Big Buddha, Koh Samui, Thailand

The Kahneman-Tversky (K-T) Portfolio is a simple Dual Momentum (DM) portfolio with a choice of only one ETF from a total of 3. It therefore requires very little time/effort to manage the portfolio. The only twist to this portfolio is that it is split into two portions with different lookback periods to measure momentum in slow (Kahneman) and fast (Tversky) timeframes.

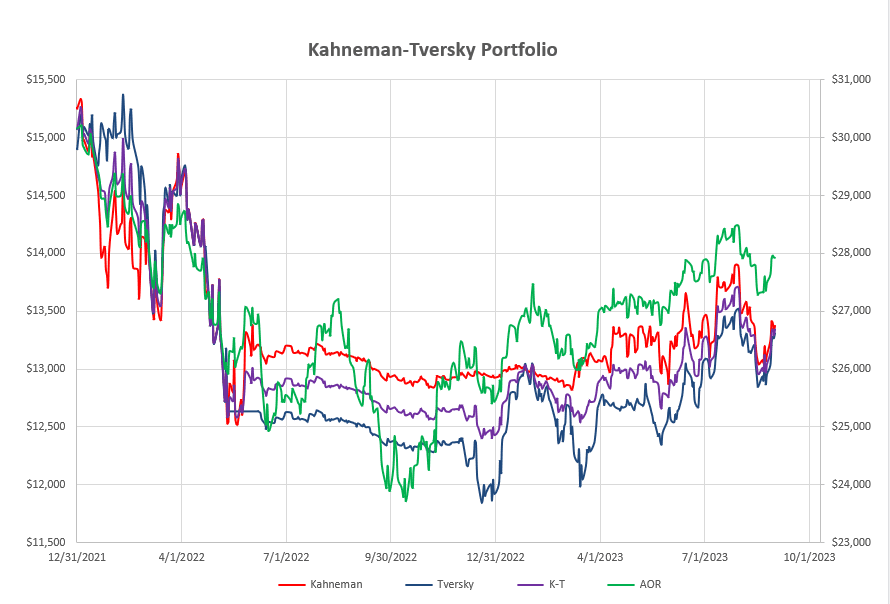

Let’s take a look at performance over the past 20 months:

The obvious feature of this figure is the impact of moving from equities to bonds in May 2022 and back into equities in December 2022 (Tversky -fast) and 3 months later in March 2023 (Kahneman – slow). At the time of the move to bonds in May 2022 the Kahneman (slow) portion of the portfolio was outperforming the Tversky (fast) portion. However, the earlier move back to equities in the Tversky portion has resulted in both portions presently showing essentially the same returns. However, both lag the performance of the benchmark AOR fund (green line). The only possible consolation for this under-performance is the fact that we did not have to suffer through the volatile July – December period. The above figure also illustrates the major weakness of momentum systems – i.e. the late exits from/entries to equities from the less volatile bonds.

The obvious feature of this figure is the impact of moving from equities to bonds in May 2022 and back into equities in December 2022 (Tversky -fast) and 3 months later in March 2023 (Kahneman – slow). At the time of the move to bonds in May 2022 the Kahneman (slow) portion of the portfolio was outperforming the Tversky (fast) portion. However, the earlier move back to equities in the Tversky portion has resulted in both portions presently showing essentially the same returns. However, both lag the performance of the benchmark AOR fund (green line). The only possible consolation for this under-performance is the fact that we did not have to suffer through the volatile July – December period. The above figure also illustrates the major weakness of momentum systems – i.e. the late exits from/entries to equities from the less volatile bonds.

