Picking the (smartly dressed) Kids up from School, Bali, Indonesia

It has been 3 months since I last posted a review of the Kahneman-Tversky (K-T) Portfolio since no adjustments have been called for. The K-T Portfolio is a simple Dual Momentum Portfolio that needs very little attention since we only have a choice of three ETFs from which to choose and we select the one with the highest momentum.

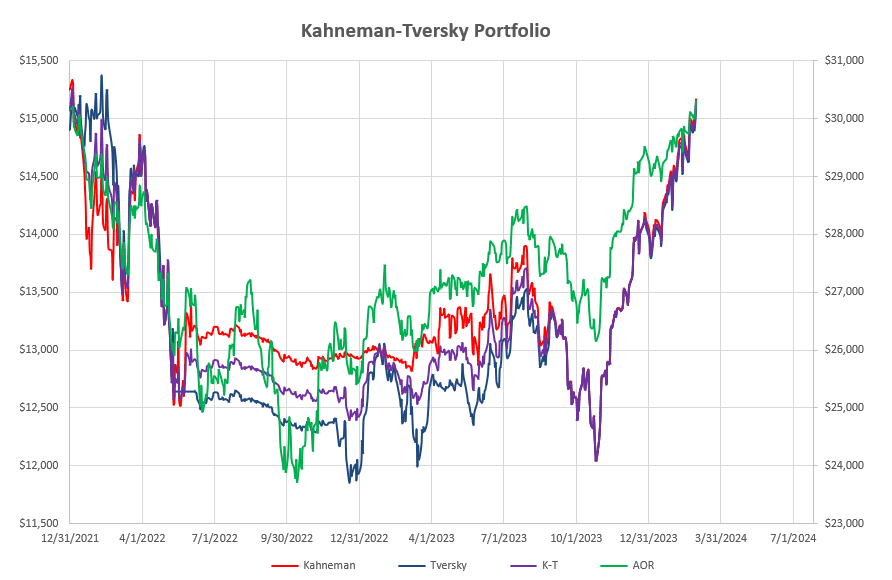

Performance of this portfolio over the past 26 months looks like this:

where we see that current returns are the same as for the benchmark AOR Fund with a little less volatility through the rough times.

where we see that current returns are the same as for the benchmark AOR Fund with a little less volatility through the rough times.

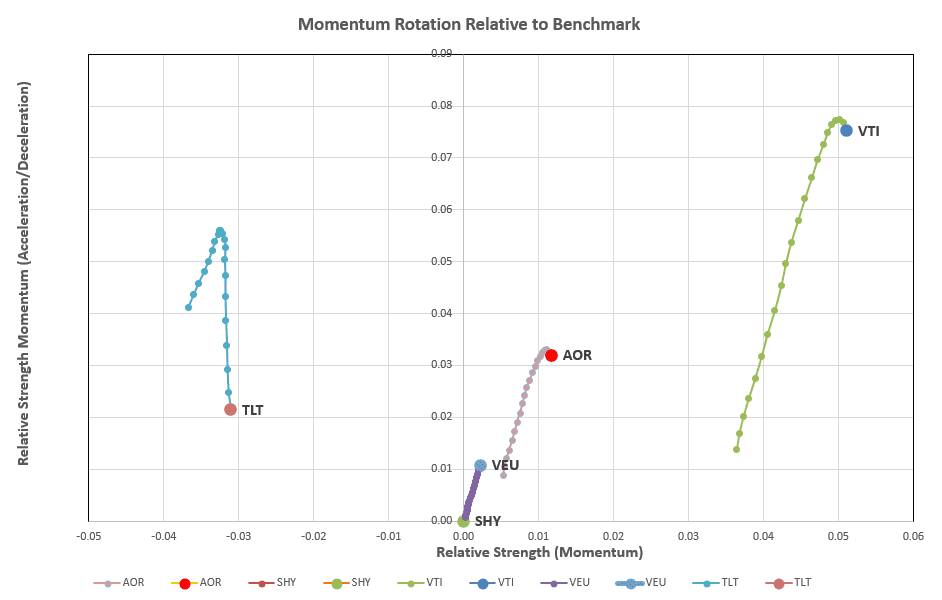

Checking the rotation graphs for the slower moving Kahneman portion of the portfolio (single 12-month lookback to measure momentum) we see that VTI (US Equities) is clearly leading in the top right quadrant.

