Kipling greeting the woman who rescued him. He has never forgotten.

Millikan is another Sector BPI Plus portfolio. This portfolio began as a Dual Momentum™ model portfolio and I shifted it over to the Sector BPI model as the hypothesis seemed to be stronger than the DM approach. More time and history is needed to see if this move makes sense. So far it has as the performance is improving with respect to the benchmark (SPY).

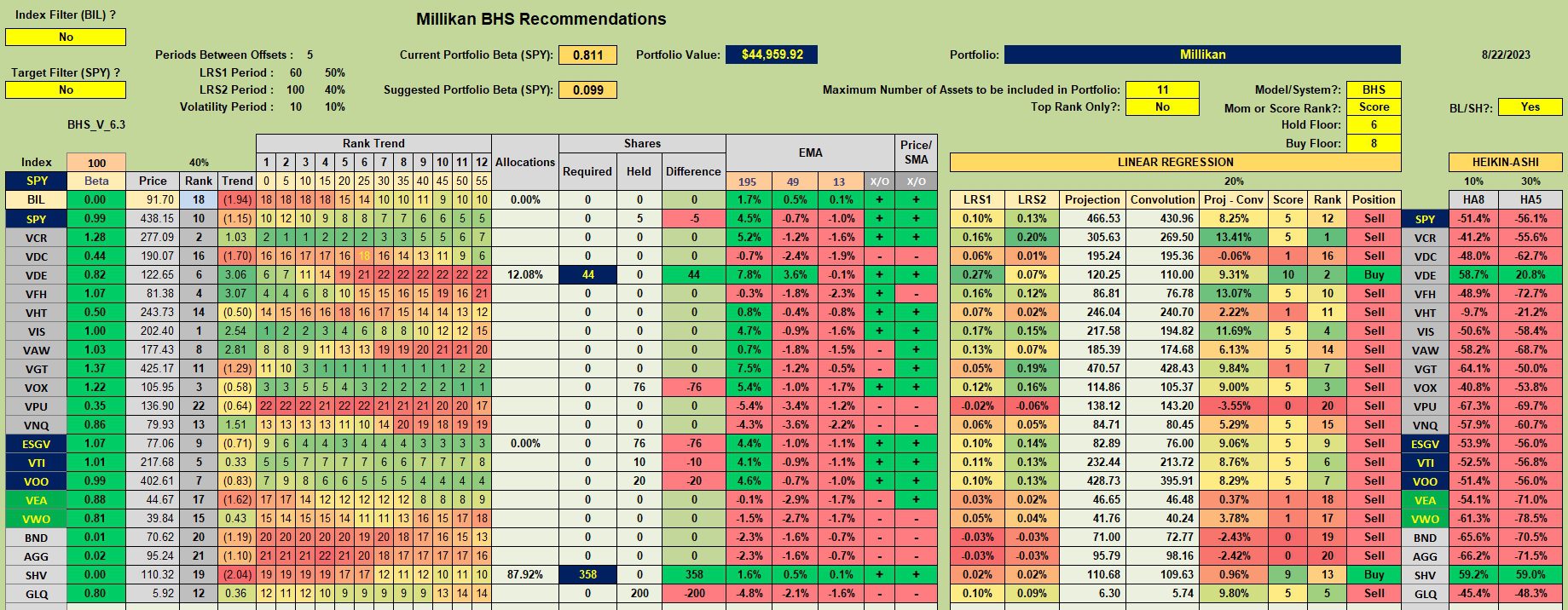

Millikan Security Recommendations

Below is the investment quiver and the current holdings for the Millikan. Keep in mind that the ETFs with the gray background are managed differently than the other ETFs available for purchase. Currently no Buy or Sell signals apply to the sector ETF (VOX) held in the Millikan.

All equities are calling for a sell when the Buy-Hold-Sell (BHS) model is applied and we use the “default” look-back combination. The recommendation is to invest in short-term treasury (SHV) and that is the plan to follow.

