Bali, Indonesia

The Hawking Portfolio is a “Buy-and Hold” Income generating portfolio built using Closed End Funds (CEFs) with high distributions. Usually, the only action required is to re-invest the dividends received so as to promote geometric growth.

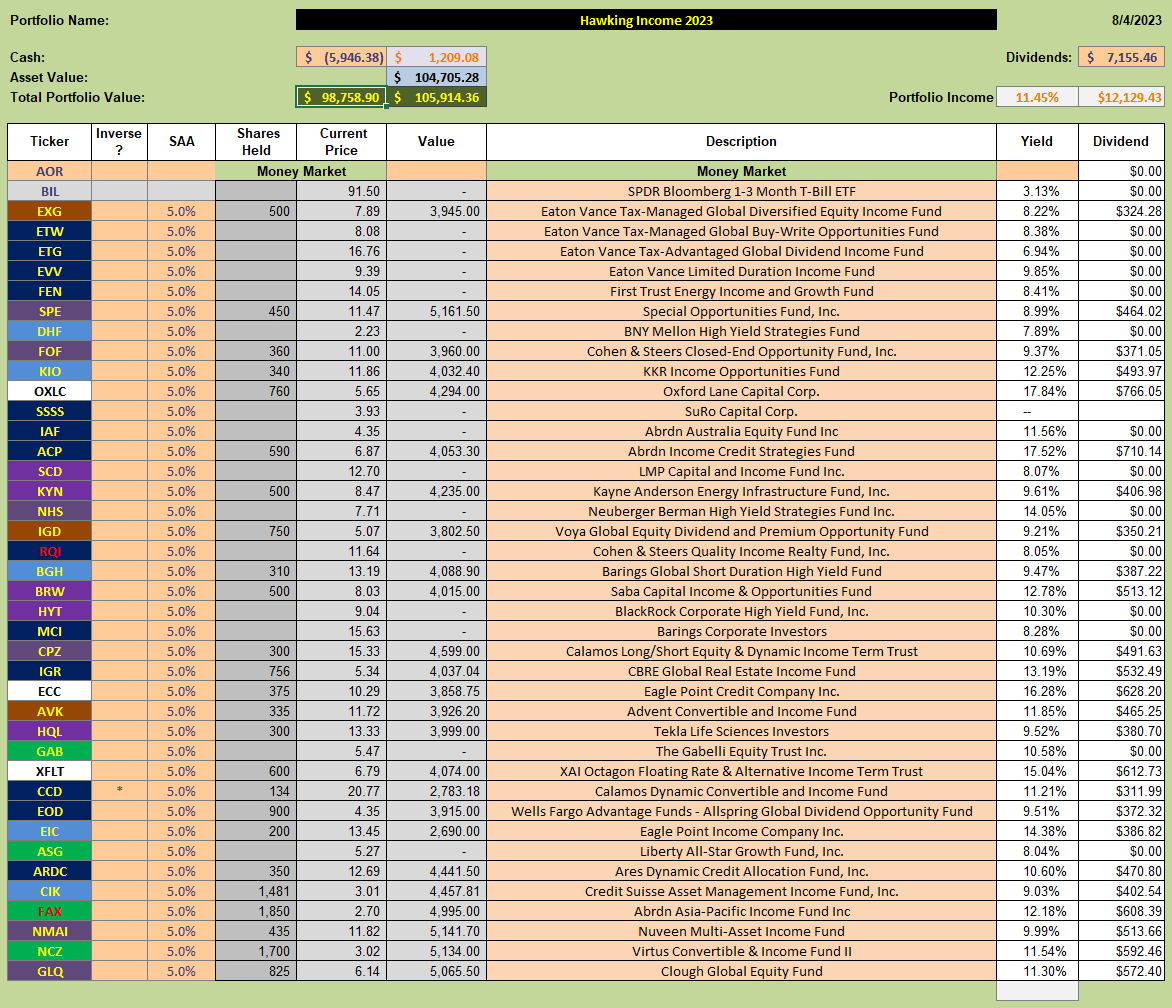

Current Holdings look like this:

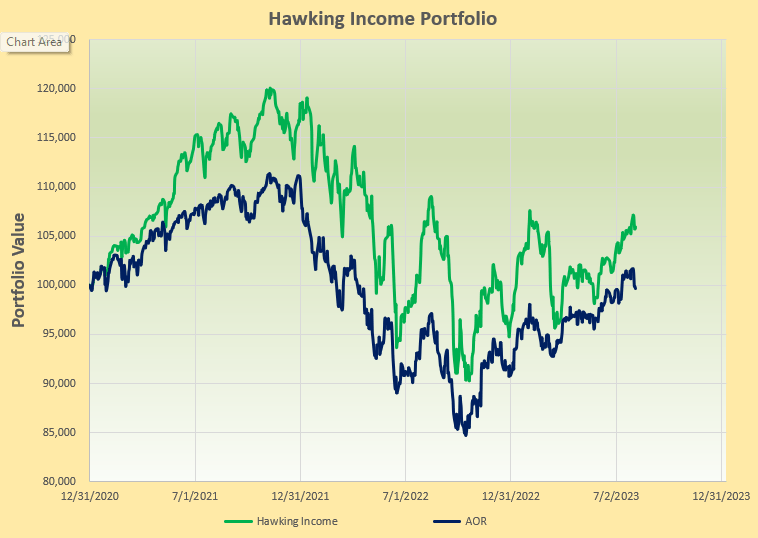

with performance like this:

with performance like this:

Over this ~30 month period, the Hawking Portfolio has outperformed the benchmark AOR fund by ~6% thanks to the consistent high dividends.

Over this ~30 month period, the Hawking Portfolio has outperformed the benchmark AOR fund by ~6% thanks to the consistent high dividends.

At present I have ~$1,200 from this months “income” to reinvest – I will be adding additional shares in KYN and CPZ.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

What criteria is used for selecting which funds to reinvest dividends?

Thanks,

Bill

Bill,

The Hawking portfolio is managed by Hedgehunter so he may have a different response.

When I’m selecting Closed-End-Funds (CEFs) I look for securities that are yielding dividends of 8% or higher and are currently priced below their Net Asset Value (NAV). Not a deal breaker, but I prefer leverage below 25%.

Lowell

Thank you

Bill,

For this Hawking Portfolio I use a very simple crude table as shown in the link below. It justs identifies the yield and discount and uses (yield – discount) to rank. The performance shown in the post has been the result. Since I don’t want a lot of churning I don’t do a lot of rotation and rarely sell one fund to replace with another (even if it comes to the top of the list) – unless something really significant changes.

https://www.dropbox.com/s/6jar6lj192cgsfa/Hawking%202022-02-05_08-56-24.png?dl=0

David