Holiday Barge at Pitlochry, Loch Ness, Scotland

I opened the Dirac Portfolio in March 2024, as an “Income” portfolio, with the intent of populating it with CEFs using a mean reversion strategy based on 12-month Z-scores. However, with the markets being in a strong uptrend through 2024, no funds were satisfying the requiremnts that I had established. This means that I have lost out on significant gains this year because I have been too busy with other things to spend time to re-evaluate the “rules” for entry. I will have to find the time to do this as, when once the portfolio is populated, it essentially becomes a low maintenance “Buy-And-Hold” portfolio. With hindsight I should just have populated the portfolio and worried about weeding/adjustment later.

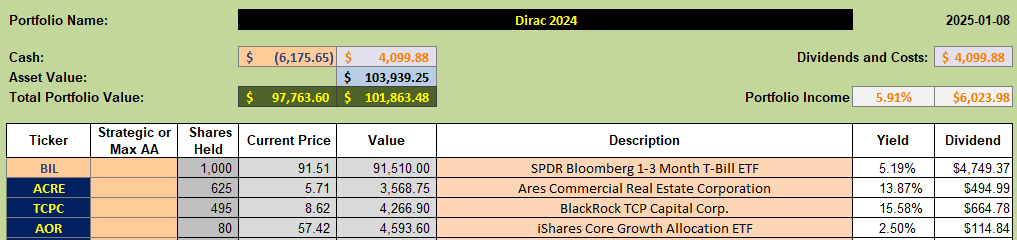

At present the portfolio is sitting 90% in Cash (T-Bills) with only 10% invested in active funds:

Of these, buying shares in AOR was a mistake in that these were supposed to be purchased in another account. However, I have left them in here as a “benchmark”.

Of these, buying shares in AOR was a mistake in that these were supposed to be purchased in another account. However, I have left them in here as a “benchmark”.

The other 2 funds, ACRE and TCPC are down ~26% and 16% respectively – not exactly great success stories – although these CEFs are paying 14% and 16% dividends respectively – so the net return is only mildly negative. With BIL yielding 5% returns the portfolio is still slightly ahead by ~2%. Obviously I need to pay more attention to this portfolio and the rules for management – that I hope to do over the next few weeks – but the intent is still to stay with an “income” portfolio – but with different entry rules from the Hawking Portfolio – although there will likely be some overlap.

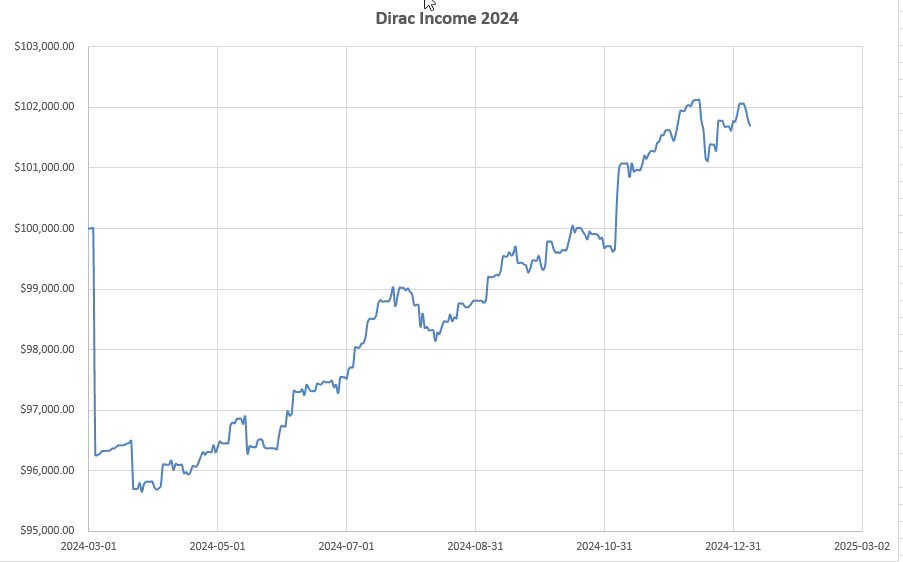

Performance of the portfolio (for what it’s worth) looks like this:

The drop at the beginning of the curve is a bit misleading but is due to the fact that the plot is based on pulling adjusted prices from the downloaded data and, since these are adjusted for dividend payments, the drop from the $100,000 initial value to ~$96,000 is indicative of dividends paid – the actual dividends paid to date is, in fact, $4099.88. The equity curve from the lows is indicative of volatilty – obviosly pretty low with only ~10% invested.

The drop at the beginning of the curve is a bit misleading but is due to the fact that the plot is based on pulling adjusted prices from the downloaded data and, since these are adjusted for dividend payments, the drop from the $100,000 initial value to ~$96,000 is indicative of dividends paid – the actual dividends paid to date is, in fact, $4099.88. The equity curve from the lows is indicative of volatilty – obviosly pretty low with only ~10% invested.

My database of possible candidates to hold is presently ~120 funds – and this needs to be updated. I plan to revisit this porfolio soon and to try to find a better filter for entry. But, it does show that oversold assets can remain oversold for longer than we would like – one reason why I have always been a little apprehensive when it comes to mean reversion strategies for intermediate term investment (at least a few months). Longer term mean reversion should be ok – but this may lead to acceptance of larger draw-downs. Lowell uses overbought indicators for exits from his BPI portfolios – but this can cut profits short – although he replaces more “focused” assets with broader-focused assets of the same type (equities) so, to a large extent, this should compensate.

Hopefully another update with more action coming shortly.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question