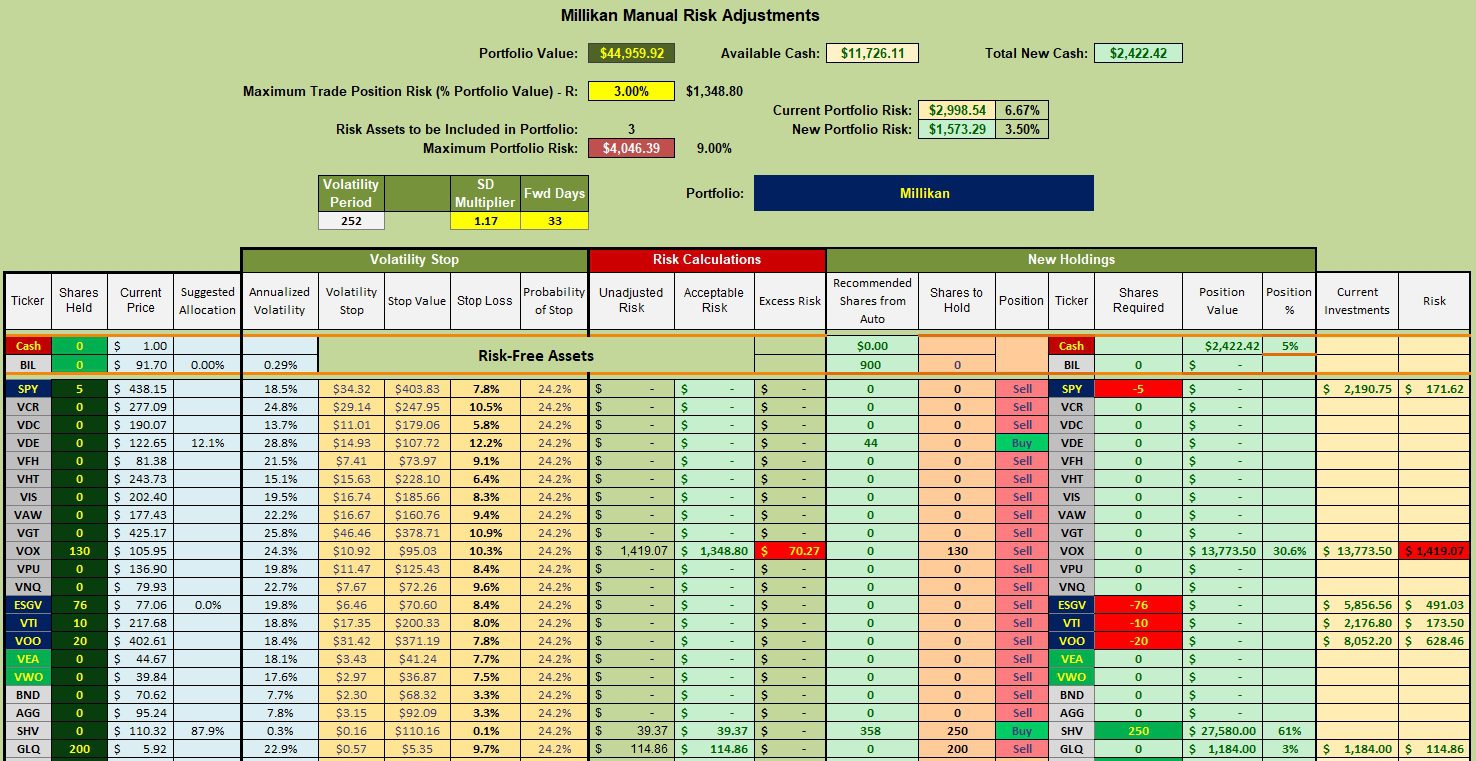

Millikan Manual Risk Adjustments

Trailing Stop Loss Orders (TSLOs) are in place to sell SPY, ESGV, VTI and VOO. I set the percentages between 3% and 8%. A limit order is in place to purchase 100 shares of SHV. I don’t have sufficient cash to purchase more shares until the equity ETFs are sold.

