Huygens is one of three portfolio operating under the Asset Allocation investing model. The other two are the Pauling and Schrodinger. The Schrodinger is slightly different in that computers are used to manage the allocations.

Only recently did I move the Huygens to the Asset Allocation model so we need to pay attention to growth rates over the next few months to see how well the model performs.

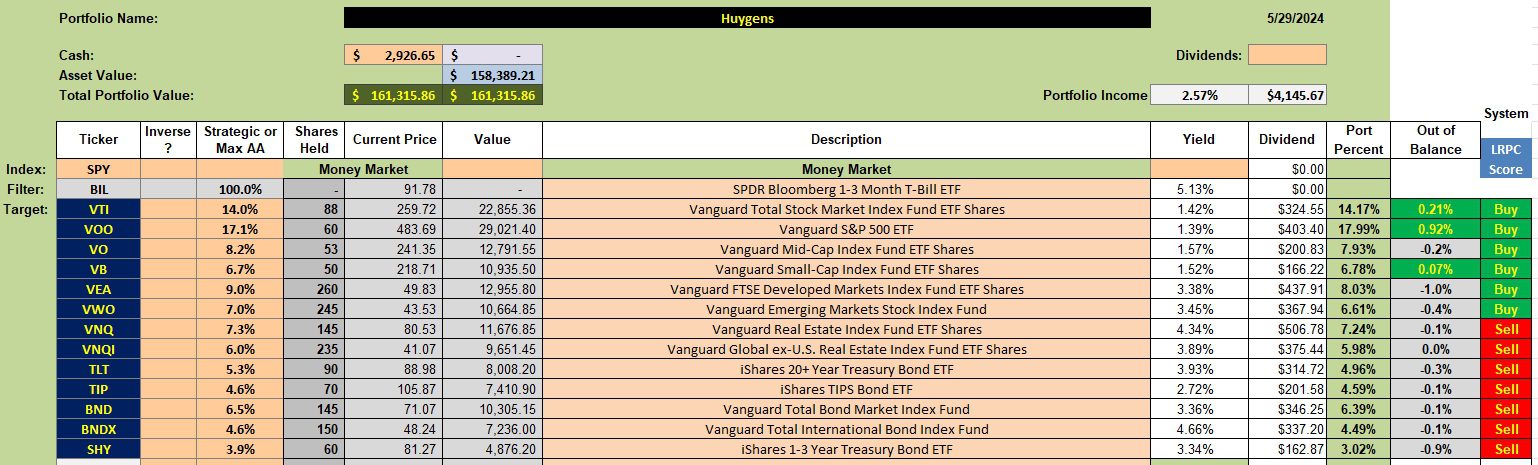

Huygens Asset Allocation Model

Below is the investment quiver and current holdings. The desired allocations are found in the third column from the left. In the second column from the right we see how close each ETF or asset is to being in balance. The goal is to keep all ETFs within +/- 0.5% of the Maximum Asset Allocation. VOO is currently is above the allocation goal while SHY is slightly below. VWO is just within the limits.

When dividends are declared, as we anticipate at the end of the second quarter, the available cash will be used to bring SHY up to the stated goal. In general, no sales will take place in the Huygens unless there is an emergency. When cash is available it will be used to bring the asset class (ETF) into balance. When SHY is in balance VWO is next in line for attention.

