Old Brewery Tavern

Gauss is one of the portfolios converted from the Sector BPI investing model over to a simplified Asset Allocation investing model. This will reduce workload as well as shift investments toward a more conservative asset allocation. As with the Millikan portfolio, update posted yesterday, the Gauss is moving toward a very low beta value. There is simply too much unrest and chaos going on in Washington to place too much trust in U.S. Equities. For that reason the Gauss will eventually hold 40% of the portfolio in bonds and treasuries. Bonds are anything but my favorite investment, particularly during a period when interest rates may increase. However, they do reduce portfolio volatility and that is a primary shift over to this simplified asset allocation model.

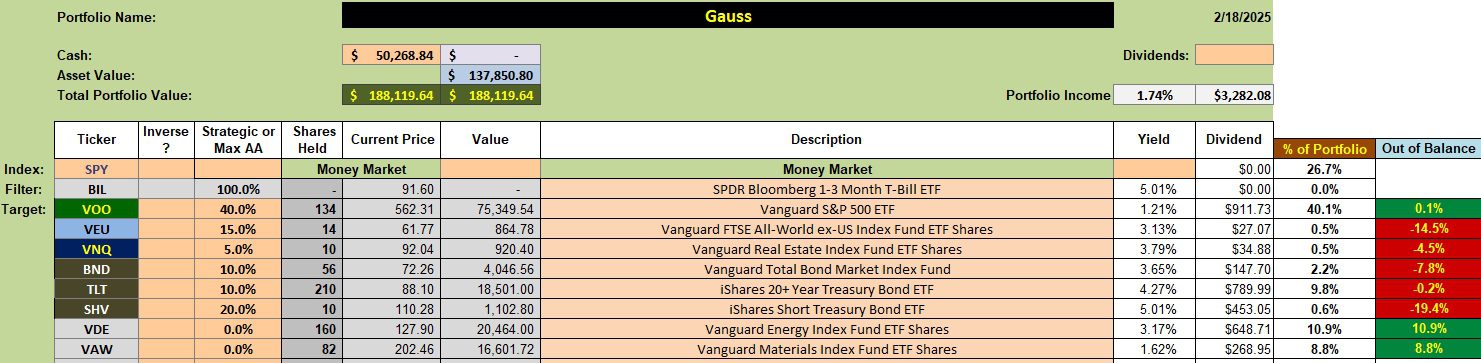

Gauss Asset Allocation Portfolio

I plan to continue to hold Energy and Materials sectors until they move into the overbought zone. Until VDE and VAW are sold the Gauss will not be in balance. International Equities (VEU) and Short-Term Treasuries (SHV) are the two asset classes most out of balance. Should new cash be added I will rebuild SHV as soon as possible. Monthly dividends will also aid in moving SHV and VEU toward their target percentages.

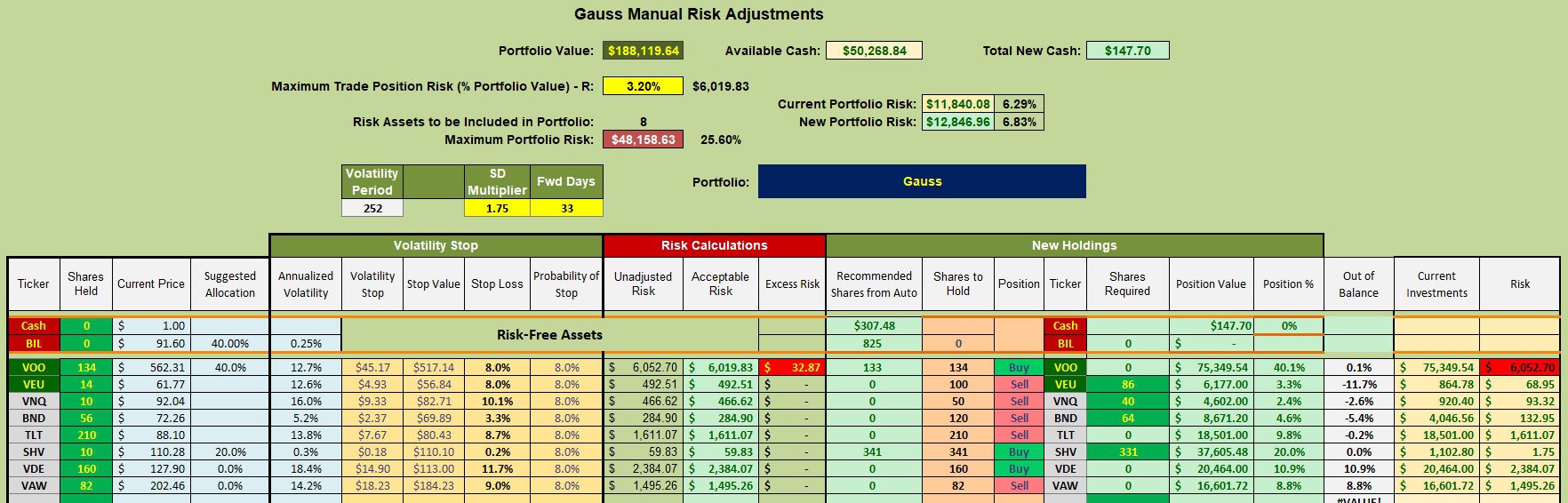

Gauss Rebalancing Recommendations

The 6th column from the right (screenshot below) shows the number of shares on order to bring the various asset classes into balance. When in balance the beta of Gauss will reside somewhere below 0.4 so Gauss is a very conservative portfolio.

