Portland and Western train along Route 99E.

Yesterday I updated the Franklin, a poor performing Dual Momentum™ portfolio. This morning the McCormick is up for review and the performance is quite different. Chalk the difference up to the luck-of-review-day rather than the particular investing model.

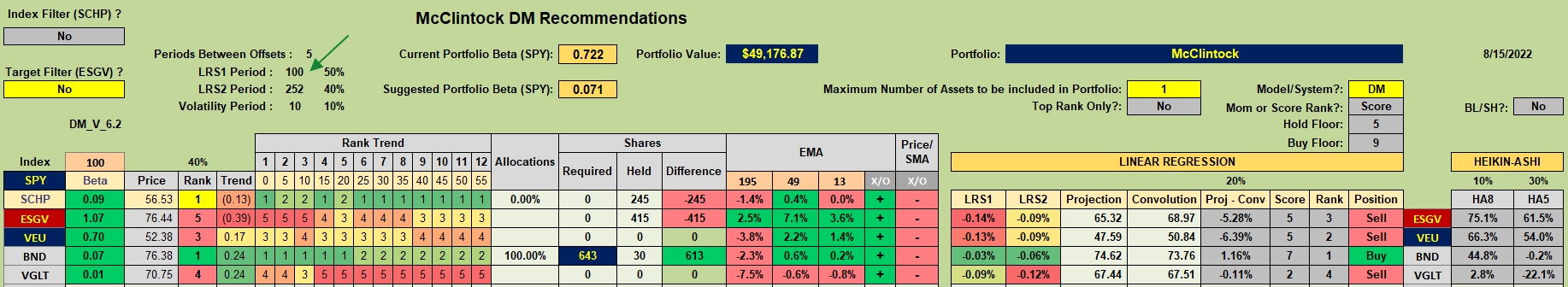

McClintock Dual Momentum Recommendation

The current recommendation is to place 100% of the portfolio in bonds (BND). Since SCHP is also a low volatile security I don’t plan to sell any inflation protection shares. I’ll place TSLOs to sell off shares of ESGV and use the cash to increase shares of BND.

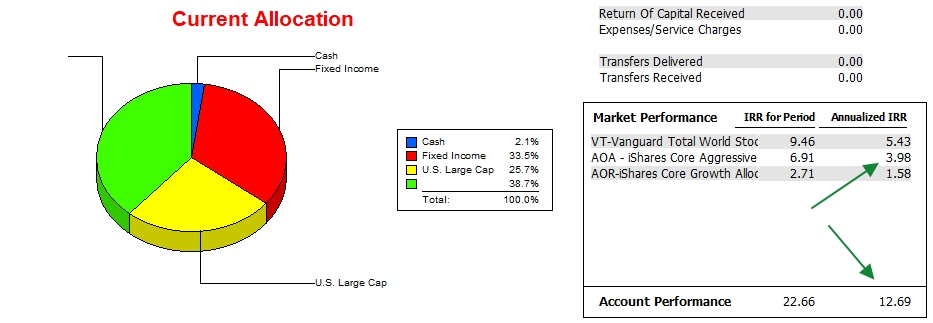

McClintock Performance Data

Contrary to the Franklin, the McClintock is performing very well as it is 3 times the IRR of the AOA benchmark and well ahead of both the Vanguard Total World Stock Fund and AOR. Would that all portfolios are performing this well. Now we need to consider the risks involved in achieving these results.

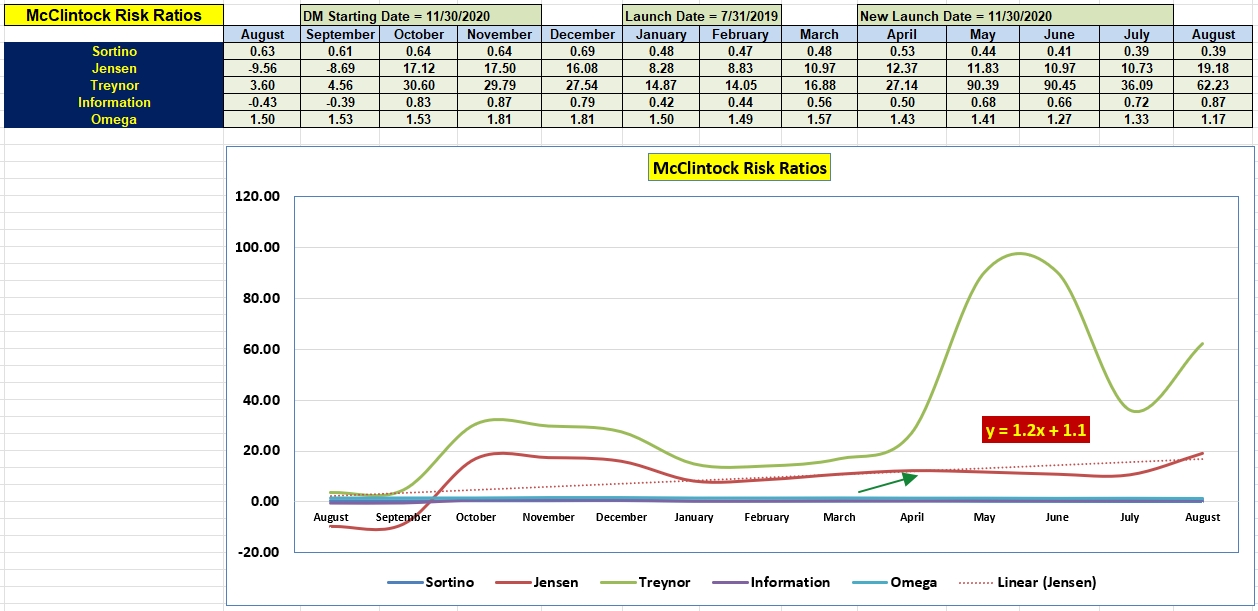

This data runs from 11/30/2020 through mid-morning of 16 August 2022.

McClintock Risk Ratios

The Jensen Performance Index is a very high 19.2 or the highest it has been over the past year of record keeping. The goal is to keep this excellent record moving forward. The slope of the Jensen is also a very high 1.2 value.

McClintock Portfolio Review: 10 June 2022

Relative Portfolio Performance: 8 April 2021

Constructing a “Core” Investment Portfolio : Part 3 – Risk Parity and Volatility Targeting

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.