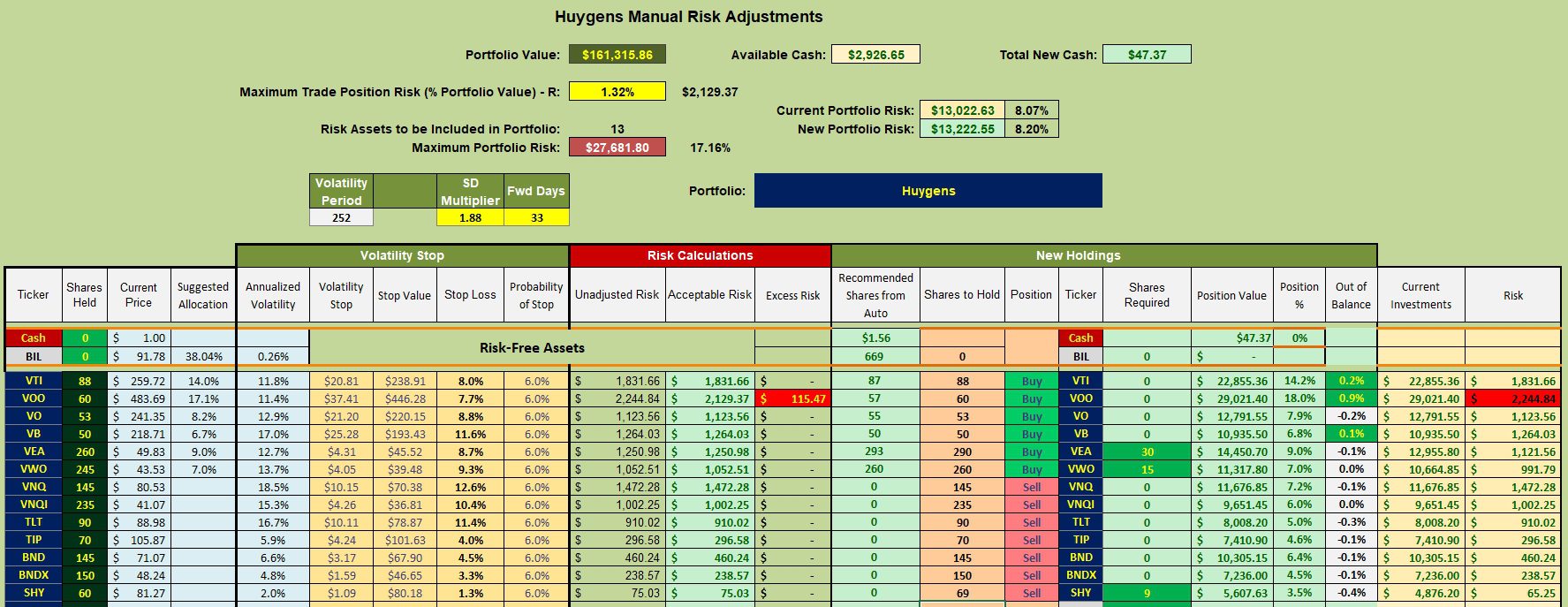

Huygens Manual Risk Adjustments

Limit orders are in place to add shares to VEA, VWO, and SHY. Overall, the Huygens is in good shape as we enter the summer months.

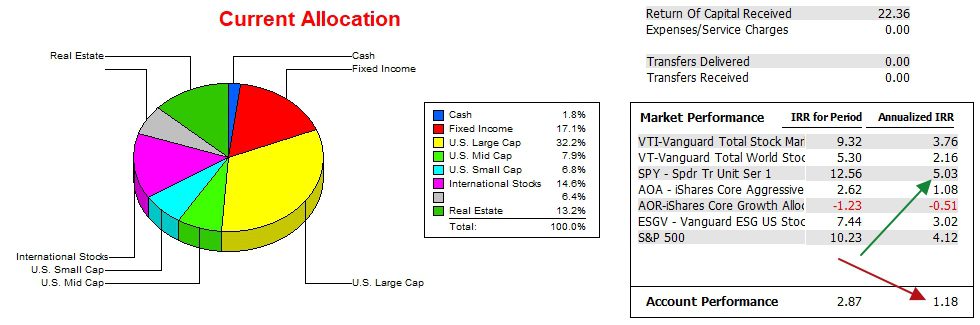

Huygens Performance Data

Since 12/31/2021 the Huygens lags the SPY benchmark, but it is above both AOA and AOR. VT is within striking distance.

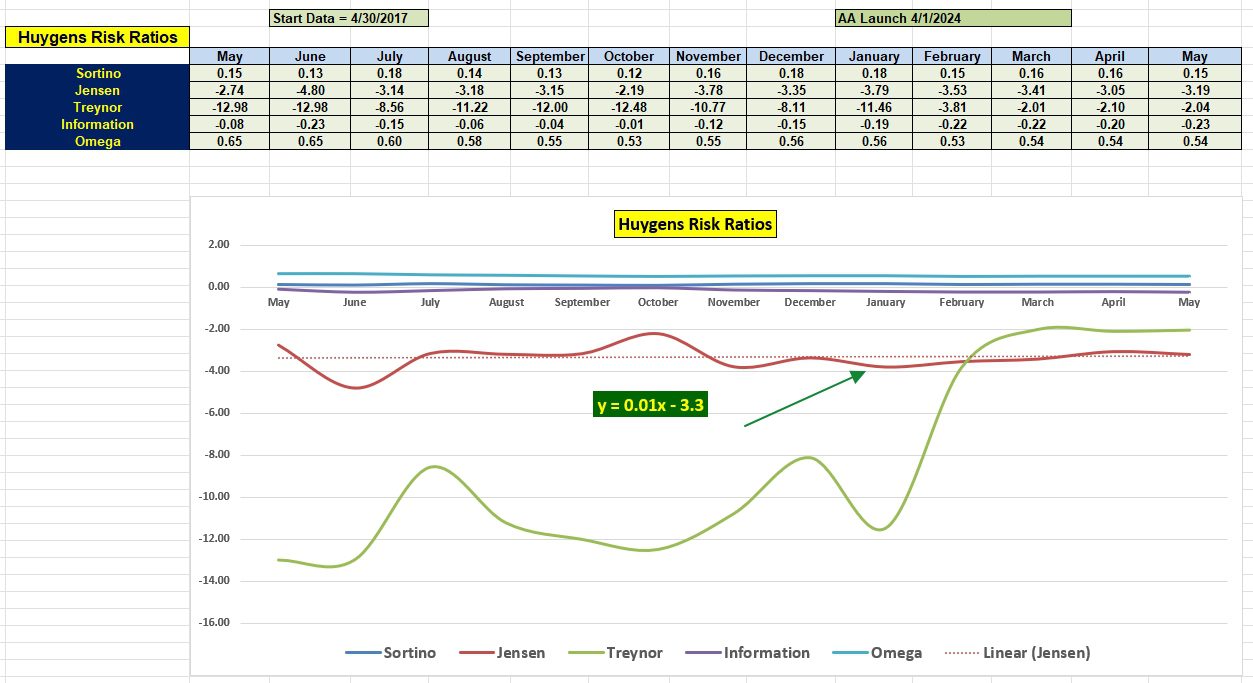

Huygens Risk Ratios

The immediate goal for the Huygens is to move the Jensen Performance Index into positive territory. That is also true for the Information Ratio. Holding 17% of the portfolio in Fixed Income will make it difficult for the Huygens to catch up to the S&P 500.

Tentative Asset Allocation Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question