Since I am waiting on VDE and VAW sectors to move into the overbought zone it will likely be months before the Gauss is in balance. Patience is required at this time.

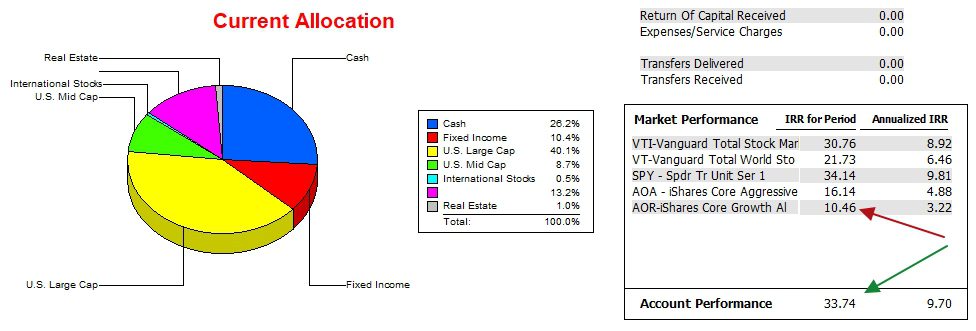

Gauss Performance Data

Since 12/31/2021 the Gauss has outperformed all the tracked benchmarks with exception of the S&P 500 (SPY). As stated many times, it is very difficult to consistently outperform the broad U.S. Equities market.

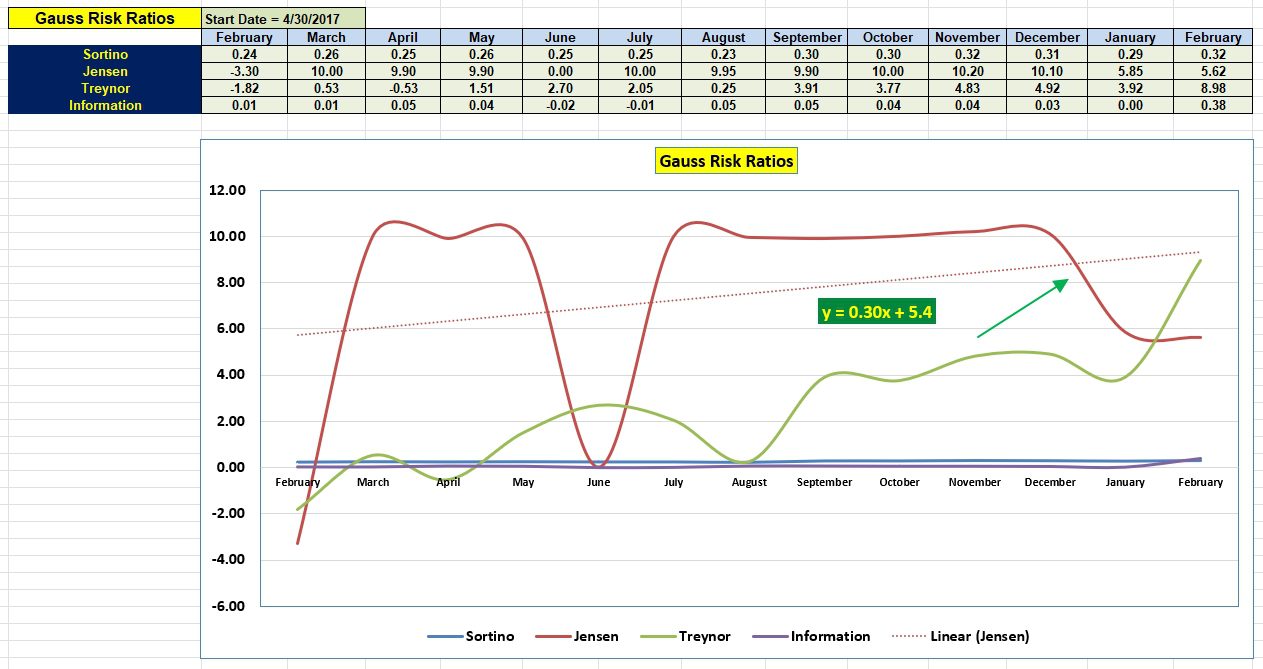

Gauss Risk Ratios

How is the Gauss performing when risk enters the equation? For this information we look to the four risk ratios below.

- The Sortino Ratio lets us know if the value of the portfolio is increasing. It is and that is positive news.

- The Jensen Performance Index (frequently known as Jensen Alpha) is well off its high value, but significantly above where it was a year ago. As the beta of the portfolio is lowered the Jensen Alpha will rise. We are also dependent on risk-free interest rates as this is one of four metrics involved in the Jensen calculation.

- Note the jump in the Treynor Ratio. Increasing shares in SHV lowered the portfolio beta and this caused the Treynor spike up.

- The Information Ratio provides a quick glimpse as to how well the portfolio is performing compared to the AOR benchmark. We see improvement.

Comments and Questions are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question