Sunset over the Pacific Ocean off the “Gold Coast” of Australia.

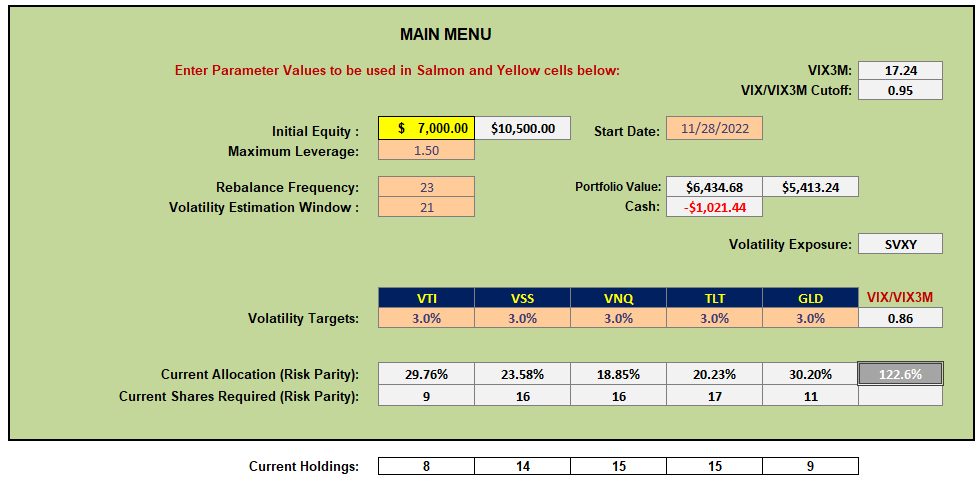

The Darwin Portfolio is an “all-weather” portfolio that requires few adjustments, based on risk parity, only when allocations get significantly out-of-line. The portfolio holds only 5 assets that may be adjusted for risk parity with an allocation to “Volatility” – considered as a separate asset class – for a little extra diversification. Current holdings are shown at the bottom of the following screenshot with current recommended holdings (based on risk parity) shown slightly above (in the green box):

As can be seen, none of the allocatins differs by more than 2 shares. The suggested requirements for holding a few more shares in some of the assets is a result of the current low volatility environment – so I will not be making any adjustments at this review since these recommendations will come down should volatility return to the markets and I am presently leveraged at about the 20% level. If I drop the maximum allowable leverage to ~10% the current holdings are about right.

As can be seen, none of the allocatins differs by more than 2 shares. The suggested requirements for holding a few more shares in some of the assets is a result of the current low volatility environment – so I will not be making any adjustments at this review since these recommendations will come down should volatility return to the markets and I am presently leveraged at about the 20% level. If I drop the maximum allowable leverage to ~10% the current holdings are about right.

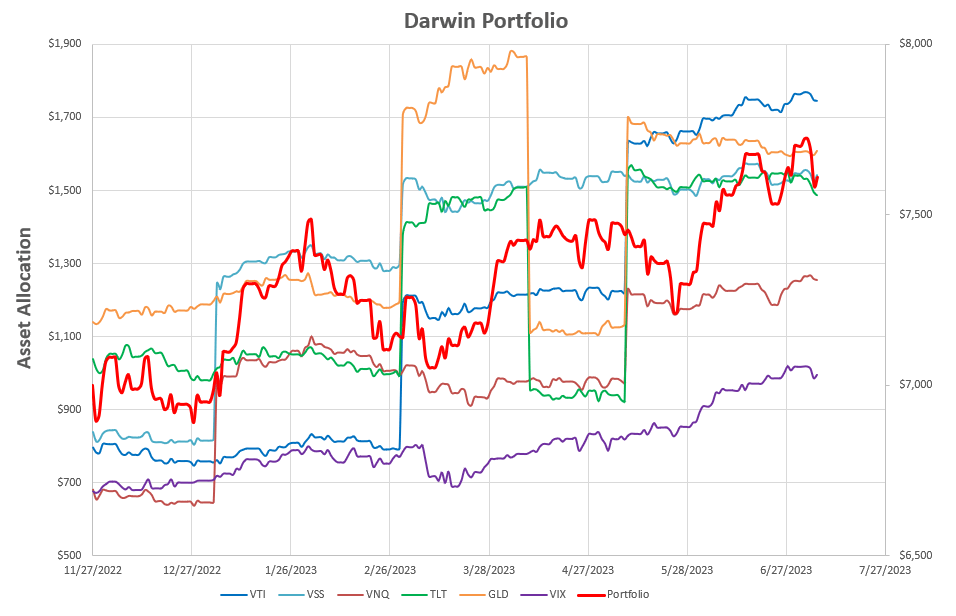

Performance of the portfolio to date (since reducing volatility targets to 3% in November 2022) looks like this:

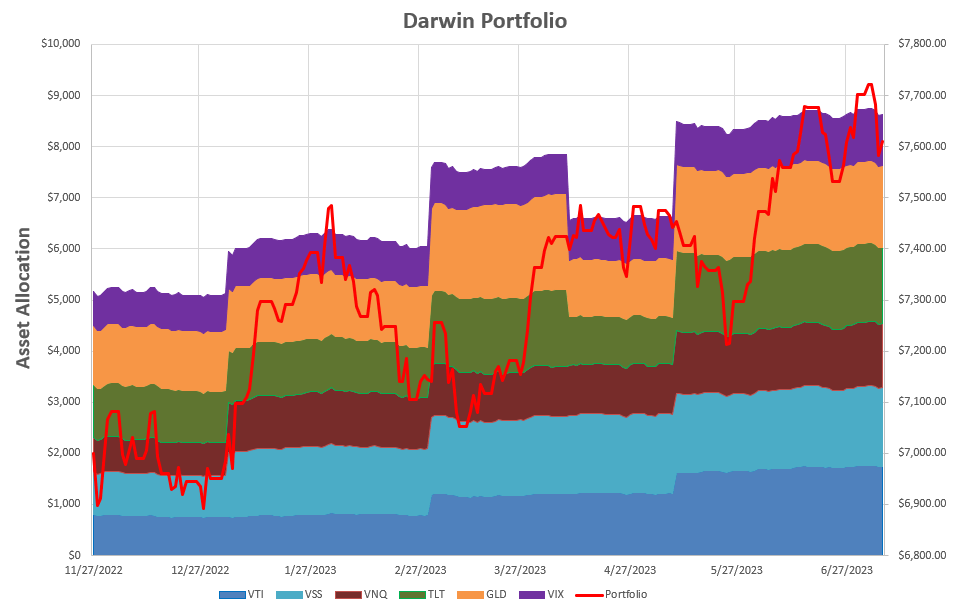

or, in “stacked” format:

or, in “stacked” format:

Discontinuities in the above figures correspond to allocation adjustments to the various holdings with the red line representing the net equity performance.

Discontinuities in the above figures correspond to allocation adjustments to the various holdings with the red line representing the net equity performance.

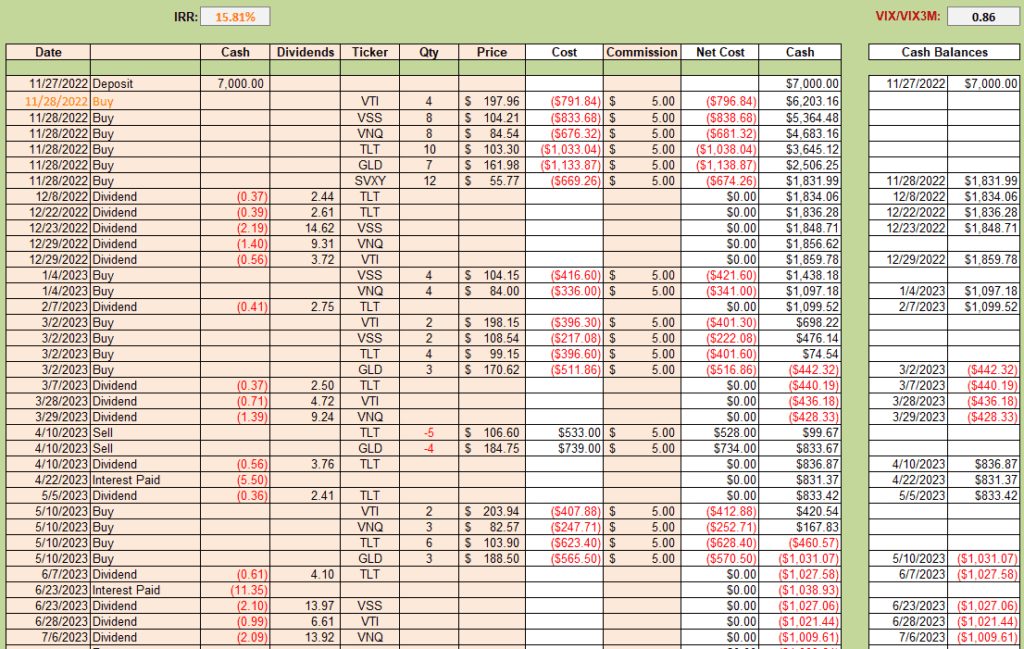

In terms of quantitative numbers, as the figure below shows, annualized Internal Rate of Return (IRR) over this period is ~ 15.8%

As I’ve mentioned in previous reviews, one of the key observations from the above figures is the contribution that has come from the volatility (SVXY) holdings (purple lines/areas) despite the fact that this only started out as a 10% allocation ($670).

As I’ve mentioned in previous reviews, one of the key observations from the above figures is the contribution that has come from the volatility (SVXY) holdings (purple lines/areas) despite the fact that this only started out as a 10% allocation ($670).

We’ll leave the portfolio to do it’s thing and check on it again next month.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.