Attractive Wall Art in Car Park, Christchurch, New Zealand.

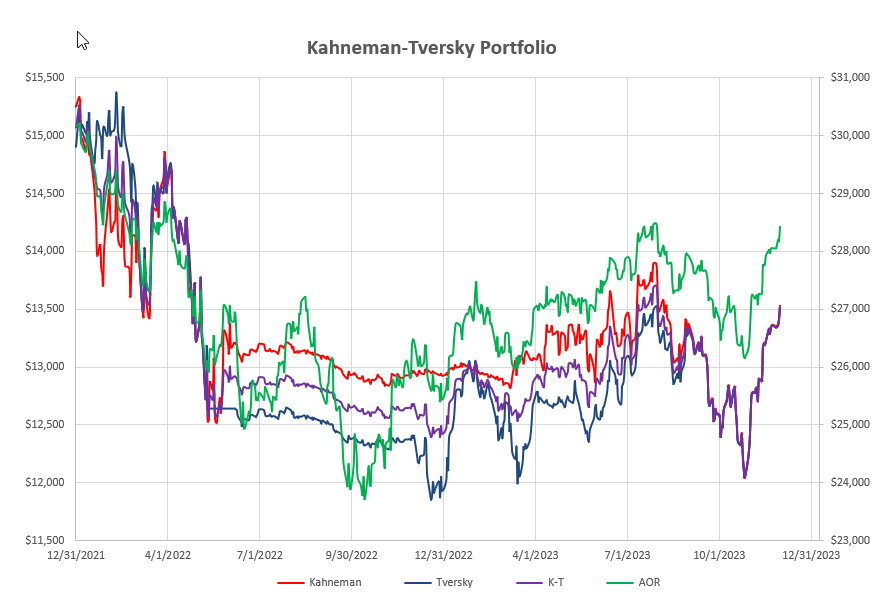

The Kahneman-Tversky (K-T) Portfolio is another simple portfolio that requires very little attention and few adjustments. No adjustments have been made in the past 3 months since the last review on this site. Performance to date looks like this:

where we can see that we were calm through the tumultuous July 2022 – April 2023 period but were a little slow in picking up the bounce from the 2022 decline.

where we can see that we were calm through the tumultuous July 2022 – April 2023 period but were a little slow in picking up the bounce from the 2022 decline.

The K-T portfolio is a variation on Gary Antonacci’s Dual Momentum approach and uses a slow-reacting (Kahneman) portion that uses Antonacci’s single 252-day (12 month) look-back period to measure momentum and a faster-reacting (Tversky) portion that uses a combination of 60- and 100-day lookbacks. Each portion comprises a quiver of only 3 assets in addition to the benchmark AOR fund and SHY (short-term Treasuries), the reference for positive absolute momentum. Only one ETF is selected in each portion.

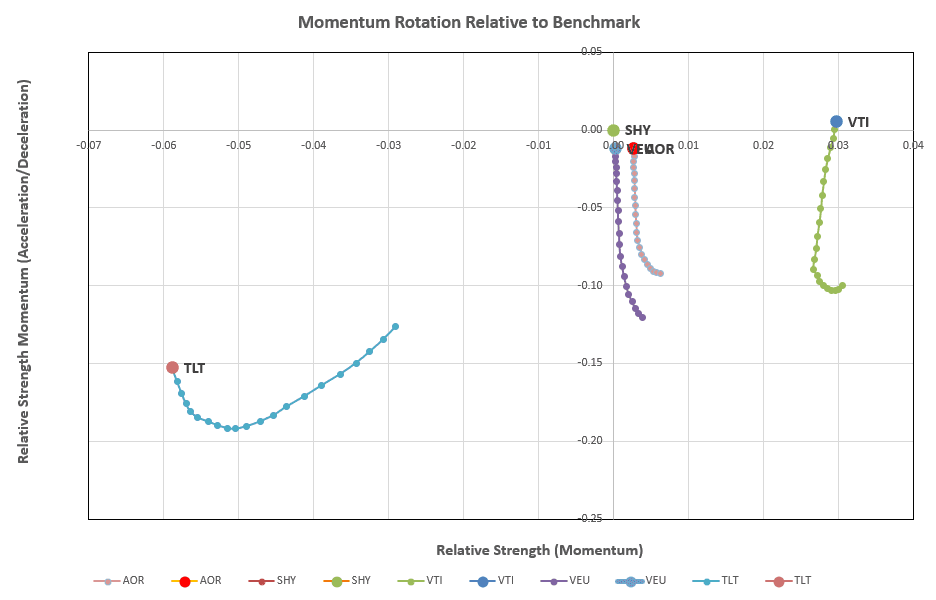

Looking at the rotation graphs for the slower-reacting Kahneman portion:

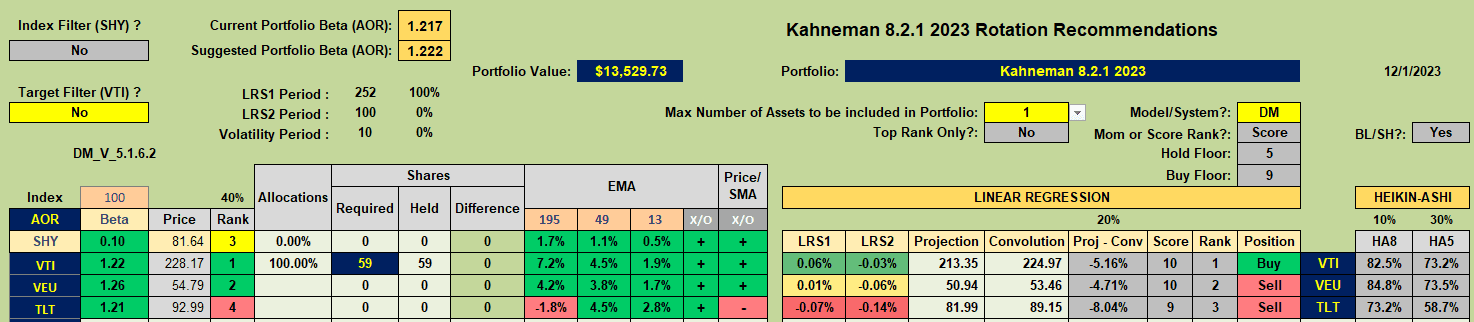

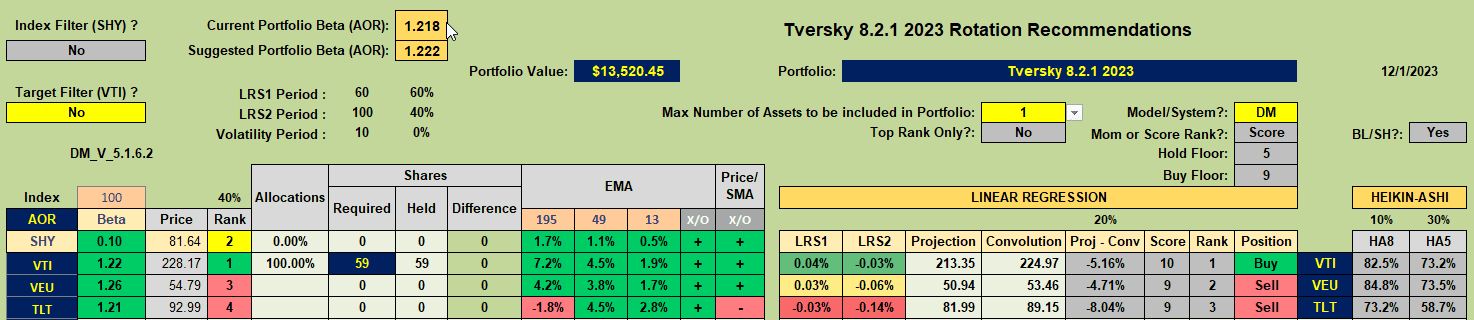

we see VTI moving upwards (strong short-term momentum) in to the desirable top right quadrant and showing strongest in terms of momentum in the longer term (furthest to the right). It is therefore not surprising to see VTI as the recommended ETF to hold:

we see VTI moving upwards (strong short-term momentum) in to the desirable top right quadrant and showing strongest in terms of momentum in the longer term (furthest to the right). It is therefore not surprising to see VTI as the recommended ETF to hold:

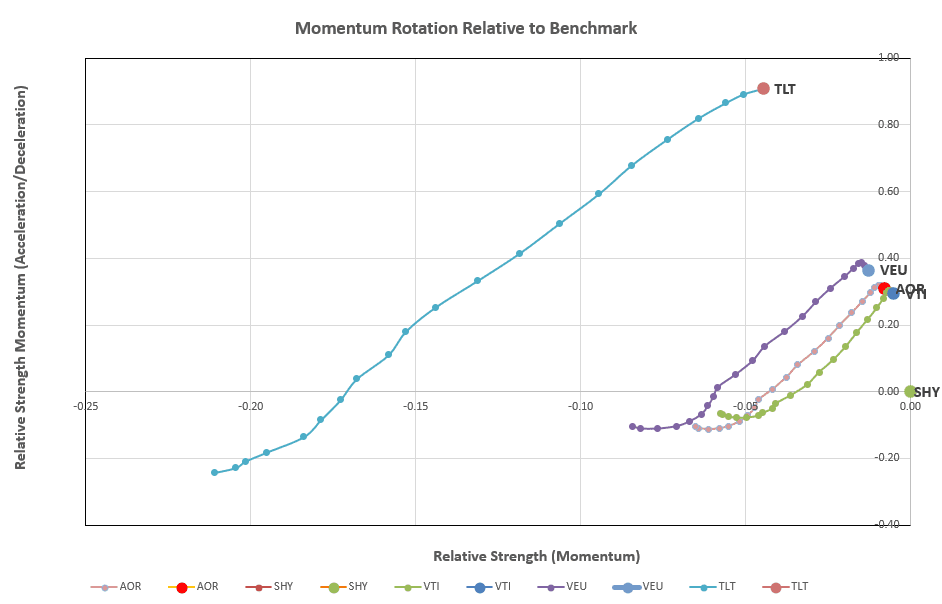

Moving to the faster-reacting Tvesrsky portion we see the following picture:

Moving to the faster-reacting Tvesrsky portion we see the following picture:

with no assets to the right of the vertical axis (weak momentum in the intermediate term – in terms of time relative to the slower moving Kahneman portion) but upward movement (short-term strength) in all assets in the quiver. However, VTI remains the recommended ETF to hold in this portion as well as in the Kahneman portion:

with no assets to the right of the vertical axis (weak momentum in the intermediate term – in terms of time relative to the slower moving Kahneman portion) but upward movement (short-term strength) in all assets in the quiver. However, VTI remains the recommended ETF to hold in this portion as well as in the Kahneman portion:

These are the recommendations we had in September and are the holdings presently in place – so no adjustments are called for.

These are the recommendations we had in September and are the holdings presently in place – so no adjustments are called for.

Note (in the top figure) how the faster-reacting Tversky portion got us into VTI ahead of the slower moving Kahneman portion such that returns from both portions of the portolio are now almost identical despite the fact that the Tversky portion lagged behind the Kahneman portion through the last half of 2022.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.