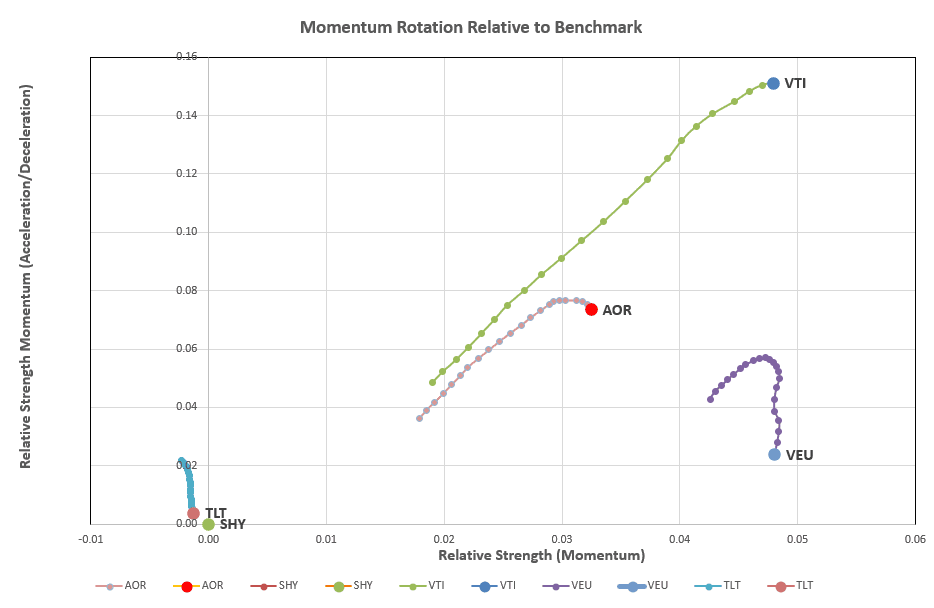

Checking the rotation graphs for the slow moving Kahneman portion of the portfolio:

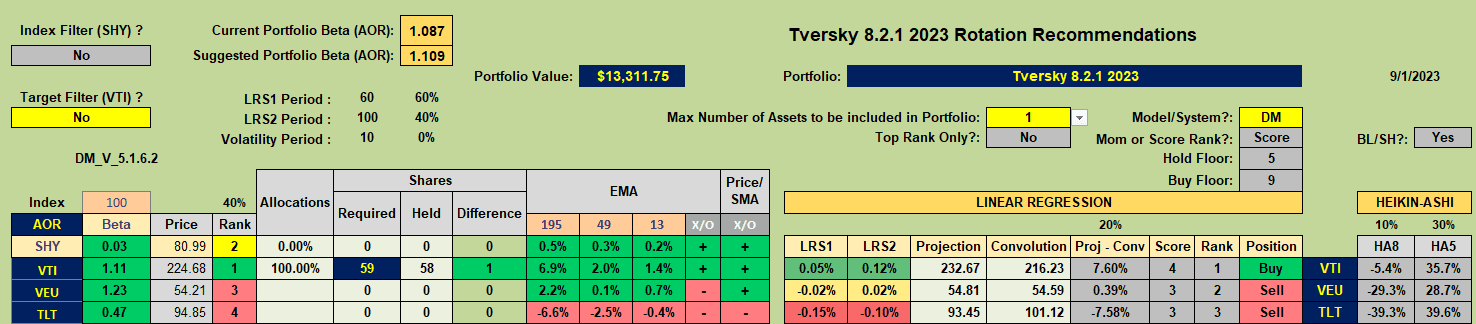

we see that VEU and VTI are practically the same distance to the right along the horizontal axis (that is the measure used for the DM system) – although we notice the short-term weakness in VEU (downward vertical movement). If I were using a rotation system I would be favoring VTI here but we’ll follow the recommendations from the Tranche worksheet:

we see that VEU and VTI are practically the same distance to the right along the horizontal axis (that is the measure used for the DM system) – although we notice the short-term weakness in VEU (downward vertical movement). If I were using a rotation system I would be favoring VTI here but we’ll follow the recommendations from the Tranche worksheet:

