Garage Sale Poster

McClintock is one of three portfolios managed using the Sector BPI model. The other two are the Carson and Franklin, named after Rachel and Rosalind respectively. During the recent market declines numerous sectors dropped into the oversold zone. In other words, many sectors ended up with 30% or fewer bullish stock within the sector. When this market action occurs we place purchase orders to pick up shares of Exchange Traded Funds (ETFs) that mirror the sector.

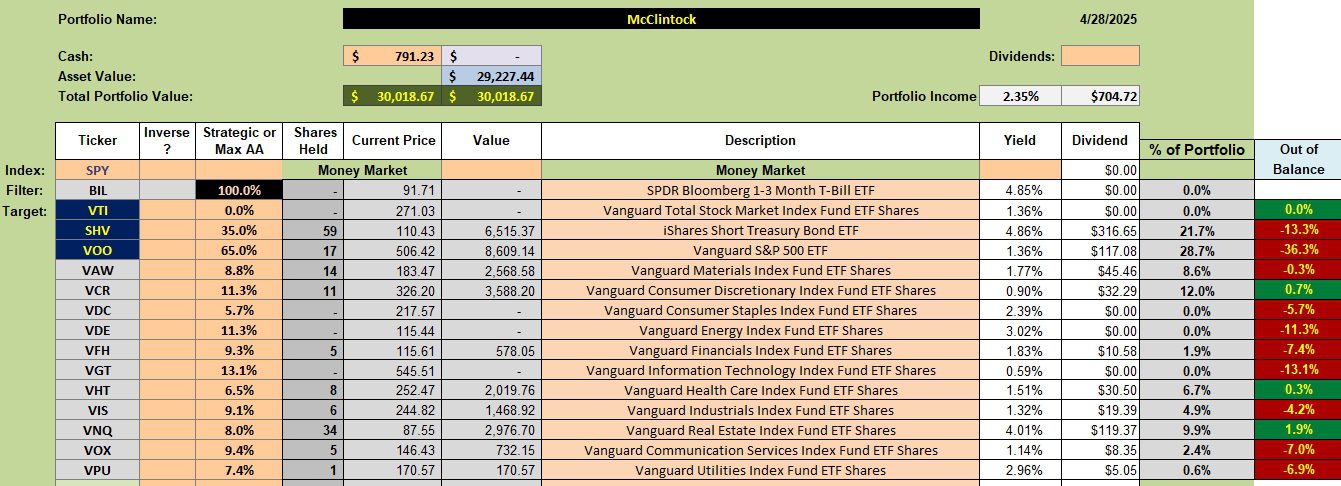

McClintock Security Holdings

Currently the McClintock is holding shares in eight of the eleven sectors. Several sectors are below the recommended percentage target. Examples are: Financials, Communication Services, and Industrial. If an oversold sector is not up to the recommended percentage there are several explanations.

- There was insufficient cash when the oversold condition occurred. I was reluctant to sell shares of VOO to raise cash so the decision was mine.

- I may have placed a limit order that was not struck, hoping for a lower price. Some of those limit orders are still in place.

- The drop into the oversold zone occurred mid-day and I missed the opportunity to purchase shares.

