Cutsforth Market Produce

Gauss is not scheduled for a review until later this month, but since I am shifting this account from a Sector BPI investing model over to a simplified Asset Allocation investing model, I need to get started on the rebalancing process. The following analysis will walk readers through this process of conversion.

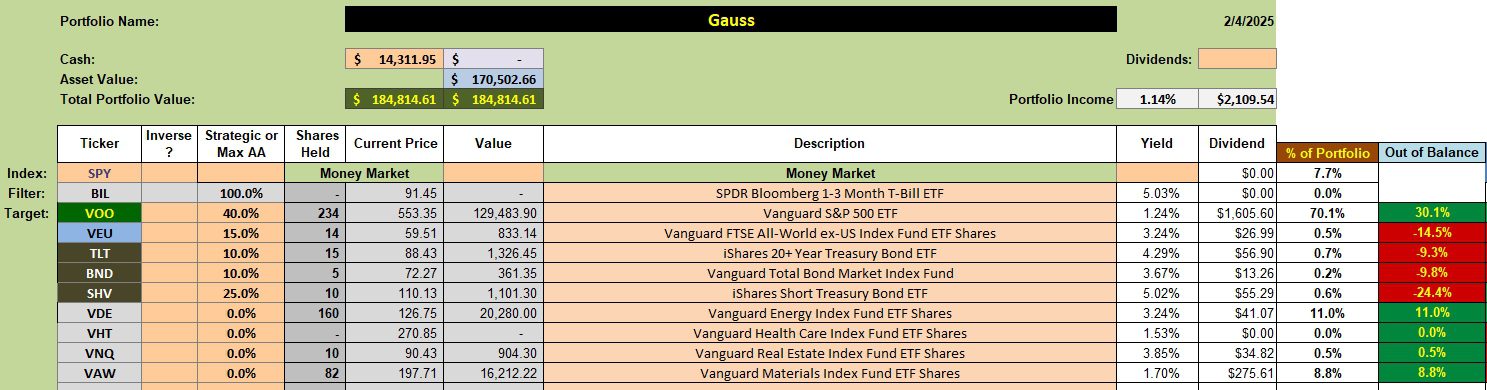

Gauss Asset Allocation Portfolio

The goal is to eventually narrow the Gauss down to a maximum of five asset classes represented by VOO, VEU, TLT, BND, and SHV. This ends up with a 55% stock to 45% bond equivalent ratio. This is a rather conservative approach, at least in my view. When the Gauss is completely rebalanced the beta should range around 0.5 to 0.6. What this means is that the portfolio will move a half step behind the S&P 500.

Coming from the Sector BPI investing model, the Gauss still holds shares of Energy (VDE), Real Estate (VNQ), and Materials (VAW). These three sector ETFs will remain in the portfolio until the sector climbs into the overbought zone (70% or higher on the bullish PnF scale) at which time 3% TSLOs will be placed under the ETFs.