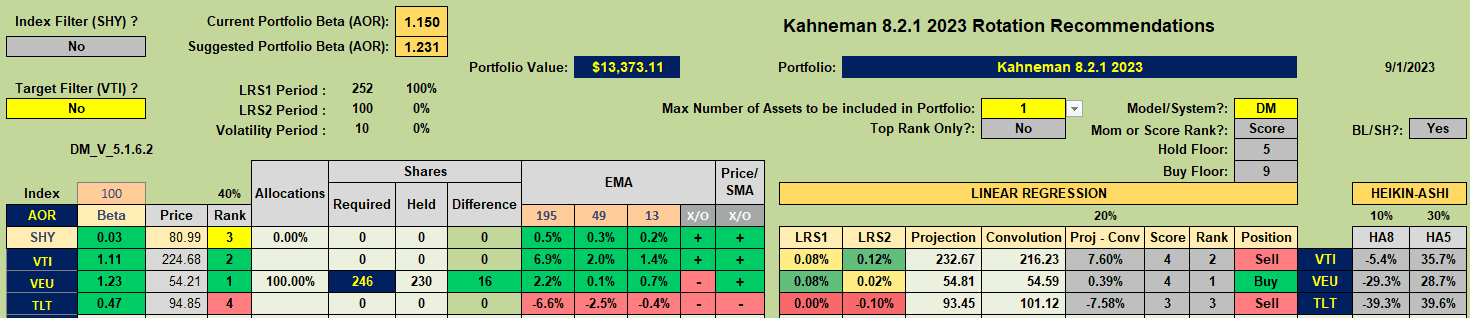

that is still favoring VEU (very slightly – LRS1 is showing equal at 2 decimal place accuracy but is slightly greater as we go out to more decimal places).

that is still favoring VEU (very slightly – LRS1 is showing equal at 2 decimal place accuracy but is slightly greater as we go out to more decimal places).

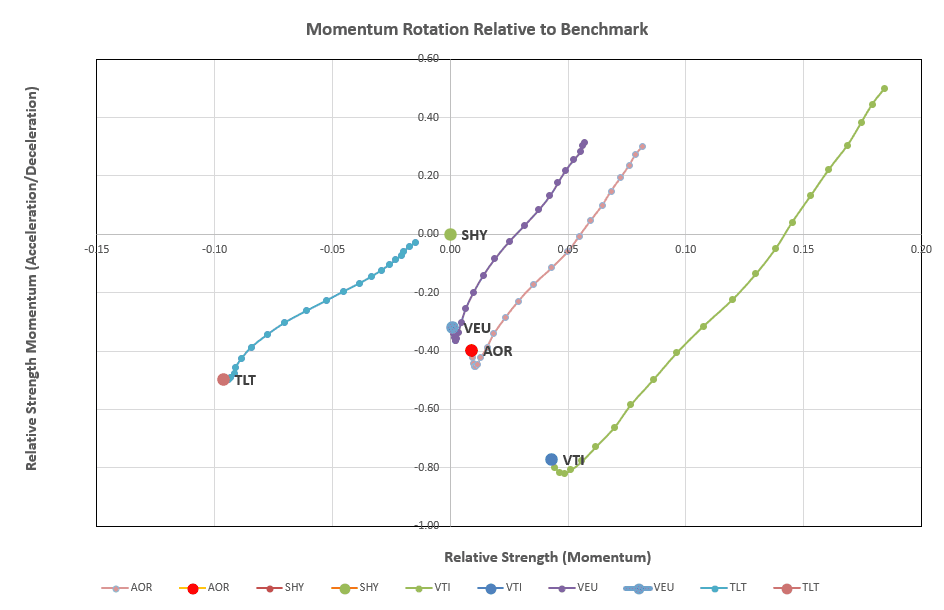

Moving to the rotation graphs for the Tversky portion:

VTI is leading the longer term momentum race – but all ETFs are showing short-term weakness. However, the DM system uses longer-term measurements so we see:

VTI is leading the longer term momentum race – but all ETFs are showing short-term weakness. However, the DM system uses longer-term measurements so we see:

confirmation of the VTI recommendation.

confirmation of the VTI recommendation.

At this point in time I will not be making a switch to VTI in the Kahneman portion of the portfolio but I will probably be checking the recommendations more frequently over the next few days/weeks before the next “official” review and will post any adjustments that might arise.

The only other thing that I need to do is to use cash from dividend payments to add a few more shares to both portions of the portfolio.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

As I noted in the above post VTI looked to be stronger than VEU and this has been confirmed by price action in the past 2 days resulting in VTI becoming the recommended Buy asset to hold in the Kahneman portion of the portfolio. This is an exanple of timing/review date luck and I will be moving to VTI tomorrow.

David