Darwin, Australia

The Darwin Portfolio differs from other portfolios that I review on this site since it is a more “classical” diversified portfolio that does not rely on momentum measurements but stays invested in the same assets at all times (see lower screenshot below). The only adjustments necessary are to adjust for Risk Parity should allocations get out of line with required limits targetting 3% maximum volatility per asset held in the portfolio.

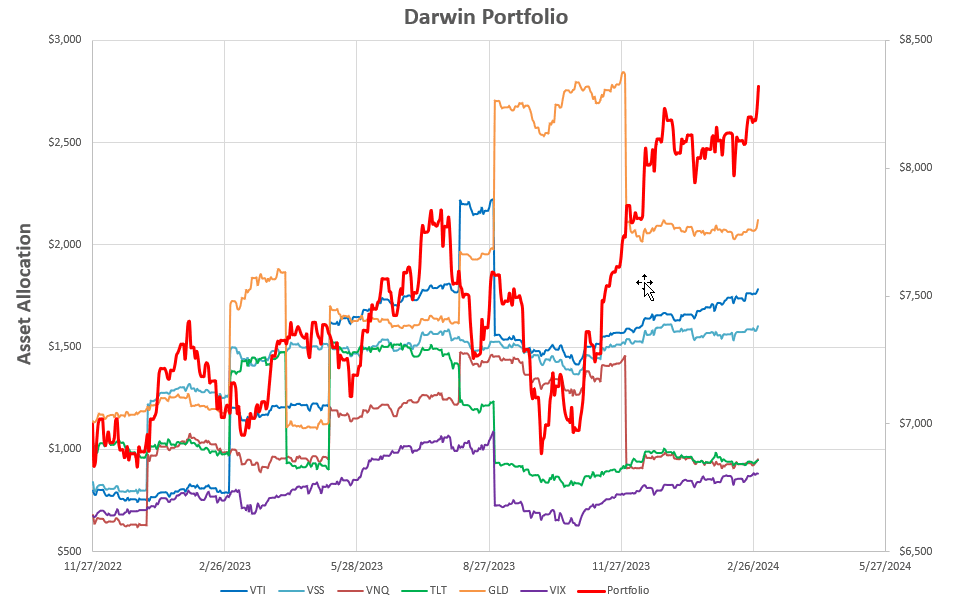

Performance over the past 15 months looks like this:

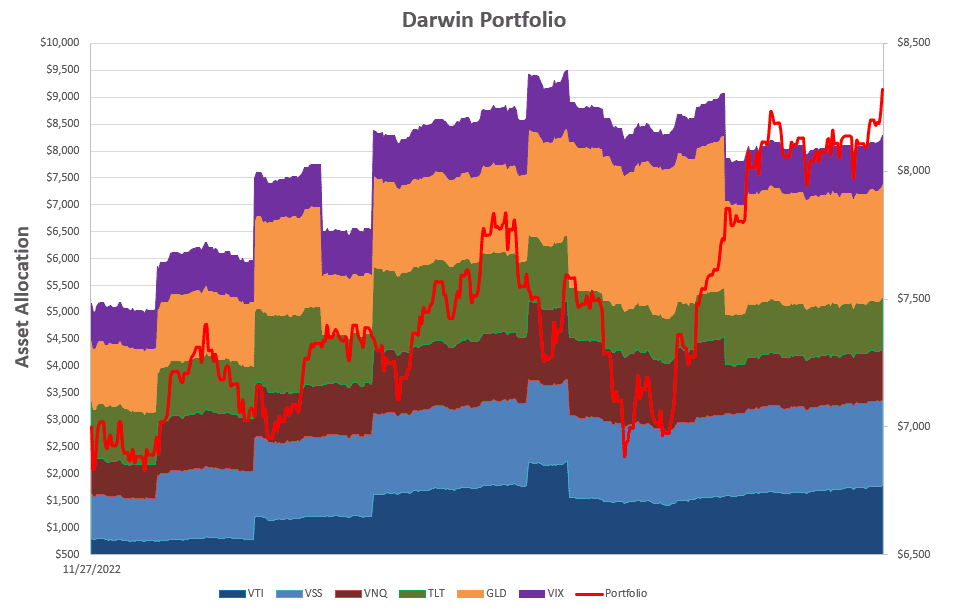

or, in stacked format:

or, in stacked format:

The discontinuities in the graphs reflect the allocation adjustments made to the portfolio.