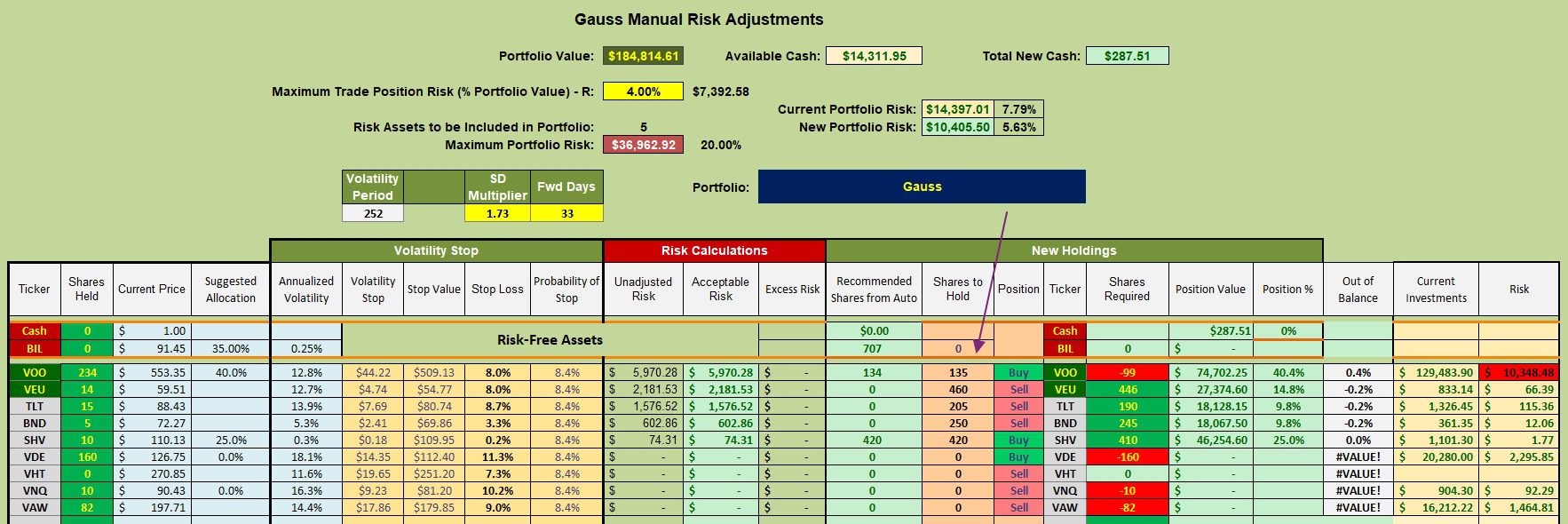

Gauss Rebalancing Recommendations

The purple arrow points to the rebalancing efforts in place for the Gauss. Until the three sector ETFs are sold the portfolio will not achieve balance. Shares of VOO also need to be sold to bring U.S. Equities back into balance.

A number of limit orders are in place to use up the $14,000 currently in cash. Several limit orders are in to purchase shares of SHV.

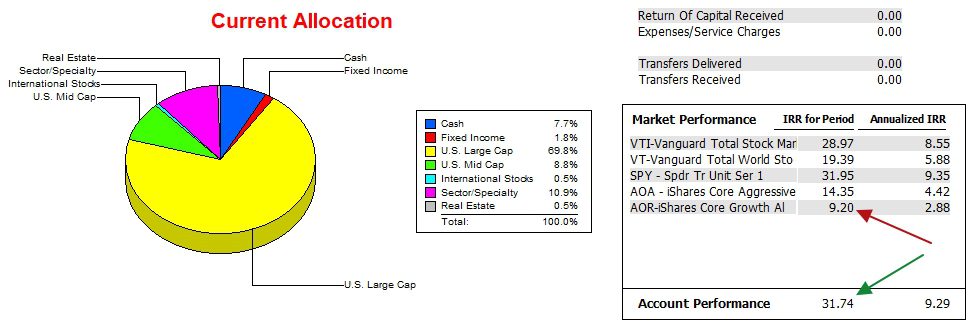

Gauss Performance Data

Since 12/31/2021 the Gauss is either in a race with SPY or winning by several percentage points. Now that Gauss is an asset allocation portfolio the benchmark is AOR.

Over the next few months the pie chart will change dramatically as the new allocations move toward the target percentages.

Gauss Risk Ratios

The following data table will not be all that useful until several months pass. We need much more data to see how the new asset allocation works. SHV is the asset class most in need of more shares. This short-term treasury is currently yielding 5% and those dividends will be reinvested in the portfolio.

There is an error in the June Jensen reading. That should read 10 instead of zero.

Before the end of February I will revisit this portfolio. I plan to “fast-track” the rebalancing process. With the U.S. government in complete chaos we don’t know how long the stock market will tolerate this behavior. That is one reason for increasing the percentage in lower volatile securities such as BND and SHV.

If one is completely wary of this market, then consider moving more assets into SHV or a similar secure investment. Tone down equity holdings. Consider this to be what I am doing rather than investment advice. I prefer not to give advice, but rather carefully lay out what I am doing with the portfolios I watch over.

Once the portfolio is in balance, the Gauss will become a passively managed portfolio. What that means is that any new investments and dividends will be used to bolster asset classes below target in an effort to bring each of the five asset classes into balance. The Gauss will become a tax efficient portfolio.

Lowell

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Gauss and Millikan are two portfolio I moved from the Sector BPI investing model over to a simplified asset allocation model. This change will reduce my work load and is OK with the owners.

Lowell

Lowell,

Both BIV and SHV are short-term bond etfs, with less than a quarter of a year in duration? Since you already have BIV, why not replace SHV with a 1-3 year bond etf, such as SHY (iShares 1-3 year treasury bond etf)?

~jim

I am not investing in BIV and SHV has a higher yield than SHY.

Lowell