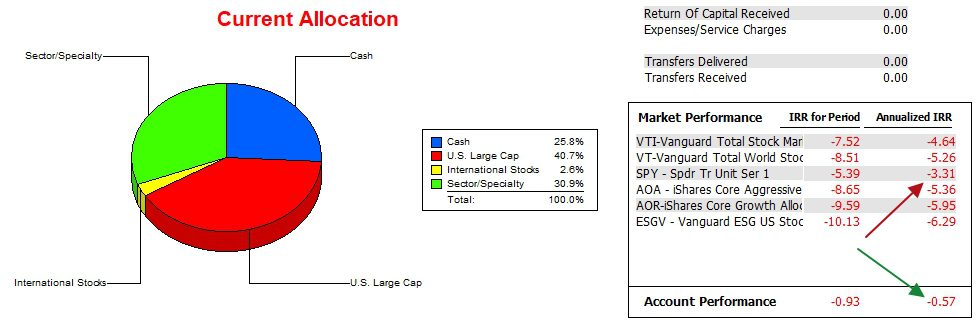

Millikan Performance Data

As we near 19 months of data the Millikan is outperforming the S&P 500 (SPY) by a few percentage points.

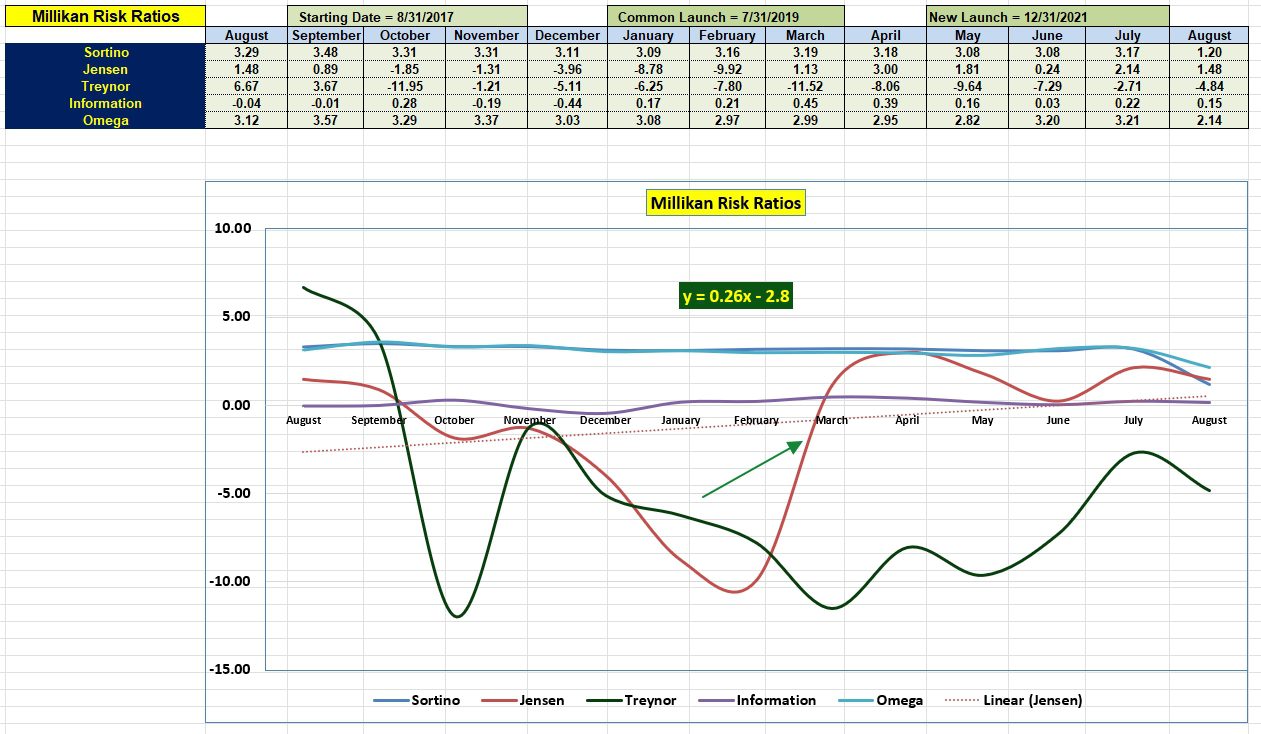

Millikan Risk Ratios

The Risk Ratios cover one (1) year of information. Once more, the critical values are found in the Jensen, Information, and Sortino ratios. The positive Jensen slope (0.26) is encouraging and should only improve as we move closer to October.

Since moving to the Sector BPI model the Millikan has improved vs. its benchmark. Check the Information Ratio for these results.

Millikan Sector BPI Update: 20 July 2023

Tweaking Sector BPI Plus Model: 20 May 2023

The ITA blog is now free to all who register as a Guest. Pass on the ITA link to friends and family.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.