Cannery Pier Hotel – Astoria, Oregon.

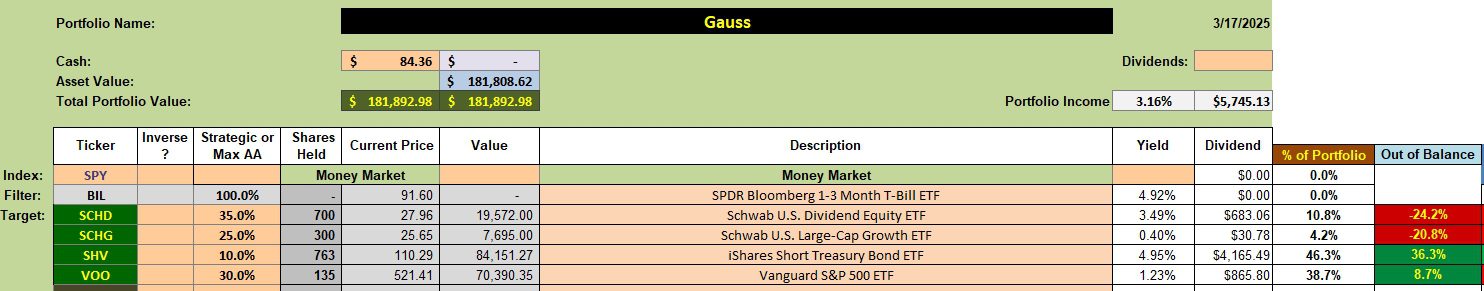

Gauss is another simplified asset allocation portfolio. The goal is to concentrate on three asset classes with a fourth (SHV) used to house cash. The portfolio is very cost effective as the expense ratios are very low.

- A broad market ETF where VOO fits the bill. Expense ratio is 3 basis points.

- A growth ETF designed to add an extra boost when experiencing a bull market. SCHG is the ETF of choice. Expense ratio is 4 basis points.

- A dividend producing ETF to balance the growth ETF. SCHD is the ETF of choice. Expense ratio is 6 basis points.

Cash is held either in a money market or SHV (expense ratio is 15 basis points). To increase the dividend I plan to hold most of the excess cash in SHV.

Gauss Asset Allocation Simplified

The current holdings in the Gauss portfolio are listed below. Only SHV is recommended as a Buy and there is very little cash available. Therefore the Gauss will remain much the same until the April review. First quarter dividends should provide a little cash in case either VOO, SCHG or SCHD move into the Buy zone.

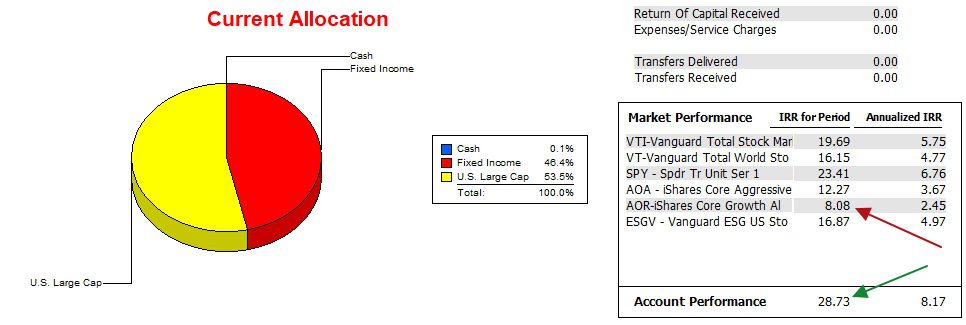

Gauss Performance Data

Since 12/31/2021 the Gauss has performed quite well as the IRR for Period exceeds the AOR benchmark by a wide margin as well as topping all other potential benchmarks.

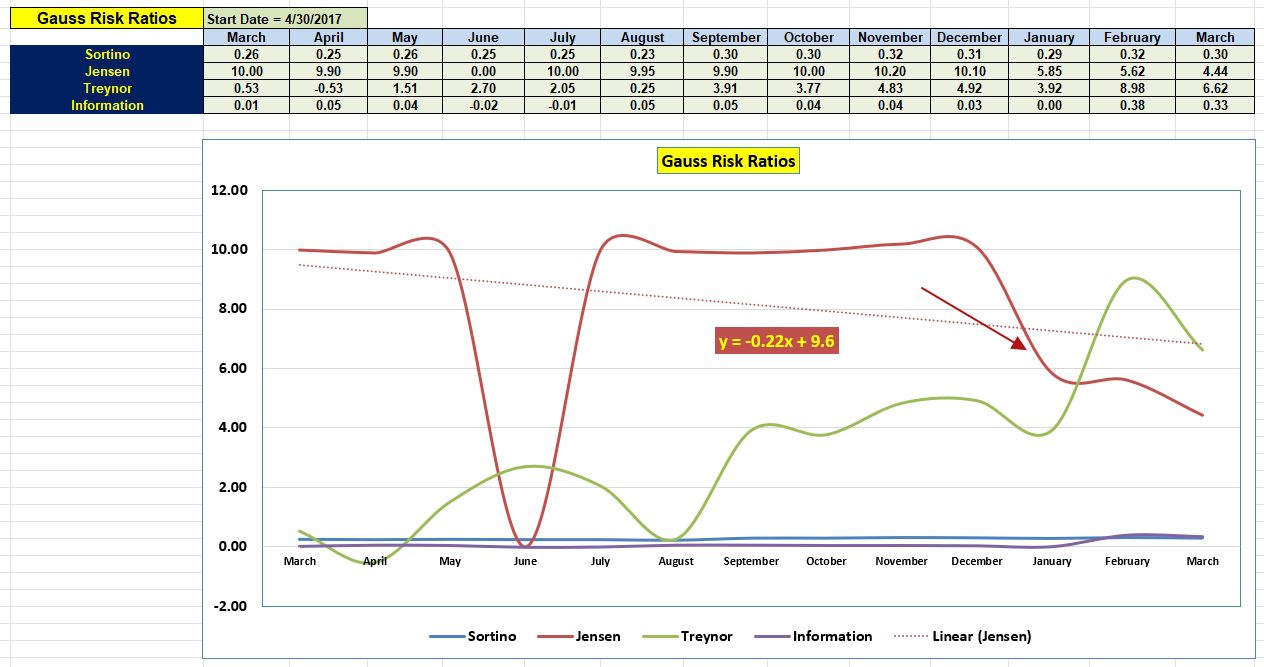

Gauss Risk Ratios

The picture is not quite as rosy when risk enters the equation. The slope of the Jensen Alpha is negative and it dropped during the first half of March.

The good news is that the Information Ratio is much stronger these last two months. We now need to watch the Jensen behavior over the next several quarters to see how the new asset allocation performs.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question