Most likely a 1939 Desoto.

Sector BPI investing continues to be tested through the Franklin portfolio. Launched in early November of 2022 we now have 1.5 years of data with this portfolio. Few trades occurred over this period, but we recently sold Technology (VGT) and Utilities (VPU) as both sectors reached the overbought zone. This leaves the Franklin with over $6,000 and the decision as to what to do with this cash. We look to the Kipling spreadsheet for guidance. Follow along with this review.

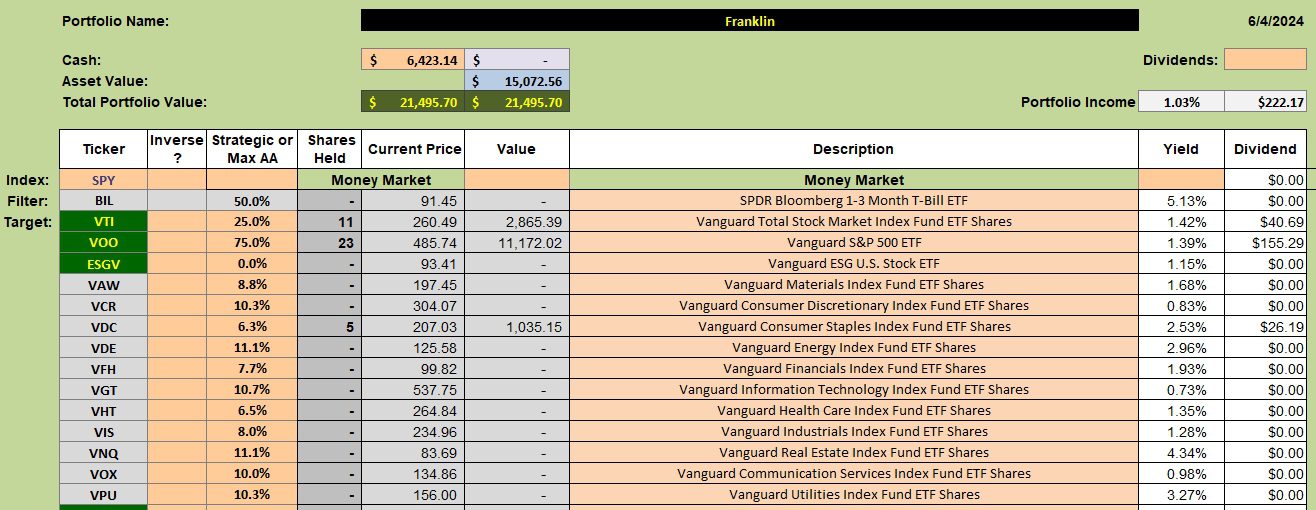

Franklin Investment Quiver and Current Holdings

After selling VGT and VPU the Franklin is down to one sector (VDC) and two U.S. Equity ETFs, VTI and VOO. When there are no oversold sectors available for investing we check to see if market conditions are recommending U.S. Equities. For this information we move down to the Manual Risk Adjustment worksheet which is embedded in or part of the Kipling spreadsheet.

