Botanic Gardens, Singapore

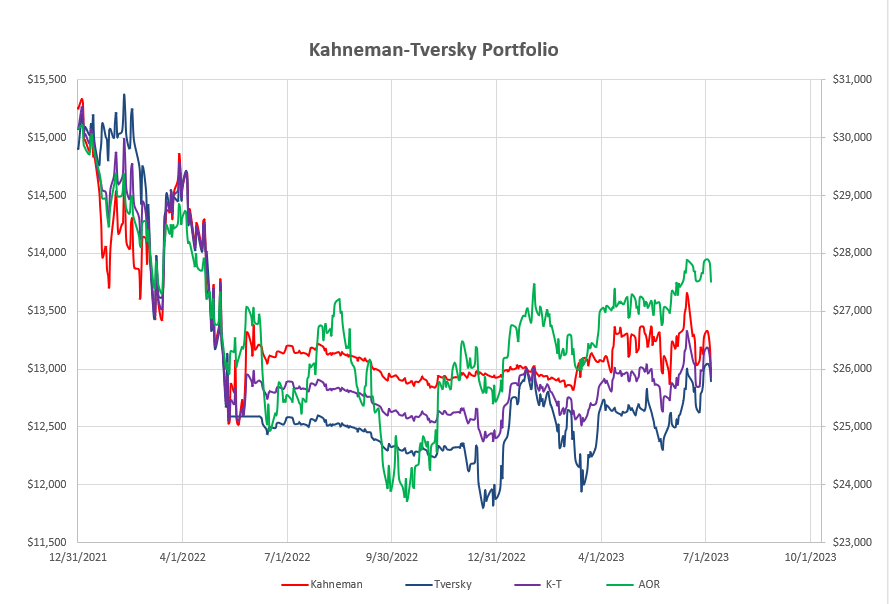

The Kahneman-Tversky Portfolio is a simple Dual Momentum portfolio that invests in only one asset in each portion of a 2-split portfolio where the split is based on different look-back periods to measure Momentum. The Kahneman portion uses a single 252-day lookback period to measure momentum – and this reacts slowly to changes in market behavior. The Tversky portion of the portfolio uses 60- and 100-day lookback periods that react faster to changes in market behavior. It is difficult/impossible to deterine whether a slow or fast system will produce better results over the long term – so we diversify the portfolio by using both systems.

Performance to date looks like this:

that hasn’t moved too far over the past month – but has shown relativrly high volatility. Although this portfolio remained relatively calm through the weak 2022 markets it has been a little slow to react to the 2023 bounce/recovery.

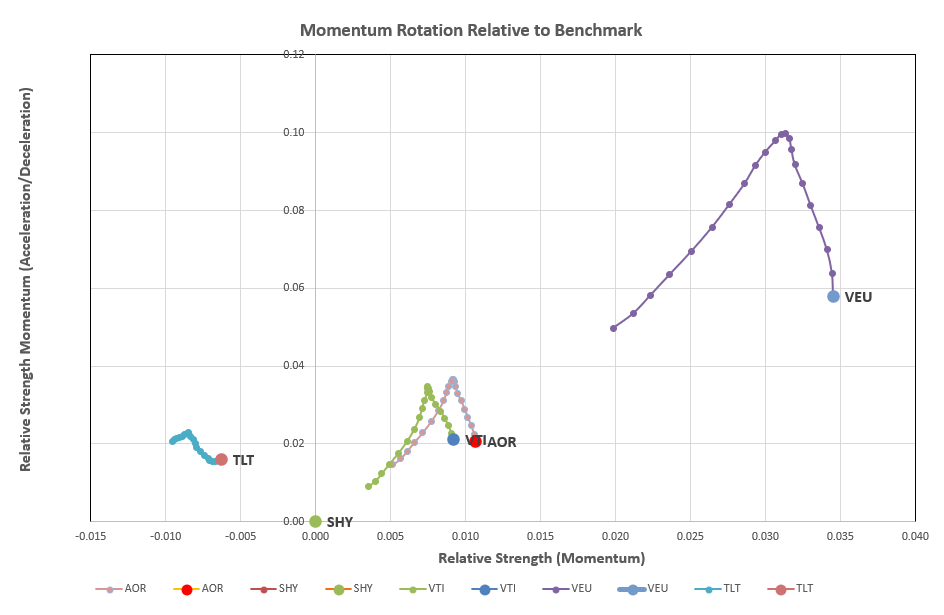

Checking the rotation graphs for the slow moving Kahneman portion of the portfolio:

we note the strong performance of VEU (Developed market equities) over the long term (far right location) but the relative weakness (downward trend) in the short term.

we note the strong performance of VEU (Developed market equities) over the long term (far right location) but the relative weakness (downward trend) in the short term.