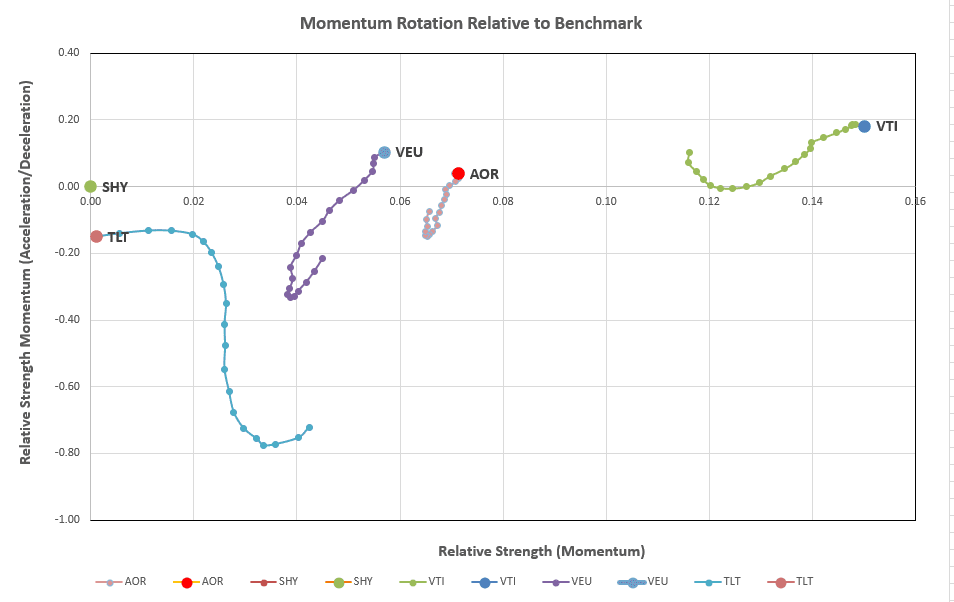

The same is true for the faster moving (60- and 100-day lookbacks) Tversky portion:

The same is true for the faster moving (60- and 100-day lookbacks) Tversky portion:

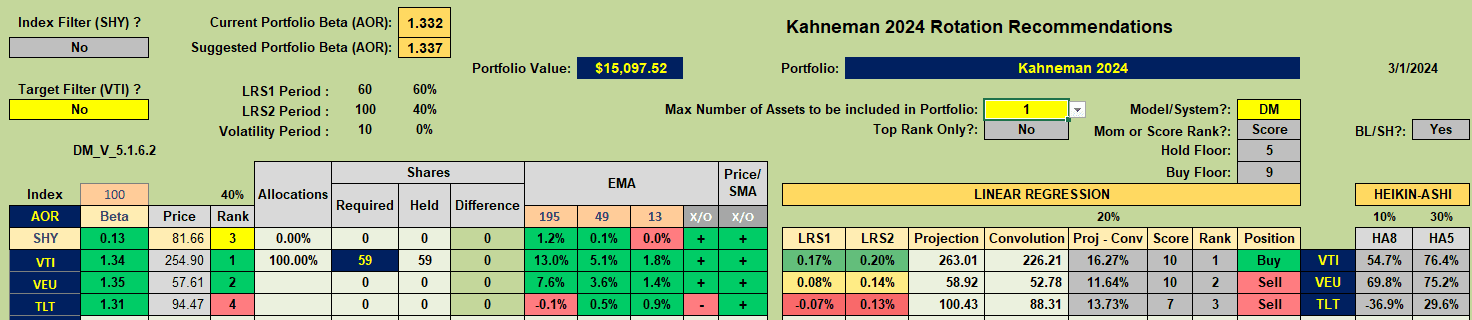

so we shall continue to hold VTI in both portions of the portfolio going forward:

so we shall continue to hold VTI in both portions of the portfolio going forward:

As we can see from the top screenshot, holding VTI for the past 3 months has enabled us to catch up with the return performance of the benchmark AOR Fund. This is a simple portfolio requiring few adjustments.

As we can see from the top screenshot, holding VTI for the past 3 months has enabled us to catch up with the return performance of the benchmark AOR Fund. This is a simple portfolio requiring few adjustments.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Do you plan on reviewing your Hawking portfolio any time soon?

~jim

Yes Jim, later tonight or tomorrow – I’m just waiting for a few dividend payments to get posted.