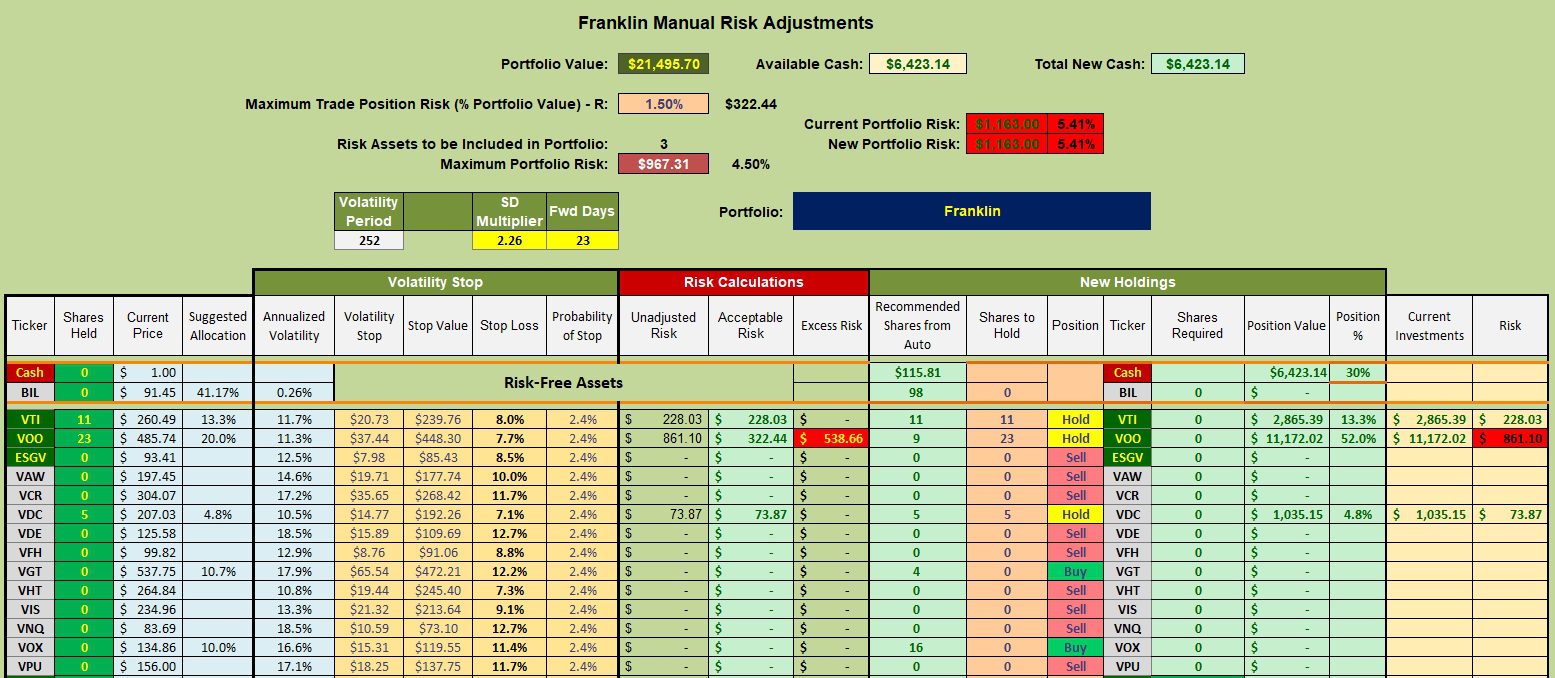

Franklin Manual Risk Adjustments

Note that both VTI and VOO are recommended as a Hold, not a Buy. What I’ve done with the $6,400 in cash is to place limit orders for these two equity ETFs at prices 3%, 5%, and 7% below yesterday’s closing price. In other words, I’m not in a big hurry to invest in the current market so I am not purchasing shares at the market price or as we say – at market.