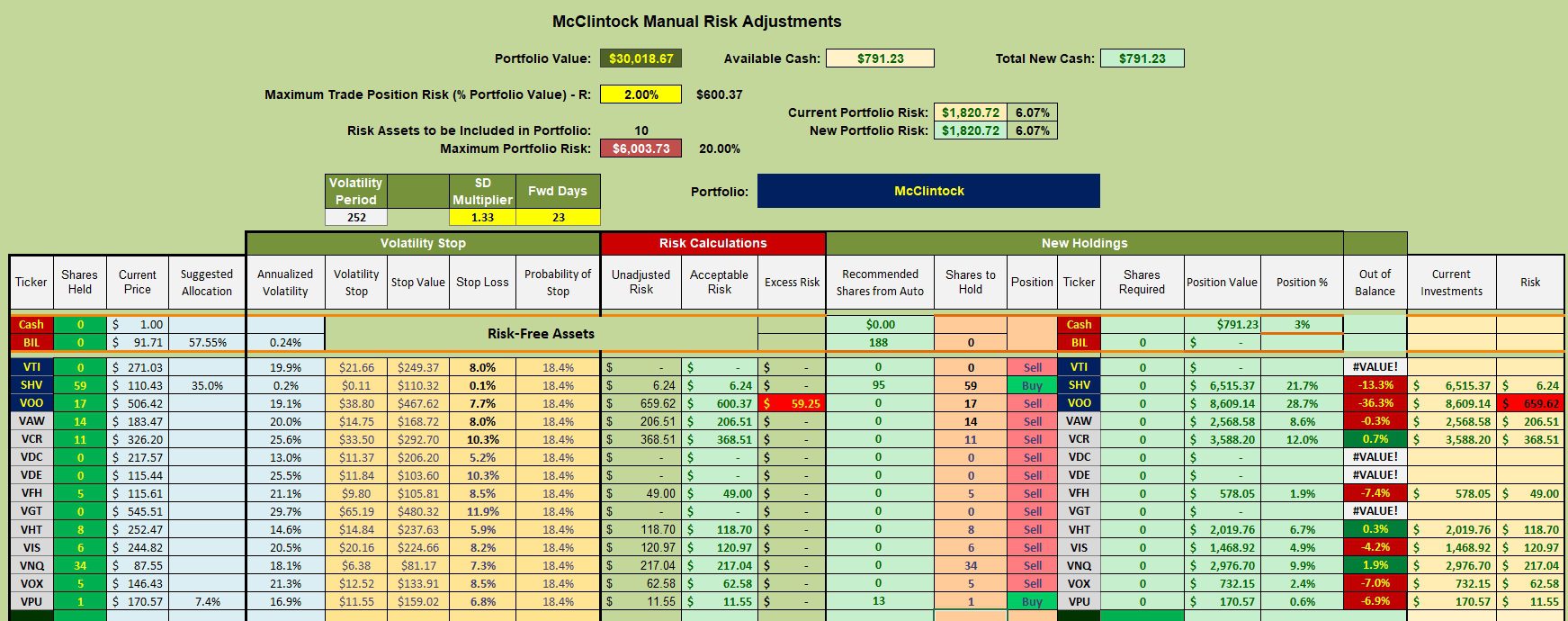

McClintock Rebalancing Recommendations

Currently, no sectors are oversold so I moved cash into SHV to pick up additional dollars from interest payments. Should we see another market drop, and I expect we will before Fall, I will sell shares of SHV to raise cash. I have a VOO Trailing Stop Loss Order (TSLO) in place to preserve capital.

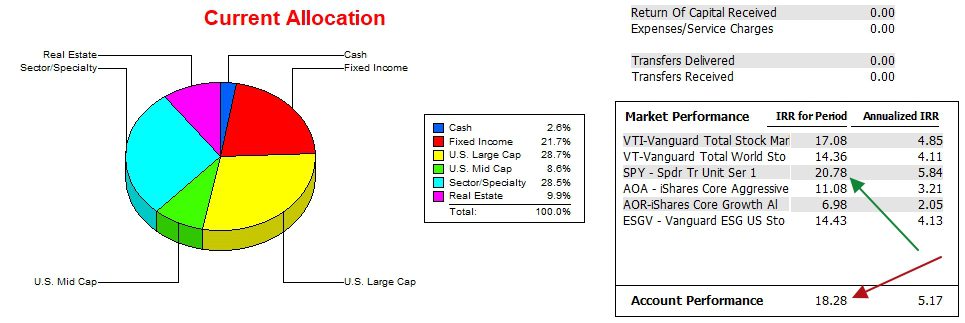

McClintock Performance Data

Since 12/31/2021 the McClintock trails the S&P 500 by a small percentage. SPY is the ETF we use as a possible investment tool for the S&P 500. The S&P 500 is the only benchmark that is topping the McClintock portfolio.

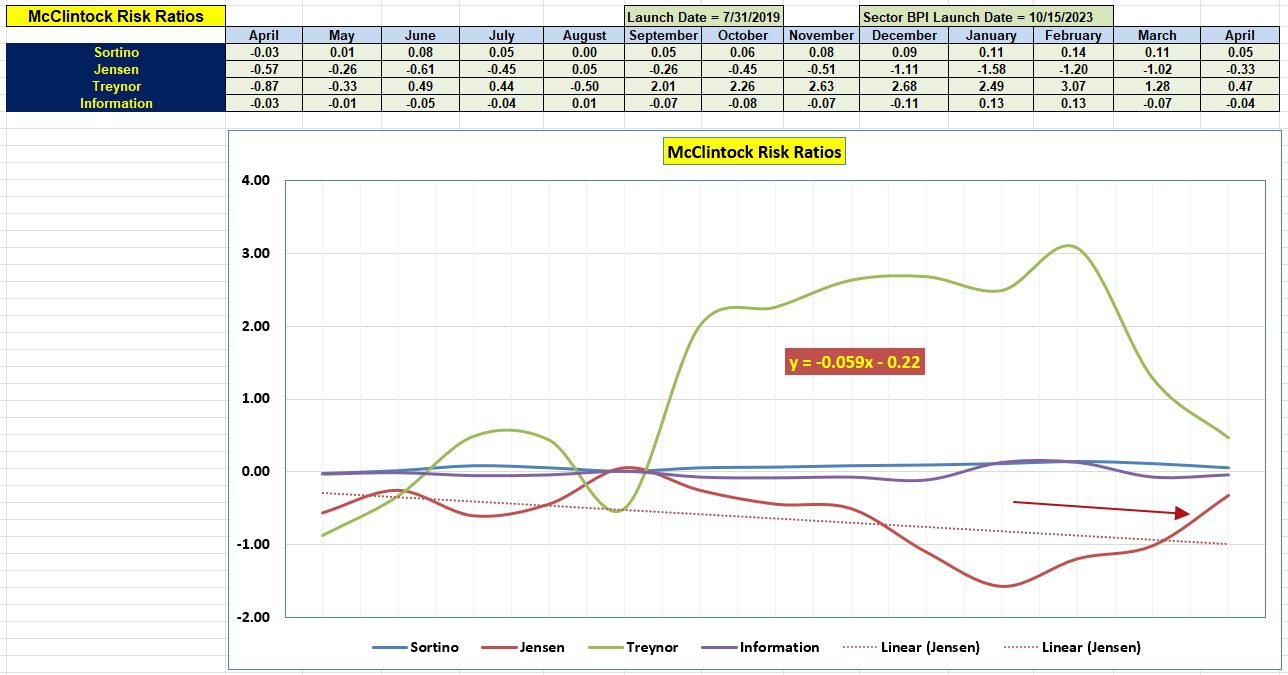

McClintock Risk Ratios

The good news is that all risk measurements are better than they were a year ago with exception of the Information Ratio. Most encouraging is the gradual improvement of the Jensen Alpha in recent months.

Comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question