The discontinuities in the graphs reflect the allocation adjustments made to the portfolio.

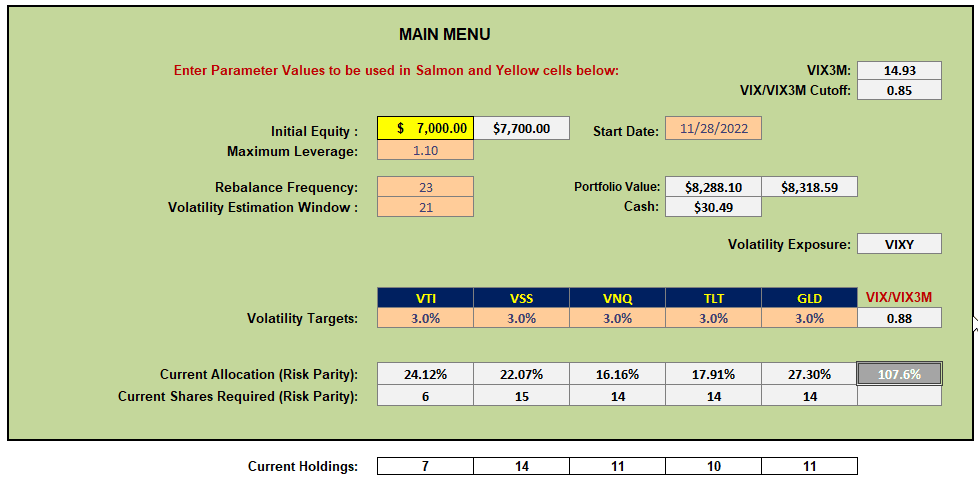

Current and suggested allocations look like this:

that suggests adding a few more shares of VNQ (US Real Estate), TLT (Long-Term US Treasuries) and GLD (Gold) to the portfolio. However, since the portfolio is currently fully invested (without using margin) I am going to pass on making these adjustments right now. The reason for this is that the VIX/VIX3M ratio is very close to the 0.85 Cutoff limit that determines whether I want to be short volatility (i.e. expect volatility to move lower). At the 12-14% level, volatility is currently relatively low (although it has been down at the 10% level) and since I am holding SVXY (an inverse volatility ETF) in this portfolio I am seriously considering selling out of this position as we move into this election year since I expect volatility to increase as the media hypes up every political move. In addition, falling prices also results in higher volatility (and we are currently at/near all-time highs and possible risistance), so I’m not too inclined to be margined in a bullish portfolio even though election years are historically bullish.

that suggests adding a few more shares of VNQ (US Real Estate), TLT (Long-Term US Treasuries) and GLD (Gold) to the portfolio. However, since the portfolio is currently fully invested (without using margin) I am going to pass on making these adjustments right now. The reason for this is that the VIX/VIX3M ratio is very close to the 0.85 Cutoff limit that determines whether I want to be short volatility (i.e. expect volatility to move lower). At the 12-14% level, volatility is currently relatively low (although it has been down at the 10% level) and since I am holding SVXY (an inverse volatility ETF) in this portfolio I am seriously considering selling out of this position as we move into this election year since I expect volatility to increase as the media hypes up every political move. In addition, falling prices also results in higher volatility (and we are currently at/near all-time highs and possible risistance), so I’m not too inclined to be margined in a bullish portfolio even though election years are historically bullish.

For now I am leaving this portfolio “as-is” but I will post an update should I decide to sell out of SVXY as I am watching this closely. Over the past 15 months SVXY has been a big winner and I have already made one allocation adjustment to take profits off the table.

Detailed tracking of this portfolios shows the portfolio generating a respectable 15.9% annualized Internal Rate of Return (IRR) over this 15 month period.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.