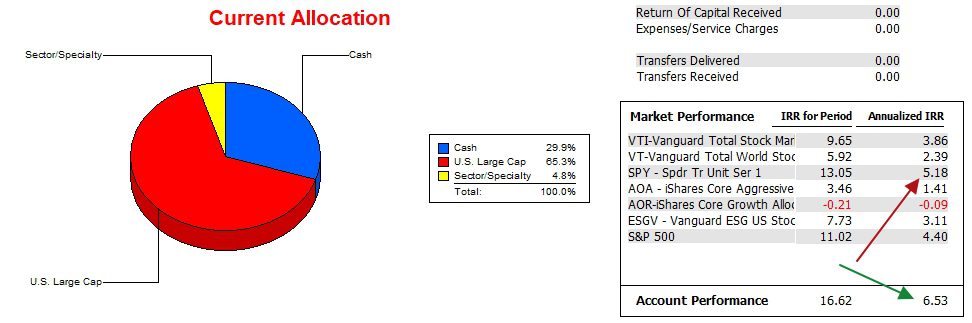

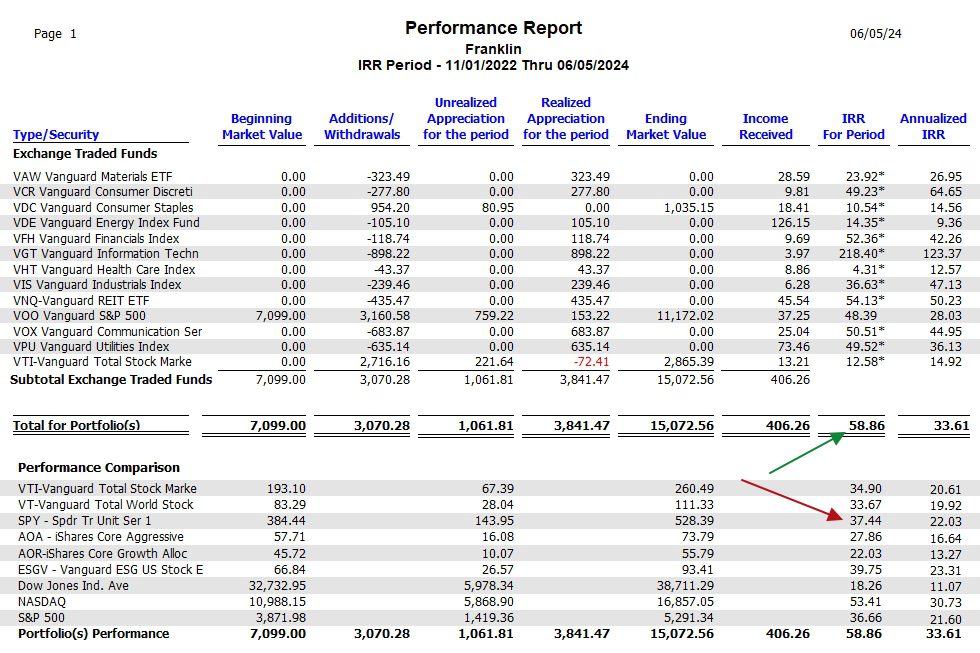

Franklin Performance Data

Since 12/31/2021 the Franklin is edging out the SPY benchmark. The advantage is not great, but it tops all other possible benchmarks.

To see how well the Franklin performed since the launch of the Sector BPI model we move to the last screenshot. Before that, check out the next table or the five risk ratios.

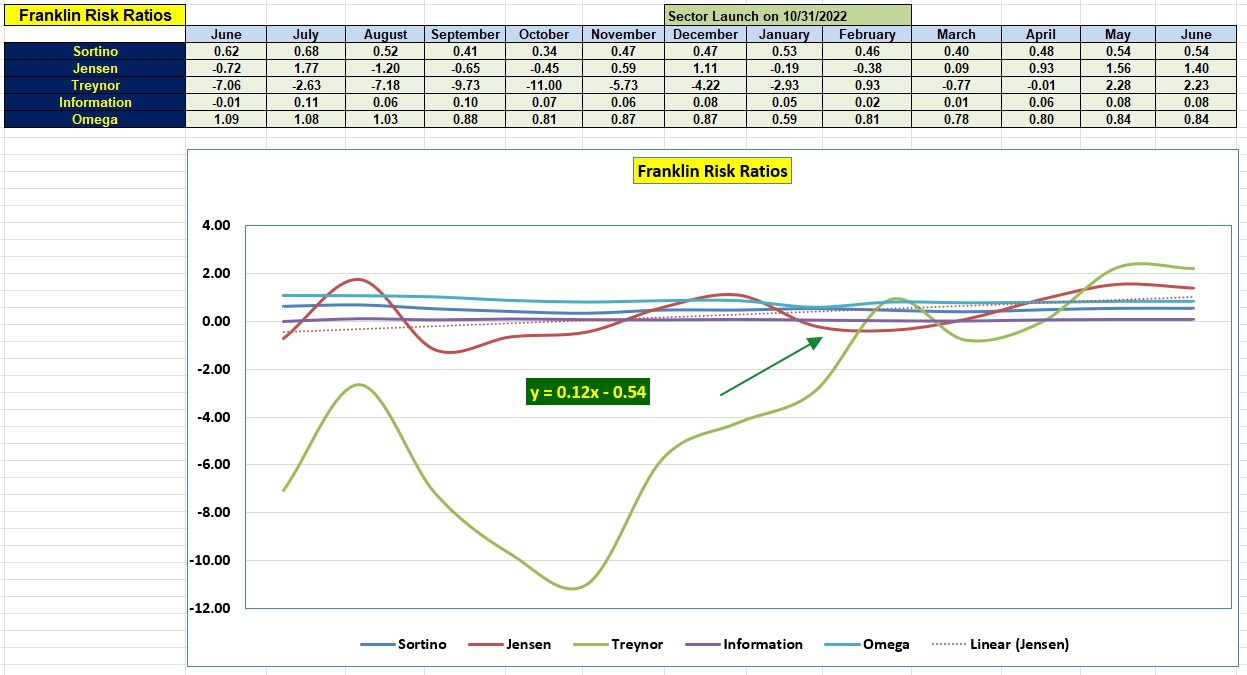

Franklin Risk Ratios

Based on the Jensen Performance Index, the Franklin has not been all that consistent over the past year. We see several negative months. The slope of the Jensen (0.12) is positive so that is a good sign the portfolio is moving in the right direction.

The Information Ratio comes in a close second to the Jensen in importance as a positive value indicates the Franklin is outperforming the SPY benchmark.

Franklin Sector Portfolio Report

Since launching the Sector BPI model the Internal Rate of Return (IRR) for the Franklin is crushing the SPY benchmark. Only the NASDAQ comes close to matching the portfolio performance.

VDC is the one sector ETF the Franklin has held for much of this period and we see where it has added little value to the portfolio. VGT is the big winner.

Based on this information the Sector BPI model continues to show promise.

Franklin Portfolio Review: 21 July 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question