Gemini AI generated painting of St Johns Bridge in Portland, OR

The Millikan Sector BPI portfolio is a continuation of support for this particular investing model. This review includes nearly 1.5 years of data so it is not the youngest or the oldest Sector BPI portfolio. Historical data is beginning to build support for this model so readers not using it should take particular notice. The Sector BPI model is not complicated. There are few straight forward rules. If these need to be reviewed, let me know.

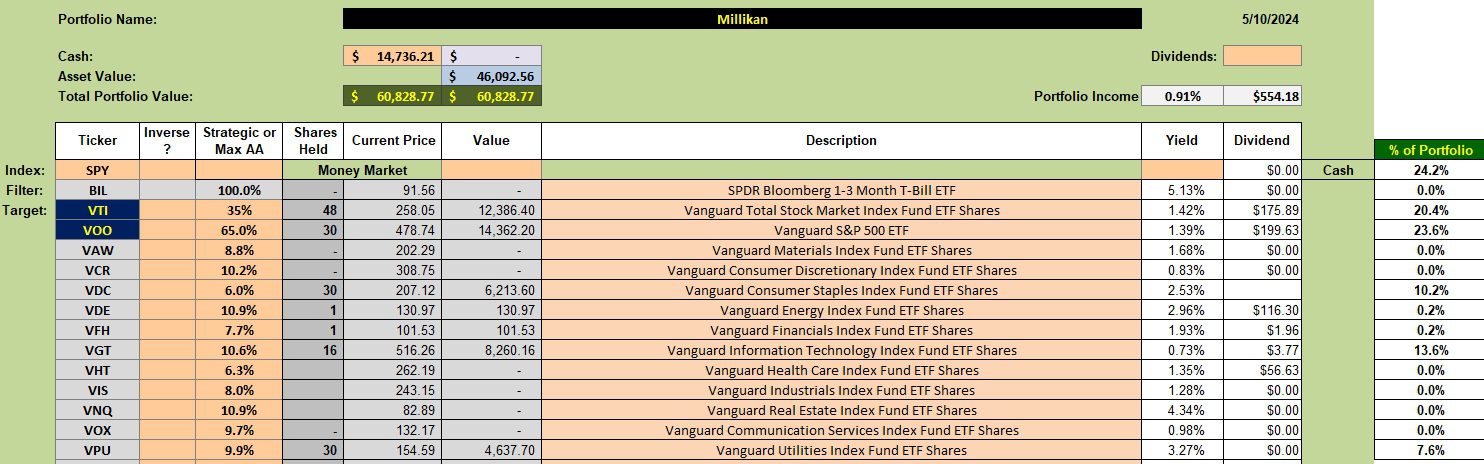

Millikan Investment Quiver and Holdings

While the Millikan performance is strong, it would be even better if it did not hold so much cash while the market is moving up. Regardless, we continue to follow the defined rules as the Sector BPI investing model is undergoing testing.

Patience is required with this model. An example is the Consumer Staples (VDC) sector. The Millikan has been holding VDC for many months and it seems as if it will never reach the overbought zone. In the meantime the Millikan will continue to reap the benefits of the 2.53% yield.

