Orton Effect applied to Ponderosa Pine forest in Central Oregon

Before completing the review of the Franklin I checked to see if any sectors reached the oversold zone. Not one sector is in this condition so there are no Buy recommendations. The only remaining sector holding is Communications (VOX) as all other sector holdings managed to hit their Trailing Stop Loss Order (TSLO) strike price. The sale of sector ETFs leaves cash in the account and that is where other equity ETFs come into play. This is the weakness in the Sector BPI model that required a patch. Hence, the Sector BPI Plus investing model.

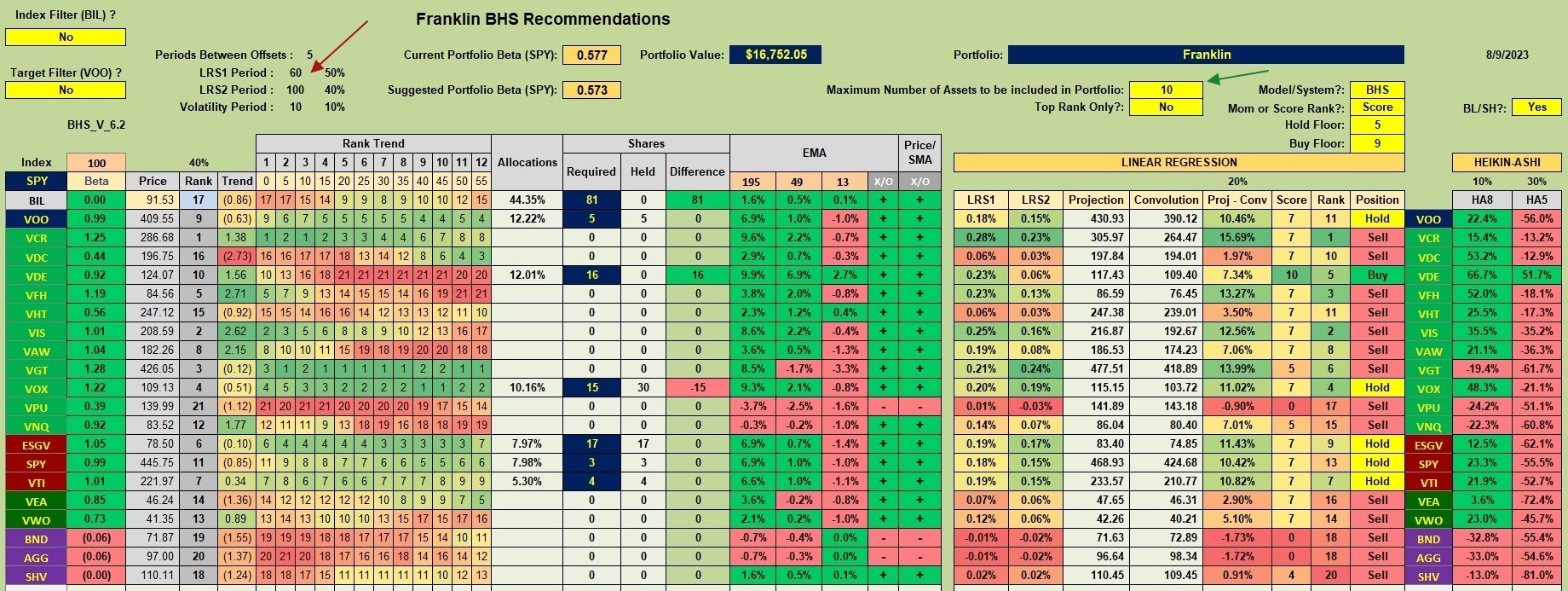

Franklin Security Recommendations

Using the BHS model combined with the “default look-back” periods (see red allow) there are no Buy recommendations outside the eleven sector ETFs. Check the fourth column from the right and you will see VOO, ESGV, SPY, and VTI are all recommending a Hold position. VEA down through SHV are all a Sell recommendation. When this is the case we look to BIL as the “off ramp” or where we go to invest remaining cash. See the second screenshot.

