Hardy Local Fisherman (not me 🙂 )

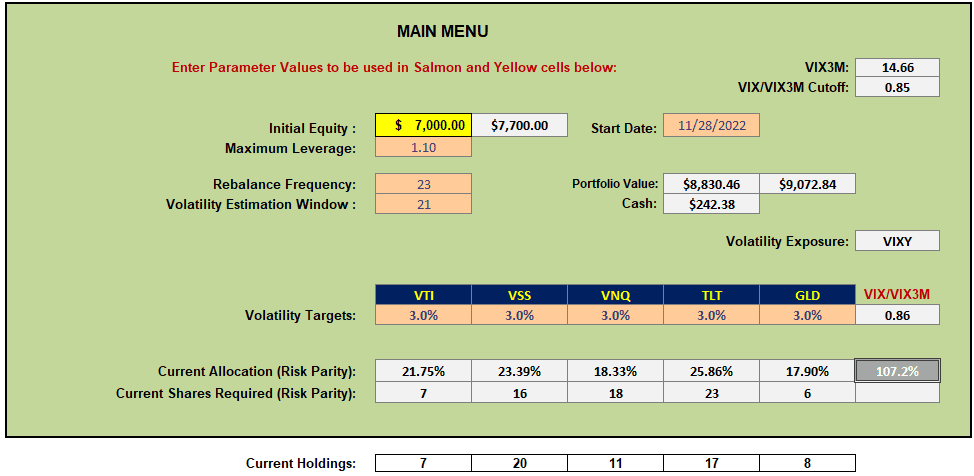

The Darwin Portfolio is an “All-Weather” Portfolio built from 5 ETFs representing diversification in 5 major asset classes. The portfolio also hold a ~10% allocation to “volatility” as an asset class providing even more diversification. Allocations in the 5 major asset classes are made based on the concepts of Risk Parity with a 3% volatility target and the portfolio in adjusted only infrequently (~quarterly) if/when the allocations get severely out of balance.

Current holdings and suggested allocations look like this:

and, although the allocations are a little out of balance, I shall not bother to adjust this month since I made adjustments last month. Perhaps more significant is the observation that the volatility ETF to be included in the portfolio should be long volatility (anticipating an increase in volatility). This recommendation has been flipping from long/short/long for over a month now and I don’t want to get into a lot of whipsaw trades so, since this is a small portfolio, I have sold the inverse SVXY ETF (short volatility) but have not entered a long volatility position since increases in volatility are usually fast and difficult to time (entry and exits) – i.e. susceptible to whipsaws.

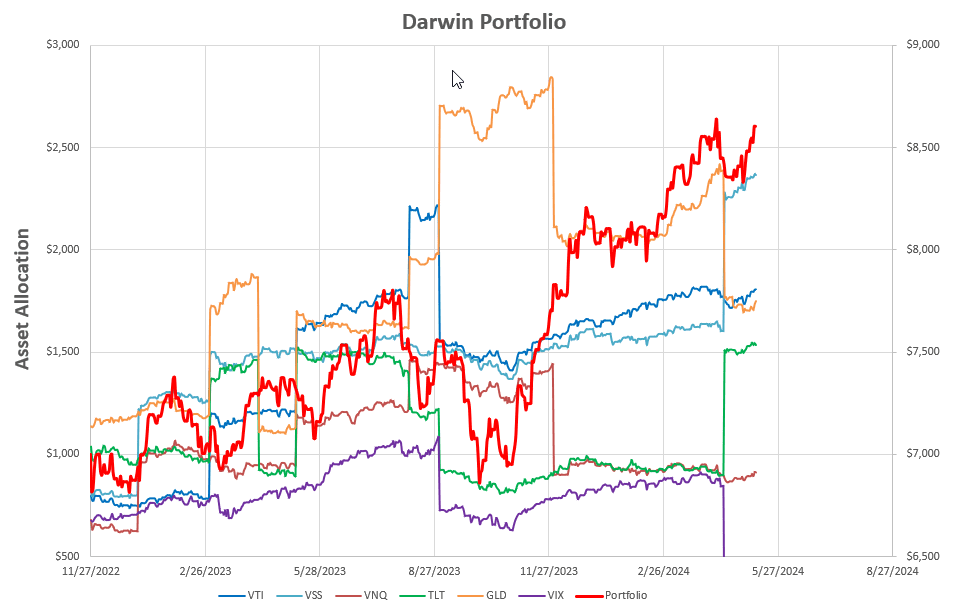

Recent performance looks like this:

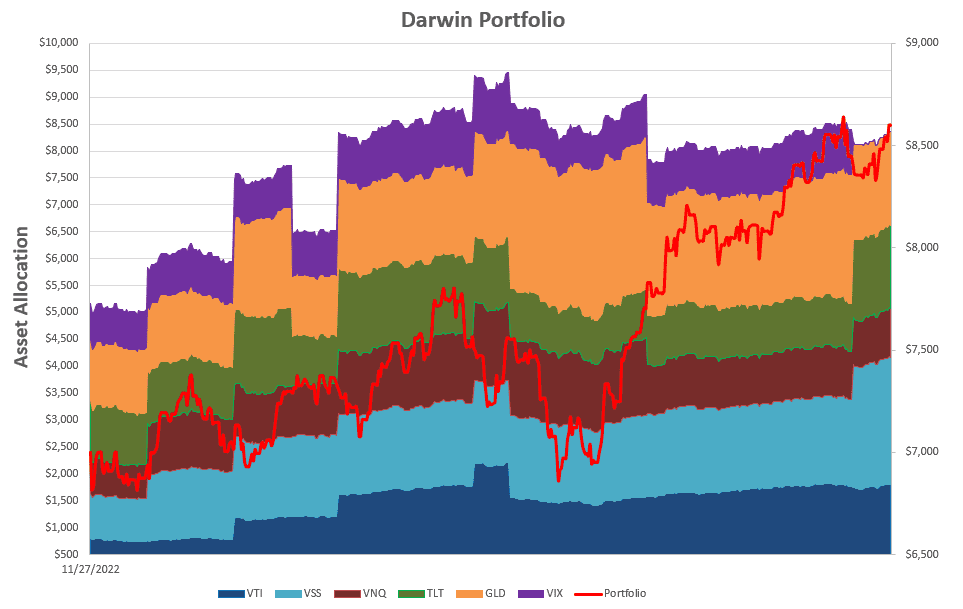

or, in stacked format:

or, in stacked format:

where the discontinuities correspond to allocation adjustments.

where the discontinuities correspond to allocation adjustments.

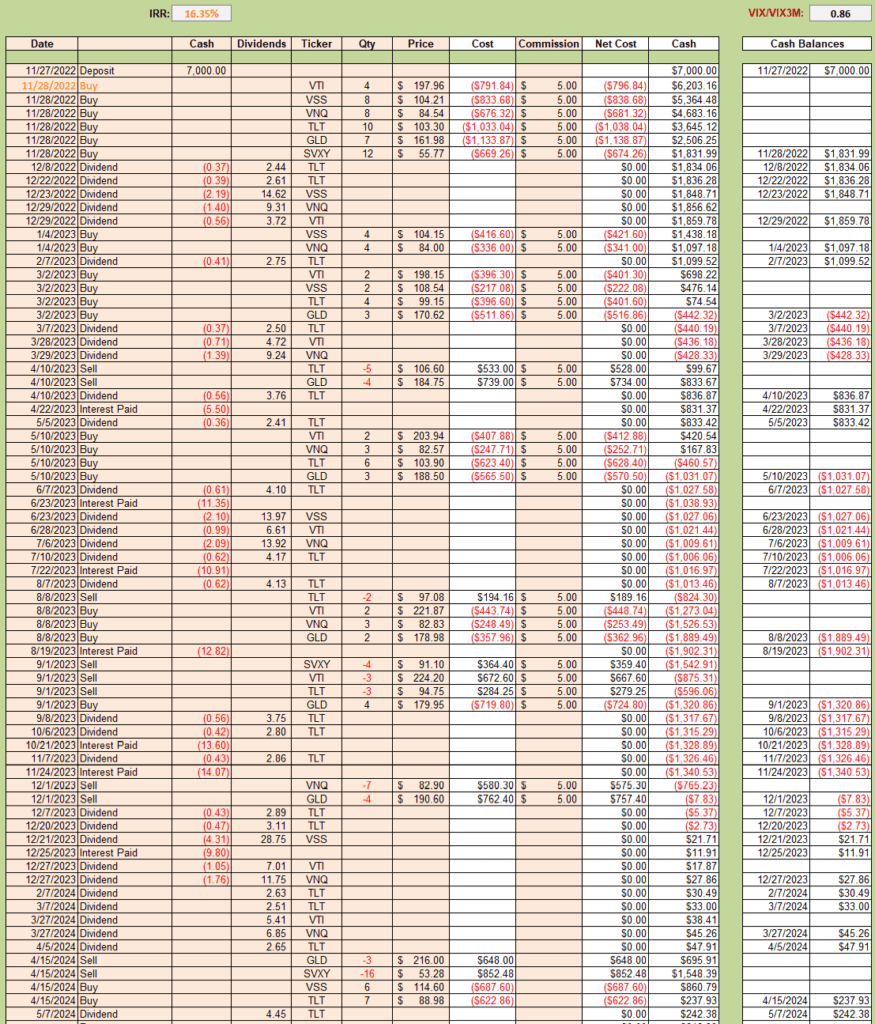

Performance of this portfolio is reflected in the following screenshot showing trade activities in the 17-months since inception in November 2022

The portfolio is showing a respectable annualized Internal Rate of Return (IRR) of 16.35% – despite the fact that this isn’t one of my favorite investment styles/strategies 🙂

The portfolio is showing a respectable annualized Internal Rate of Return (IRR) of 16.35% – despite the fact that this isn’t one of my favorite investment styles/strategies 🙂

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.