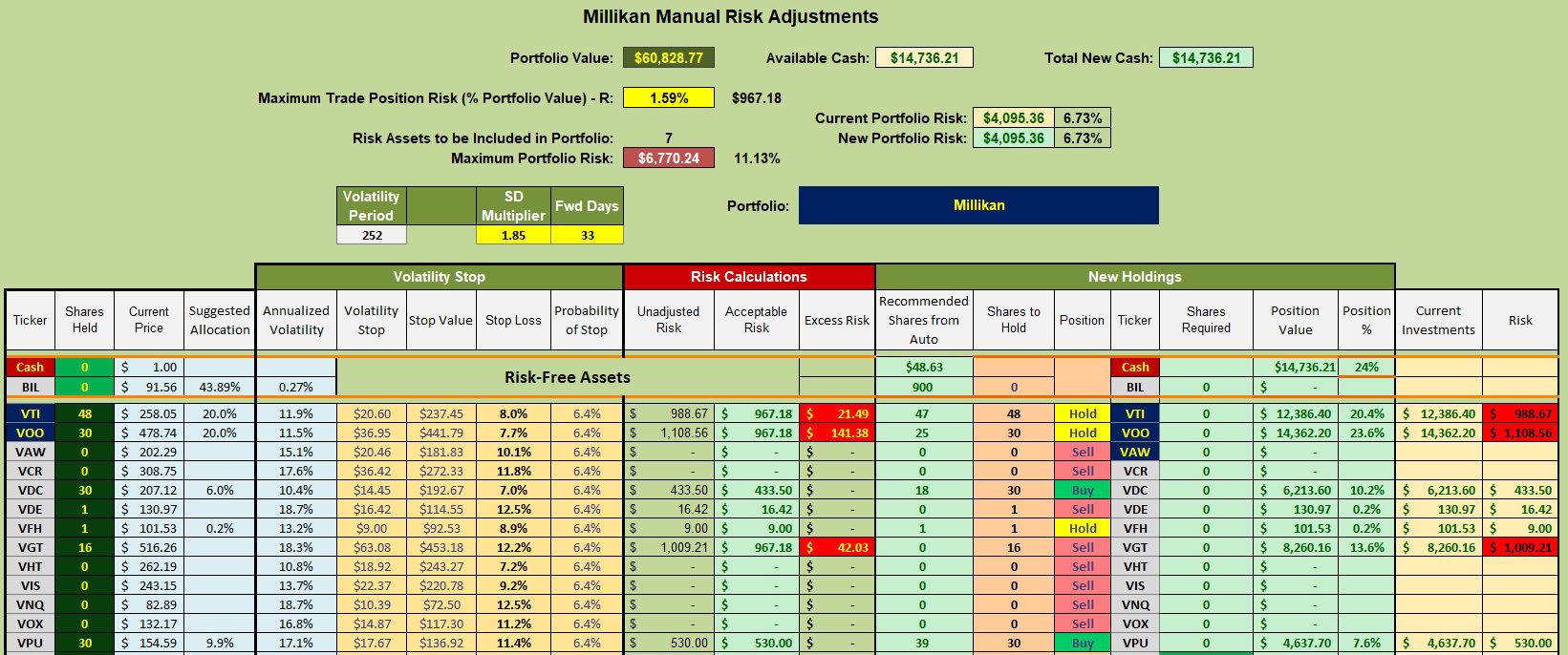

Millikan Manual Risk Adjustments

Are any adjustments recommended at this time? No sectors are in the oversold zone and we have TSLOs set for sectors that are overbought. Neither VTI or VOO are recommended for purchase so we do nothing at this time.

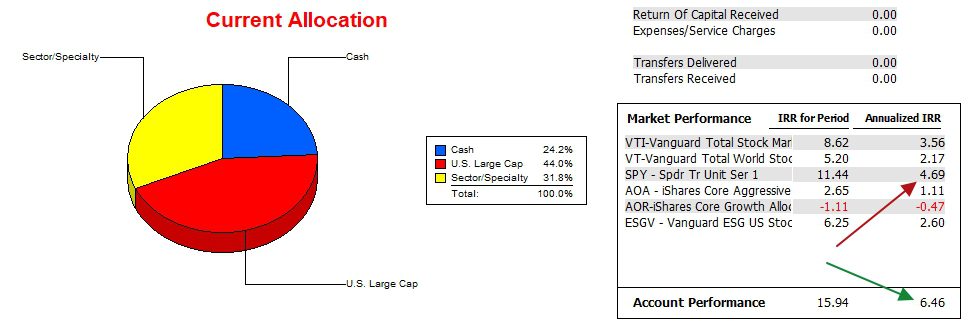

Millikan Performance Data

Since 12/31/2021 the Millikan has outperformed the SPY benchmark. It was about one year later that I moved the Millikan over to the Sector BPI model and the performance improved since then. See the final screenshot.

Millikan Risk Ratios

When risk is factored into the performance equation the Millikan is holding steady. Keep in mind that the risk-free interest rate of SHV is a tad over 5.0% and this high value is placing downward pressure on the Jensen Performance Index (frequently known as Jensen’s Alpha). We can truthfully say that the Sector BPI model is adding alpha to the portfolio.

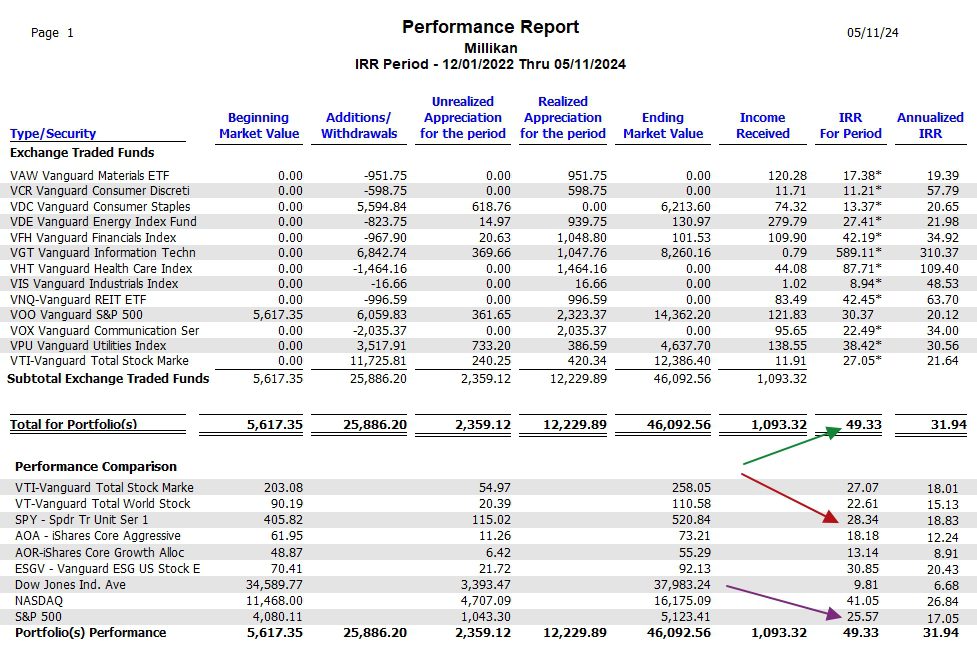

Millikan Sector Portfolio Report

Since December of 2022 the Sector BPI portfolio has outpaced the SPY benchmark by a wide margin. The purple arrow points to the S&P 500. Note that the 500 ETF is outperforming the index itself. The SPY managers must be doing something right.

Keep in mind that the cash holding does not enter into the following data. Therefore, portfolio performance is lower than the 49.3% return. I need to do a better job of keeping cash to a minimum. This table shows how well the sector ETFs are performing when using the Sector BPI investing model.

Tweaking Sector BPI Plus Model: 20 May 2023

Tweaking Sector BPI Plus Investing Model: Part II

Millikan Sector BPI Update: 20 July 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.