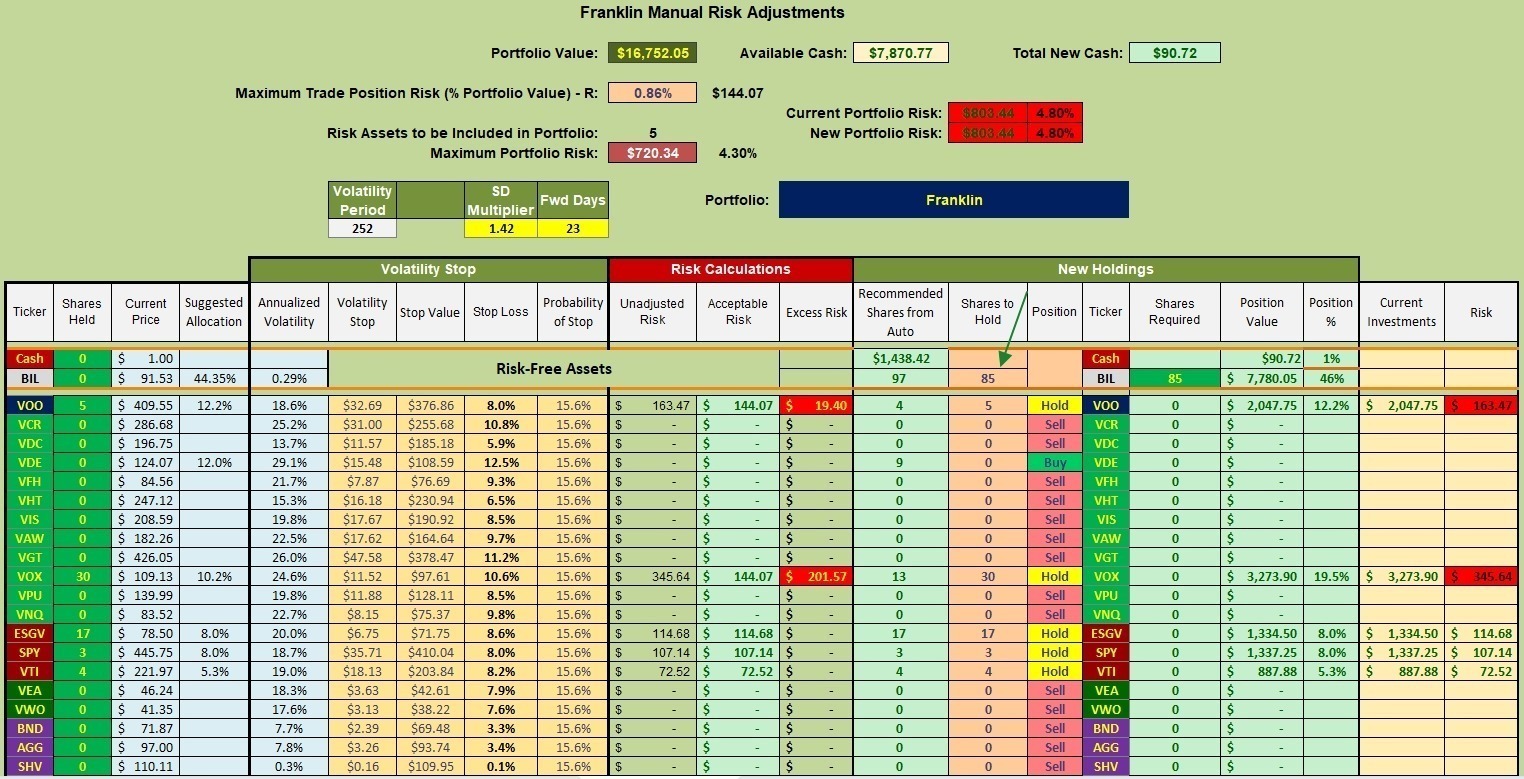

Franklin Manual Risk Adjustments

The $7,870.77 held in cash will be used to purchase as many shares of BIL as possible. I currently have several limit orders in place to purchase 85 shares of BIL. If those limit orders are not struck I’ll wait for one or more of the sectors ETFs to drop down into the oversold zone. This wait could last a few months.

