In an earlier post this morning I mentioned Huygens as a serious contender to be included as one of the investing models for the family portfolio. The Huygens, and several other portfolios I track here at ITA, were recently converted from other models to this very traditional Asset Allocation model. If wishing more information as to the advantages of this type of investing, read William J. Bernstein’s books.

Initially the goal for any of the AA model portfolios was to keep each asset within + or – 0.5% of the stated goal. I see where that is going to be nearly impossible due to the volatility changes among the different asset classes. I don’t want to be in the business of selling winners to raise cash to purchase more shares of those asset classes below target. What I intend to do is focus on equity ETFs that are most out of balance on the low end, while not completely neglecting bonds and treasury asset classes.

Huygens Asset Allocation

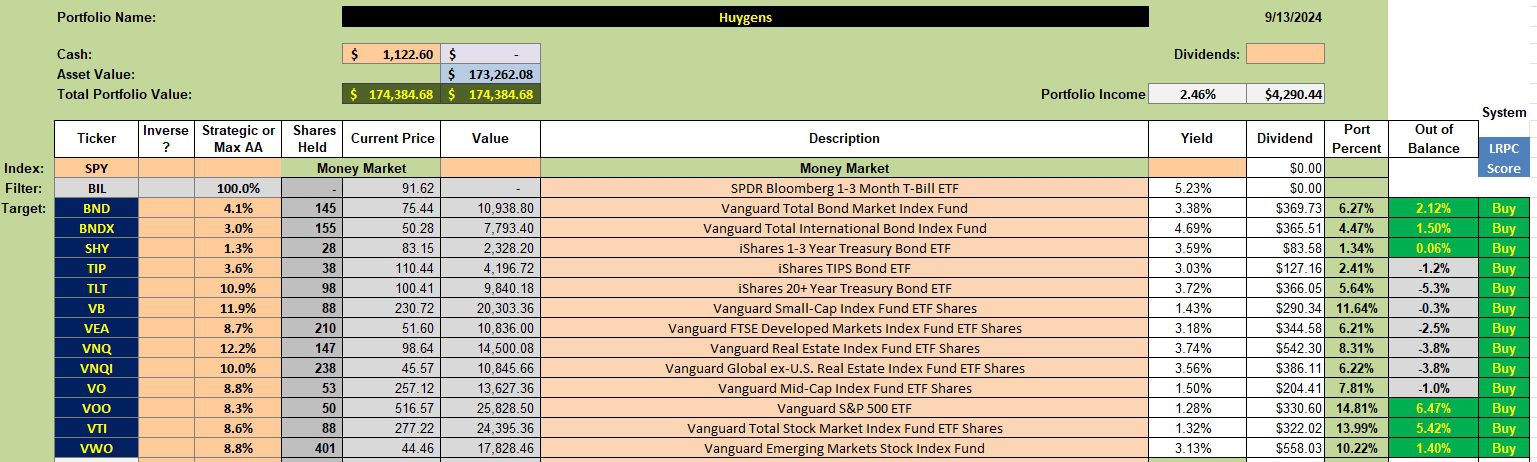

The following table lays out the different asset classes and the Exchange Traded Funds I’m using to fill those asset classes. For example, I use VNQ for the U.S. Real Estate asset class.

In the second column from the right readers can see how far an asset class is from being in balance. Currently TLT is most out of balance.

Once third quarter dividends are paid I will have a bit of cash to further bring the various asset classes into balance.