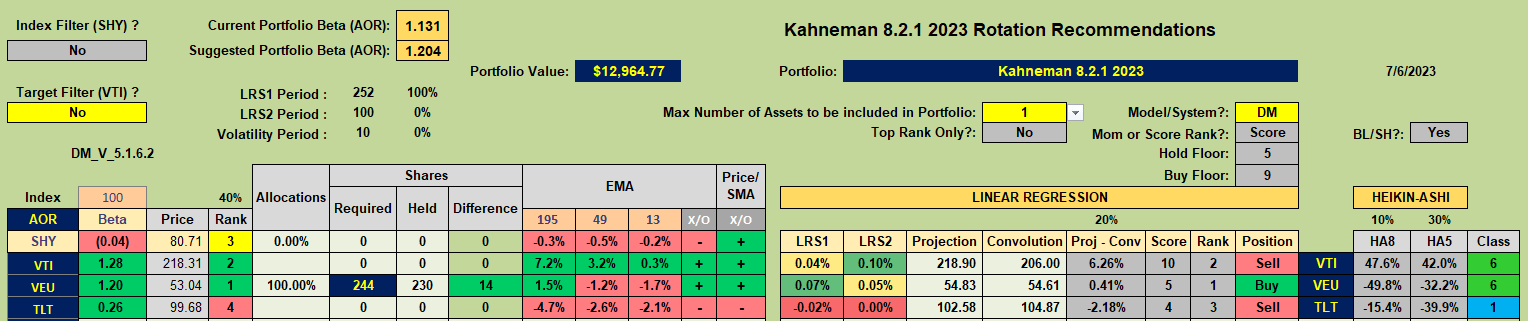

Recommended holdings from this (Kahneman) portion of the portfolio look like this:

that is an endorsement to continue to hold a position in VEU (Developed market equities).+

that is an endorsement to continue to hold a position in VEU (Developed market equities).+

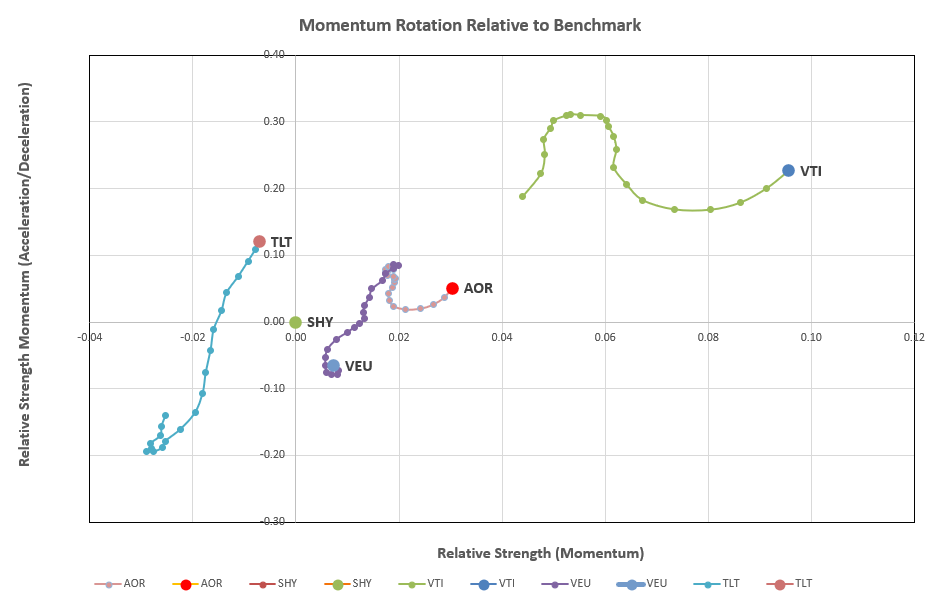

Moving to the faster moving Tversky portion of the portfolio we see the following rotation graphs:

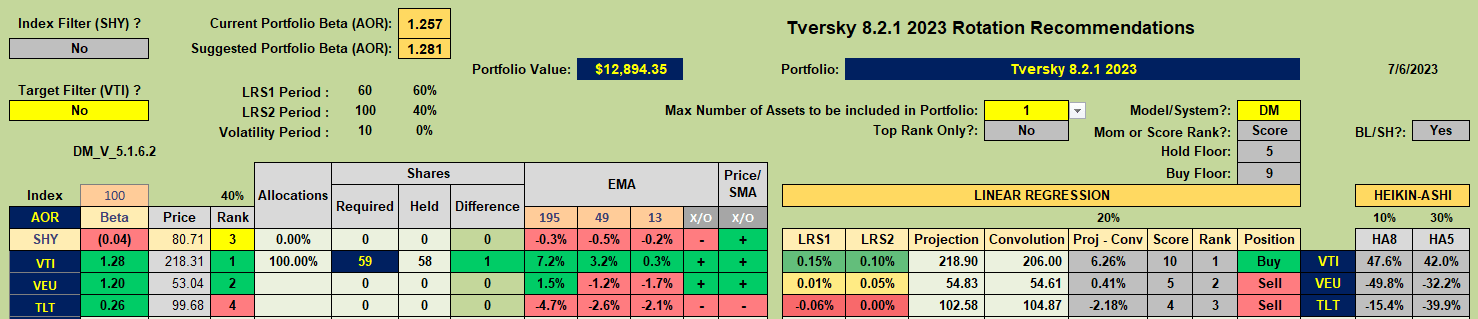

with VTI (US Equities) showing the strongest momentum. This is confirmed in the Tranche recommendation sheet:

with VTI (US Equities) showing the strongest momentum. This is confirmed in the Tranche recommendation sheet:

and, since we are currently holding this ETF in the portfolio, means that no adjustments are called for at this time.

and, since we are currently holding this ETF in the portfolio, means that no adjustments are called for at this time.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.