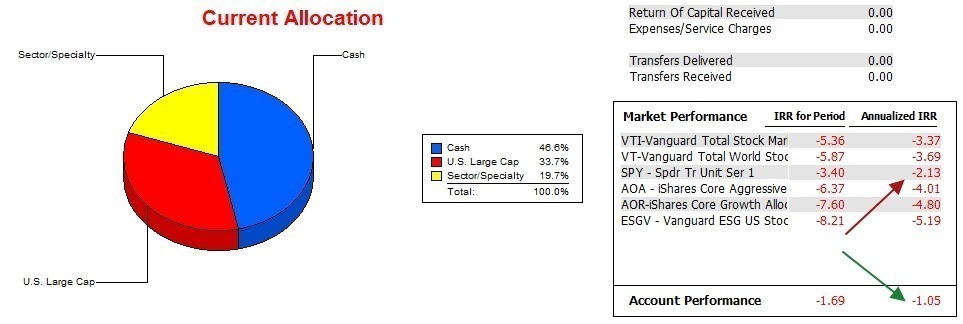

Franklin Performance Data

Over the past 18.3 months the Franklin is edging out the S&P 500 (SPY) when calculating the Internal Rate of Return percentages. The winning margin is even greater for the other five possible benchmarks. Thus far the Sector BPI Plus model is working as conceived.

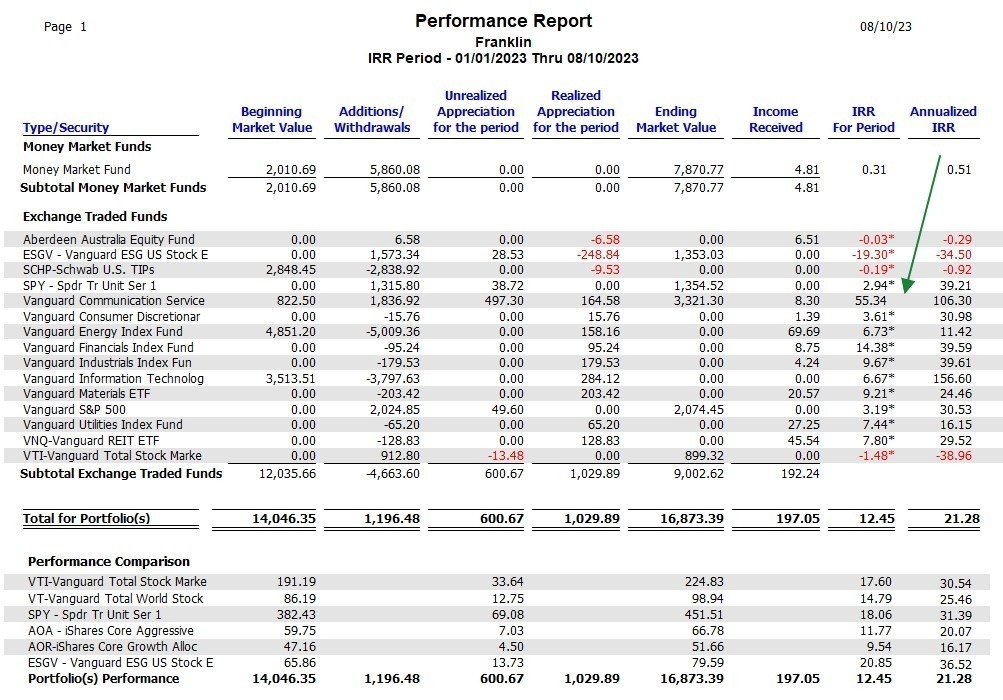

Franklin Sector Performance

I rarely post the following data. It is included here to show readers how the different sector ETFs have performed within the Franklin since the beginning of 2023. Only nine of the eleven sectors were involved in the Franklin and all show a profit. The Buy low Sell high BPI model is working so far.