Huygens Rebalancing Activities

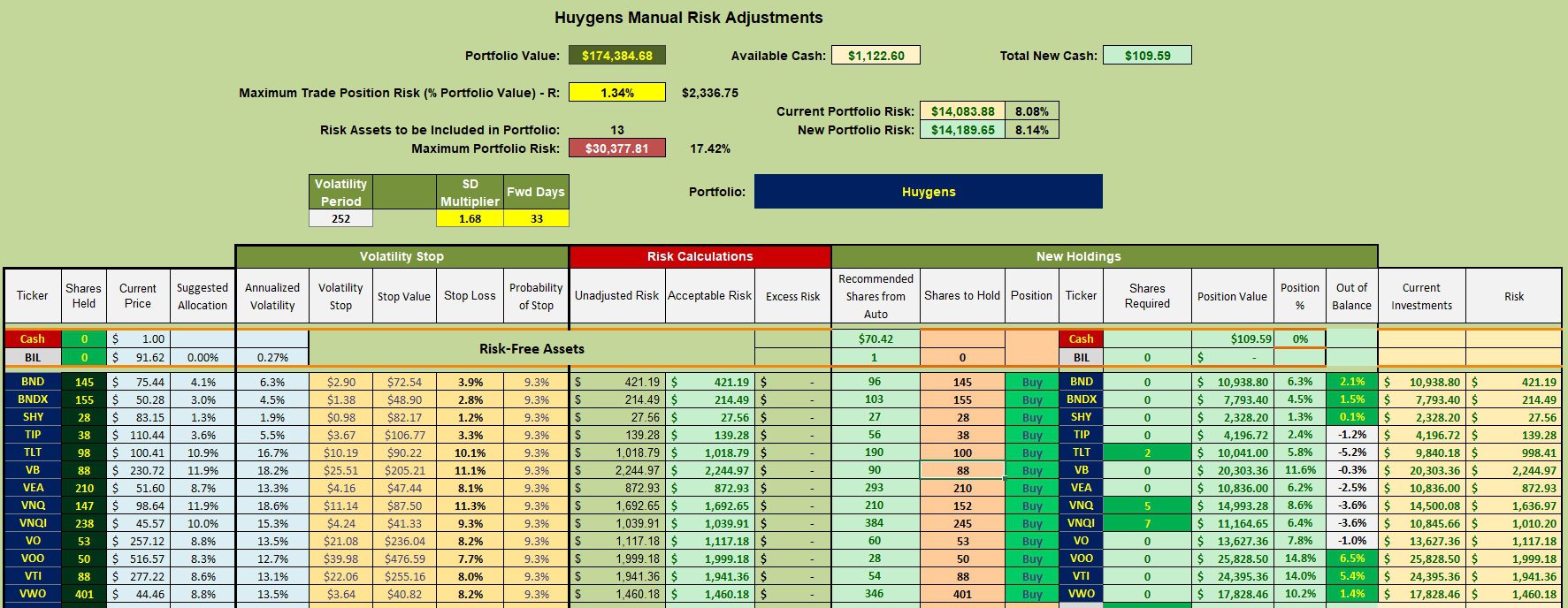

Cash is at a premium so limit orders are in place to pick up 2 shares of TLT, 5 shares of VNQ, and 7 shares of VNQI. While TLT lags the suggested allocation by 5.2%, I don’t want to totally neglect equities such as the two real estate asset classes.

Since the last review VOO performed very well and is now out of balance on the high end. I plan to let VOO run rather than selling shares to bring it back to balance.

Huygens Performance Data

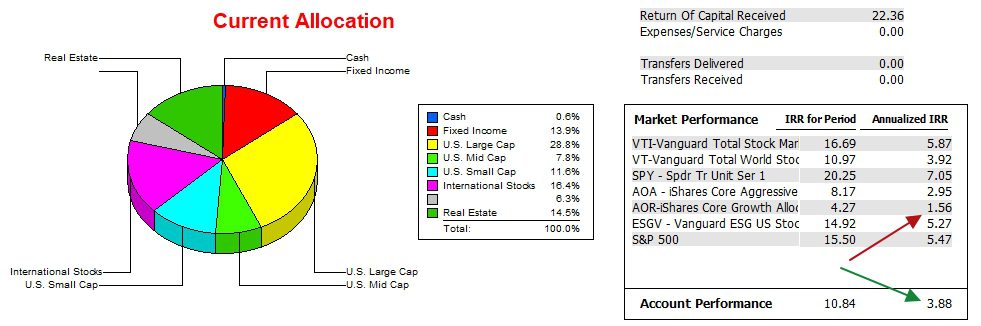

Since 12/31/2021 the Huygens is besting the AOR benchmark by more than double. Due to the broad diversification of Huygens, SPY is no longer an appropriate benchmark. Thus that switch from SPY to AOR.

Huygens Risk Ratios

Since the Huygens has only been operating under the AA model since last April, we need to see how well it is performing since that time. The risk ratio values look like they are trending in the right direction. It will be at least a year before we can draw useful conclusions.

The Argument for Self-Management

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

I really don’t know how VOO and other equities will respond to falling interest rates, but am comfortable believing that TLT will benefit, to the extent that the risk/reward is better for intermediate and long-term bond ETFs than for equities. Thoughts.

~jim

Jim,

I prefer to take the long view. We shall see, although I don’t have a TLT only style portfolio. The Copernicus is an equity only portfolio so that will provide a gauge on the equity side.

While I have not posted a portfolio report on any of the Asset Allocation portfolios, I can do that as that screenshot from the IAM portfolio identifies how well the different assets within a portfolio perform.

None of the Asset Allocation portfolios are up for review very soon, but I could insert one (Pauling) just to see how the different assets performed since last April or when the AA model was launched.

In general, I don’t expect treasuries or bonds to perform as well as equities such as VTI, VO, VB, or VOO.

Lowell

Lowell,

Thanks for the response. The genesis of my comment above are your comments above about TLT being out of balance on the short side and VOO being out of balance on the long side. I was just wondering if rebalancing wouldn’t be a better risk/reward play at this time.

~jim

JIm,

I need to do more work when it comes to rebalancing, particularly with specific portfolios. In the transition from one model to the Asset Allocation model, shares held in VTI and VOO are dominate. I am hesitant to sell and incur a taxable event. If I don’t sell shares of assets above the recommended percentage I need to wait for the owner to add new money or patiently wait for dividends to accumulate. Both will take time.

I’ll try to remember to include Portfolio Reporting which will show which asset classes are performing best. Thanks for the comments.

Lowell