East Lake Resort Truck

Based on discussions found in the Comment section of the most recent BPI blog post, below is an investment quiver that may be the future of the Sector BPI Plus portfolios. What I’ve done is to add eleven sector ETFs where these new eleven are equal-weight index securities rather than cap-weighted. If readers wish to learn more about what is behind the equal-weight philosophy I highly recommend reading “The Fundamental Index: A Better Way to Invest” by Robert D. Arnott, Jason C. Hsu & John M. West.

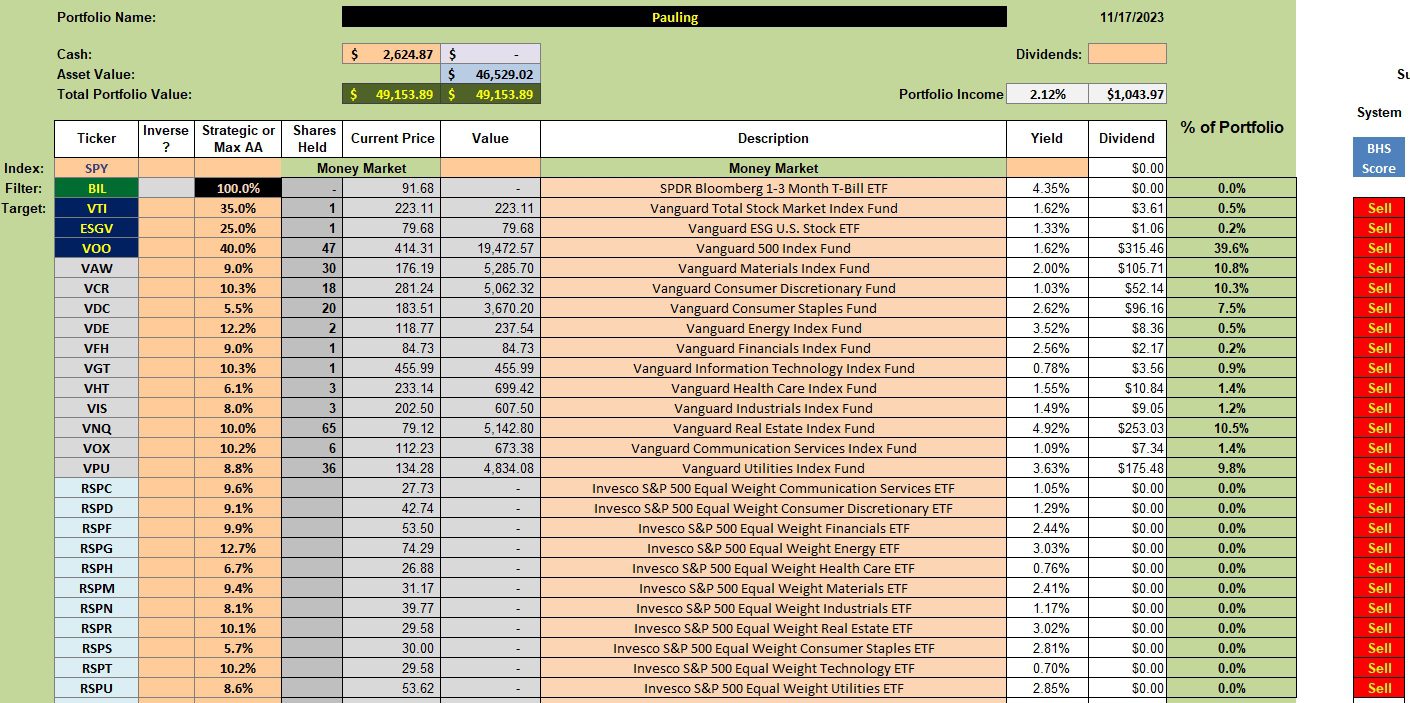

Revised Pauling Investment Quiver

I selected Pauling as a test portfolio as it is modest in size, performance is lacking, and the owner gives the OK to make a change. In addition to the original eleven sectors, plus three U.S. Equity ETFs, I’ve added eleven equal-weight ETFs. Those are the RSP? securities or those with the light blue background.

Since I will invest in only one sector from either group, the percentage sum from VAW down through RSPU adds to 200%. Here are two examples based on the current BPI data.

- Discretionary shows VCR is outperforming RSPD over the past five years so the Pauling should hold a minimum of 9.0%. It currently holds 10.3% so all is well.

- Take Health as a second example. This sector shows RSPH is outperforming VHT over the past five years so we go with RSPH. Since Health is currently not in the oversold zone we patiently wait for a Buy or Sell signal. If a Buy signal emerges, we once more compare the performance between VHT and RSPH to see which is the better performer and go with that ETF.

The logic behind this modification is to squeeze a little more return out of the ETFs. Some investor might prefer to go with one set of sector ETFs and not deal with the combination as it requires one additional step of analysis when a Buy signal is triggered.

Questions or Comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Selecting between capital weighted and equal weighted, to me, appears to be an excellent refine. In making the binary choice, why is a 5 year look-back used rather than some other amount of time?

Oh, and Happy Thanksgiving.

Lee,

When using Finance-Yahoo for the comparisons the longer options are 5-years and then it jumps to Maximum. The different ETFs have different launch dates if I select the Max option. Therefore I use 5-years as it logs a reasonable length of time and gives me the same time frame. I would prefer a longer period, but the Maximum option has it problems as described.

Lowell

Thank you.