On again, off again tariff threats are constantly roiling the stock and bond markets. This morning the direction happens to be to the upside. When in a dark room filled with furniture – stand still. That is the attitude businesses have as it is most difficult to plan for the future when uncertainty abounds. One way to “stand still” when it comes to portfolio management is to invest in low volatile securities such as short-term treasuries. That is why I am setting Trailing Stop Loss Orders of around 3% on equity holdings and when sold, use the cash to invest in SHV. SHV is my “stand still” security.

This morning I added another 27 shares of SHV to the Millikan Portfolio, thus using up all available cash.

Millikan Security Holdings

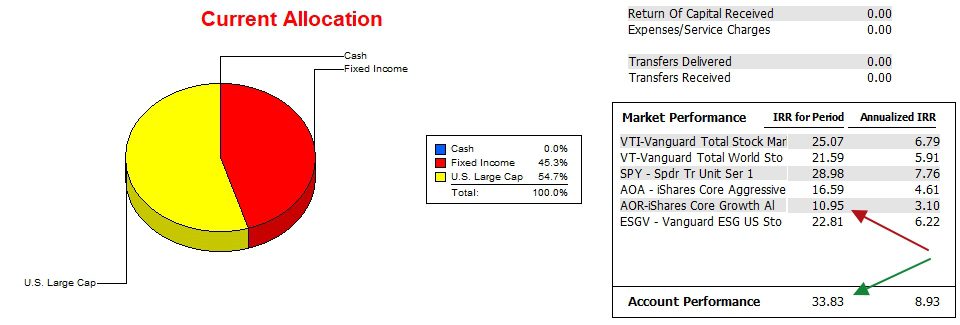

Below is the current makeup of the Millikan portfolio. At this point I have not placed a TSLO under SCHD, but will likely do so sometime after the second quarter comes to a close. Listening to sharp economists, the tariffs will most likely hit during the third and fourth quarters of this year.

Today’s up spike is most likely a “dead cat bounce.” Better economic minds than mine are sending out dire warnings so pay attention.

Millikan Performance Data

Since 12/31/2021 the Millikan has far outperformed the AOR benchmark and is besting the other five standards I’m tracking using the Investment Account Manager software.

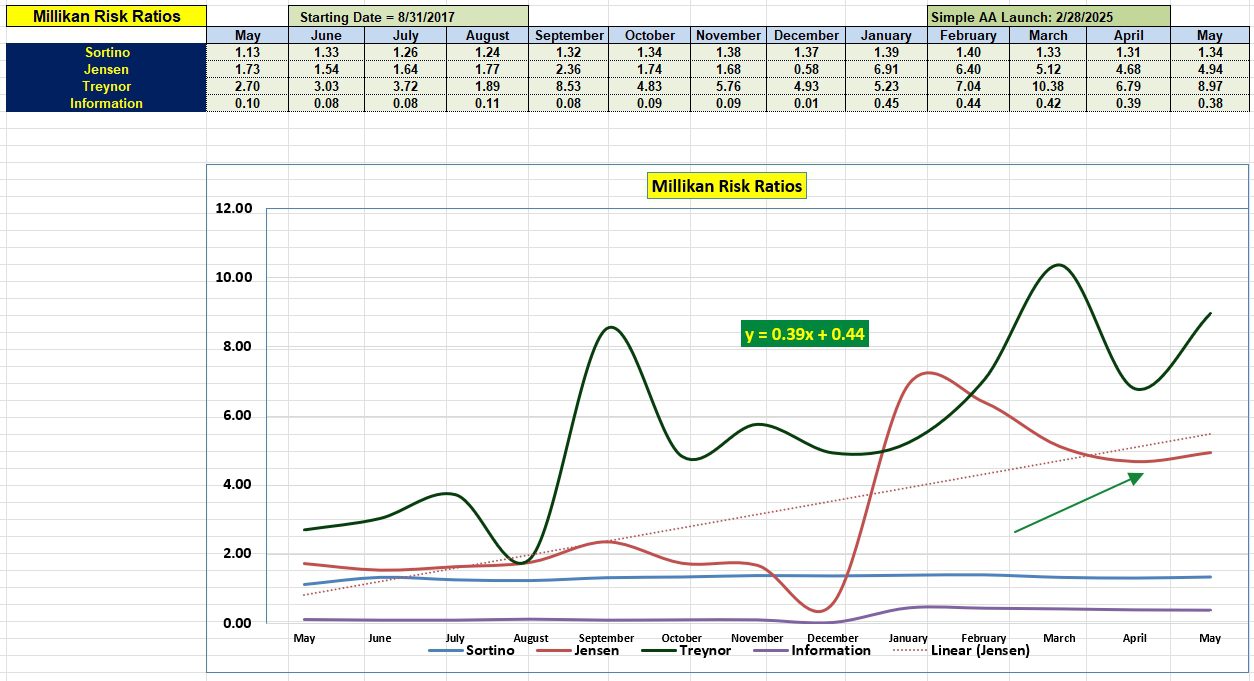

Millikan Risk Ratios

A risk ratios are well ahead of where they were in May of 2024. Most encouraging is the uptick in the Jensen Alpha value since this past April. Since January the portfolio did lose ground to the benchmark. For this trend check the Information Ratio.

One goal is to sustain the positive slope for the Jensen, the most important risk ratio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question