Holiday lights at Wait Park

Copernicus is an equity oriented portfolio designed for young investors or folks who have 10 to 15 years of investing ahead. Investors in retirement who are still able to save a modest amount each month are encouraged to use this asset allocation for at least one portfolio. While the target percentages will vary from investor to investor, seriously consider including an equity only as one of your potential portfolios. A full review of the Copernicus will occur on Wednesday of this week.

Over the long run, it is difficult to outperform the S&P 500 (VOO). This is the primary reason for including an equity only asset allocation for at least one of your portfolios. A slightly more conservation approach is to use the equal-weighted S&P 500 Exchange Traded Fund (ETF), RSP. RSP is a new addition to the Copernicus and I will be adding shares before the end of this year. The new asset allocation model shown below is the setup for 2026.

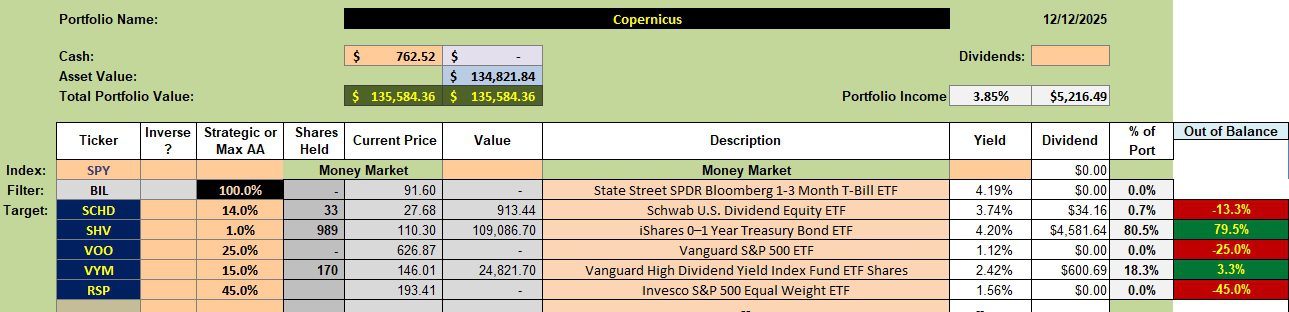

Copernicus Asset Allocation

Below is the asset allocation plan for 2026. The asset percentages are different from last month and I added RSP to the existing ETFs. If you are willing to take on more risk, concentrate on VOO and RSP and lower the target percentages of VYM and SCHD. SHV is a holding bucket to earn interest until Buy orders show up for an ETF such as VOO.

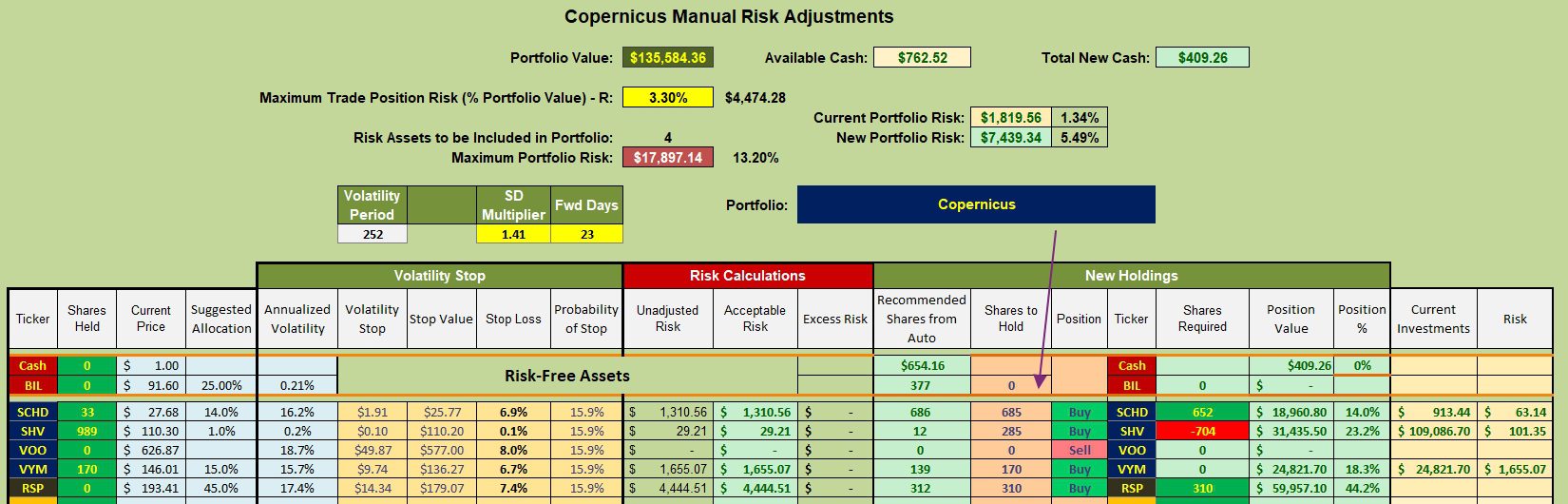

Copernicus Rebalancing Recommendations

This coming week I will sell shares of SHV to raise cash to purchase more share of SCHD and RSP. VYM is over target so I’ll let this dividend oriented ETF ride. No change is necessary for VYM. The current recommendation for VOO is a Sell where the Copernicus holds zero shares so no change is recommended.

As the months pass and new cash is added to the Copernicus, the goal is to keep adding shares when the ETF is below target and the recommendation is a Buy. If the security is showing a Hold or Sell the plan is to do nothing so as to minimize taxes.

I would not recommend holding all investments in this high risk portfolio. Rather, think of the Copernicus as one portfolio among several where other portfolios hold bonds and treasuries. Long-time readers know I am all about diversification.

- The first order diversification is to use no-load mutual funds or Exchange Traded Funds (ETFs) instead of individual stocks to build a portfolio. I prefer ETFs over mutual funds and use them exclusively.

- The second order diversification is to use different ETFs to cover different asset classes. Portfolio such as Gauss, Einstein, Bethe, Bohr, and Kepler do just this.

- The third order diversification is to use different investing models. The Schrodinger and Copernicus are examples as they are very different investing models.

Over the next two weeks approximately 10 portfolios will be reviewed so new readers will see asset allocation examples that differ from the Copernicus. As mentioned above, the Copernicus will have a complete review this coming week.

Share the itawealth.com URL with your relatives and friends. Post on Facebook if you think this information is useful.

Recession: Will Equities Drop In The Next 18 Months?

Copernicus Portfolio Review: 14 November 2025

Disclaimer: The ITA blog is an educational site designed to help individuals manage their own portfolios instead of paying fees to a “professional” money manager. Rather than investment advice, the different portfolios are examples, using real money, of how individual investors might manage their own portfolio(s).

Lowell

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question