Ready for some serious Fishing

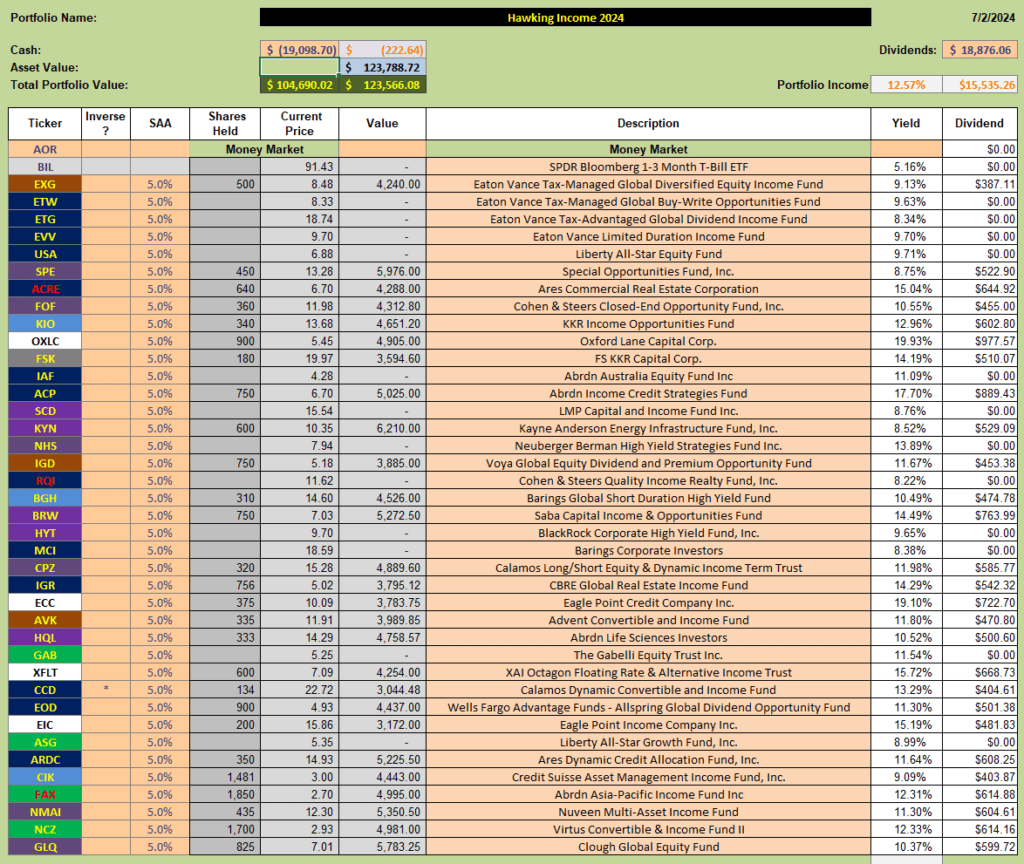

The Hawking Portfolio is a High Yield “Income” portfolio that requires only a modest amount of attention other than to re-invest dividends so as to generate geometric “growth”. Since the portfolio generates ~$1,000 per month and I had over $3,000 sitting in cash I have added additional shares to three holdings in the portfolio – OXLC, BRW and ACP. The composition of the portfolio now looks like this:

with a projected annual “income” return of a little over 12%.

with a projected annual “income” return of a little over 12%.

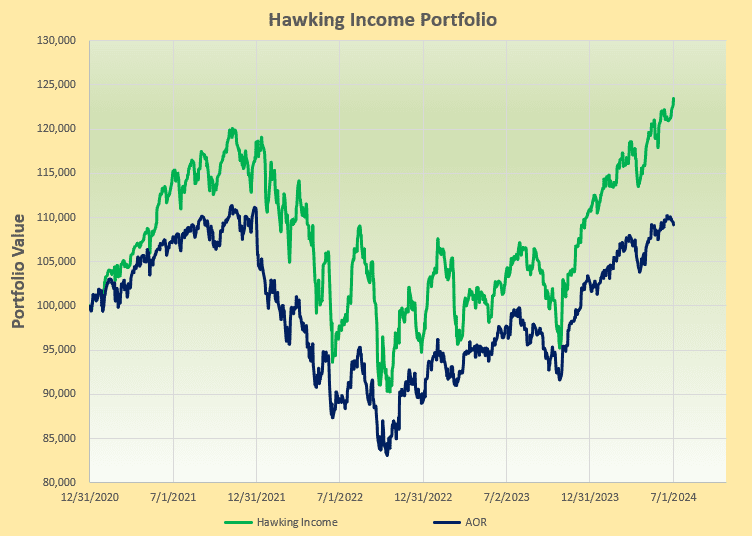

The impact of these high returns can be seen in the performance of the portfolio over the past 3.5 years (that includes the ~20% pullback/downtrend experienced through 2022):

where we can see that it is beating the performance of the benchmark AOR Fund by a healthy 14%. It should be mentioned however, that it is not ahead of the S&P 500 Index (SPY) over the same period. SPY is not used as the benchmark for the Hawking Portfolio since the construction of the portfolio is based on a requirement for diversification – that SPY does not represent.

where we can see that it is beating the performance of the benchmark AOR Fund by a healthy 14%. It should be mentioned however, that it is not ahead of the S&P 500 Index (SPY) over the same period. SPY is not used as the benchmark for the Hawking Portfolio since the construction of the portfolio is based on a requirement for diversification – that SPY does not represent.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Thanks for updating the Hawking post. Question: have you sold any of the CEFs over the last year? And if so, why? ~jim

Jim,

I don’t recall selling anything (one reason being that I was pre-occupied with moving from a house to a Condo) but I’ll have to go back through my statements to confirm – I can only get a 30-day look-back check on my trading platform. The nice thing about this portfolio is that I don’t have to worry about it too much other than to try to remember to re-invest the (healthy) dividends. The times when I will try to check on whether to sell is when I notice a rights offering – it is often better to sell before the offer closes and (maybe) buy back in after the issuance of new shares – but with a diversified portfolio of ~25 funds it isn’t too critical. I certainly don’t place stop loss orders on these funds – just try to check regularly that something extremely weird isn’t going on – especially when the activists (like Saba) get involved.

David,

Thanks for the reply. The reason for my question was in response to you anticipated purchase of ACP. I looked it up on Fidelity’s website and it had a premium/discount of +1.95 (1-month rolling average as of june 30, 2024).

~jim

Jim,

Yes, ACP has now moved to a premium – at the time I did my analysis CEFConnect was showing a 2.96% discount (see attached link). There was also a bullish trendline of higher lows (also a bearish trendline of lower highs – pendant pattern) – second image in link. Since this was an addition to an existing underweighted position (and not a new position) and with a 17% yield I thought it might be a good buy – so far so good (see green arrow in chart for where I bought). Also, there is a planned merger with FSD that I felt should be beneficial.

https://www.dropbox.com/scl/fi/5xzfytzr7dtsda242dda9/ACP-2024-07-15_20-59-16.png?rlkey=t0u9yeml1zl872fqfrwqnxou1&dl=0

https://www.dropbox.com/scl/fi/4bdj0odevkods9s1l896p/ACP-2024-07-15_20-56-51.png?rlkey=71e1v0mi3i0fj8tyxvk9ud9zl&dl=0

David,

Thanks for the reply. ~jim