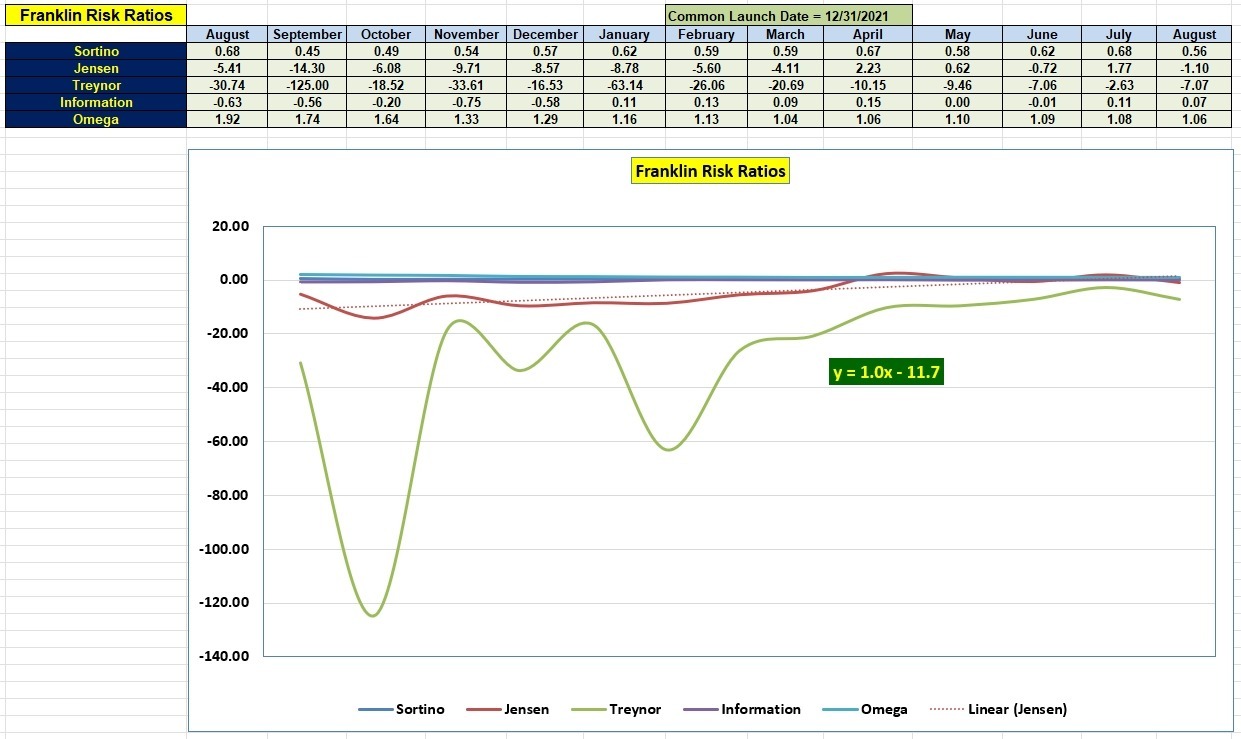

Franklin Risk Ratios

While most of the risk ratios are higher than they were a year ago, I see where the Jensen moved back into negative territory. Higher short-term interest rates for the risk-free short term treasure is placing downward pressure on the Jensen. Since this variable is part of the Jensen calculation we just need to deal with it.

The slope of the Jensen (1.0) is still positive and that is a plus as is the positive Information Ratio.

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.