Morning Delight

Kepler is a portfolio in transition. The move is from a growth portfolio to an income portfolio where the income is derived from Closed-End-Funds (CEFs). In a recent blog post I requested readers submit CEF ideas, but to limit them to no more than five (5) at a time. One recent recommendation (EIC) was added to the Kepler this morning.

Kepler Security Holdings

At this point the Kepler is incomplete as the goal is to populate the portfolio with 20 ETFs. Excluding SHV, the Kepler is now holding 18 CEFs. The plan is to add two more high ranking CEFs and then to go through the existing holdings and eliminate the weakest ones, assuming I am able to find stronger securities.

One goal is to keep the Portfolio Income at 10.0% or higher. Kepler is meeting this goal.

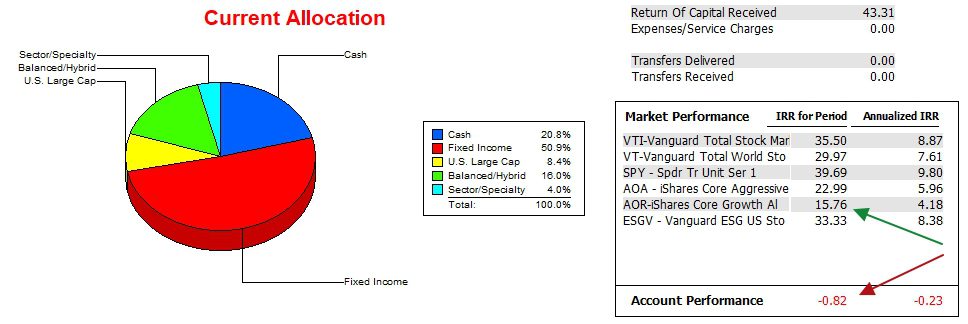

Cash is available to purchase two more CEFs and to build up some of the higher generating income securities.

Kepler Performance Data

Since 12/31/2021 the Kepler has been a return laggard. It is far off the mark set by AOR as well as all the other five potential benchmarks. With the new CEF approach I will be watching the Risk Ratio values to see what direction the Kepler is moving.

Kepler Risk Ratios

It is much too early to draw any conclusions as to how the CEF management approach will work. The current Jensen Performance Index is one of the lowest over the past year. Keep an eye on this metric over the next few months to see if there is improvement.

Once more, we are less interested in growth as the focus is on increasing income.

Readers: Keep suggestions for CEFs coming.

If interested in the CEF management model, follow the Hawking portfolio, managed by Hedgehunter.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question