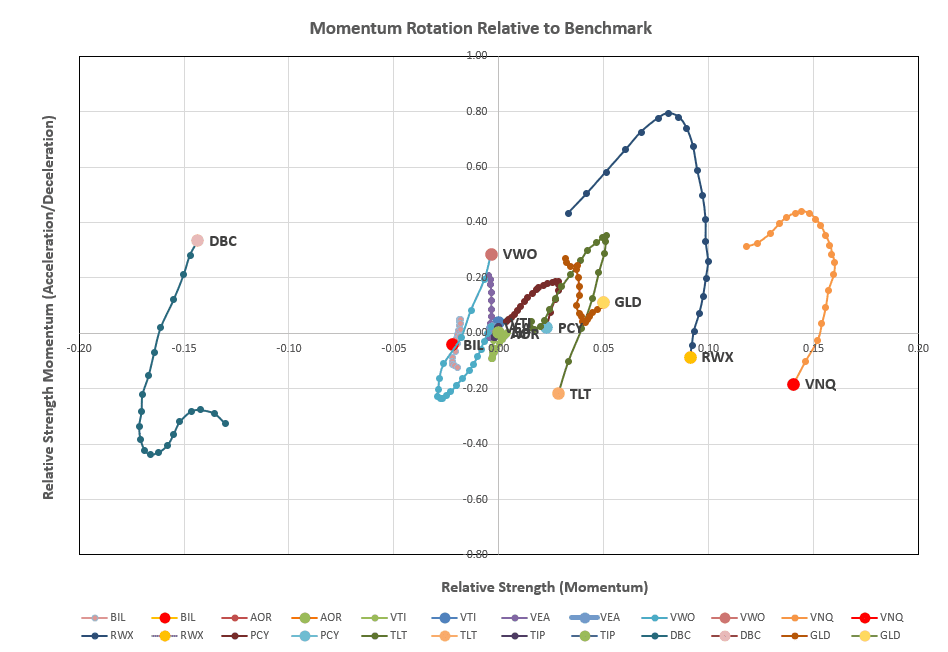

Checking the rotation graphs:

we note that Real Estate (VNQ and RWX), although still leading in terms of longer term momentum (furthest to the right along the horizontal axis), have now fallen out of the desirable top right quadrant due to their weaker short-term momentum (top to bottom movement along the vertical axis). GLD appears to be picking up a little momentum over both time frames.

we note that Real Estate (VNQ and RWX), although still leading in terms of longer term momentum (furthest to the right along the horizontal axis), have now fallen out of the desirable top right quadrant due to their weaker short-term momentum (top to bottom movement along the vertical axis). GLD appears to be picking up a little momentum over both time frames.

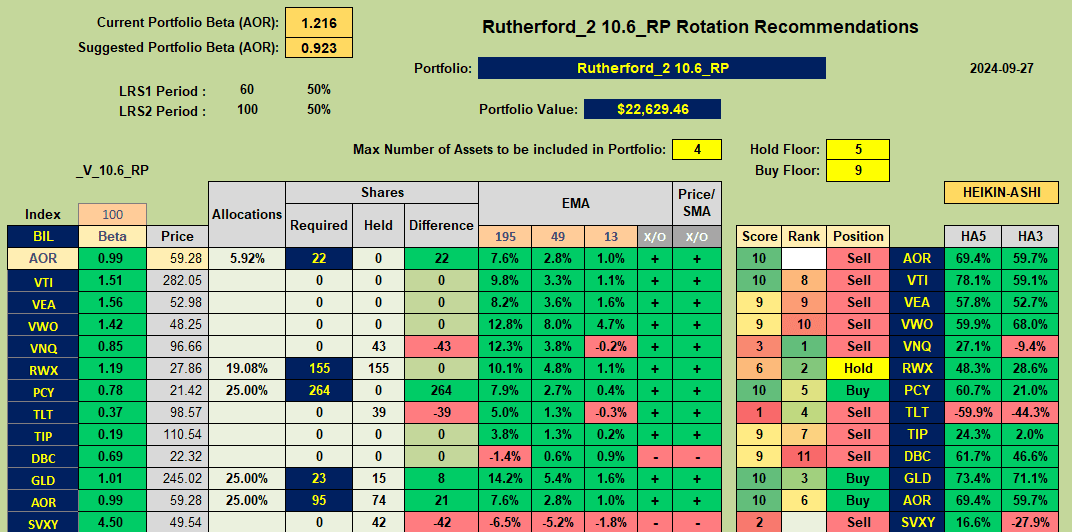

Recommendations from the rotation model algorithm used to manage this portfolio look like this:

with recommendations to Sell current holdings in VNQ (US Real Estate) and TLT (US Treasuries) and Buy/add to currently held positions in PCY, GLD and AOR. RWX is a recommended Hold position.

with recommendations to Sell current holdings in VNQ (US Real Estate) and TLT (US Treasuries) and Buy/add to currently held positions in PCY, GLD and AOR. RWX is a recommended Hold position.

Adjustments for next week for Tranche 2 will therefore look something like this:

with Cash from the sale of shares in VNQ and TLT being used to add a new position in PCY. I will not worry about the minor adjustments in GLD and RWX and any excess Cash will be used to add shares of AOR.

with Cash from the sale of shares in VNQ and TLT being used to add a new position in PCY. I will not worry about the minor adjustments in GLD and RWX and any excess Cash will be used to add shares of AOR.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question